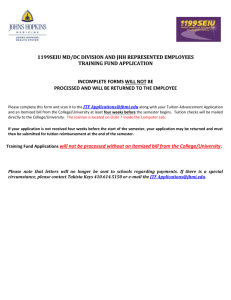

The Johns Hopkins Hospital

advertisement