Mahmood ALAM SHER Resume

advertisement

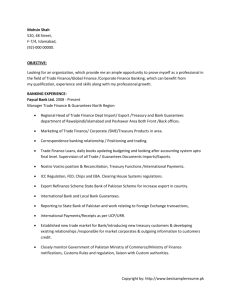

Mahmood ALAM SHER Contact No. E-Mail Web Page : : : 0092 333 5199953 awansher@gmail.com http://www.alamsher.yolasite.com http://pk.linkedin.com/in/mahmoodalamsher http://fr.linkedin.com/in/mahmoodalamsher/fr SYNOPSIS A result oriented professional, experienced in Banking and Financial Sector encompassing Finance & Accounts, Business Development, Credit Management, Credit Administration, Project Management, and Team Management. Have diversified experience of Islamic Banking, Conventional Banking, Investment Banking, Project Financing & Payment Industry etc. Strong business acumen with skills to remain on the cutting edge; drive new business through conceptualising strategies, augmenting & streamlining networks, implementing product promotions etc. ACADEMIC CREDENTIALS 2008 MS/Master 2 (Research) in Economy University Paris 1 (Pantheon Sorbonne), Paris – France Specialization: Money, Banking & Finance Final Research Report: Credit Derivatives & Financial Stability 1999 Master in Business Administration (Marketing) Islamia University, Bahawalpur - Pakistan PROFESSIONAL QUALIFICATION 2006 Banking Superior Qualification Institute of Bankers Pakistan EMPLOYMENT PROFILE - July 2012 till date “Head of Finance Department” at 1 Link (Guarantee) Ltd, Karachi (PAKISTAN) Working as Head of Finance at 1 Link (Guarantee) Ltd, Karach (Pakistan). Major job responsibilities include; 1. Strategic: To ensure that an appropriate financial policy framework is in place to guide 1 Link’s financial decision-making and development particularly in relation to reserves, expense and granting ratios and income streams. To ensure the appropriateness of the key assumptions included in the strategic plans and annual budget proposals. Provide advice to senior management colleagues on these matters. To prepare annual budget and forecasts aligned to strategic plans and in accordance with guidelines provided by BoD. Provide a high level of professionalism reflected in a sound budgetary policy. To work closely with the Team as part of a mutually supportive senior management team, advising them on the likely financial consequences of all proposed courses of action. To maintain contact and liaise with bankers, insurance companies, pension advisors and auditors to ensure the long term financial security and stability of 1 Link. To contribute as an effective member of 1 Link’s Operational Management Team. Contribute to 1 Link’s Risk Management strategic policy and procedures. To provide leadership by delegating tasks, responding to staff inquiries and providing overall direction to section employees. Member of Purchase Committee, major responsibilities are to develop and implement purchasing practices and monitor the purchasing system. To respond to auditors’ comments concerning finances and operations and oversee required action to address deficiencies. 2. Finance & Accounting: To provide full accounting services to other Head of Departments and managers including departmental financial analysis and exploring any potential problems with them in order to make appropriate budgetary decisions. To produce rolling cash flow forecasts, monitor cash position daily and ensure creditors’ terms are met. Establish and maintain cash controls. Manage investments and reserves. To advise the Team on major financial issues as they arise. To establish and maintain internal controls to ensure compliance with financial legislation, policies and procedures. To manage the maintenance and upgrade of financial & payroll systems. To manage the financial resources of the company and conduct resource planning for future needs. To design the company's financial policies, rules and regulations, and makes sure that every department adheres to them. Responsible for account monitoring and control of all the departments of the organization. Account receivables & account payable management. To prepare and supervise the financial reports in discussion with all the other departments in the company, and then presents it before the CEO & board of directors. To oversee cash management, banking and financial institution relationships. Negotiate bank and service fees. Implement new bank technologies, products and services to improve cash cycle and simplify company operations. To ensure adequate liquidity for working capital needs and invest short term excess cash. - March 2011 till date “External Subject Matter Expert/External Reviewer” at The Edcomm Group Banker’s Academy, USA Working as External Subject Matter Expert/External Reviewer (stationed at Pakistan) at Banker’s Academy. It is one of the best financial services training company and consultant in the world, operating since 1987. It has over 2,000 clients (financial institutions) in 75 Countries. My job responsibilities include consulting work, reviewing outlines and drafts and making content recommendations for either classroom or eLearning training programs. - January 2009 to July 2012 “Financial Consultant/Coordinator - Accounting” (Pakistan & France) Worked as financial consultant (external) for different sole proprietors, partnership firms and SMEs. Depending upon the nature of contract, I performed following duties to assist my customers; - Review of the financial management function against best practices: the objective of this review was to help the customers develop a strong financial planning capacity using inputs from the core lending and saving operations, accounting treasury and financial control. Develop and introduce the financial administration procedures. Cost & benefit analysis of different funding resources available to the customers, provided guidelines and assisted in completing formalities for obtaining loans from Banks/Financial Institutions. Designed the financial reporting & Internal Control systems to establish the effectiveness of the financial management and control systems in place, i.e. to prevent, detect and correct errors and irregularities. Contributed to the promotion of best practice in the financial management and control by recommending an optimum organizational structure to cover the key functions needed to develop an advanced financial management capacity: organization chart, positions, skills/profiles and job descriptions, reporting lines, etc. Assisted in preparing/re-appropriation of the budget, budgetary control of expenditure, development of different processes in Revenue Booking & Reporting etc. September 2006 to June 2007 “Relationship Manager - Corporate Banking” at Faysal Bank Limited (Pakistan) Major Responsibilities; 1. 2. Relationship Management & Marketing: Maintenance and growth of portfolio of corporate accounts through deepening in existing relationships and targeting new relationships to grow the book and maximize revenues for the bank. Provided superior customer services through efficient and accurate responses to customers’ queries, proactively anticipating customer requirements and suggesting improvements to ongoing customer banking arrangements. Supported the profitability by generation of non-funded business comprising of imports, exports, guarantees etc. Cross selling of bank’s other products such as consumer finance facilities, investment products etc. Credit Management: Processed high quality credit/loan proposals through compiling and analyzing complete information. Structuring of credit facilities in line with regulations of Faysal Bank, State Bank of Pakistan, Securities & Exchange Commission of Pakistan, etc. Ensure timely drawdown after completion of all requisite security documentation in coordination with the Credit Administration Team to ensure that all conditions of sanction are followed. I was also required to make quarterly plant / factory / site visits to observe the progress / operations of the projects and also to verify the hypothecated / pledged assets. Major Achievements; Solicited PKR 500 million (US$ 6.25 million) new deposits and rollovers / enhancement of more than PKR 1,000 million (US$ 12.50 million). - I was maintaining a total credit/loan portfolio of more than PKR 6,000 million (US$ 75 million) with deals in pipeline comprising of projects worth more than PKR 1,000 Million (US$ 12.50 million). Also generated non-funded business comprising of imports, exports, guarantees etc. of more than PKR 400 million (US$ 5 million) during my tenure there. March 2004 to September 2006 “Manager – Credit Administration & Corporate Finance” at Saudi Pak Industrial & Agricultural Investment Company (Pvt) Limited (Pakistan) Major Responsibilities; 1. 2. 3. 4. Marketing & Relationship Management: Marketing of financial services offered by Saudi Pak. Keeping Liaison with other institutions operating in financial sectors, and business groups for the purpose of business development. Identifying such clients requiring financial support by approaching the corporate sector directly. Managing customer service operations, ensuring customer delight by achieving delivery & quality service in the shortest possible time.. Project Appraisal & Management: To analyze customer’s plans for Expansion or Balancing, Modernization and Rehabilitation/Replacement (BMR) and appraisal of requests for financing facilities. Assisting borrowers in completion of all formalities for implementation and operation of the project. Studying/reviewing and discussing with clients, the areas of problems reported to have adversely affected their business and recommending most suitable measures to the Competent Authority for consideration. To visit factory/project sites for ascertaining a realistic idea of the actual status of the Customer’s project and business and to ensure proper utilization of loan for the same purpose it was obtained. Preparation of progress reports on the project. To analyze customer’s requests for rescheduling/rollover of loans and work out project rehabilitation plan when the need arises. Credit Administration: Monitoring the progress of outstanding loans and to provide feedback to management to serve as an “early warning signal”. Identifying suspected problems in early stages and recommending suitable remedial measures. Overall risk review of Working Capital, Lease and Project Financing through periodic “Credit Risk Rating” of the customers and analysis of Financial Statements/ Audited Accounts. To ensure compliance to Central Bank’s Prudential Regulations and other regulations. To coordinate and to make liaison with Internal/External & SBP Inspectors/ Auditors and compliance/reply of audit/inspection report. Preparation of special reports for policy decisions of Saudi Pak Management. ALCO: To compile, process and analyze the data regarding Credit Assets for Assets Liability Management Committee of Saudi Pak. To analyze the financial data regarding assets & liabilities of Saudi Pak to generate different reports for consideration of Management/BoD and for onward submission to State Bank of Pakistan, Securities & Exchange Commission of Pakistan etc. Major Achievements; - Active member of the committee who designed Credit Policy for Saudi Pak. Formed Credit Risk Rating Checklist. I was among pioneer members of Credit Administration Division of Saudi Pak and designed Credit Administration System and Procedures. Pivotal in recommending capping credit limit for Real Estate & Housing Sector, which was approved by the Board of Directors. Handled gamut of activities for Asset & Liability Management Committee. Supervised a team looking after exposure of Term Financing, Working Capital Financing, Lease Financing, and investment in Term Finance Certificates. Total credit/loan portfolio approximately amounting to PKR 2,600 Million (US$ 32.50 million) December 2000 to March 2004 Major Responsibilities; “Credit Administration Officer - Corporate Banking” at MCB Bank Limited, Pakistan Worked in MCB Bank Limited (Formerly Muslim Commercial Bank Limited). Accomplished comprehensive training in Branch Banking Operations, Credit Management and in International Banking. Served as Credit Administration Officer in Corporate Branch – The Mall, Rawalpindi (Pakistan). Credit exposure consisted of working capital finances, term finances and syndicate finances extended to companies operating in Petroleum, Cement, Sugar, Fertilizer and Textile sectors. I was also responsible for; Overall risk review of Working Capital and Project Financing. Pre-disbursement authentication of all advances. Supervising audit and making liaison with Internal/External & SBP Inspectors/Auditors. Ensuring compliance to Central Bank’s Prudential Regulations and other regulations. Arranging collateral appraisal and legal review of documents. Legal/Security documentation regarding financing. Major Achievements; Handled total credit/loan portfolio of above PKR 6,000 Million (US$ 75 million) at MCB Corporate The Mall Branch, Rawalpindi. Participated and closed many Syndicated transactions for granting loans to corporate customers operating in cement, fertilizer sectors etc. CORE COMPETENCIES Business Development & Marketing, Client Relationship Management, Strategic Planning, Credit Risk Management, Credit Administration and Monitoring, Credit Risk Analysis, Appraisal of Credit Proposals, Project Appraisal & Financing, Financial Management, Corporate Finance. AFFILIATION/MEMBERSHIP Associate Member of Pakistan Institute of Management, Ministry of Industries & Production (Government of Pakistan). (www.pim.com.pk) Junior Associate of Institute of Bankers, Pakistan. (www.ibp.org.pk) PERSONAL VITAE Languages : English, French, Hindi, Urdu, Punjabi