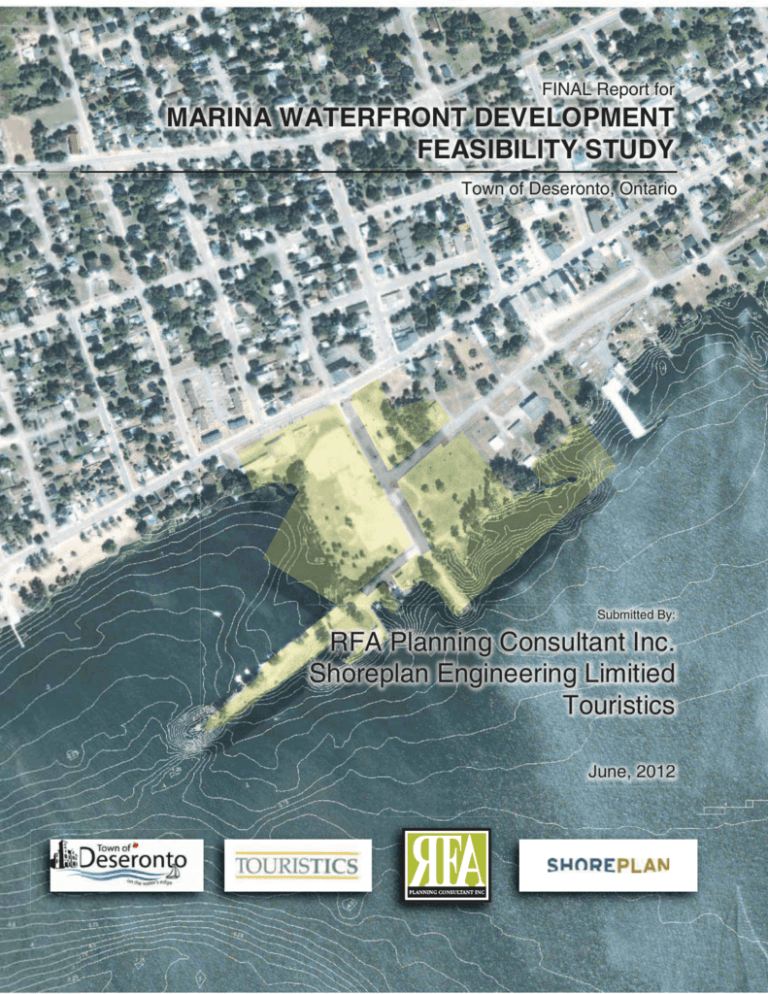

Feasibility Study Final Report

advertisement