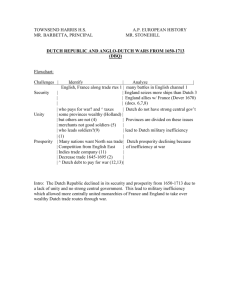

A View of the Dutch IPO Cathedral

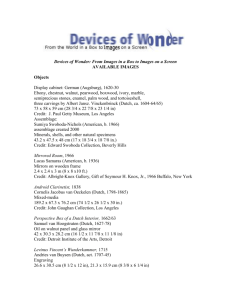

advertisement