Asia Pacific Equity Research

31 August 2006

Globe Union Industrial Corp

Overweight

1H06 net profit up 313%; reiterate Overweight

NT$27.20

31 August 2006

Price Target: NT$33.00

• Strong earnings recovery on track: Globe Union (GUIC)

reported 1H06 net profit of NT$292 million or EPS of NT$1.26,

up significantly by 313% Y/Y. This is in line with our expectation

and we reiterate our Overweight rating.

• ODM and OBM show robust growth in 1H06: Revenues from

the ODM business increased by 50% Y/Y while OBM revenues

grew by 20% Y/Y in 1H06. Robust revenue growth is the key

driver for a strong bottom-line recovery this year.

• Margins hold up well despite rising material prices: Margins

(on a consolidated basis) held up quite well in 1H06 despite raw

material price hikes, supported by strong growth of its high-margin

OBM business.

• Ex-dividend new price target of NT$33: We are not changing

our earnings estimates for GUIC as the results are in line with our

expectations. However, we have adjusted our price target to

NT$33 from NT$35 mainly on the back of new shares issued in

early August as dividends. Our August 2007 DCF-based price

target equates to 11x 2007E P/E and implies 21% potential upside

from the current level.

• Key risks to our view and price target: (1) potential raw

material price hikes; and (2) buoyancy of the US housing market.

Taiwan

Household Products

John ChungAC

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Nick Lai

(886-2) 2725-9864

nick.yc.lai@jpmorgan.com

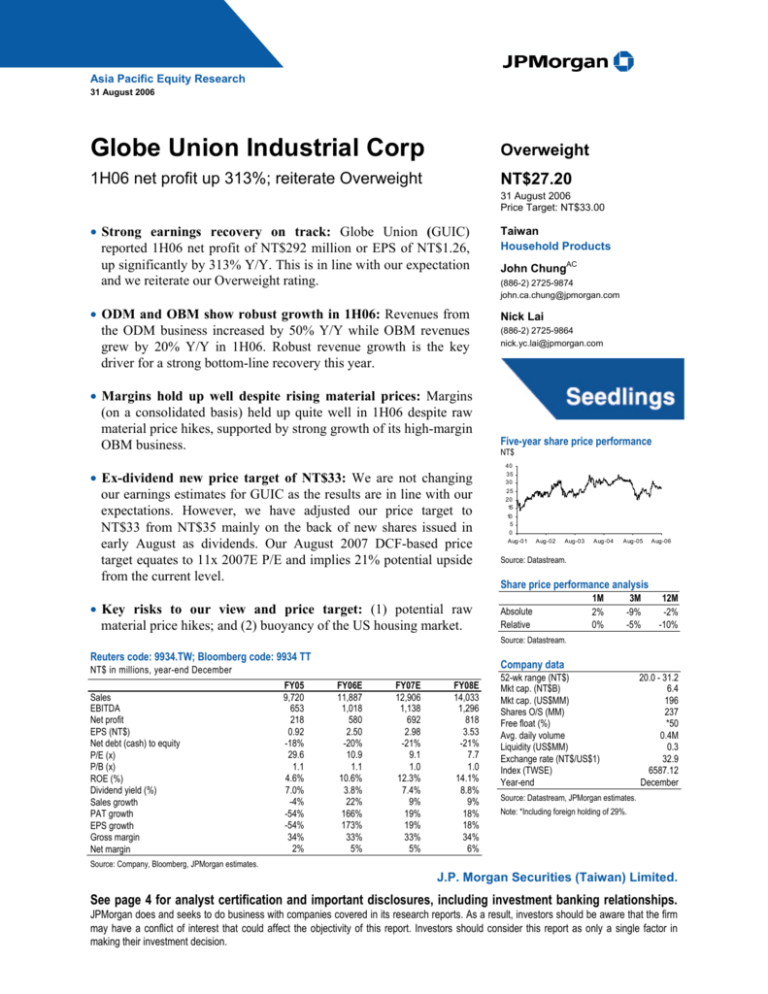

Five-year share price performance

NT$

40

35

30

25

20

15

10

5

0

Aug-01

Aug-02

Aug-03

Aug-04

Aug-05

Aug-06

Source: Datastream.

Share price performance analysis

Absolute

Relative

1M

2%

0%

3M

-9%

-5%

12M

-2%

-10%

Source: Datastream.

Reuters code: 9934.TW; Bloomberg code: 9934 TT

Company data

NT$ in millions, year-end December

Sales

EBITDA

Net profit

EPS (NT$)

Net debt (cash) to equity

P/E (x)

P/B (x)

ROE (%)

Dividend yield (%)

Sales growth

PAT growth

EPS growth

Gross margin

Net margin

FY05

9,720

653

218

0.92

-18%

29.6

1.1

4.6%

7.0%

-4%

-54%

-54%

34%

2%

FY06E

11,887

1,018

580

2.50

-20%

10.9

1.1

10.6%

3.8%

22%

166%

173%

33%

5%

FY07E

12,906

1,138

692

2.98

-21%

9.1

1.0

12.3%

7.4%

9%

19%

19%

33%

5%

FY08E

14,033

1,296

818

3.53

-21%

7.7

1.0

14.1%

8.8%

9%

18%

18%

34%

6%

52-wk range (NT$)

Mkt cap. (NT$B)

Mkt cap. (US$MM)

Shares O/S (MM)

Free float (%)

Avg. daily volume

Liquidity (US$MM)

Exchange rate (NT$/US$1)

Index (TWSE)

Year-end

20.0 - 31.2

6.4

196

237

*50

0.4M

0.3

32.9

6587.12

December

Source: Datastream, JPMorgan estimates.

Note: *Including foreign holding of 29%.

Source: Company, Bloomberg, JPMorgan estimates.

J.P. Morgan Securities (Taiwan) Limited.

See page 4 for analyst certification and important disclosures, including investment banking relationships.

JPMorgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm

may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in

making their investment decision.

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

31 August 2006

1H06 results summary

Globe Union (GUIC) reported 1H06 EPS of NT$1.26 or net profit of NT$292

million, up significantly by 313% Y/Y. This is in line with our expectation and we

are not changing our earnings estimates for the company. GUIC is due to report the

consolidated numbers on September 13, 2006. Nonetheless, our discussions with

management about the company’s 1H06 preliminary consolidated numbers support

our positive view of a strong fundamental recovery. Consolidated sales grew by 37%

Y/Y in 1H06, with the gross margin remaining steady at 32% despite raw material

price hikes. Strong growth of its high-margin OBM business was the major support

for GUIC’s margin level; revenues from the business grew by 20% Y/Y in 1H06.

Table 1: Globe Union—1H06 preliminary consolidated result

NT$ in millions

1H05

4,466

NA

1,491

NA

33%

142

NA

3%

93

71

-78%

2%

Net sales

Y/Y % growth

Gross profit

Y/Y % growth

Gross margin

Operating income

Y/Y % growth

Operating margin

Pre-tax income

Net income

Y/Y % growth

Net margin

1H06

6,135

37%

1,972

32%

32%

456

222%

7%

464

292

313%

5%

% of 2006E

52%

51%

61%

58%

50%

2006E

11,887

22%

3,892

19%

33%

753

69%

6%

795

580

166%

5%

Source: Company, JPMorgan estimates.

Valuation and recommendation

GUIC’s stock has outperformed the market by 7% YTD and is now trading at 11x

2006E or 9x 2007E P/E. We have not changed our earnings estimates as the

company is on track to reach our full-year estimate. However, we have adjusted our

EPS and price target to NT$33 from NT$35 mainly to reflect the changes in the

number of shares after the stock dividends were paid in early August. We reiterate

our Overweight rating on GUIC. Our DCF-based August 2007 price target equates to

11x 2007E P/E and implies 21% potential upside from current level.

Figure 1: Globe Union—P/B band

Figure 2: Globe Union—One-year forward P/E band

NT$

NT$

50

80

1.6 x

1.4 x

1.2 x

1.0 x

0.8 x

0.6 x

0.4 x

40

30

20

10

Jan-02

Jan-03

Source: TEJ, JPMorgan estimates.

2

50

40

30

20

10

0

0

Jan-01

25 x

22 x

19 x

16 x

13 x

10 x

7x

4x

70

60

Jan-04

Jan-05

Jan-06

Jan-01

Jan-02

Jan-03

Source: TEJ, JPMorgan estimates.

Jan-04

Jan-05

Jan-06

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

31 August 2006

Company profile

Globe Union Industrial Corp. (GUIC) is the largest faucet and bathroom accessories

manufacturer in Asia. With its headquarters and R&D center in Taiwan and

manufacturing plants in China, the company exports most of its products to the North

American market, which accounted for 85% of the consolidated revenue in FY05.

Established in 1979, GUIC has ODM and OBM business lines, which accounted for

56% and 44% of consolidated revenues in FY05, respectively. For its ODM business,

Home Depot is a major customer, accounting for 22% of consolidated revenues.

For its OBM business, GUIC has four major brands in different regions: Gerber and

Danze in the US, Gobo in China, and Lenz in Germany. We believe the OBM

business in the US and ODM business in Europe should be the major growth drivers

in the near-to-mid term, while the Chinese market offers strong growth potential for

the OBM business in the long term.

Figure 3: Globe Union—2005 consolidated revenues breakdown by

product

Accessory

Others

8%

1%

Figure 4: Globe Union—2005 consolidated revenues breakdown by

region

Europe

Show erheads

China

Other

2%

7%

6%

9%

Vitreous

China

18%

Source: Company.

Faucets

North America

64%

85%

Source: Company.

3

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

31 August 2006

Analyst Certification:

The research analyst(s) denoted by an “AC” on the cover of this report certifies (or, where multiple research analysts are primarily

responsible for this report, the research analyst denoted by an “AC” on the cover or within the document individually certifies, with

respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views expressed in this report

accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of any of the research

analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the

research analyst(s) in this report.

Important Disclosures

•

•

Client of the Firm: Globe Union Industrial Corp is or was in the past 12 months a client of JPMSI.

Non-Investment Banking Compensation: An affiliate of JPMSI has received compensation in the past 12 months for products or

services other than investment banking from Globe Union Industrial Corp.

Globe Union Industrial Corp (9934.TW) Price Chart

Date

60

20-Jan-06 OW

50

40

Price(NT$)

Rating Share Price

(NT$)

26.17

Price Target

(NT$)

38.00

OW NT$38 OW NT$35

30

20

10

0

Aug

03

Nov

03

Feb

04

May

04

Aug

04

Nov

04

Feb

05

May

05

Aug

05

Nov

05

Feb

06

May

06

Aug

06

Source: Reuters and JPMorgan; price data adjusted for stock splits and dividends.

Initiated coverage Jan 18, 2006. This chart shows JPMorgan's continuing coverage of this stock; the current analyst may

or may not have covered it over the entire period. As of Aug. 30, 2002, the firm discontinued price targets in all

markets where they were used. They were reinstated at JPMSI as of May 19th, 2003, for Focus List (FL) and selected Latin

stocks. For non-JPMSI covered stocks, price targets are required for regional FL stocks and may be set for other stocks

at analysts' discretion.

JPMorgan ratings: OW = Overweight, N = Neutral, UW = Underweight.

Explanation of Equity Research Ratings and Analyst(s) Coverage Universe:

JPMorgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the

average total return of the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Neutral [Over the next six to twelve

months, we expect this stock will perform in line with the average total return of the stocks in the analyst’s (or the analyst’s team’s)

coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of

the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] The analyst or analyst’s team’s coverage universe is the sector

and/or country shown on the cover of each publication. See below for the specific stocks in the certifying analyst(s) coverage universe.

Coverage Universe: John Chung: Basso Industry Corp (1527.TW), Formosa International Hotel (2707.TW), Giant Manufacturing

(9921.TW), Globe Union Industrial Corp (9934.TW), Makalot Industrial Co. Ltd. (1477.TW), Nien Made Enterprise (9915.TW), St.

Shine Optical Co., Ltd. (1565.TWO)

4

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

31 August 2006

JPMorgan Equity Research Ratings Distribution, as of July 3, 2006

JPM Global Equity Research Coverage

IB clients*

JPMSI Equity Research Coverage

IB clients*

Overweight

(buy)

42%

44%

38%

62%

Neutral

(hold)

40%

47%

47%

57%

Underweight

(sell)

18%

37%

15%

47%

*Percentage of investment banking clients in each rating category.

For purposes only of NASD/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold

rating category; and our Underweight rating falls into a sell rating category.

Valuation and Risks: Please see the most recent JPMorgan research report for an analysis of valuation methodology and risks on any

securities recommended herein. Research is available at http://www.morganmarkets.com , or you can contact the analyst named on the

front of this note or your JPMorgan representative.

Analysts’ Compensation: The equity research analysts responsible for the preparation of this report receive compensation based upon

various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which

include revenues from, among other business units, Institutional Equities and Investment Banking.

Other Disclosures

Options related research: If the information contained herein regards options related research, such information is available only to persons who

have received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation’s Characteristics and Risks of

Standardized Options, please contact your JPMorgan Representative or visit the OCC’s website at

http://www.optionsclearing.com/publications/risks/riskstoc.pdf.

Legal Entities Disclosures

U.S.: JPMSI is a member of NYSE, NASD and SIPC. J.P. Morgan Futures Inc. is a member of the NFA. J.P. Morgan Chase Bank, N.A. is a

member of FDIC and is authorized and regulated in the UK by the Financial Services Authority. U.K.: J.P. Morgan Securities Ltd. (JPMSL) is a

member of the London Stock Exchange and is authorised and regulated by the Financial Services Authority. South Africa: J.P. Morgan Equities

Limited is a member of the Johannesburg Securities Exchange and is regulated by the FSB. Hong Kong: J.P. Morgan Securities (Asia Pacific)

Limited (CE number AAJ321) is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong.

Korea: J.P. Morgan Securities (Far East) Ltd, Seoul branch, is regulated by the Korea Financial Supervisory Service. Australia: J.P. Morgan

Australia Limited (ABN 52 002 888 011/AFS Licence No: 238188, regulated by ASIC) and J.P. Morgan Securities Australia Limited (ABN 61

003 245 234/AFS Licence No: 238066, a Market Participant with the ASX) (JPMSAL) are licensed securities dealers. New Zealand: J.P. Morgan

Securities New Zealand Limited is a New Zealand Exchange Limited Market Participant. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a

participant of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Commission. India: J.P. Morgan

India Private Limited is a member of the National Stock Exchange of India Limited and The Stock Exchange, Mumbai and is regulated by the

Securities and Exchange Board of India. Thailand: JPMorgan Securities (Thailand) Limited is a member of the Stock Exchange of Thailand and

is regulated by the Ministry of Finance and the Securities and Exchange Commission. Indonesia: PT J.P. Morgan Securities Indonesia is a

member of the Jakarta Stock Exchange and Surabaya Stock Exchange and is regulated by the BAPEPAM. Philippines: This report is distributed

in the Philippines by J.P. Morgan Securities Philippines, Inc. Brazil: Banco J.P. Morgan S.A. is regulated by the Comissao de Valores

Mobiliarios (CVM) and by the Central Bank of Brazil. Japan: This material is distributed in Japan by JPMorgan Securities Japan Co., Ltd., which

is regulated by the Japan Financial Services Agency (FSA). Singapore: This material is issued and distributed in Singapore by J.P. Morgan

Securities Singapore Private Limited (JPMSS) [mica (p) 235/09/2005 and Co. Reg. No.: 199405335R] which is a member of the Singapore

Exchange Securities Trading Limited and is regulated by the Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A.,

Singapore branch (JPMCB Singapore) which is regulated by the MAS. Malaysia: This material is issued and distributed in Malaysia by

JPMorgan Securities (Malaysia) Sdn Bhd (18146-x) (formerly known as J.P. Morgan Malaysia Sdn Bhd) which is a Participating Organization of

Bursa Malaysia Securities Bhd and is licensed as a dealer by the Securities Commission in Malaysia

Country and Region Specific Disclosures

U.K. and European Economic Area (EEA): Issued and approved for distribution in the U.K. and the EEA by JPMSL. Investment research

issued by JPMSL has been prepared in accordance with JPMSL’s Policies for Managing Conflicts of Interest in Connection with Investment

Research which can be found at http://www.jpmorgan.com/pdfdoc/research/ConflictManagementPolicy.pdf. This report has been issued in the

U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2001 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons who are not

relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be engaged

in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in

their home jurisdiction Germany: This material is distributed in Germany by J.P. Morgan Securities Ltd. Frankfurt Branch and JPMorgan Chase

Bank, N.A., Frankfurt Branch who are regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Australia: This material is issued and

distributed by JPMSAL in Australia to “wholesale clients” only. JPMSAL does not issue or distribute this material to “retail clients.” The

5

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

31 August 2006

recipient of this material must not distribute it to any third party or outside Australia without the prior written consent of JPMSAL. For the

purposes of this paragraph the terms “wholesale client” and “retail client” have the meanings given to them in section 761G of the Corporations

Act 2001. Hong Kong: The 1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the

Hong Kong Code of Conduct for persons licensed by or registered with the Securities and Futures Commission. (For research published within

the first ten days of the month, the disclosure may be based on the month end data from two months’ prior.) J.P. Morgan Broking (Hong Kong)

Limited is the liquidity provider for derivative warrants issued by J.P. Morgan International Derivatives Ltd and listed on The Stock Exchange of

Hong Kong Limited. An updated list can be found on HKEx website: http://www.hkex.com.hk/prod/dw/Lp.htm. Korea: This report may have

been edited or contributed to from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul branch. Singapore: JPMSI and/or its

affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding

is disclosed in the Legal Disclosures section above. India: For private circulation only not for sale.

General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan

Chase & Co. or its affiliates and/or subsidiaries (collectively JPMorgan) do not warrant its completeness or accuracy except with respect to any

disclosures relative to JPMSI and/or its affiliates and the analyst’s involvement with the issuer that is the subject of the research. All pricing is as

of the close of market for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this

material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or

solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual

client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to

particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments

mentioned herein. JPMSI distributes in the U.S. research published by non-U.S. affiliates and accepts responsibility for its contents. Periodic

updates may be provided on companies/industries based on company specific developments or announcements, market conditions or any other

publicly available information. Clients should contact analysts and execute transactions through a JPMorgan subsidiary or affiliate in their home

jurisdiction unless governing law permits otherwise.

Revised July 3, 2006.

Copyright 2006 JPMorgan Chase & Co. All rights reserved.

6

John Chung

(886-2) 2725-9874

john.ca.chung@jpmorgan.com

Asia Pacific Equity Research

01 August 2006

Globe Union Industrial Corp: Summary of financials

(consolidated)

Profit and loss statement

Cash flow statement

NT$ in millions, year-end December

Net sales

Gross profit

Operating income

Interest income

Investment income

Total non-op. income

Interest expenses

Total non-op. exp.

Pre-tax income

Income tax expense

Net income

EBIT

EBITDA

EPS (NT$)

Growth (%)

Sales

PBT

PAT

EPS

NT$ in millions, year-end December

FY05

9,720

3,265

447

32

0

111

80

195

363

103

218

442

653

0.92

FY06E

11,887

3,892

753

47

0

131

67

89

795

199

580

862

1,018

2.50

FY07E

12,906

4,301

879

50

0

138

70

95

923

231

692

993

1,138

2.98

FY08E

14,033

4,778

1,043

69

0

140

71

92

1,091

273

818

1,162

1,296

3.53

-4%

-59%

-54%

-54%

22%

119%

166%

173%

9%

16%

19%

19%

9%

18%

18%

18%

Net income

Depreciation

Amortization

Dec(inc)-A/R

Dec(inc)-Inventory

Inc(dec)-A/P

Other adj.

Cash flow - operating

Sales (purchase) LT invest

Sales (purchase) of FA

Others

Cash flow - inv.

Free cash flow (opt + invt CF)

Dividend paid

Inc(dec) - S-T debt

Inc(dec) - L-T debt

Others

Cash flow - financing

Cash equiv. - begin

Cash equiv. - end

Balance sheet

Ratio analysis

NT$ in millions, year-end December

Year-end December

Cash and equivalent

Marketable security

A/R and N/R

Inventories

Total current assets

Long-term investment

Total fixed assets

Total other assets

Total assets

Short-term borrow.

Bills issued

A/P and N/P

Total current liab.

LT liabilities

Total other LT liab

Total liabilities

Common stocks

Total equity

Total liab and equity

FY05

3,029

141

2,198

1,964

7,586

478

1,405

565

10,034

1,094

0

1,382

3,407

1,102

158

4,668

2,152

5,366

10,034

Source: Company, JPMorgan estimates.

Note: * Dividends paid for last year’s earnings.

FY06E

3,283

141

1,971

1,971

7,621

483

1,329

552

9,986

1,194

0

1,162

3,234

1,092

127

4,454

2,152

5,532

9,986

FY07E

3,418

141

2,061

2,122

7,996

488

1,264

539

10,287

1,294

0

1,218

3,378

1,082

117

4,577

2,152

5,710

10,287

FY08E

3,456

141

2,226

2,282

8,359

493

1,170

534

10,557

1,294

0

1,307

3,447

1,072

117

4,636

2,152

5,921

10,557

Financial structure

Total debt/total asset

Net debt to equity

Liquidity

Current ratio (x)

Quick ratio (x)

Interest cover (x)

Margins

Gross margin

Operating margin

Net margin

Profitability

ROE

ROA

ROCE

Others

BV per share (NT$)

Cash dividend (NT$) *

Dividend yield

FY05

218

178

33

(708)

(276)

477

175

96

(466)

(115)

286

(296)

(201)

(378)

(116)

(32)

2,195

1,669

1,474

3,029

FY06E

580

136

20

227

(8)

(220)

4

739

(5)

(60)

(79)

(144)

595

(431)

100

(10)

0

(341)

3,029

3,283

FY07E

692

125

20

(90)

(151)

56

4

657

(5)

(60)

(34)

(99)

558

(514)

100

(10)

0

(424)

3,283

3,418

FY08E

818

113

20

(164)

(160)

89

4

720

(5)

(20)

(39)

(64)

656

(608)

0

(10)

0

(618)

3,418

3,456

FY05

22%

-18%

FY06E

23%

-20%

FY07E

23%

-21%

FY08E

23%

-21%

2.2

1.6

5.6

2.4

1.7

12.8

2.4

1.7

14.2

2.4

1.7

16.3

34%

5%

2%

33%

6%

5%

33%

7%

5%

34%

7%

6%

5%

2%

4%

11%

6%

10%

12%

7%

12%

14%

8%

13%

24.93

1.90

7%

25.70

1.03

4%

26.53

2.00

7%

27.51

2.39

9%