Solutions for Week 02 Question 1 a) For price weighted index: Rp

advertisement

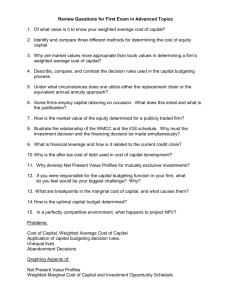

Solutions for Week 02 Question 1 a) For price weighted index: Rp= [5/2+(122.5- 125)]/125 = 0% For market value weighted index: Rp= [5000+74,000-70,000]/70,000 = 12.875% b). For price weighted index: D/P = 5/122.5 = 4.08% For market value weighted index D/P = 5000/74,000=6.757% c). Ea = 55/15 = 3.667 Eb = 190/25 = 7.6 For price weighted index P/E = (190+55)/2/(3.667+7.6) =10.87 For market value weighted index 74000 P/E = ___________________________________ = 1.67 3.667x1000+7.6x100 (S&P500 company uses the following method to calculate P/E ratio, P/E= Sum( market value of index)/Sum(Earning of all stocks). Notes: Please notice the results differences based on different methods. Dow Jones Index uses Price-weighted, whereas S&P500, FTSE100 and NASDAQ use Capitalization weighted method. Question 2 Consider the follows: • • • • • • • • The overviews of economy across those stock markets at that time ( 10/02) Dow Jones does not include technology stocks such as Microsoft, which do not pay a dividend and hence have a zero dividend yield Generally the higher the PE the lower the DY The trailing figures for NASDAQ and NK225 are negative. PE’s don’t make sense in this case Current PE are generally lower than the trailing PE indicates that analysts expectations are more optimistic On NASDAQ, high technology companies would like to keep the earning in the company to let it grow rather than paying dividends In 2002, Japan markets was at the bottom Capital gains tax rates are lower than dividend payment rates for investors Question 3 Refer to Shiller’s paper(1998). Http://www.econ.yale.edu/~shiller Question 4 Refers to handout page 18. Do you consider other factors that explain if the current market has corrected sufficiently?