300000 Trust Preferred Securities Banca Popolare di

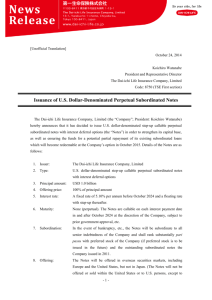

advertisement