Resume Example- Template - Maharishi University of Management

advertisement

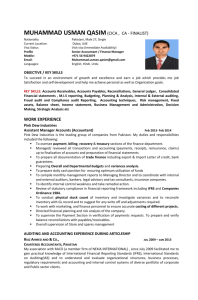

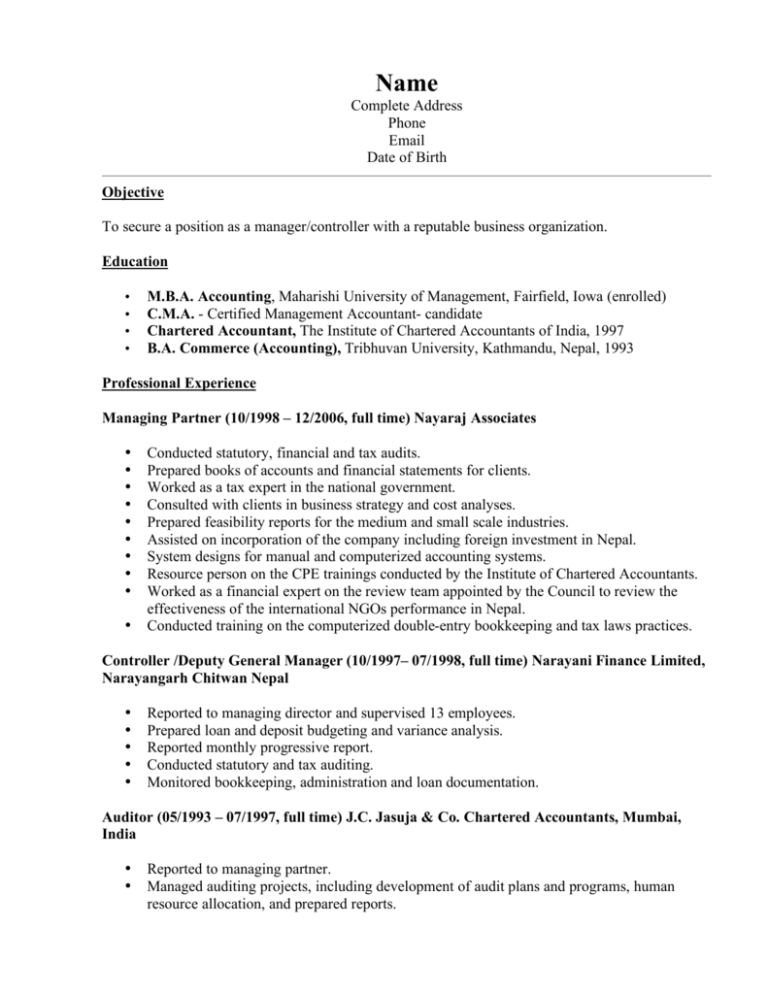

Name Complete Address Phone Email Date of Birth Objective To secure a position as a manager/controller with a reputable business organization. Education • • • • M.B.A. Accounting, Maharishi University of Management, Fairfield, Iowa (enrolled) C.M.A. - Certified Management Accountant- candidate Chartered Accountant, The Institute of Chartered Accountants of India, 1997 B.A. Commerce (Accounting), Tribhuvan University, Kathmandu, Nepal, 1993 Professional Experience Managing Partner (10/1998 – 12/2006, full time) Nayaraj Associates • • • • • • • • • • Conducted statutory, financial and tax audits. Prepared books of accounts and financial statements for clients. Worked as a tax expert in the national government. Consulted with clients in business strategy and cost analyses. Prepared feasibility reports for the medium and small scale industries. Assisted on incorporation of the company including foreign investment in Nepal. System designs for manual and computerized accounting systems. Resource person on the CPE trainings conducted by the Institute of Chartered Accountants. Worked as a financial expert on the review team appointed by the Council to review the effectiveness of the international NGOs performance in Nepal. Conducted training on the computerized double-entry bookkeeping and tax laws practices. Controller /Deputy General Manager (10/1997– 07/1998, full time) Narayani Finance Limited, Narayangarh Chitwan Nepal • • • • • Reported to managing director and supervised 13 employees. Prepared loan and deposit budgeting and variance analysis. Reported monthly progressive report. Conducted statutory and tax auditing. Monitored bookkeeping, administration and loan documentation. Auditor (05/1993 – 07/1997, full time) J.C. Jasuja & Co. Chartered Accountants, Mumbai, India • • Reported to managing partner. Managed auditing projects, including development of audit plans and programs, human resource allocation, and prepared reports. • • • • Accounting, tax, and legal consulting. Participated in communication with clients. Developed ways of tax-minimizing tactics. Developed strategies of defense in courts and governmental commissions concerning tax and financial issues. Strongest Skills Auditing, consultancy services, tax policy analysis and planning, accounting system designing and coding in Visual Basic, cost and managerial accounting, computerized bookkeeping, financial statement preparation, training, activity-based costing, budgeting, financial management, economic analysis, leadership, Excel with pivot tables, application and understanding of US GAAP/GAAS, Sarbanes Oxley Act, IFRS and IAS. Information Technology Skills • • • • • Book keeping Software: Tally, self-designed accounting software Presentation Software: PowerPoint, Visual Basic 6 Spreadsheets: Advance Excel Word Processing: Word Database: Access, SQL server Industries, Languages, and Personal • • • Industries: statutory, internal and tax auditing (manufacturing, trading, NGO's, construction, service and government organizations) Fluent Languages: English, Nepali, Hindi. Membership in Professional Organizations: The Institute of Chartered Accountants of India & Nepal, Rotary, Chamber of Commerce.