Monitoring of Television Promotion of Breast-milk

advertisement

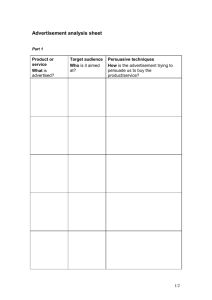

Monitoring of Television Promotion of Breast-milk Substitutes and Complementary Foods in Phnom Penh, Cambodia September 2013-September 2014 EXECUTIVE SUMMARY • From September 2013 to September 2014, 10 TV channels in Phnom Penh, Cambodia had advertisements for breast-milk substitutes (BMS): Bayon, CTN, CNC, HMTV, MyTV, PPCTV9, PPCTV10, Sea TV, TV7, and TV9. Among these, three top channels (CTN, PPCTV09, and HMTV) accounted for about 70% of total advertising minutes on all TV channels for this 1 year period. Three TV channels aired commercially produced complementary food (CPCF) advertisements (CTN, MyTV and PPCTV09). • Seven BMS companies advertised their products during this one-year period: Dumex, Abbott, Friesland, Biofoodnutrition SE, NutriBio, Gilbert Laboratories, and Nestle. The majority of these advertisements were for growing-up milk products (age of introduction >12 months). The specific BMS products featured in advertisements within these 12 months are as follows: Dumex Dugro Gold, Similac Gain Plus, PediaSure Complete, Dutch Lady 5X-HDA, Fabimilk, Lailac Powder Milk, Lactogen Toddler, and Physiolac Growing up. • Three CPCF companies advertised their products, including Saint Amand (natural mineral water), Nestlé (Cerelac), and PPM (Bor Bor Rung Roeung) Infant Cereal/Porridge. • In total, there were 2693 minutes of BMS and CPCF advertisements in these 12 months. About 90% of that advertisement was for BMS while CPCF accounted for only around 10% of the total duration. • BMS and CPCF advertisements represent a minor percentage of overall TV advertising time across 16 channels in Phnom Penh. Overall, BMS represented about 0.8% of all television commercials (TVCs) across the 10 in which any BMS advertisement was observed. CPCF advertisements represented 0.4% of the total minutes for TVCs on the 3 channels that aired any CPCF advertisements. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org • Brand advertisement from Dumex, Physiolac, and Similac were the active brands in terms of TVCs for BMS products. These three brands accounted for about 70% of the total minutes of BMS advertising. • BMS advertisements appeared most frequently during 16:01-20:00 timeslot and the majority of these ads were 30-40 seconds in length. CPCF advertisements appeared most frequently from 10:01-16:00 with most advertisements of shorter duration, about 15-20 seconds. • Both BMS and CPCF companies spent about $635,327 USD from September 2013 to September 2014. Of this expenditure, 96% was for BMS advertisement while CPCF accounted for approximately 4%. Within these 12 months, CPCF product advertisement gradually declined from September 2013 to December 2013 and seemed stable from January to September 2014 (except dramatic drop in April 2014) while BMS spending fluctuated (with the highest expenditure in May 2014 followed by December 2013, accounting for 22% of total expenditure for these two months. One television channel, CNT, took about 60% of total market share for BMS advertisement among the 16 channels sampled. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 2 Table of Contents 01- BACKGROUND AND OBJECTIVE OF THE STUDY 02- LIST OF ACRONYMS 03- SCOPE OF WORK/METHODS 04- RESEARCH FINDINGS 04-A. FREQUENCY AND DURATION OF BMS/CPCF ADVERTISEMENTS 04-B. COVERAGE OF BMS/CPCF ADVERTISEMENT-PERCENTAGE OF ALL MINUTES FOR ADVERTISEMENTS 04-C. COVERAGE OF BMS/CPCF ADVERTISEMENT-PERCENTAGE ON TV CHANNELS WITH ADVERTISEMENTS FOR BMS OR CPCF 04-D: SPENDING-TV EXPENDITURE ON BMS/CPCF ADVERTISEMENT 05- APPENDIX 1. DEFINITIONS 06- APPENDIX 2. ADVERTISEMENT TRANSCRIPTS •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org List of Tables Figure 1: Summary information of BMS and CPFC advertisements (12 months) ........................................ 9 Figure 2: Number of minutes for BMS shown on TV advertisement of each station by month............ 10 Figure 3: Number of minutes for CPCF shown on TV advertisement of each station by month .......... 11 Figure 4: Total number of minutes for BMS and CPCF advertisements (12 months-Sep 2013-Sep 2014) by all stations ............................................................................................................................................................. 12 Figure 5: Number of minutes for BMS brands by station (for 12 months-Sep 2013- Sep 2014) ......... 13 Figure 6: Total number of minutes for all stations by BMS brands (For 12 months-Sep 2013- Sep 2014) .......................................................................................................................................................................................... 14 Figure 7: Number of minutes for CPCF brands by station (for 12 months-Sep 2013- Sep 2014) ....... 14 Figure 8: Total number of minutes for all stations by CPCF brands (for 12 months-Sep 2013- Sep 2014) .......................................................................................................................................................................................... 15 Figure 9: Frequency of advertisement (BMS & CPCF) by Manufacturer/Sub brand(For 12 months- Sep 2013- Sep 2014) ............................................................................................................................................................ 16 Figure 10: Frequency and number of minutes of BMS advertisement by TVC (For 12 months-Sep 2013- Sep 2014)..................................................................................................................................................................... 17 Figure 11: Frequency and number of minutes of CPCF advertisement by TVC (For 12 months-Sep 2013- Sep 2014)..................................................................................................................................................................... 19 Figure 12: Number of BMS Advertisements in Each Duration by Timeslot over 12 Months ................ 20 Figure 13: Number of CPCF Advertisements in Each Duration by Timeslot over 12 Months ............... 21 Figure 14: Total Number of BMS Advertisements (Regardless of length) over 12 Months by time slots ............................................................................................................................................................................................. 22 Figure 15: Total Number of CPCF Advertisements (Regardless of length) over 12 Months by time slots ............................................................................................................................................................................................. 23 Figure 16: Number of minutes for BMS brand by Manufacturer/Sub-brand (For 12 months, Sep 2013- Sep 2014)..................................................................................................................................................................... 24 Figure 17: Number of minutes for CPCF brand by Manufacturer/Sub-brand (For 12 months-Sep 2013- Sep 2014)..................................................................................................................................................................... 25 Figure 19: Number of minutes for BMS brand by TV Channel (For 12 months-Sep 2013- Sep 2014) ....................................................................................................................................................................................................... 26 Figure 20: Number of minutes for CPCF brand by TV Channel (For 12 months-Sep 2013- Sep 2014) ....................................................................................................................................................................................................... 27 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Figure 21: Number of minutes for BMS brand by all (n=10) TV Channels (For 12 months-Sep 2013- Sep 2014) .................................................................................................................................................................................. 28 Figure 22: Number of minutes for CPCF brand by all TV Channels (For 12 months-Sep 2013- Sep 2014) .......................................................................................................................................................................................... 28 Figure 23: % of total minutes for BMS advertisements (Comparing with all TVCs on (n= 10) TV channels having BMS advertisement 12 months).................................................................................................... 29 Figure 24: % of total minutes for BMS advertisements on Top 3 Channels (Comparing with all TVCs on Top 3 TV channels having BMS advertisement 12 months) ......................................................................... 30 Figure 25: % of total minutes for CPCF advertisements (Comparing with all TVCs on (n= 3) TV channels having CPCF advertisement with 12 months)........................................................................................ 31 Figure 26: % of total minutes for BMS advertisements by month with BMS brand(Comparing with all TVCs on (n= 10) TV channels having BMS advertisement with 12 months) .......................................... 32 Figure 27: % of total minutes for CPCF advertisements by month with CPCF brand (Comparing with all TVCs on (n=3) TV channels having CPCF advertisement with 12 months) ............................................ 33 Figure 28: % of BMS advertisements by TV Channels (at least 5 advertisements monthly .................. 34 Figure 29: % of CPCF advertisements by TV Channels (at least 5 advertisements monthly) ............... 35 Figure 30: Total Monthly Expenditure (USD) on BMS/CPCF Advertisement (12 moths) ...................... 36 Figure 31: Share of Voice on BMS/CPCF ...................................................................................................................... 37 Figure 32: Share of Voice on BMS by TV Channel .................................................................................................... 38 Figure 33: Share of Voice on CPCF by TV Channel ................................................................................................... 39 Figure 34: Total Monthly Spending on BMS Advertisement by Company..................................................... 40 Figure 35: Total Monthly Spending on CPCF Advertisement by Company ................................................... 41 Figure 36: Total Monthly Spending on BMS Advertisement by Company and Type of BMS ................. 42 Figure 37: Total Monthly Spending on CPCF Advertisement by Company and Type of CPCF .............. 42 Figure 38: Share of Voice on BMS Advertisement by Company and each Type of BMS........................... 43 Figure 39: Total Monthly Spending on CPCF Advertisement by Company and Type of CPCF .............. 44 Definitions of Breast Milk Substitutes (BMS): ........................................................................................................... 45 Definition of complementary foods ............................................................................................................................... 45 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 5 01- BACKGROUND AND OBJECTIVE OF THE STUDY Article 13 of Cambodia’s Sub-Decree 133 prohibits advertisements for foods for children less than 24 months of age, including breast-milk substitutes (BMS) and commercial complementary foods on television, radio, and print media. BMS include infant formula (for infants up to 6 months of age, follow-up formula (6-12 months of age) and growing-up or toddler milks, for children (1-3 years of age) 1 (Annex 1). Of all urban households in Cambodia, 89% have a television, and 58% have a radio. 2 Among urban women 15-49 years of age living in Phnom Penh, 93% watched television at least once a week, 28% listened to the radio at least once a week and only 12% read newspapers at least once a week. There are 14 television stations, including some broadcast locally and some relayed from cable. 3 Local broadcast TV stations air free programming over public airwaves to television antennas and work with local cable, satellite and telephone companies to distribute programming through these channels as well. Cable networks typically do not use public airwaves, and distribute national programming in conjunction with national and local companies. 4 Preliminary results from the HKI ARCH Study of IYCF Promotion and Practices among Mothers in Health Facilities indicate that 86% mothers of children less than 24 months of age in Phnom Penh reported seeing, hearing or reading advertising for breast-milk substitutes and 31% reported observing advertising for commercially produced complementary foods. Among mothers who reported having seen, heard or read commercial promotions for BMS, 89% reported having seen them on television, 12% in magazines/newspapers, 8% on the radio and 2% on the internet. For complementary foods among those who had seen ads, 84% reported seeing them on television, and less The Cambodian Code restricts marketing BMS up to 24 mo of age unless prior permission has been received from the Ministry of Health. 2 National Institute of Statistics, Directorate General for Health & ICF Macro. Cambodia Demographic and Health Survey 2010. Phnom Penh, Cambodia and Calverton, Maryland, USA: National Institute of Statistics, Directorate General for Health, and ICF Macro. 3 http://www.asiawaves.net/cambodia-tv.htm 4 http://www.timewarnercable.com/en/residential-home/support/faqs/faqs-tv/retransmis/whats-thedifference-between-a.html 1 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org than 2% were in magazines/newspapers, radio or internet 5. Only11% were not exposed to any media in the period since their youngest children was born. In order to better understand current media promotion of infant foods in Cambodia, Helen Keller International (HKI) has undertaken a media monitoring study to assess promotion of BMS and commercial complementary foods through television channels. Similar studies have been conducted by Alive and Thrive in Vietnam and Bangladesh on BMS and commercial complementary foods. Other studies have been conducted on marketing of foods to children, particularly television advertisements during children’s programming. The primary objective of this media monitoring study is to monitor frequency/duration, coverage, and spending on BMS/commercial complementary food television ads in Phnom Penh, Cambodia. 02- LIST OF ACRONYMS BMS: Breast-milk substitute CPCF: Commercially produced complementary foods TVC: Television Commercial TV: Television Ad spot: Advertising Spot Ad Spend: Advertising Spend Mn: Minute 03- SCOPE OF WORK/METHODS The media monitoring covered 13 Local TV + 3 Cable TV channels over the course of 12 months (September 2013-September 2014) in Phnom Penh, Cambodia. This report will cover the following information. 1- Frequency/duration of BMS/CPCF advertisements shown from 6:00 am to midnight daily Alissa Pries. Assessment and Research on Child Feeding (ARCH) Project Health Systems Study. Cambodia country report. 5 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 7 2- Coverage of BMS/CPCF advertisements - Percentage of all minutes for advertisements 3- Coverage of BMS/CPCF advertisements - Percentage of television channels with advertisements for BMS or CPCF 4- Spending - television expenditure on BMS/CPCF advertisements Media Scope Local Chanel: 1. CTN 8. MyTV 2. TV3 9. SEATV 3. TV5 10. CNC 4. TV9 11. Hang Meas TV 5. TVK (TV7) 12. Bayon News 6. TV11 13. CTV8 7. TV27 (Bayon) Cable Chanel: 1. CCTV27 2. PPCTV09 3. PPCTV10 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 8 04- RESEARCH FINDINGS 04-A. Frequency and Duration of BMS/CPCF Advertisements BMS Product Figure 1: Summary information of BMS and CPFC advertisements (12 months) Type of product Manufacturer Brand Subbrand Age of Introduction Step NA Growing up Growing up Growing up Dumex Dumex Abbott Abbott Biofoodnutrition SE Nestlé NutriBio Gilbert Laboratories Friesland Company NA Dugro Similac PediaSure NA Gold Gain Plus Complete NA 1-3 years 1-3 years 1 - 9 years NA #3 #3 NA Lactogen Lai Lac Toddler NA Growing up 1-3 years 1-3 years #3 #3 #3 Growing up Growing up Growing up Growing up CPCFs Growing up • Cereal/Porridge Cereal/Porridge Natural Mineral Water Nestlé PPM Saint Amand Fabimilk Physiolac Dutch Lady Cerelac Bor Bor Rung Roeung Saint amand NA 5X - HDA NA NA NA 1-3 years 1-3 years 1 year and above 6 months onward 6 - 24 months NA From September 2013 to September 2014, there were 7 BMS companies that advertised on TV while there were only 3 companies that advertised for CPCF • products. Most of the BMS products were Growing-up for children aged 1-3 years old. Cereal and Porridge was also seen as active type of product for CPCF advertisement by Nestle (Cerelac) and PPM (Bor Bor Rung Roeung) for children aged from 6-24 months while Saint Amand 6 focused only on natural mineral water. Saint Amand mineral water was included in the study because labelling of this product includes instructions for use in infant formula preparation. 6 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org #3 #3 NA NA NA Figure 2: Number of minutes for BMS shown on TV advertisement of each station by month TV Sep Oct Nov Dec Channel -13 -13 -13 -13 Bayon CNC CTN HMTV MyTV PPCTV 09 PPCTV 10 Sea TV TV7 TV9 5 2 6 4 69 53 15 - 29 - 12 10 5 9 - 5 86 1 - 68 - 45 96 35 - - 89 - 26 - Jan Feb Mar Apr -14 -14 -14 14 7 - - 69 47 42 61 12 7 10 20 - 65 - 32 10 1 22 - - 62 - - - 20 38 - 7 - Ma y14 Jun -14 Jul Aug Sep -14 -14 14 - - - - 44 52 40 673 16 18 13 185 - 177 - 86 20 44 42 13 37 21 37 11 31 23 - 30 14 22 - 27 76 29 22 - 24 63 19 24 - 2 23 - - 42 Tot al 22 - - 38 54 - 15 - 131 24 532 70 537 - 5 13 117 Overall, there are four TV channels: CTN, HMTV, MyTV, and PPCTV09 that had BMS products advertised almost every month from September 2013 to September 2014. Among those, CTN, PPCTV09 and HMTV are the top 3 channels that account for about 70% of total minutes advertising on TV for this 1 year period. The Figure also depicts that the highest number of minutes for BMS advertisement is at HMTV in September 2013 while another peak is at PPCTV09 in December 2013. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Figure 3: Number of minutes CPCF advertisements shown on TV for each station by month CTN 17 16 MyTV 18 PPCTV09 18 18 16 15 17 18 18 17 12 9 9 8 4 2 1 For CPCF, from September 2013 to September 2014, there were three TV channels that had CPCF advertisements. Only PPCTV09 gained the advertisement for subsequent 12 months from October 2013 to September 2014. It is approximately 80% of the total amount of minutes that this channel had the advertisement of CPCF. Additionally, October 2013 is seen as the peak period of CPCF advertisement comparing to other months. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 11 Figure 4: Total number of minutes for BMS and CPCF advertisements (12 months-Sep 2013-Sep 2014) by all stations 2693 2464 229 Total BMS CPCF Overall, there are 2693 minutes of BMS and CPCF advertisements on all TV stations. About 90% of the total duration of advertisement is BMS advertisement while only around 10% of total duration is CPCF’s. It clearly shows that BMS is the most active in the market from September 2013 to September 2014. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 12 Figure 5: Number of minutes for BMS brands by station (for 12 months-Sep 2013- Sep 2014) Product Brand Bayo n CN C - Dugro - Dutch Lady Fabimilk Lactogen Lai Lac NA( From Dumex) 14 8 97 - 12 PediaSure - - Physiolac Similac 1 - Total 23 22 13 1 CT N 21 5 1 63 10 0 14 6 68 82 67 3 HMT V MyTV PPCTV0 9 PPCTV1 0 Sea TV TV7 TV9 164 1 - - - - - 6 57 8 47 - - - 5 - - 117 120 29 87 89 - 86 - 31 - 105 - - - - 100 47 66 43 116 229 88 - - - - 532 185 537 177 5 86 117 Among all BMS brand advertisement, it is clearly shown that brand advertisement from Dumex, Physiolac and Similac were the active brands for TVC during this 1 year. These three brands accounted for about 70% of the total minutes. It is interesting to see that CTN is the most popular TV station that all BMS brands had advertisements on, followed by PPCTV09 and HMTV. It is also noticed that the numbers of advertisements for BMS brands on HMTV were more than that of PPCTV09 even as overall, the total durations for BMS brands’ advertisement on PPCTV09 was more than HMTV’s. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 13 Figure 6: Total number of minutes for all stations by BMS brands (For 12 months-Sep 2013- Sep 2014) 2464 522 379 25 57 281 229 110 460 401 Advertisement from Dumex (NA and Dugro) is the leading advertisement in terms of number of minutes followed by Physiolac and Similac. The total amount of minutes of advertisement from Dumex is about 37% of the BMS brands’ advertisement. It also shows that Dutch Lady has the least duration of advertisement among BMS brands. Figure 7: Number of minutes for CPCF brands by station (for 12 months-Sep 2013- Sep 2014) TV Channel CTN MyTV PPCTV09 Bor Bor Rung Roeung 13 - - Saint amand - - 187 Cerelac Total 9 21 22 21 - 187 Different from BMS, CPCF had only 3 brands, namely Bor Bor Rung Roeung, Cerelac and Saint amand that did the advertisement on only three TV channels. It shows that Saint •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 14 amand had only one advertisement on PPCT09 but had the highest duration of advertisement. Figure 8: Total number of minutes for all stations by CPCF brands (for 12 months-Sep 2013- Sep 2014) 229 187 13 Total Bor Bor Rung Roeung 29 Cerelac Saint amand In total, there were 229 minutes for CPCF advertisement. Saint amand had the highest number of minutes among other CPCF brands. It also demonstrates that Bor Bor Rung Roeung had the least duration of advertisement. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 15 Figure 9: Frequency of advertisement (BMS & CPCF) by Manufacturer/Sub brand (For 12 months-Sep 2013- Sep 2014) Product BMS CPCF Type of Product NA Growing up Growing up Growing up Manufacturer Brand Dumex NA Dumex Dugro Abbott Similac Abbott PediaSure Biofoodnutrition Growing up Fabimilk SE Growing up Nestlé Lactogen Growing up NutriBio Lai Lac Gilbert Growing up Physiolac Laboratories Friesland Growing up Dutch Lady Company Total Cereal/Porridge Nestlé Cerelac Bor Bor Cereal/Porridge PPM Rung Roeung Natural Mineral Saint Saint Amand Water amand Total Sub-brand NA Gold Gain Plus Complete NA Toddler NA Growing up 5X - HDA # Advertising Spots 317 757 1048 974 157 281 458 919 50 NA 4961 115 NA 670 NA 27 812 Within this 1 year, there were 4961 advertisements for BMS product, about 6 times more than the number of CPCF advertisements. Among those, 94% of BMS advertisement times were about Growing up product. Abbott Company had the highest number of frequency of its product advertisement which was totally about 2022 times for both Gain Plus and Complete. For CPCF, Saint Amand stood out in terms of frequency of advertisement on TV for its product followed by Nestle and PPM. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Figure 10: Frequency and number of minutes of BMS advertisement by TVC (For 12 months-Sep 2013- Sep 2014) Brand Name Dugro NA (from Dumex) Dutch Lady Fabimilk Lactogen Lai Lac PediaSure Similac Physiolac Subbrand Gold TVC Name Dumex Dugro Gold Milk (Boy & Girl) 30" Dumex Milk (Information from Company II) 110" Dumex Milk (Information from Company) NA (from 120" Dumex) Dumex Milk (Interview, Man) 90" Dumex Milk (Interview, Woman) 90" Dumex Milk (Interview) 90" 5X - HDA Dutch Lady Powder Milk (Family) 30" Fabimilk Powder Milk (Niroth & Son, Edit Down) 16'' NA Fabimilk Powder Milk (Niroth & Son) 32'' Lactogen Powder Milk (Mom & Son, Edit Toddler Down) 15" Lactogen Powder Milk (Mom & Son) 30" NA Lailac Powder Milk (Kids) 30'' Pedia Sure Complete (Mum & Child, Edit Complete Down) 15" Pedia Sure Complete (Mum & Child) 36" Similac Gain (Abbott Kid's Champion) 50" Similac Gain (Mum & Daughther, Edit Gain Plus Down) 15" Similac Gain (Mum & Daughther) 30" Growing Physiolac Powder Milk (Family) 30" up Total # Ad Spot 757 # minute 379 34 68 89 163 20 25 149 30 38 224 100 27 50 57 123 25 30 31 158 458 79 229 108 105 65 87 866 217 631 158 919 460 312 4961 156 2464 Figure 10 shows that most of TVCs were the same but used many times by companies to advertise its products and some TVCs just reduced the length to increase the number of advertisements. Dumex stayed still for the duration of 30 seconds advertisement for Dugro Gold containing 379 minutes of total advertisement but long advertisement was used for the content of company information and the quality of products in general. This accounted for about 20% of total advertisement duration of BMS products for the whole year. The total amount of minutes for BMS advertisement was 2464 minutes within this 1 year. Among those, there were three companies which had high shares of minutes for •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 17 advertisement. Dumex in overall took about 37% of total minutes followed by Abbott about 28% and Gilbert Laboratories about 19%. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 18 Figure 11: Frequency and number of minutes of CPCF advertisement by TVC (For 12 months-Sep 2013- Sep 2014) Brand Name Bor Bor Rung Roeung Cerelac Saint amand Subbrand TVC Name NA Rongreoung Porrige (Cartoon) 15" NA Nestlé Cerelac (New Animation) 30" Saint Amand Water (Train, Tag On) 17" NA Rongreoung Porrige (Cartoon) 30" Nestlé Cerelac (Mum & Son) 15" Saint Amand Water (Train) 15" Total # Ad Spot # minute 1 - 26 13 585 166 812 229 114 1 85 29 1 21 As noticed, CPCF products prefer short length advertisement between 15-30 seconds. Mostly, they also used one TVC within different length of advertisement to capture the market attention. With a number of 812 spots, the total duration of advertisement was 229 minutes. Again, Saint Amand took the large share not only in terms of frequency but also the duration (187 minutes) of advertisement for CPCF. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 19 Figure 12: Number of BMS Advertisements in Each Duration by Timeslot over 12 Months Advertisement Duration in Seconds for BMS 15-20 2819 30-40 50-60 90-100 Numbers of Advertisements in Each Duration for BMS over 12 Months 1720 194123 105 Total 701 468 47 86 34 10:01 - 16:00 988 829 58 70 59 16:01 - 20:00 578 326 38 22 20:01 - 24:00 Timeslots of advertisement 552 97 8 5:01-10:00 Among all timeslots, 16:01-20:00 was the most popular time for BMS advertisement in these 12 months. The length of 30-40 seconds was also indicated as the most popular duration of advertisement for all timeslots. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 20 Figure 13: Number of CPCF Advertisements in Each Duration by Timeslot over 12 Months Advertisement Duration in Seconds for CPCF 15-20 30-40 785 Numbers of Advertisements in Each Duration for CPCF over 12 Months 417 27 Total 363 26 10:01 - 16:00 5 16:01 - 20:00 1 20:01 - 24:00 Timeslots of advertisement Different from BMS, CPCF advertisement was mostly between 15-20 seconds which was even shorter than that of BMS and the preferable timeslots were 10:01-16:00 and 20:0124:00. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 21 Figure 14: Total Number of BMS Advertisements (Regardless of length) over 12 Months by time slots 4961 1336 Total 2004 964 10:01 - 16:00 16:01 - 20:00 20:01 - 24:00 Timeslot/interval for advertisement 657 05:01-10:00 Regardless of the length of advertisement, the time interval of 16:01-20:00 still has the highest number of BMS advertisement accounting for about 40% of the total number of advertisements followed by 10:01-16:00 (27%), 20:01-24:00 (19%), and the less attractive time interval, 05:01-10:00 (13%). •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 22 Figure 15: Total Number of CPCF Advertisements (Regardless of length) over 12 Months by time slots 812 443 Total 10:01 - 16:00 364 5 16:01 - 20:00 20:01 - 24:00 About 55% of total number of advertisement (regardless length of advertisement) was put at 10:01-16:00 time interval that made it become the leading timeslot within these 12 months for CPCF advertisement followed by 20:01-24:00. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 23 Figure 16: Number of minutes for BMS brand by Manufacturer/Sub-brand (For 12 months, Sep 2013- Sep 2014) BMS Manufacturer Brand name Sub brand Abbott PediaSure Similac Complete Gain Plus Age Introduction 1 - 9 years 1-3 years Dumex Dugro NA Gold NA 1-3 years NA 379 522 1-3 years 460 Biofoodnutrition SE Friesland Company Gilbert Laboratories Nestlé NutriBio Fabimilk Dutch Lady Physiolac Lactogen Lai Lac NA 1-3 years 5X - HDA 1 year and above Toddler NA 1-3 years 1-3 years Growing up Minutes 281 401 57 25 110 229 There were three leading companies which had about 93% of total minutes for BMS advertisement from September 2013 to September 2014: Dumex, Abbot and Gilbert Laboratories. Dumex accounts for 37% of total minutes followed by Abbott with 28%, and Gilbert Laboratories with 19%. Abbott had advertisements for two types of products called PediaSure Complete and Similac Gain Plus which were the main focus of Abbott for children age 1-9 years old and 13 years old respectively. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 24 Figure 17: Number of minutes for CPCF brand by Manufacturer/Sub-brand (For 12 months-Sep 2013- Sep 2014) Manufacturer Brand name Nestlé Cerelac Saint amand PPM Saint Amand Bor Bor Rung Roeung CPCF Sub brand Age introduction Minutes NA from 6 months onward 29 NA NA 187 NA 6 - 24 months 13 In total, there were about 229 minutes for CPCF advertisement for one year from September 2013 to September 2014. Nestle focused mainly on Cerelac for children aged from 6 months onward with 13% of total minutes while PPM did the advertisement for Bor Bor Rung Roeung for children aged 6-24 months. The largest share about 82% was taken by Saint Amand. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 25 Figure 19: Number of minutes for BMS brand by TV Channel (For 12 months-Sep 2013- Sep 2014) Dugro Dutch Lady Lactogen PediaSure Lai Lac 673 82 68 146 23 1 8 14 131 22 12 97 Fabimilk 100 63 1 215 NA (From Dumex) Physiolac 537 532 47 100 31 120 8 57 6 164 Similac 229 185 43 66 29 47 1 116 105 87 177 88 89 5 5 86 86 117 117 Figure 19 shows that all BMS brands preferred CTN, HMTV and PPCTV09 to advertise their products from September 2013 to September 2014. NA (from Dumex) which talked about company information and product quality was on about 7 TV channels except Bayon, Sea TV, and TV9. The popular TV channels for NA (from Dumex) were CTN, HMTV and PPCTV09. Physiolac was seen to have the highest minutes at PPCTV09 followed by HMTV and PPCTV10. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 26 Figure 20: Number of minutes for CPCF brand by TV Channel (For 12 months-Sep 2013- Sep 2014) Bor Bor Rung Roeung Cerelac Saint amand 187 9 13 CTN 21 MyTV PPCTV09 Figure 20 shows that Saint Amand advertised its product mainly only on PPCTV09 while Bor Bor Rung Roeung was seen only on CTN. However, Cerelac did advertisement on different two channels differently namely MyTV about 70% of its total advertisement while other 30% was put on CTN. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Figure 21: Number of minutes for BMS brand by all (n=10) TV Channels (For 12 months-Sep 2013- Sep 2014) 2464 379 57 25 110 229 522 281 460 401 Considering all TV channels, the top brands of BMS advertisement in terms of minutes within these 12 months are NA (from Dumex) which accounted for almost 21% then Physiolac with 19%, Similac with 16% and Dugro (from Dumex) with 15%. Figure 22: Number of minutes for CPCF brand by all TV Channels (For 12 monthsSep 2013- Sep 2014) 229 Total 187 13 Bor Bor Rung Roeung 29 Cerelac Saint amand Saint Amand’s share was about 14 times more than Bor Bor Rung Roeung and about 6 times more than that of Cerelac. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 28 04-B. COVERAGE OF BMS/CPCF ADVERTISEMENT-PERCENTAGE OF ALL MINUTES FOR ADVERTISEMENTS Figure 23: % of total minutes for BMS advertisements (Comparing with all TVCs on (n= 10) TV channels having BMS advertisement 12 months) Total Minutes: Sep-13=28,231 mn, Oct-13=23,616mn, Nov-13=19,382mn, Dec-13=25,337mn, Jan-14=20303mn, Feb-14=19,052mn, Mar-14= 20819mn, Apr-14=24751mn, May-14= 25643mn, Jun-14=25559mn, Jul14=22252mn, Aug-14=22595mn, Sep-14=21575mn, Total: 299113 mn Other TVCs BMS 0.8% 1.0% 1.4% 0.6% 1.2% 0.6% 0.6% 0.8% 0.6% 0.9% 0.6% 0.6% 0.8% 0.7% 99.2% 99.0% 98.6% 99.4% 98.8% 99.4% 99.4% 99.2% 99.4% 99.1% 99.4% 99.4% 99.2% 99.3% Top 5 Categories of Other TVCs in Total TVCs Category Percentage Beverage 33% Telecommunication 13% Professional services 7.4% 7% Health Personal Care 7% •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org In total, there is about 1 minute for BMS in 100 minutes of all TVCs. The shares of BMS advertisement were more than 1% in September, October and December 2013 while there were more than 99% of other TVCs for the rest of the months for this one year. It also clearly shows that, among those other TVCs, the top advertisement was for Beverage category (Alcoholic and non-alcoholic beverages) followed by telecommunication (Equipment supplies and Service providers), and professional services. Figure 24: % of total minutes for BMS advertisements on Top 3 Channels (Comparing with all TVCs on Top 3 TV channels having BMS advertisement 12 months) Total Minutes CTN: 32,293 mn, HMTV: 42,886 mn, PPCTV09: 10,883mn Top 3 Channels with BMS Ads in Total Other TVCs 1.0% 99.0% CTN 0.5% 99.5% HMTV BMS 2.2% 97.8% PPCTV09 Top 5 Categories of Other TVCs in Total Top Categories for CTN % 32% Beverage 20% Telecommunication 9% Professional services 8% Health 7% Personal Care Top Categories for HMTV Beverage Health Personal Care Telecommunication Professional Services % 32% 8% 7% 7% 6% Top Categories for PPCTV09 Beverage Telecommunication Personal Care Health Professional Services % 29% 15% 11% 10% 7% •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 30 Among top 3 channels with BMS advertisements, it clearly shows that there was a small percentage of BMS comparing with other TVCs within these 12 months. HMTV had less than 1% with BMS advertisement while CTN had only 1% of BMS advertisement. PPCTV09 gained more accounting about 2% of BMS advertisement comparing with the total advertisements. Among other TVCs in these three channels, Beverage Category shows the highest rate which was about 32% at CNT and HMTV, and 29% at PPCTV09. Figure 25: % of total minutes for CPCF advertisements (Comparing with all TVCs on (n= 3) TV channels having CPCF advertisement with 12 months) Total Minutes: Sep-13=9,068 mn, Oct-13=11,490mn, Nov-13=7,394mn, Dec-13=8,101mn, Jan-14=1,645mn, Feb-14=1,801mn, Mar-14=1916mn, Apr-14=1957mn, May-14=2126mn, Jun-14=1918mn, Jul-14=1940mn, Aug-14=2020mn, Sep-14=1909mn, Total: 53,284 mn Other TVCs CPCF 0.4% 0.1% 0.3% 0.3% 0.2% 1.1% 0.9% 0.9% 0.0% 0.8% 0.9% 0.9% 0.9% 0.9% 99.6% 99.9% 99.7% 99.7% 99.8% 98.9% 99.1% 99.1%100.0%99.2% 99.1% 99.1% 99.1% 99.1% Top 5 Categories of Other TVCs in Total % Beverage 28% Telecommunication 18% 10% 9% 9% Personal Care Professional Services Health •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 31 For CPCF comparing with all TVCs having CPCF advertisement from September 2013 to September 2014, there was only 0.4% share of voice as overall. There was only one month that CPCF share reached more than 1% which was in January 2014 while other months the share of voice for CPCF was very low. In total, Beverage, Telecommunication and Personal Care were the top three categories among other TVCs. Figure 26: % of total minutes for BMS advertisements by month with BMS brand (Comparing with all TVCs on (n= 10) TV channels having BMS advertisement with 12 months) Total Minutes: Sep-13=28,231 mn, Oct-13=23,616mn, Nov-13=19,382mn, Dec-13=25,337mn, Jan-14=20303mn, Feb-14=19,052mn, Mar-14= 20819mn, Apr-14=24751mn, May-14= 25643mn, Jun-14=25559mn, Jul14=22252mn, Aug-14=22595mn, Sep-14=21575mn, Total: 299,113 mn Dugro Lactogen PediaSure Dutch Lady Lai Lac Physiolac Fabimilk NA (From Dumex) Similac 0.1% 0.2% 0.1% 0.8% 0.1% 0.1% 1.2% 0.4% 0.1% 0.1% 0.1% 0.8% 0.1% 0.1% 0.2% 0.1% 0.2% 0.3% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.2% 0.3% 0.1% 0.1% 0.1% 0.2% 0.1% 0.1% 0.2% 0.1% 0.2% 0.1% 0.2% 0.1% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.2% 0.3% 0.1% 0.1% 0.1% 0.2% 0.2% 0.3% 0.1% 0.1% 0.1% •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 32 Compared with other TVCs, there was very small percentage of share for BMS brand. Most of them were less than 1%. Only NA (from Dumex) shared more than 1% in October 2013 while Physiolac had the highest percentage of 0.8% in December 2013. Figure 27: % of total minutes for CPCF advertisements by month with CPCF brand (Comparing with all TVCs on (n=3) TV channels having CPCF advertisement with 12 months) Total Minutes: Sep-13=9,068 mn, Oct-13=11,490mn, Nov-13=7,394mn, Dec-13=8,101mn, Jan-14=1,645mn, Feb-14=1,801mn, Mar-14=1916mn, Apr-14=1957mn, May-14=2126mn, Jun-14=1918mn, Jul-14=1940mn, Aug-14=2020mn, Sep-14=1909mn, Total: 53,284 mn Bor Bor Rung Roeung 1.1% 0.1% 0.2% Cerelac 0.9% 0.9% Saint amand 0.8% 0.9% 0.9% 0.9% 0.9% 0.1% 0.1% 0.1% 0.2% Similar to BMS, CPCF had very low rate of share comparing with other TVCs within these 12 months. Only Saint Amand increased its advertisement from October 2013 from 0.1% to about 1.1% in January 2014 and decreased to less than 1% from February 2014 onward. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 33 04-C. COVERAGE OF BMS/CPCF ADVERTISEMENT-PERCENTAGE ON TV CHANNELS WITH ADVERTISEMENTS FOR BMS OR CPCF Figure 28: % of BMS advertisements by TV Channels (at least 5 advertisements monthly) Sep-13=287, Oct-13=327, Nov-13=290, Dec-13=656, Jan-14=255, Feb-14=266, Mar-14= 408, Apr-14=391, May-14= 567, Jun-14=420, Jul-14=341, Aug-14=367, Sep-14=377, Total: 4952 Bayon 16% 3% 13% 39% 23% 2% 3% CNC 18% 28% 6% 29% 19% 18% 30% 34% 14% 4% CTN 19% 34% 4% 20% 23% 1% HMTV 23% 5% 25% 42% 5% MyTV 5% 36% 7% 15% 36% PPCTV09 14% 14% 11% 11% 20% 19% 36% 22% 13% 31% 10% PPCTV10 8% 15% 13% 15% 33% 16% Sea TV 22% 12% 8% 37% 20% 26% 11% 23% 32% 8% TV7 8% 23% 12% 23% 34% From September 2013 to September 2014, totally there were 10 channels that advertised BMS products. Among them, CTN, HMTV, and PPCTV09 were the top channels (with the most TV commercials and that had advertisement of BMS every month). CTN increased BMS advertisement across the months by getting the highest percentage of 42% in January 2014 while HMTV gained the top share in September with 39% of BMS advertisement but the advertisement started to decrease gradually from that to September 2014. It also shows that PPCTV09 had notably increased the advertisement within 6 months (Sep 2013- Feb 2014) and started to decrease from March to August 2014. In September 2014, PPCTV09 gained the highest rate of 42% in September 2014. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org TV9 7% 42% 8% 16% 27% Figure 29: % of CPCF advertisements by TV Channels (at least 5 advertisements monthly) Sep-13=52, Oct-13=132, Nov-13=76, Dec-13=61, Jan-14=62, Feb-14=56, Mar-14=62, Apr 2014=0, May 14=62, Jun 14= 60, Jul 14=62, Aug 14= 62, Sep 14=60, Total=807 CTN 69% 31% 45% 35% 80% MyTV 100% 100% 100% 100% PPCTV09 100% 100% 100% 100% 100% 20% 20% For CPCF products, there are only three TV stations- CTN, MyTV and PPCTV09 that advertised the products. MyTV took large advertisement share which was around 70% while CTN's was about 30% in September 2013. Then they reduced the share dramatically until no advertisement at all from December 2013. Notably, it shows that there was only PPCTV09 that CPCF increased its advertisement considerably from October 2013 to September 2014. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 35 04-D: SPENDING-TV EXPENDITURE ON BMS/CPCF ADVERTISEMENT Figure 30: Total Monthly Expenditure (USD) on BMS/CPCF Advertisement (12 moths) Total 66929 64339 59056 56971 63197 46536 7873 25234 21975 10435 3259 40579 38187 57629 57032 39984 37648 1142 595 BMS 539 CPCF 70216 69619 41668 41649 597 19 48832 46921 48235 46343 39378 38443 38800 37846 597 578 597 597 Within 1 year, the graph explicitly demonstrates that CPCF products advertisement had been reduced gradually from September 2013 to February 2014 and it was almost stable from March to September 2014 while BMS spending fluctuated. The graph shows BMS had the high expenses in September 2013, December 2013, March 2014, and May 2014 which totally accounts for about 40% of the total expense for these 12 months. Remarkably, September 2013 was the most active month of total expenditure for BMS and CPCF advertisement. In that month both BMS and CPCF spent about 67,000 USD on advertising their products. Of those, 88% belonged to BMS advertisement expenditure while CPCF had just about 12% of the total share of voice. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 36 578 Figure 31: Share of Voice on BMS/CPCF Sep-13=$66,929, Oct-13=$56,971, Nov-13=$25234, Dec-13=$64,339mn, BMS CPCF Jan-14=$40,579, Feb-14=$38,187, Mar14=$57629, Apr-14=$41668, May-14=$70216, Jun-14=$46921, Jul-14=$38443, Aug-14=$48832, Sep14=$39378Total=$635,326 4% 12% 18% 13% 2% 1% 1% 1% 0% 1% 1% 2% 1% 1% 98% 99% 99% 99% 100% 99% 99% 98% 99% 99% 96% 88% 82% 87% As the graph shows BMS took a great share of voice comparing with CPCF advertisement. As overall, it is 96% of BMS share of voice while CPCF has only about 4% of the total share of voice within 12 months. Within this 1 year, only in October 2013, CPCF had the highest rate of share which was about 20% while starting from December 2013 to September 2014 it was about 99% of share belonged to BMS. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Figure 32: Share of Voice on BMS by TV Channel Bayon CNC CTN $900 $285 $2,555 $4,077 $1,600 $650 $23,246 $200 $936 $42,882 $1,058 $8,052 $11,189 $740 $790 PPCTV09 PPCTV10 Sea TV TV7 TV9 $7,130 $626 $6,465 $8,810 $11,450 $3,096 $20,765 $13,362 $16,889 MyTV $2,124 $3,204 $2,747 $240 $17,727 HMTV $6,856 $666 $5,677 $360 $677 $4,080 $4,360 $1,553 $3,897 $910 $2,090 $2,573 $6,555 $7,290 $1,461 $654 $4,130 $3,361 $4,710 $1,150 $8,597 $1,933 $617 $2,758 $3,026 $2,921 $6,735 $3,600 $3,998 $41,547 $6,080 $31,213 $1,690 $28,050 $35,324 $31,935 $23,598 $3,120 $25,160 $29,828 $23,735 $6,996 $6,720 $1,935 In overall, CTN gained the largest share of voice among all TV channels that had BMS advertisement, followed by HMTV which is about 60% and 17% of total expenditure respectively. It also shows that CTN had a very large share of voice from December 2013 to September 2014. Moreover, December 2013 is shown as the most active month of advertisement expense (about 12%) for BMS followed by May 2014 (about 11%). •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 38 Figure 33: Share of Voice on CPCF by TV Channel CTN $508 $1,300 $6,573 MyTV PPCTV09 $1,560 $8,367 $559 $2,700 $602 $540 $595 $539 $597 $19 $597 $578 $597 $597 Similar to BMS case, CTN was also the leading channel for CPCF advertisement. CPCF advertisement was very active in September and October 2013 accounting for more than 80% of total expense at this channel and dramatically reduced the amount of expense from November 2013 to December 2013 and there was no advertisement at all of CPCF from January 2014 to September 2014. It’s also noticed that PPCTV09 had the CPCF advertisement almost every month though it gained just as number two comparing with other TV channels. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org $578 Figure 34: Total Monthly Spending on BMS Advertisement by Company Sep-13 Oct-13 Apr-14 $ 215,542 $7,091 $22,169 $19,233 $12,198 $17,709 $7,523 $15,815 $8,500 $13,908 $11,420 May-14 $16,465 $18,379 $13,989 $13,563 $15,249 $14,675 $16,247 $23,981 $21,218 $6,347 $6,397 $8,757 $43,544 Jun-14 Dec-13 Jul-14 of the Aug-14 $ 86,461 $11,114 $3,327 $2,689 $12,030 $14,626 $29,399 $12,871 $ 8,694 $1,887 $3,267 $3,540 Among all companies, Dumex spent about 35% Jan-14 Feb-14 Mar-14 $ 49,940 $ 51,351 Sep-14 $ 198,407 $23,140 $36,432 Nov-13 total expense on BMS $ 5,525 $4,130 advertisement which made it become the $4,360 $1,935 $5,400 leading share of voice followed by Abbott which had about 33% share of voice within these 12 months. September and October $12,366 on television commercials to gain the market $10,410 Company were very passive and did only $8,810 2013 were the months that Dumex spent a lot share while Biofoodnutrition SE and Friesland three months across this one year. $1,690 $2,975 Friesland Company $2,090 NutriBio $3,152 $9,669 $9,041 $16,160 $3,918 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 40 Figure 35: Total Monthly Spending on CPCF Advertisement by Company $ 16,270 Sep-14 Aug-14 Jul-14 Jun-14 $8,397 May-14 Apr-14 $7,873 Nestlé $ 6,366 $578 $ 4,770 $597 $540 $597 $2,700 $1,530 PPM $539 $602 $559 $508 Saint Amand Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Nestle is the biggest spender for CPCF’s. It spent about 60% of total expense of CPCF products’ advertisement. However, this company did the advertisement activities only during September and October 2013 while Saint Amand did advertisement almost every month except September 2013. It also shows that among those companies, PPM had the least spending on advertisement within this one year. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 41 Figure 36: Total Monthly Spending on BMS Advertisement by Company and Type of BMS Manufacturer Type of product Abbott Biofoodnutrition SE Friesland Company Gilbert Laboratories Growing up Nestlé NutriBio Dumex Total- Growing Up Dumex NA Total- NA (from Dumex) Sep-13 Oct-13 $ 8,757 $ 6,397 $ 3,540 $ 3,267 $ 2,975 $ 240 $ 440 $ 15,512 $ 10,104 $ 43,544 $ 36,432 $ 43,544 $ 36,432 Nov-13 Dec-13 $ 6,347 $ 21,218 $ 1,887 $ 860 $ 12,871 $ 29,399 $ 870 $ 300 $ 11,420 $ 21,975 $ 63,197 - Jan-14 $ 23,981 $ 1,690 $ 405 $ 13,908 $ 39,984 - Feb-14 $ 23,140 $ 3,918 $ 2,090 $ 8,500 $ 37,648 - Mar-14 $ 16,247 $ 16,160 $ 8,810 $ 15,815 $ 57,032 - Apr-14 $ 14,675 $ 9,041 $ 10,410 $ 7,523 $ 41,649 - May-14 $ 15,249 $ 14,626 $ 9,669 $ 12,366 $ 17,709 $ 69,619 - Jun-14 $ 13,563 $ 12,030 $ 3,152 $ 5,400 $ 12,198 $ 46,343 - Jul-14 Aug-14 Sep-14 $ 13,989 $ 18,379 $ 16,465 $ 2,689 $ 3,327 $ 11,114 $ 1,935 $ 4,360 $ 4,130 $ 19,233 $ 22,169 $ 7,091 $ 37,846 $ 48,235 $ 38,800 - Almost every company competed on Growing up product types. Most of advertisement spending was for this type of product across the months. Comparing with other months, May 2014 saw the most spending for all companies. However, for Dumex Company, it shows a lot of advertisement specifically related to the company information and brand trust/communication rather than specific product types and the advertisement spent a lot in September and October 2013 and did not have any amount of expense at all for this purpose from November 2013 to September 2014. Figure 37: Total Monthly Spending on CPCF Advertisement by Company and Type of CPCF Manufacturer Type of product Sep-13 Nestlé PPM Cereal/Porridge Saint Amand Natural Mineral Total- Cereal/Porridge Total- Natural Mineral $ 7,873 $ $ Oct-13 8,397 1,530 $ Nov-13 $ 7,873 $ 9,927 $ 2,700 $ - $ $ 508 $ 508 $ Dec-13 2,700 $ 540 559 $ 559 $ 540 602 $ 602 $ Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 - - - - - - - - - - 595 $ 595 $ - 539 $ 539 $ - 597 $ 597 $ - 19 $ 19 $ - 597 $ 597 $ - 578 $ 578 $ - 597 $ 597 $ - 597 $ 597 $ There are two companies that competed on Cereal/Porridge product types namely Nestle and PPM. Nestle was very aggressive on advertisement spending in September and October which was $16,270 across 2 months. It also shows that Saint Amand focused mainly on Natural Mineral product advertisement and the spending was almost stable from October 2013 to September 2014. However, in April 2014, the spending on advertisement for Saint Amand was very little. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 42 - 578 578 Figure 38: Share of Voice on BMS Advertisement by Company and each Type of BMS (Base: Sep-13= $59,056; Oct 2013: $46,536; Nov 2013: $21,975, Dec 13: $63,197; Jan 2014: $39,984; Feb 2014: $37,648; Mar-14=$57,032, Apr-14=$41,649, May-14=$69,619, Jun-14=$46,343, Jul-14=37,846, Aug-14=$48,235, Sep-14=$38,800) Abbott/Growing UP Biofoodnutrition/Growing UP SE Dumex-Gold/Growing UP Dumex-NA Gilbert Laboratories/Growing UP 4% 74% 5% 6% 15% Sep-13 78% 1% 7% 14% Oct-13 59% 9% 18% 47% 1% 29% 34% Nov-13 Dec-13 Nestlé/Growing UP 35% 1% 4% 23% 6% 10% 60% 61% Jan-14 Feb-14 28% 15% 28% 28% Mar-14 18% 25% 22% 35% Apr-14 Friesland Company/Growing UP NutriBio/Growing UP 25% 18% 14% 21% 22% May-14 26% 12% 7% 26% 29% Jun-14 18% 51% 46% 5% 7% 9% 7% 37% 38% 42% Jul-14 Aug-14 Sep-14 11% 29% Dumex (NA) took 74% of market share in September and 78% in October 2013. The TVC was mainly on general level about the quality and safety assurance by the company and the opinion of clients (specifically mothers) regarding the product quality and trust. Abbott Company is the only company that had share of voice across 12 months. It gradually increased its share of voice from September 2013 until September 2014 with the largest share in February 2014 (about 61%). The graph also shows that in November and December 2013, Gilbert Laboratories did spend a lot on Growing up advertisement which was about 60% of share in November and 50% in December 2013. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 43 Figure 39: Total Monthly Spending on CPCF Advertisement by Company and Type of CPCF (Base: Sep 13: $7873; Oct 2013: $10435; Nov 2013: $3259, Dec 13: $1142; Jan 2014: $595; Feb 2014: $539; Mar14=$597 Apr-14=$19, May-14=$597, Jun-14=$578, Jul-14=597, Aug-14=$597, Sep-14=$578) Nestlé/Cereal/Porridge 5% 15% 100% 80% 17% 83% PPM/Cereal/Porridge Saint Amand/Natural Mineral Water 53% 100% 100% 100% 100% 100% 100% 100% 100% 100% 47% In September 2013, only Nestle company did advertisement on Cereal/Porridge product types. Then in October 2013 its share reduced to 80% of the share since there were two more companies also focused on CPCF product market share. Saint Amand did advertisement on only natural mineral water while PPM focused on the same product as Nestle did. PPM continued to penetrate into the market by increasing its share of voice in November to 83% while Nestle became very silent since that period. Both Nestle and PPM had no activities at all in January and September 2014 while Saint Amand stood out 100% for its share of voice within the last 9 months (January to September 2014). •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 44 Appendix 1. Definitions Definitions of Breast Milk Substitutes (BMS): Infant formula, follow-up formula, infant or follow-up formula for special dietary or medical purposes, and other milk or milklike products (in liquid or powdered form) marketed or otherwise represented as suitable for feeding children younger than two years (e.g. growing-up milks, toddler milks and first milks). Any other food that is fed to a child under 6 months of age also competes with breastfeeding and thus is also considered a BMS during the data analyses. Definition of complementary foods: Complementary foods are defined as any food whether manufactured or locally prepared, suitable as a complement to breast milk or to infant formula 7 after a child is six months of age, including both foods especially prepared for the young child (porridges, etc) using home-recipes as well as commercially produced complementary foods (such as fortified infant cereals). Commercially produced complementary foods or beverages (CPCF) are products marketed for children younger than two years of age (such as cereal/porridge, pureed food, snacks/finger food, etc.) 7 World Health Organization (WHO), 1981. International Code of Marketing of Breast-milk Substitutes. Geneva. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org Appendix 2. Advertisement Transcripts BMS Advertisement Transcripts Dumex Dugro Gold Milk (Boys & Girls) 30" - Dumex Dugro Gold Milk (Boys & Girls) 30sec 16-Oct-11 TVCTN Kid’s voice: Once up on time, there were 3 small houses. Which one was the strongest? Not the straw house. Not the wooden house. So, was it the stone house? Woman’s voice: Yes, sure. Strong foundation could protect it well. If children’s immune systems are strong, they can be safe from infectious diseases, and they are strong and grow taller. From Dugro Gold 3. Yeah! Provide for the loved children strong health! - Dumex Dugro Gold Milk (Boys & Girls) 30sec 31-05-12 Kid’s voice: Which house is the strongest? Not the straw house. Not the wooden house. So, was it the stone house? Woman’s voice: Yes, sure. Strong foundation could protect it well. If children’s immune systems are strong, they can be safe from infectious diseases, and they are strong and grow taller. From Dugro Gold 3. Yeah! Provide for the loved children strong health! VO: Let introduce new products: Dugro and Dukid contain DHA up to 6 times. Dumex Milk (Information from Company) 120 sec 26-08-13 PPCTV09 VO: DKSH (Cambodia) Limited, Dumex office, would like to let all the customers know that the recalling of potentially contaminated products is closed now. All Dumex products in the markets are safe for consuming. Please listen to the confirmation from Mr. Kong Bo, Dumex Cambodia’s General Manager. Kong Bo: First of all, I would like to thank the Cambodian parents who have support Dumex products for more than 18 years. Since recalling of the potentially contaminated products as the prevention measure, Dumex team have worked carefully and cooperated with the relevant authorities and all business partners—wholesalers and retailers—and all clinics and hospitals. I would like to assure that all the recalled products have been tested again, and no sign of contamination is found. Dumex is always near parents and young children. Based on no-risk measure of Dumex, all Dumex products in the markets are safe. On behalf of Dumex, I would like to profusely thank the relevant authorities, business partners, and all parents, who continue to trust and support Dumex products. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org VO: Should you have questions or concerns, please feel free to contact through the number: 012 222 160. Dumex Milk (Information from Company II) 110sec 12-09-13 CTN Female presenter: Hello. We would like to provide important news for you. Mr. Kong Bo (General Manager Dumex- Cambodia): More than 18 years, Dumex always provide the Cambodian parents high quality nutrient foods. A few weeks ago, Dumex recalled some suspected products as a measure to prevent in advanced because Dumex has never risked the Cambodian children’s health and safety. All the recalled products were tested again by an independent laboratory. The result showed that they are safe for use. On 28th September, New Zealand’s Primary for Industries confirmed that all the products are safe for use. I would like to share the information through our expert. Expert: You would not take a risk with the health of your baby neither would we. So we recalled all potentially affected Dumex products and tested them to see if any of the products were tainted. I can confirm that no contamination was found. As our tests had indicated, the recalled products had, in fact, been 100% safe. Because when it comes to the safety we don’t take any risks. Mr. Kong Bo (General Manager Dumex- Cambodia): We have improved safety assurance with 5 steps: thorough testing, applying with the standard, focusing on health and hygiene standard, reliability, being able to be checked and followed up. And, 3 commitments: More control on the distributors, more commitment toward parents, and practice on the new innovation for improving the sustainability of standard manufacturing. Finally, I would like to thank Cambodian parents who continue to support Dumex products. Dumex is always near the mothers to feed your children. Dumex Milk (Interview man) 90 sec Voice: Dumex would like to share the honest words from the bottom of our heart. Man: I got the information from Fonterra that some Dumex products were suspected to be contaminated. I was so worry because my child and thousands of other children in Cambodia are using Dumex milk. At that time, I have arranged a meeting with my team, and tried to find a way to collect the products back as soon as possible in order to protect the users’ health. Woman: As a mother and a staff in Dumex, I was so worry after receiving the information about the potential of health harming to my child and my customers. I have had meetings with regional management team until late at night. Sometimes, I felt lonely. When I arrived home, everyone had been sleeping already. Mother1: Although, Dumex has encountered the problem, I still trust Dumex milk. The other companies have encountered such a problem, but they’ve never revealed the •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 47 problem. In contrast, Dumex Company didn’t hide it because it wants to ensure its customers are healthy. Mother2: I still support Dumex. If the other companies have such a problem, they might not have high responsible like recalling their products from around the world like this, and they might not reveal the secret. Voice: The honest words from the bottom of the hearts. Dumex Milk (Interview, Woman) 90" Voice: Dumex would like to share the honest words from the bottom of our heart. Woman: During recalling the products, as a Legal Relation Officer, I received a lot of phone calls from journalists. We welcome them because we want to provide information to customers everywhere. What I can’t forget is my mom waited me until late at night, but it’s what I can do for customers. We want to be reachable, and make sure we provide high quality milk. Mother1: My husband has called to the company. When asking them, they said nothing serious. It’s just under company’s suspicion. I am happy because Dumex products are suitable with my child. She is smart and grows well. Mother2: I am happy when seeing the company is active in arranging the recalling. They’re worry that their reputation will be damaged if the children who consume their milk get sick, so they must show their responsibility. As I know the suspicion is not just for Dumex products, but also the other brands. However, those companies didn’t show their responsibility, unlike Dumex. Father: I believe that Dumex has lost much, but gain trust on its responsibility on its products. Voice: The honest words from the bottom of the hearts. Lactogen Baby Powder Milk (Mom & Son) 30sec VO: What make mothers happy? Children are happy and their digestive systems work well. That’s why I provide them Lactogen 3. Lactogen 3 has been improved better with L comfortis, DHA, 23 types of vitamins and minerals, for growing and development. Lactogen 3 for growing and happy children. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 48 Lactogen Baby Powder Milk (Mom & Son) 15sec VO: Lactogen 3 has been improved better with L comfortis, DHA, 23 types of vitamins and minerals, for growing and development. Lactogen 3 for growing and happy children. Physiolac Powder Milk (Family) VO: What makes the kid so happy and healthy? Strong bones, getting rid of wastes well, intelligence. All these can be received from Physiolac Milk Powder which is rich of fiber, GOS and FOS, improving immune and digestive systems; calcium and vitamin D, strengthening bones; Taurine and Choline, making kids smarter. Physiolac is the original French product, distributed by Alliance Pharma Cambodge. Similac Gain (Abbott Kid's Champion) 50sec Text 1: This is the first time in Cambodia. Text 2: Abbott Kid’s Champion Event (Music and activities without voice) Girl: Similac Gain IQ makes me smarter and stronger and ready for starting to go to school. Yeah! Mother 1: I am really happy today. I’ve learned about many important things of Similac Milk Powder which helps for my child’s growing in her kindergarten school age. Mother 2: My family really likes this Abbott Kid’s Champion Event. We’ll join in the event next. Yeah! VO: Good mom provides only what is the best. Similac is for the future of your children. Similac Gain (Mum & Daughther, Edit Down) 15sec VO: Similac Gain IQ and Gain IQ Kid are Palm Olein Oil free for helping to soften children’s stool. It has Intelli-pro mixed with DHA and Lutein to support brain and eye growing. Good mom provides only what is the best. Similac is for the future of your children. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 49 Lailac Powder Milk (kids) 30sec VO: Lailac imported from France. Lailac contains ALA, DHA, Taurine, ARA, LA, Choline, Iron, which are useful for brain and nerve cell development. Lailac is the best for blood cell development with B1, B2, B5, B6, B12, Beta Carotene, Vita A, Zinc, providing protective system. Lailac contains Ca, D3, P, for supporting height growing of children. Sodiaal is a leading company in France. Pedia Sure Complete (Mum & Child) 36sec Woman: Pedia Sure add Synbiotics mixed with 3 types of proteins. It’s rich of energy foods. It’s been scientifically recognized and studied. It also contains enough nutrition for better growing. VO: Pedia Sure, the best solution for me and my children. Dutch Lady Powder Milk (Family) (Baby crying) Boy: Wait! VO: Dutch Lady Milk Powder contains DHA five times more than before, and food substances which help to nourish kids’ brain. The product from Holland. Fabimilk Powder Milk (Niroth & Son) 32sec Woman: With trust, I still continue choosing Fabimilk milk powder for well development and healthiness of my child. It has DHA and DRA to boost brain ability, Nucleotide to boost immune system, Protein to ensure well development, FOS and GOS to maintain healthiness of digesting system. Calcium and B3 vitamin support height growing. VO: Fabimilk, good food, good health. Made and packed in Holland. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org 50 CPCF Advertisement Transcripts Nestlé Cerelac (Mum & Son) 15sec 01-03-13 CTN VO: Nestle Cerelac provides main natural nutrients which are important for growing. And BL Bifidus helps to protect digestive system well. You look after your children from the outside and we look after your children from inside. VO: Nestle Good Food, Good Life. Nestlé Cerelac (New Animation) 30sec VO: After six months old, children need important nutrients such as Carbohydrate, Protein, Fat, Mineral, and Vitamin. However, their stomach is still small, so mothers should choose Nestle Cerelac which contains nutrients of the 5 food groups for the growing of children. Nestle Cerelac contains main nutrients from the 5 food groups for the children’s small stomachs. Rongreoung Porriage (Cartoon) 30sec VO: One day, my child will go to school and then become a doctor. Rabbit: The bright future of your children starts with the right nutrition. Rongreoung Porridge is a quality additional food for better development. It’s a type of porridge powder made from good local ingredients, which is rich of vitamins and minerals. One sachet is enough for one day, and it can be made quickly. VO: It’s only 500 riel for my child's health. VO: Rongreoung Porridge, healthy children, happy family. Saint Amand Water (Train, Tag On) 17sec VO: Must choose what is good. Must be loyal to what we have. Must provide what is the best for you. It’s only Saint Amand mineral water which is your best choice. •••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••• Helen Keller International www.hki.org