Consumption and Income in Slovakia

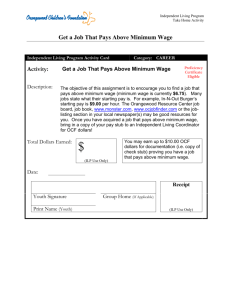

advertisement