Birla Sun Life Emerging Leaders Fund – Series 7

advertisement

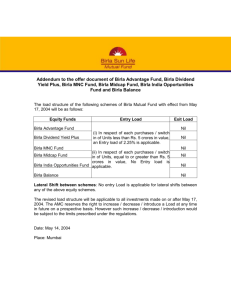

Birla Sun Life Emerging Leaders Fund – Series 7 Fund Features Issue Opens Issue Closes Nature of the Scheme Friday, February 05, 2016 Friday, February 19, 2016 3.5 Year close ended Equity scheme Instrument Benchmark Load Structure Minimum Investment Minimum Rs. 5000/- & in multiples of Re. 10/- thereafter Option Plans Fund Manager Mr. Mahesh Patil Plans A Close ended equity scheme Nifty Midcap 100 Entry Load: Nil Exit Load: Nil Growth Option and Dividend Option with Payout Facility Regular Plan and Direct Plan Application forms available on www.edelweisspartners.com Investor can attached Cheque / Demand Draft (DD) in favor of “Birla Sun Life Emerging Leaders Fund – Series 7” along with application form. Investment Objective The primary objective of the Scheme is to generate long-term capital appreciation by investing predominantly in equity and equity related securities of Small & Mid Cap companies. The Scheme does not guarantee/indicate any returns. There can be no assurance that the Schemes’ objectives will be achieved. Some Key theme that are likely to be focus Bottom up stock picking across these themes could benefit significantly. The scheme seeks to build a concentrated Portfolio of 25 stocks from the mid cap and small cap segment. It does not tend to have any sector bias. A brief on scheme composition - concentrated Small & Midcap portfolio with the following salient features CONCENTRATED PORTFOLIO – While diversification helps diversify risk, concentration helps accumulate alpha. It does also build in higher volatility but pays off handsomely if the concentration is reasonable enough. Research has shown that the sweet spot lies between 20-30 stock. The fund is targeting to have ~25-30 stocks, spread across 5-8 sectors. Small & Midcap bias – It’s a Small & Midcap focus fund but has the ability to ride through volatility by allocating upto 40% in large caps also. Bottom up stock picking – Investment approach is largely stock selection based and seeks to select long term winners. Over the past few months, we have been able to demonstrate our stock picking ability through success of similar portfolios. The portfolio will be focusing on companies with sustainably higher than industry growth rates as well as businesses run by managements that are focused. Themes in focus – The fund seeks to focus on themes that are either beneficiaries of Government action / reforms like Defence, Railways & roads or themes which are expected to have significantly high growth rates due to the inherent drives – Discrete consumption, Ecommerce, new age banking etc. As a fund that focuses on long term value, it will also look at companies / businesses that are going through special situations like agrochemical, whose valuations have suffered due to poor back to back monsoons. Statistically, this is not expected to happen again and hence the case for bottom fishing for cheap valuations in this sector. Some Key Reasons to Invest Now • Valuations reasonable, ripe for investments now – earnings growth across Small & Midcaps is strong and valuations within Long term average • Bottom up concentrated approach – fundamental research driven approach to invest in a focused portfolio of high growth companies that have rerating potential • Small & Midcap companies typically makes more money in full cycle – historically Small & Midcaps have significantly outperformed the Large cap peers • Handpicked themes across sectors with strong fundamentals – to maximize alpha contribution from each holding, each portfolio company will be picked up using Bottom Up investments approach Asset Allocation Pattern Instrument Equity and Equity related securities Out of which: Small & Mid Caps : 60% - 100% Other than Small & Mid Caps : 0% - 40% Cash, Money Market* & Debt instruments* Risk Profile Normal Allocation (% of total Assets) High High High Low 80 - 100% 0-20% Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Derivatives are high risk, high return instruments as they may be highly leveraged. A small price movement in the underlying security could have a large impact on their value and may also result in a loss. All the information quoted in this document has been taken from document provided by Birla Sun Life Mutual Fund Company. This document is only for the purpose of information. All the data / information quoted in this document has been taken from the scheme related document provided by Birla Sun Life Mutual Fund Company and other communication provided by Birla Sun Life AMC. For more details, please read the scheme information document (www.mutualfund.birlasunlife.com)