This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Asia Pacific Equity Research

07 February 2016

Neutral

Lupin Ltd.

LUPN.NS, LPC IN

Base business growth in US sales drive 3Q beat;

Near-term visibility but drivers for growth post 2HFY17

still evolving

As against expectation of another muted quarter (stock declined 8% in the week

before results), Lupin reported strong beat with EBITDA of Rs8.8bn (JPMe/Cons

at Rs8bn). The key drivers for the 3QFY16 revenue beat of ~6% (Rs35.6bn vs.

JPMe Rs33.5bn) were: a) 20% QoQ growth in US sales aided by branded (+56%

due to seasonality) and generic (+18% aided mostly by existing portfolio growth);

b) Improvement in Japan performance (+11% YoY vs. 4% in 1HFY16) in Kyowa

and I’rom; c) 40% QoQ increase in Other operating income (Rs2bn vs. Rs1.4bn in

2Q) with a certain amount received for contract during the quarter vs. over a

period of time. The strong US recovery due to pricing adjustment in base portfolio

and other operating income helped drive EBITDA margin expansion to 24.7% vs.

23% in 1HFY16. The full impact of the Fortamet price increase and gGlumetza

FTF launch will drive strong earnings over the next two quarters. We believe that

consensus P/E of 24-25x FY17E factors in the near term growth drivers, but not

the medium term risks from delay in key approvals in 2HFY17, execution risk in

its inorganic growth strategy and evolving growth drivers for FY18 and later.

US – Focus on sustainability of existing business growth and gGlumetza

ramp-up. The $34Mn QoQ increase in US revenue was aided by seasonality

(~$5-6Mn from Suprax and growth in Cephs). But bulk of the increase was

driven by portfolio optimization of its base business (price increase and volume

increase) with <5% contribution from new launches. While the new launch

revenue will increase sharply over the next two quarters with exclusivity launch

of gGlemtza (~$1bn annualized brand sales) and contribution from a few other

new products (LoFibra, Azithromycin, Potassium Chloride). We expect US

revenue to increase from $208Mn in 3QFY16 to $250+Mn over the next two

quarters aided by seasonality (flu season improving into 4QFY16), full benefit

of Fortamet price increase, strong new launch revenue.

What are the key triggers into 2HFY17? a) Sustainability of Fortamet price

hike – LPC sees it as limited competition with only one other approval (Mylan

but not launched); b) Rx trend for Glumetza over the next month will be key to

understand the full revenue potential from FTF launch; c) Post exclusivity

landscape for gGlumetza given Valeant’s Walgreen tie-up and two other

possible players; d) TADs for most of its pipeline (+90% pre Oct-14 pipeline)

with 15-month approval but further delay in key approvals in 2HFY17 is a risk.

Lupin Ltd. (Reuters: LUPN.NS, Bloomberg: LPC IN)

Rs in mn, year-end Mar

FY14A

FY15A

Revenue (Rs mn)

110,866

125,997

EBITDA (Rs mn)

30,028

36,196

Net Profit (Rs mn)

18,364

24,032

EPS (Rs)

40.79

53.20

DPS (Rs)

5.97

7.46

EPS growth (%)

39.4%

30.4%

EBITDA Margin

27.1%

28.7%

ROCE

25.9%

26.8%

ROE

30.3%

30.4%

P/E (x)

44.2

33.9

Source: Company data, Bloomberg, J.P. Morgan estimates.

FY16E

133,351

35,481

22,838

50.56

7.11

(5.0%)

26.6%

19.4%

23.2%

35.7

FY17E

164,618

45,617

31,065

68.77

9.66

36.0%

27.7%

21.0%

25.7%

26.2

FY18E

176,248

46,249

32,327

71.56

10.06

4.1%

26.2%

18.3%

21.9%

25.2

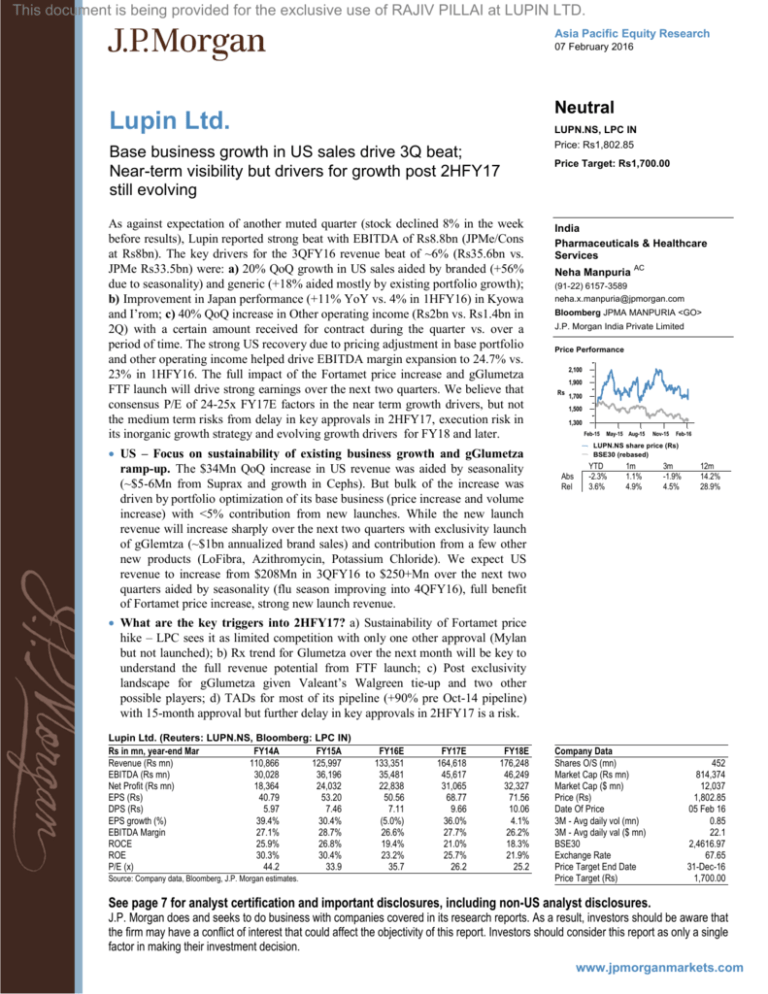

Price: Rs1,802.85

Price Target: Rs1,700.00

India

Pharmaceuticals & Healthcare

Services

Neha Manpuria

AC

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Bloomberg JPMA MANPURIA <GO>

J.P. Morgan India Private Limited

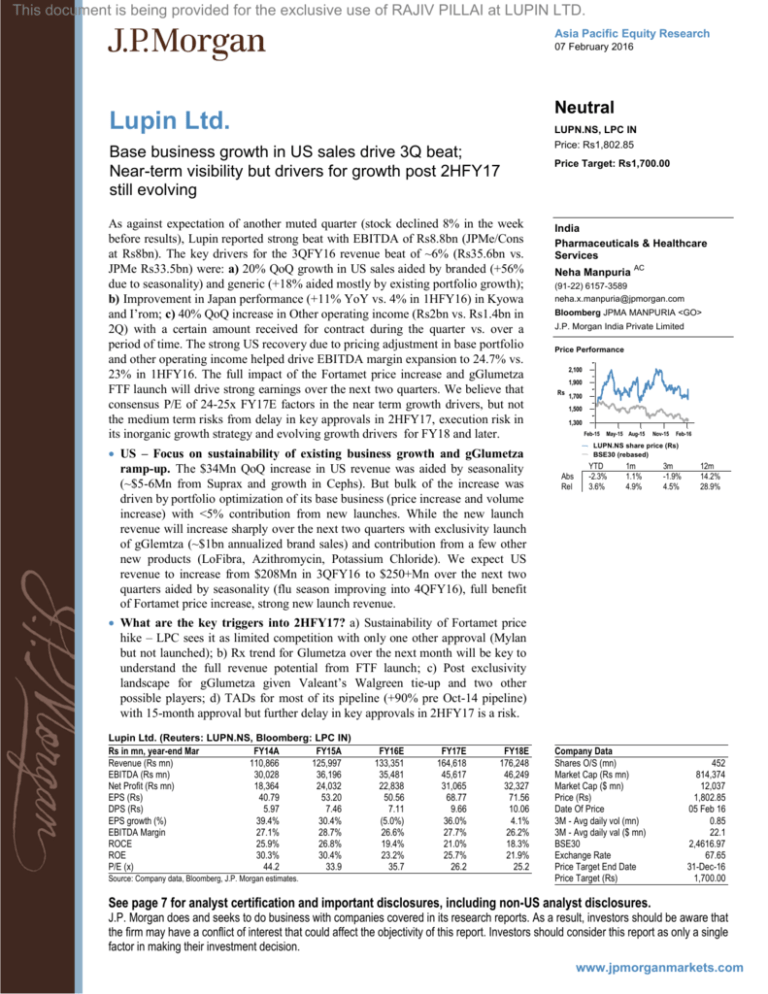

Price Performance

2,100

1,900

Rs 1,700

1,500

1,300

Feb-15

May-15 Aug-15

Nov-15

Feb-16

LUPN.NS share price (Rs)

BSE30 (rebased)

Abs

Rel

YTD

-2.3%

3.6%

1m

1.1%

4.9%

Company Data

Shares O/S (mn)

Market Cap (Rs mn)

Market Cap ($ mn)

Price (Rs)

Date Of Price

3M - Avg daily vol (mn)

3M - Avg daily val ($ mn)

BSE30

Exchange Rate

Price Target End Date

Price Target (Rs)

3m

-1.9%

4.5%

12m

14.2%

28.9%

452

814,374

12,037

1,802.85

05 Feb 16

0.85

22.1

2,4616.97

67.65

31-Dec-16

1,700.00

See page 7 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that

the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single

factor in making their investment decision.

www.jpmorganmarkets.com

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Asia Pacific Equity Research

07 February 2016

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Key catalysts for the stock price:

• Ramp-up of new brands and

acquisition of brands for its US

business

• Progress of upcoming niche launches

in the US

• Improvement in growth trend in Japan

Upside risks to our view:

• Faster-than-expected ramp up of US-Branded

business

• Big-ticket approval for the US Generic

business

• Growth from Japan exceeding expectations

given the drugs going off-patent in the medium

term

Downside risks to our view:

• Delay in approvals of products in the US

• Protracted slowdown in the domestic pharma market

• Regulatory/Litigation risks

• Continued weakness in its Japanese business

• INR appreciation could hurt non-INR revenue (~40% of revenue

in US$)

Key financial metrics

FY15A

FY16E

FY17E

FY18E

Valuation and price target basis

Revenues (LC)

125,997

133,351

164,618

176,248

Our Dec-16 PT of Rs1700 is based on at a P/E of 24x, a 20% premium to the

13.6

5.8

23.4

7.1

36,196

35,481

45,617

46,249

28.7

26.6

27.7

26.2

Revenue growth (%)

EBITDA (LC)

EBITDA margin (%)

28.4

31.0

28.0

26.0

24,032

22,838

31,065

32,327

EPS (LC)

53.2

50.6

68.8

71.6

EPS growth (%)

30.4

-5.0

36.0

4.1

DPS (LC)

7.5

7.2

9.7

10.1

Tax rate (%)

Net profit (LC)

BVPS (LC)

196.5

238.7

296.2

356.0

Operating cash flow (LC mn)

27,331

25,165

27,132

35,456

Free cash flow (LC mn)

22,354

14,875

20,132

29,456

Interest cover (X)

369.0

102.1

138.6

148.8

Net margin (%)

19.1

17.1

18.9

18.3

Sales/assets (X)

1.1

0.9

0.9

0.8

Debt/equity (%)

0.1

0.2

0.1

0.1

Net debt/equity (%)

-0.2

-0.2

-0.3

-0.4

ROE (%)

30.9

23.3

25.8

22.0

FY15A

FY16E

FY17E

FY18E

USD/INR

61.2

64.7

64.7

64.7

US Revenue Growth

11.0

-5.9

34.4

-6.0

Japan Revenue Growth

10.8

7.5

10.0

15.0

Key model assumptions

Source: Company data and J.P. Morgan estimates.

Sensitivity analysis

domestic peer group given its strong growth profile, higher return ratios and upside

from M&A.

Key risks include earlier than expected/delay in approvals in the US, regulatory risk,

and M&A execution.

LPC – US growth visibility in near-term but still WIP for FY18 and beyond

38%

1250

40%

34%

1,127

35%

1150

1,060

30%

1050

25%

891

950

839

20%

803

850

693

15%

750 12%

16%

10%

650

5%

11%

-6% 0%

550

504

-6%

450

-5%

350

-10%

FY12 FY13

FY14 FY15 FY16E FY17E FY18E

US Revenue ($Mn)

% YoY

Source: Bloomberg, Company data and J.P. Morgan estimates.

EBITDA

EPS

JPMe vs. consensus, change in estimates

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

1% chg in US Generic Revenue

0.4%

0.5%

0.4%

0.5%

JPMe old

47.3

67.1

1% chg in Japan Revenue

0.1%

0.1%

0.1%

0.1%

JPMe new

50.6

68.8

1% chg in R&D Expense

0.3%

0.4%

0.3%

0.4%

% chg

7%

3%

Consensus

50.2

72.9

Sensitivity to

Source: J.P. Morgan estimates.

2

EPS

Source: Bloomberg, J.P. Morgan.

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Asia Pacific Equity Research

07 February 2016

Key highlights from the conference call and our views

R&D – Starting to pick-up investment in complex portfolio: LPC continued to

see higher R&D spend (Rs3.9bn vs. Rs2.5-3bn run-rate last year) with management

guiding to strong filing pipeline. We expect R&D to remain at 11-11.5% over the

medium term as LPC steps up investment in injectable, respiratory, bio-similars for

Japan and investment in branded business. LPC has filed 15 ANDAs in 9MFY16 and

indicated at least 10 derma filings by end of fiscal. On respiratory, LPC filed its first

nasal spary, started work on the first MDI (going into clinics), Tiotropium and

Advair. On Advair DPI, management indicated clinics to start in mid-FY17 with this

likely to be its largest R&D program. In terms of its partnership for DPI, LPC

indicated that its partner has worked on the issues in the prototypes, resolved the IP

issues and capacity constraints. On the exiting pipeline, LPC has TADs for (+90%

of its pre-Oct-14 pipeline). On Nexium approval, management indicated that there

are no pending queries from USFDA but sees launch likely only in next fiscal. On

the launch timeline for Welchol and Sevelamer tabs, management indicated that there

are no open CRL and expects launch in 2HFY17. On the suspensions for both, LPC

has open CRL and expects launch only in FY18.

Gavis – Update from management: The closure of the Gavis deal has been delayed

by a few month given the pending FTC approval (asking for divestment of a few

Gavis’ existing products), but expect deal to be done by end of the month/fiscal.

Quarterly revenue run-rate at Gavis is still $30Mn (~$120Mn sales in 2015 vs.

$96Mn in 2014), which is tracking below management estimates. LPC pointed that

Gavis has not launched some of the products that received approvals (controlled

substances) as in some cases it sees chances of better market share as Lupin launch.

LPC said that after seeing the pipeline more closely, it believes it can achieve more

than 3x sales over time. On concerns related to the news-flow on API sourcing for

govt. supplies, LPC pointed that this is upside to the sales expectation and API can

be sourced from markets outside of India (i.e. countries like Italy, Spain, etc.).

Branded business - Working on organic and inorganic growth strategy: The

branded revenue improved 56% QoQ aided by growth in Suprax /Antara. LPC has

optimized its branded portfolio and also reorganized its salesforce to improve sales

for its brands. The Suprax franchise was aided by the flu season (despite soft start)

with good contribution from suspension and growth in chewable and capsules too.

LPC expects Suprax to continue to generate the similar level of sales if not higher.

Management expects the organic strategy to deliver growth in the branded business

in FY17 with continue effort to augment the segment by evaluating inorganic

opportunities. While LPC does need M&A to augment its portfolio and drive larger

contribution, we believe that organic efforts can help improve branded sales to $~6070Mn over the next few years (vs. <$50Mn currently).

Japan – 10-15% growth achievable: Japan performance improved in the quarter

with 10-13% YoY growth in both I’rom and Kyowa. Management indicated that

Japan will continue to see pressure from price cuts for next three years but this will

be offset from new launches and increasing push for generics. On the turnaround in

I’rom, LPC indicated that the growth near-term would be small with meaningful

improvement a few quarters away. We expect Japan business to grow 10-15% over

FY17-18, but margin improvement in the business remains key.

3

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Asia Pacific Equity Research

07 February 2016

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Other operating income – Some one-off element for the quarter: While a

significant portion of the OII is related to erport incentives (over Rs1bn),

management indicated that the QoQ increase in OII was due to the amount received

in lieu of newer contracts during the quarter instead of over a period of time. We

expect OII to remain elevated vs. last years level in the next two quarters due to

higher export incentives, but the Rs2b OII reported in the quarter in not sustainable

into 3QFY16, in our view.

Other details: a) Tax rate was higher in the 3Q (~35%) given tax on unrealized

profits related to good transferred out of India but not sold as yet. LPC expects this to

normalize to 30-31% in FY16; b) LPC indicated that the Gavis deal is a share

buyout, but it would give the company tax breaks going forward (substantial)

effectively implying faster payback; c) Staff cost flat QoQ despite the bonus payout

in 2QFY16 given increase in R&D employee costs, higher expenses in international

markets like Brazil and also impact from weak INR; d) Working capital days

increased from 106 days in Sep-15 to 123 in Dec-15, which management indicated is

due to account receivables and should come down by end of fiscal; e) Compliance

update: LPC had 12 inspection in the last year with Form 483 issues in 3 cases

(Indore, Goa and Aurangabad). While Indore has received EIR, LPC is working on

resolving the issues from Goa and Aurangabad (but got approval from both

facilities). LPC indicated that most new filings are from Indore and Nagpur.

Table 1: Indian Pharma: Valuation summary

Mcap

Sun Pharma

Lupin

Dr Reddy's

Cipla

Cadila

Aurobindo

Glenmark

CMP

858

1,803

3,109

570

326

763

734

$Mn

30,505

12,006

7,837

6,770

4,940

6,597

3,061

P/E (x)

CY16/FY17

26.0

26.9

19.8

20.5

19.6

17.5

14.1

CY17/FY18

20.5

25.0

14.7

16.5

15.8

14.6

13.1

EV/EBITDA (x)

CY16/FY17

17.3

17.1

12.1

15.0

13.9

11.6

9.7

CY17/FY18

13.8

15.6

9.0

12.4

11.4

10.1

8.7

P/BV (x)

CY16/FY17

5.7

6.2

3.4

3.2

5.1

4.5

3.4

CY17/FY18

4.6

5.1

2.9

2.8

4.0

3.7

2.8

RoE (%)

CY16/FY17

27.5

25.6

18.6

17.4

28.1

30.8

27.4

CY17/FY18

28.1

22.6

21.2

18.4

27.4

27.4

23.5

Source: Bloomberg, J.P. Morgan. Note: Consensus estimates for NC stocks Aurobindo and Cadila. J.P. Morgan estimates for all others.

Lupin Ltd. (Neutral; Price Target: Rs1,700.00)

Investment Thesis

We believe LPC is a high-quality stock in the sector, trading at a premium valuation

given its strong U.S. generics business, debt-free balance sheet and higher return

profile. The current multiple fairly values the earnings growth trajectory, in our view,

and we see limited scope for further re-rating. In our view, business development

opportunities pursued by the company will remain a key driver for the stock given

the comfortable balance sheet.

Valuation

Our Dec-16 price target of Rs1700 is based on a 24x P/E, a 20% premium to the

domestic peer group average given LPC’s relatively strong growth profile in the U.S.

generics business (aided by business development), presence in Japanese markets,

and better return ratios.

Risks to Rating and Price Target

Key upside risks include accretive business development opportunity, faster-thanexpected ramp-up of approvals in the U.S. and Japan. Downside risks include delays

in approvals for the U.S. generics business, regulatory risk and INR appreciation.

4

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Asia Pacific Equity Research

07 February 2016

Lupin Ltd.: Summary of Financials

Income Statement

Rs in millions, year end Mar

Revenues

% change Y/Y

Gross Profit

% change Y/Y

EBITDA

% change Y/Y

EBIT

% change Y/Y

EBIT Margin

Net Interest

Earnings before tax

% change Y/Y

Tax

as % of EBT

Net income (reported)

% change Y/Y

Shares outstanding

EPS (reported)

% change Y/Y

Balance sheet

Rs in millions, year end Mar

Cash and cash equivalents

Accounts receivable

Inventories

Others

Current assets

Cash flow statement

FY14

FY15 FY16E FY17E FY18E Rs in millions, year end Mar

110,866 125,997 133,351 164,618 176,248 PBT

17.2% 13.6%

5.8%

23.4%

7.1% Depr. & amortization

72,693 84,427 90,012 114,410 122,492 Change in working capital

22.9% 16.1%

6.6%

27.1%

7.1% Other

30,028 36,196 35,481 45,617 46,249 Cash flow from operations

32.3% 20.5%

(2.0%)

28.6%

1.4%

27,418 31,849 31,091 40,628 40,659 Capex

41.5% 16.2%

(2.4%)

30.7%

0.1% Other

24.7% 25.3%

23.3%

24.7%

23.1% Free cash flow

(267)

(98)

(347)

(329)

(311)

28,317 34,148 33,244 43,299 43,848 Equity raised/(repaid)

47.1% 20.6%

(2.6%)

30.2%

1.3% Debt raised/(repaid)

(9,622) (9,704) (10,306) (12,124) (11,401) Other

34.0% 28.4%

31.0%

28.0%

26.0% Dividends paid

18,364 24,032 22,838 31,065 32,327 Beginning cash

39.7% 30.9%

(5.0%)

36.0%

4.1% Ending cash

450

452

452

452

452 DPS

40.79

53.20

50.56

68.77

71.56

39.4% 30.4%

(5.0%)

36.0%

4.1%

Ratio Analysis

FY14

FY15 FY16E FY17E FY18E Rs in millions, year end Mar

7,975

4,814 29,131 42,718 65,428 Gross margin

24,641 26,566 28,116 34,709 37,161 EBITDA margin

21,295 25,036 27,401 33,826 36,215 Operating margin

5,330

5,350

5,662

6,990

7,483 Net margin

61,005 78,324 106,870 134,801 162,846

Sales per share growth

LT investments

21

25

25

25

25 Sales growth

Net fixed assets

30,019 32,961 35,571 37,581 37,991 Net profit growth

Total Assets

102,060 131,377 165,983 196,606 225,314 EPS growth

Liabilities

Interest coverage (x)

Payables

15,941 19,561 20,702 25,556 27,362

Others

5,326 13,379 13,953 14,585 15,280 Net debt to equity

Short-term debt

5,028

4,353 18,000 17,000 16,000 Working Capital to Sales

Total current liabilities

26,296 37,292 52,655 57,141 58,641 Sales/assets

Long-term debt

1,510

1,018

1,018

1,018

1,018 Assets/equity

Other liabilities

2,945

2,465

2,465

2,465

2,465 ROAE

Total Liabilities

32,075 42,396 57,921 62,585 64,281 ROACE

Shareholders' equity

69,316 88,741 107,821 133,780 160,792

BVPS

153.95 196.45 238.69 296.16 355.96

Source: Company reports and J.P. Morgan estimates.

FY14 FY15

28,317 34,148

2,610 4,347

(4,663) (949)

2,234

680

20,039 27,330

FY16E

33,244

4,390

(2,510)

100

25,165

FY17E

43,299

4,990

(9,361)

110

27,132

FY18E

43,848

5,590

(2,892)

121

35,456

(5,252) (8,676) (10,290)

(2,446) 4,425

0

14,963 18,725 15,115

(7,000)

0

20,369

(6,000)

0

29,686

2

2

(5,298) (700)

(41)

302

(3,234) (1,573)

3,109 6,066

7,975 4,813

5.97

7.46

0

13,647

(447)

(3,757)

4,814

29,131

7.11

0

(1,000)

(439)

(5,106)

29,131

42,718

9.66

0

(1,000)

(432)

(5,315)

42,718

65,428

10.06

FY14

65.6%

27.1%

24.7%

16.6%

FY15

67.0%

28.7%

25.3%

19.1%

FY16E

67.5%

26.6%

23.3%

17.1%

FY17E

69.5%

27.7%

24.7%

18.9%

FY18E

69.5%

26.2%

23.1%

18.3%

16.9%

17.2%

39.7%

39.4%

112.7

13.3%

13.6%

30.9%

30.4%

369.0

5.8%

5.8%

(5.0%)

(5.0%)

102.1

23.4%

23.4%

36.0%

36.0%

138.6

7.1%

7.1%

4.1%

4.1%

148.8

(2.1%)

31.3%

1.2

1.6

30.3%

25.9%

0.6%

32.6%

1.1

1.5

30.4%

26.8%

(9.4%) (18.4%) (30.1%)

40.7% 47.2% 59.1%

0.9

0.9

0.8

1.5

1.5

1.4

23.2% 25.7% 21.9%

19.4% 21.0% 18.3%

5

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Asia Pacific Equity Research

07 February 2016

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

JPM Q-Profile

Lupin Limited (INDIA / Health Care)

As Of: 29-Jan-2016

Quant_Strategy@jpmorgan.com

Local Share Price

Current:

1707.05

12 Mth Forward EPS

Current:

69.45

80.00

2,500.00

60.00

2,000.00

40.00

1,500.00

20.00

1,000.00

0.00

500.00

-20.00

24.6x

35.0x

Current:

Aug/15

Apr/14

Dec/14

Aug/13

Apr/12

P/E Relative to India Index

Dec/12

Aug/11

Apr/10

Dec/10

Aug/09

Apr/08

Dec/08

Aug/07

Apr/06

Dec/06

Aug/05

Apr/04

Dec/04

Aug/03

Apr/02

Dec/02

Aug/01

-40.00

Dec/00

Dec/15

Jun/14

Current:

Mar/15

Sep/13

Dec/12

Jun/11

PE (1Yr Forward)

Mar/12

Sep/10

Dec/09

Jun/08

Mar/09

Sep/07

Dec/06

Jun/05

Mar/06

Sep/04

Dec/03

Jun/02

Mar/03

Sep/01

Dec/00

0.00

1.45

2.00

1.80

30.0x

1.60

25.0x

1.40

1.20

20.0x

1.00

15.0x

0.80

10.0x

0.60

Earnings Yield (& Local Bond Yield)

14%

12Mth fwd EY

Current:

India BY

4.07%

Current:

Aug/15

Apr/14

Dec/14

Aug/13

Apr/12

Dividend Yield (Trailing)

Dec/12

Aug/11

Apr/10

Dec/10

Aug/09

Apr/08

Dec/08

Aug/07

Apr/06

Dec/06

Aug/05

Apr/04

Dec/04

Aug/03

Apr/02

Dec/02

Dec/00

Aug/15

Dec/14

Apr/14

Aug/13

Dec/12

Apr/12

Aug/11

Apr/10

Dec/10

Aug/09

Dec/08

Apr/08

Aug/07

Dec/06

Apr/06

Aug/05

Apr/04

Dec/04

Aug/03

Apr/02

Dec/02

Aug/01

0.00

Dec/00

0.20

0.0x

Aug/01

0.40

5.0x

0.41

10.0

Proxy

9.0

12%

8.0

10%

7.0

6.0

8%

5.0

6%

4.0

4%

3.0

2.0

2%

1.0

ROE (Trailing)

Current:

23.10

45.00

Price/Book (Value)

Current:

12.0x

P/B Trailing

40.00

Aug/15

Dec/14

Apr/14

Aug/13

Dec/12

Apr/12

Aug/11

Dec/10

Apr/10

Aug/09

Dec/08

Apr/08

Aug/07

Apr/06

Dec/06

Aug/05

Apr/04

Dec/04

Aug/03

Apr/02

Dec/02

Aug/01

0.0

Dec/00

Aug/15

Dec/14

Apr/14

Aug/13

Dec/12

Apr/12

Aug/11

Dec/10

Apr/10

Aug/09

Dec/08

Apr/08

Aug/07

Dec/06

Apr/06

Aug/05

Dec/04

Apr/04

Aug/03

Apr/02

Dec/02

Aug/01

Dec/00

0%

7.8x

P/B Forward

10.0x

35.00

30.00

8.0x

25.00

6.0x

20.00

15.00

4.0x

10.00

2.0x

Aug/15

Dec/14

Apr/14

Aug/13

Dec/12

Apr/12

Aug/11

Dec/10

Apr/10

Aug/09

Dec/08

Apr/08

Aug/07

Dec/06

Apr/06

Aug/05

Dec/04

Apr/04

Aug/03

Dec/02

Apr/02

0.0x

Aug/01

Aug/15

Dec/14

Apr/14

Aug/13

Dec/12

Apr/12

Aug/11

Dec/10

Apr/10

Aug/09

Dec/08

Apr/08

Aug/07

Dec/06

Apr/06

Aug/05

Dec/04

Apr/04

Aug/03

Apr/02

Dec/02

Aug/01

Dec/00

0.00

Dec/00

5.00

Summary

Lupin Limited

INDIA

Health Care

12mth Forward PE

P/BV (Trailing)

Dividend Yield (Trailing)

ROE (Trailing)

11188.36

2.522767 TICKER LPC IN EQUITY

Pharmaceuticals

Latest

Min

Max

24.58x

0.10

10.17

7.77x

0.00

8.78

0.41

18.19

41.24

23.10

Median

Average

2 S.D.+

2 S.D. -

5.82

0.68

30.26

5.34

0.86

28.89

9.94

3.17

42.93

0.73

-1.45

14.85

Source: Bloomberg, Reuters Global Fundamentals, IBES CONSENSUS, JPMorgan Quantitative & Derivative Strategy

6

29-Jan-16

As Of:

1,707.05

Local Price:

69.45

EPS:

% to Min % to Max % to Med % to Avg

-99%

-100%

-21%

31%

2051%

79%

-25%

67%

31%

-31%

111%

25%

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Asia Pacific Equity Research

07 February 2016

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Analyst Certification: The research analyst(s) denoted by an “AC” on the cover of this report certifies (or, where multiple research

analysts are primarily responsible for this report, the research analyst denoted by an “AC” on the cover or within the document

individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views

expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of

any of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views

expressed by the research analyst(s) in this report. For all Korea-based research analysts listed on the front cover, they also certify, as per

KOFIA requirements, that their analysis was made in good faith and that the views reflect their own opinion, without undue influence or

intervention.

Important Disclosures

Market Maker/ Liquidity Provider: J.P. Morgan Securities plc and/or an affiliate is a market maker and/or liquidity provider in

Lupin Ltd..

Client: J.P. Morgan currently has, or had within the past 12 months, the following company(ies) as clients: Lupin Ltd..

Client/Non-Investment Banking, Securities-Related: J.P. Morgan currently has, or had within the past 12 months, the following

company(ies) as clients, and the services provided were non-investment-banking, securities-related: Lupin Ltd..

Investment Banking (next 3 months): J.P. Morgan expects to receive, or intends to seek, compensation for investment banking

services in the next three months from Lupin Ltd..

Non-Investment Banking Compensation: J.P. Morgan has received compensation in the past 12 months for products or services

other than investment banking from Lupin Ltd..

Other Significant Financial Interests: J.P. Morgan owns a position of 1 million USD or more in the debt securities of Lupin Ltd..

Debt position: J.P. Morgan may own a position in the debt securities of Lupin Ltd. J.P. Morgan Securities LLC and/or its affiliates is

acting as financial advisor to GAVIS GROUP in connection with the sale to LUPIN LTD as announced on July 23, 2015. The transaction

is subject to certain closing conditions.

Company-Specific Disclosures: Important disclosures, including price charts and credit opinion history tables, are available for

compendium reports and all J.P. Morgan–covered companies by visiting https://jpmm.com/research/disclosures, calling 1-800-477-0406,

or e-mailing research.disclosure.inquiries@jpmorgan.com with your request. J.P. Morgan’s Strategy, Technical, and Quantitative

Research teams may screen companies not covered by J.P. Morgan. For important disclosures for these companies, please call 1-800-4770406 or e-mail research.disclosure.inquiries@jpmorgan.com.

Lupin Ltd. (LUPN.NS, LPC IN) Price Chart

3,366

Date

N Rs975N Rs1,300N Rs1,550

N Rs1,775

N Rs950N Rs1,175N Rs1,600

N Rs1,625

2,805

N Rs900 N Rs1,000N Rs1,400

2,244

NRN Rs1,700

Price(Rs)

1,683

1,122

561

0

Nov

10

Aug

11

May

12

Feb

13

Nov

13

Aug

14

May

15

Feb

16

Rating Share Price

(Rs)

Price Target

(Rs)

25-Nov-13 N

850.85

900.00

04-Feb-14 N

921.80

950.00

21-Apr-14

N

956.90

975.00

07-Jul-14

N

1078.10

1000.00

04-Aug-14 N

1165.40

1175.00

29-Oct-14

N

1357.55

1300.00

07-Jan-15

N

1377.60

1400.00

18-Feb-15 N

1681.85

1600.00

14-May-15 N

1689.50

1550.00

23-Jul-15

NR

1728.25

--

27-Jul-15

N

1617.55

1625.00

03-Sep-15 N

1862.35

1775.00

06-Jan-16

1753.20

1700.00

N

Source: Bloomberg and J.P. Morgan; price data adjusted for stock splits and dividends.

Break in coverage Jul 23, 2015 - Jul 27, 2015.

The chart(s) show J.P. Morgan's continuing coverage of the stocks; the current analysts may or may not have covered it over the entire

period.

J.P. Morgan ratings or designations: OW = Overweight, N= Neutral, UW = Underweight, NR = Not Rated

7

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Asia Pacific Equity Research

07 February 2016

Explanation of Equity Research Ratings, Designations and Analyst(s) Coverage Universe:

J.P. Morgan uses the following rating system: Overweight [Over the next six to twelve months, we expect this stock will outperform the

average total return of the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Neutral [Over the next six to twelve

months, we expect this stock will perform in line with the average total return of the stocks in the analyst’s (or the analyst’s team’s)

coverage universe.] Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of

the stocks in the analyst’s (or the analyst’s team’s) coverage universe.] Not Rated (NR): J.P. Morgan has removed the rating and, if

applicable, the price target, for this stock because of either a lack of a sufficient fundamental basis or for legal, regulatory or policy

reasons. The previous rating and, if applicable, the price target, no longer should be relied upon. An NR designation is not a

recommendation or a rating. In our Asia (ex-Australia) and U.K. small- and mid-cap equity research, each stock’s expected total return is

compared to the expected total return of a benchmark country market index, not to those analysts’ coverage universe. If it does not appear

in the Important Disclosures section of this report, the certifying analyst’s coverage universe can be found on J.P. Morgan’s research

website, www.jpmorganmarkets.com.

Coverage Universe: Manpuria, Neha: Apollo Hospitals Enterprise Ltd. (APLH.BO), Cipla Ltd. (CIPL.NS), Dr. Reddy's Laboratories

Limited (REDY.BO), Fortis Healthcare Ltd (FOHE.BO), Glenmark Pharmaceuticals Ltd. (GLEN.NS), Lupin Ltd. (LUPN.NS), Sun

Pharmaceutical Industries Ltd. (SUN.BO)

J.P. Morgan Equity Research Ratings Distribution, as of December 31, 2015

J.P. Morgan Global Equity Research Coverage

IB clients*

JPMS Equity Research Coverage

IB clients*

Overweight

(buy)

44%

52%

45%

70%

Neutral

(hold)

44%

47%

47%

63%

Underweight

(sell)

12%

35%

8%

50%

*Percentage of investment banking clients in each rating category.

For purposes only of FINRA/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category; our Neutral rating falls into a hold

rating category; and our Underweight rating falls into a sell rating category. Please note that stocks with an NR designation are not included in the table

above.

Equity Valuation and Risks: For valuation methodology and risks associated with covered companies or price targets for covered

companies, please see the most recent company-specific research report at http://www.jpmorganmarkets.com, contact the primary analyst

or your J.P. Morgan representative, or email research.disclosure.inquiries@jpmorgan.com.

Equity Analysts' Compensation: The equity research analysts responsible for the preparation of this report receive compensation based

upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues.

Registration of non-US Analysts: Unless otherwise noted, the non-US analysts listed on the front of this report are employees of non-US

affiliates of JPMS, are not registered/qualified as research analysts under NASD/NYSE rules, may not be associated persons of JPMS,

and may not be subject to FINRA Rule 2711 and NYSE Rule 472 restrictions on communications with covered companies, public

appearances, and trading securities held by a research analyst account.

Other Disclosures

J.P. Morgan ("JPM") is the global brand name for J.P. Morgan Securities LLC ("JPMS") and its affiliates worldwide. J.P. Morgan Cazenove is a marketing

name for the U.K. investment banking businesses and EMEA cash equities and equity research businesses of JPMorgan Chase & Co. and its subsidiaries.

All research reports made available to clients are simultaneously available on our client website, J.P. Morgan Markets. Not all research content is

redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your sales

representative.

Options related research: If the information contained herein regards options related research, such information is available only to persons who have

received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation's Characteristics and Risks of Standardized Options,

please contact your J.P. Morgan Representative or visit the OCC's website at http://www.optionsclearing.com/publications/risks/riskstoc.pdf

Legal Entities Disclosures

U.S.: JPMS is a member of NYSE, FINRA, SIPC and the NFA. JPMorgan Chase Bank, N.A. is a member of FDIC. U.K.: JPMorgan Chase N.A., London

Branch, is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and to limited regulation by

the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from J.P. Morgan on

request. J.P. Morgan Securities plc (JPMS plc) is a member of the London Stock Exchange and is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England & Wales No. 2711006. Registered Office 25

Bank Street, London, E14 5JP. South Africa: J.P. Morgan Equities South Africa Proprietary Limited is a member of the Johannesburg Securities

Exchange and is regulated by the Financial Services Board. Hong Kong: J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated

by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong and/or J.P. Morgan Broking (Hong Kong) Limited (CE

8

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Asia Pacific Equity Research

07 February 2016

number AAB027) is regulated by the Securities and Futures Commission in Hong Kong. Korea: This material is issued and distributed in Korea by or

through J.P. Morgan Securities (Far East) Limited, Seoul Branch, which is a member of the Korea Exchange(KRX) and is regulated by the Financial

Services Commission (FSC) and the Financial Supervisory Service (FSS). Australia: J.P. Morgan Australia Limited (JPMAL) (ABN 52 002 888 011/AFS

Licence No: 238188) is regulated by ASIC and J.P. Morgan Securities Australia Limited (JPMSAL) (ABN 61 003 245 234/AFS Licence No: 238066) is

regulated by ASIC and is a Market, Clearing and Settlement Participant of ASX Limited and CHI-X. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a

participant of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Bureau. India: J.P. Morgan India Private

Limited (Corporate Identity Number - U67120MH1992FTC068724), having its registered office at J.P. Morgan Tower, Off. C.S.T. Road, Kalina,

Santacruz - East, Mumbai – 400098, is registered with Securities and Exchange Board of India (SEBI) as a ‘Research Analyst’ having registration number

INH000001873. J.P. Morgan India Private Limited is also registered with SEBI as a member of the National Stock Exchange of India Limited (SEBI

Registration Number - INB 230675231/INF 230675231/INE 230675231) and Bombay Stock Exchange Limited (SEBI Registration Number - INB

010675237/INF 010675237). Telephone: 91-22-6157 3000, Facsimile: 91-22-6157 3990 and Website: www.jpmipl.com. For non local research reports,

this material is not distributed in India by J.P. Morgan India Private Limited. Thailand: This material is issued and distributed in Thailand by JPMorgan

Securities (Thailand) Ltd., which is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and

Exchange Commission and its registered address is 3rd Floor, 20 North Sathorn Road, Silom, Bangrak, Bangkok 10500. Indonesia: PT J.P. Morgan

Securities Indonesia is a member of the Indonesia Stock Exchange and is regulated by the OJK a.k.a. BAPEPAM LK. Philippines: J.P. Morgan Securities

Philippines Inc. is a Trading Participant of the Philippine Stock Exchange and a member of the Securities Clearing Corporation of the Philippines and the

Securities Investor Protection Fund. It is regulated by the Securities and Exchange Commission. Brazil: Banco J.P. Morgan S.A. is regulated by the

Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil. Mexico: J.P. Morgan Casa de Bolsa, S.A. de C.V., J.P. Morgan Grupo

Financiero is a member of the Mexican Stock Exchange and authorized to act as a broker dealer by the National Banking and Securities Exchange

Commission. Singapore: This material is issued and distributed in Singapore by or through J.P. Morgan Securities Singapore Private Limited (JPMSS)

[MCI (P) 100/03/2015 and Co. Reg. No.: 199405335R] which is a member of the Singapore Exchange Securities Trading Limited and is regulated by the

Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A., Singapore branch (JPMCB Singapore) which is regulated by the MAS. This

material is provided in Singapore only to accredited investors, expert investors and institutional investors, as defined in Section 4A of the Securities and

Futures Act, Cap. 289. Recipients of this document are to contact JPMSS or JPMCB Singapore in respect of any matters arising from, or in connection

with, the document. Japan: JPMorgan Securities Japan Co., Ltd. and JPMorgan Chase Bank, N.A., Tokyo Branch are regulated by the Financial Services

Agency in Japan. Malaysia: This material is issued and distributed in Malaysia by JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) which is a

Participating Organization of Bursa Malaysia Berhad and a holder of Capital Markets Services License issued by the Securities Commission in Malaysia.

Pakistan: J. P. Morgan Pakistan Broking (Pvt.) Ltd is a member of the Karachi Stock Exchange and regulated by the Securities and Exchange Commission

of Pakistan. Saudi Arabia: J.P. Morgan Saudi Arabia Ltd. is authorized by the Capital Market Authority of the Kingdom of Saudi Arabia (CMA) to carry

out dealing as an agent, arranging, advising and custody, with respect to securities business under licence number 35-07079 and its registered address is at

8th Floor, Al-Faisaliyah Tower, King Fahad Road, P.O. Box 51907, Riyadh 11553, Kingdom of Saudi Arabia. Dubai: JPMorgan Chase Bank, N.A., Dubai

Branch is regulated by the Dubai Financial Services Authority (DFSA) and its registered address is Dubai International Financial Centre - Building 3,

Level 7, PO Box 506551, Dubai, UAE.

Country and Region Specific Disclosures

U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by JPMS plc.

Investment research issued by JPMS plc has been prepared in accordance with JPMS plc's policies for managing conflicts of interest arising as a result of

publication and distribution of investment research. Many European regulators require a firm to establish, implement and maintain such a policy. This

report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons

who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be

engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in

their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia to "wholesale clients" only. This material does not take

into account the specific investment objectives, financial situation or particular needs of the recipient. The recipient of this material must not distribute it to

any third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the term "wholesale client" has the

meaning given in section 761G of the Corporations Act 2001. Germany: This material is distributed in Germany by J.P. Morgan Securities plc, Frankfurt

Branch and J.P.Morgan Chase Bank, N.A., Frankfurt Branch which are regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Hong Kong: The

1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons

Licensed by or Registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may

be based on the month end data from two months prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider/market maker for derivative

warrants, callable bull bear contracts and stock options listed on the Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx

website: http://www.hkex.com.hk. Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and

that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, JPMorgan Securities Japan Co., Ltd., will be

receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually

agreed between JPMorgan Securities Japan Co., Ltd., and the customer in advance. Financial Instruments Firms: JPMorgan Securities Japan Co., Ltd.,

Kanto Local Finance Bureau (kinsho) No. 82 Participating Association / Japan Securities Dealers Association, The Financial Futures Association of Japan,

Type II Financial Instruments Firms Association and Japan Investment Advisers Association. Korea: This report may have been edited or contributed to

from time to time by affiliates of J.P. Morgan Securities (Far East) Limited, Seoul Branch. Singapore: As at the date of this report, JPMSS is a designated

market maker for certain structured warrants listed on the Singapore Exchange where the underlying securities may be the securities discussed in this

report. Arising from its role as designated market maker for such structured warrants, JPMSS may conduct hedging activities in respect of such underlying

securities and hold or have an interest in such underlying securities as a result. The updated list of structured warrants for which JPMSS acts as designated

market maker may be found on the website of the Singapore Exchange Limited: http://www.sgx.com.sg. In addition, JPMSS and/or its affiliates may also

have an interest or holding in any of the securities discussed in this report – please see the Important Disclosures section above. For securities where the

holding is 1% or greater, the holding may be found in the Important Disclosures section above. For all other securities mentioned in this report, JPMSS

and/or its affiliates may have a holding of less than 1% in such securities and may trade them in ways different from those discussed in this report.

Employees of JPMSS and/or its affiliates not involved in the preparation of this report may have investments in the securities (or derivatives of such

securities) mentioned in this report and may trade them in ways different from those discussed in this report. Taiwan: This material is issued and

distributed in Taiwan by J.P. Morgan Securities (Taiwan) Limited. India: For private circulation only, not for sale. Pakistan: For private circulation only,

9

This document is being provided for the exclusive use of RAJIV PILLAI at LUPIN LTD.

Neha Manpuria

(91-22) 6157-3589

neha.x.manpuria@jpmorgan.com

Asia Pacific Equity Research

07 February 2016

not for sale. New Zealand: This material is issued and distributed by JPMSAL in New Zealand only to persons whose principal business is the investment

of money or who, in the course of and for the purposes of their business, habitually invest money. JPMSAL does not issue or distribute this material to

members of "the public" as determined in accordance with section 3 of the Securities Act 1978. The recipient of this material must not distribute it to any

third party or outside New Zealand without the prior written consent of JPMSAL. Canada: The information contained herein is not, and under no

circumstances is to be construed as, a prospectus, an advertisement, a public offering, an offer to sell securities described herein, or solicitation of an offer

to buy securities described herein, in Canada or any province or territory thereof. Any offer or sale of the securities described herein in Canada will be

made only under an exemption from the requirements to file a prospectus with the relevant Canadian securities regulators and only by a dealer properly

registered under applicable securities laws or, alternatively, pursuant to an exemption from the dealer registration requirement in the relevant province or

territory of Canada in which such offer or sale is made. The information contained herein is under no circumstances to be construed as investment advice in

any province or territory of Canada and is not tailored to the needs of the recipient. To the extent that the information contained herein references securities

of an issuer incorporated, formed or created under the laws of Canada or a province or territory of Canada, any trades in such securities must be conducted

through a dealer registered in Canada. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed judgment

upon these materials, the information contained herein or the merits of the securities described herein, and any representation to the contrary is an offence.

Dubai: This report has been issued to persons regarded as professional clients as defined under the DFSA rules. Brazil: Ombudsman J.P. Morgan: 08007700847 / ouvidoria.jp.morgan@jpmorgan.com.

General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co.

or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to

JPMS and/or its affiliates and the analyst's involvement with the issuer that is the subject of the research. All pricing is as of the close of market for the

securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change

without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any

financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not

intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own

independent decisions regarding any securities or financial instruments mentioned herein. JPMS distributes in the U.S. research published by non-U.S.

affiliates and accepts responsibility for its contents. Periodic updates may be provided on companies/industries based on company specific developments or

announcements, market conditions or any other publicly available information. Clients should contact analysts and execute transactions through a J.P.

Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

"Other Disclosures" last revised January 01, 2016.

Copyright 2016 JPMorgan Chase & Co. All rights reserved. This report or any portion hereof may not be reprinted, sold or

redistributed without the written consent of J.P. Morgan. #$J&098$#*P

10