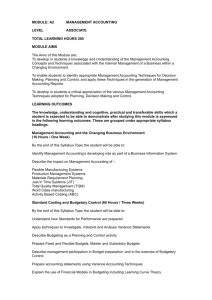

Review Questions for First Exam in Advanced Topics

advertisement

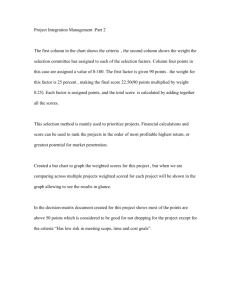

Review Questions for First Exam in Advanced Topics 1. Of what value is it to know your weighted average cost of capital? 2. Identify and compare three different methods for determining the cost of equity capital. 3. Why are market values more appropriate than book values in determining a firm’s weighted average cost of capital? 4. Describe, compare, and contrast the decision rules used in the capital budgeting process. 5. Under what circumstances does one utilize either the replacement chain or the equivalent annual annuity approach? 6. Some firms employ capital rationing on occasion. What does this entail and what is the justification? 7. How is the market value of the equity determined for a publicly traded firm? 8. Illustrate the relationship of the WMCC and the IOS schedule. Why must the investment decision and the financing decision be made simultaneously? 9. What is financial leverage and how is it related to the current credit crisis? 10. Why is the after-tax cost of debt used in cost of capital development? 11. Why develop Net Present Value Profiles for mutually exclusive investments? 12. If you were responsible for the capital budgeting function in your firm, what do you feel would be your biggest challenge? Why? 13. What are breakpoints in the marginal cost of capital, and what causes them? 14. How is the optimal capital budget determined? 15. In a perfectly competitive environment, what happens to project NPV? Problems: Cost of Capital, Weighted Average Cost of Capital Application of capital budgeting decision rules. Unequal lives Abandonment Decisions Graphing Aspects of: Net Present Value Profiles Weighted Marginal Cost of Capital and Investment Opportunity Schedule