Tactical Supply Network Planning: An Example from Specialty

advertisement

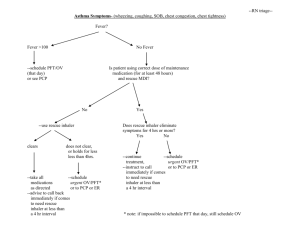

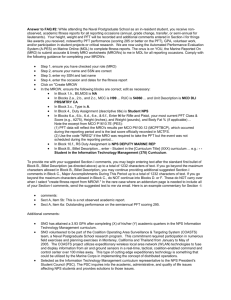

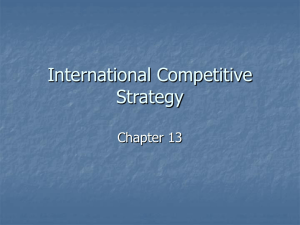

Asia Pacific Management Review (2007) 12(1), 43-51 Tactical Supply Network Planning: An Example from Specialty Chemicals Industry Reinhard Hübner and Hans-Otto Günther* Department of Production Management, Technical University of Berlin, Germany Accepted in November 2006 Available online Abstract In this paper, we present a tactical supply network planning model focusing on applications in specialty chemicals industry. The model incorporates both, industry-specific aspects such as product transfers, single-sourcing of intermediates or product mix effects on capacity and elements of international trade such as duties, duty drawbacks and currency effects. The model is integrated into a decision support system linking the optimization model developed using ILOG OPL 4.2/CPLX 10.0 to a visual user interface. Keywords: Mixed-integer linear programming; Advanced planning systems; Tactical supply network planning; Specialty chemicals 1. Introduction gregate production and inventory quantities planning. Supply chain management has to address diverse issues ranging from facility location to detailed production and procurement decisions (cf. Fleischmann, Meyr and Wagner, 2005). To reduce the complexity of planning processes, they can be hierarchically decomposed based on their time horizon and their importance for the company. While some authors distinguish only between strategic and operational planning, the framework most commonly employed - originally proposed by Anthony (1965) - includes tactical planning as an intermediate level. In the context of supply chain management, the different planning levels can be defined as follows (cf. Günther and Tempelmeier, 2005; Chopra and Meindl, 2004; Simchi-Levi, Simchi-Levi and Watson, 2003; Miller, 2002): • • • Operational planning ensures the optimum utilization of existing assets and efficient execution of the decisions taken in strategic and tactical planning. The time horizon covered is a maximum of one year with daily or weekly intervals. Typical decisions include lot sizing and production scheduling. While there are strong interdependencies between strategic, tactical and operational planning, in practice, planning processes take place in a hierarchical fashion with strategic planning forming the basis of the different tactical and operational plans. Following this logic, separate models are typically being developed for strategic, tactical and operational supply chain planning. Models integrating the different levels (e.g., Kallrath, 2002; Sabri and Beamon, 2000) are an exception. Strategic planning focuses on creating and sustaining the conditions required for the successful long term development of a company. The time horizon usually covers a period of three to ten years and decisions are of great importance for the entire company. Typical decisions include among others the product and services portfolio, configuration of production and distribution networks and investments into new production technologies. In this article, a tactical supply network planning model for use in specialty chemicals industry is proposed. To this end, peculiarities of specialty chemicals supply networks are discussed in Section 2. Section 3 introduces major elements of tactical supply network planning in specialty chemicals industry such as product transfers and product mix effects and provides references to the pertinent literature. The proposed optimization model is presented in Section 4. Finally, Section 5 summarizes the key findings and indicates directions for future research. Tactical planning implements strategic objectives in a step by step approach with a time horizon of 1 to 3 years. Typical decisions include launch or discontinuation of specific products, transfers of products within the existing production network, (limited) production capacity adjustments and ag 2. Specialty Chemicals Supply Networks * E-mail: hans-otto.guenther@tu-berlin.de 43 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 The strategies can also be combined, e.g., by establishing product plants in each of the major economic regions. Hayes and Wheelwright (1984) and Dornier, Ernst et al. (1998) list some of the advantages and disadvantages associated with Schmenner's network strategies. Kulkarni, Magazine and Raturi (2004) show that a process plant strategy can have risk pooling advantages even in the absence of economies of scale. For the United States, Schmenner (1982) found product and to a lesser extent market area plants to be by far the most common strategies. Comparing their findings 20 years later with Schmenner's data, Vokurka and Flores (2002) observe a strong trend away from market area plants towards integrated production networks. This trend was also observed by Flaherty (1986). There are various basic options available to design multi-site networks. One option is to split production volumes so that all sites perform all activities. This option duplicates activities at each new site. A second option is to divide activities across several sites by function, product or production process. In this case, each site specializes on a specific segment of the overall activities spectrum. Finally, the two options can also be combined leading to a diversified site network. Focusing on production network design, Schmenner (1979) provides a more specific classification of four distinct multi-plant strategies. Based on a product, market or process focus Schmenner defines four segmentation principles: • Product plants serve the company's entire market for the products they produce, specializing on the competitive priorities associated with their respective product portfolio. • Market area plants produce a majority of the company's products for distribution to their regional market. • Process plants focus on certain process steps usually with some plants providing components for other plants. The segmentation is based on manufacturing requirements of the components/products. • General purpose plants are designed for flexible assignment of products, markets and process segments without a specific focus. Specialty chemicals companies usually operate in several business segments (value chains) with diverse product and production process characteristics. Therefore, an analysis of the design principle underlying specialty chemicals production networks has to be performed separately for each business segment. Historically, specialty chemicals companies mainly established foreign plants to access regional markets (market area plants). One underlying reason were trade barriers such as tariffs. According to Ferdows (1997) these have declined from an average of 40% of product value in 1940 to 7% in 1990). With the increasing integration of the production networks, today many newly established sites are set up to exploit cheap factor costs. A recent example is the decision of the Germany-based Degussa company to shift a large proportion of its pharmaceutical ingredient production from Europe to China (cf. N.N., 2004). Characteristics Characteristics • High value/volume products • Significant economies of World factory World lead and regional low cost followers • Product portfolio with mix of Intermediate hub and regional spokes • Large number of product World slow movers and regional fast movers • Product portfolio consisting scale in production • Low degree of differentiation • Stable products with low transportation costs Localized specialty production • Make to order products • Low volumes, high degree of differentiation • Limited economies of scale in production • Limited product stability and/or medium to high transportation costs Regional commodity production • Medium to low value commodity products • Stable products • Medium to high transportation costs and/or • Lead time requirements new, innovative and commoditized products • Stable products with medium to high transportation costs • Only limited economies of scale in production variants made from commodity intermediates • Stable intermediates with low transportation costs and economies of scale in production of high volume and medium to low volume variants • Economies of scale in production • Stable product with low transportation costs Figure 1. Generic Production Network Design Alternatives in Specialty Chemicals 44 Asia Pacific Management Review (2007) 12(1), 43-51 of time chemical products cannot be transferred easily from one site to another. Instead, recipes have to be adjusted, personnel have to be trained and trial batches have to be produced. Both, the costs associated with such a scale-up and the production capacity required should be considered explicitly. Only a few models in literature do so. Lee (1991) includes fixed setup costs to create the capability to handle a product at a facility. For pharmaceutical industry Papageorgiou, Rostein and Shah (2001) include product scale-up, further distinguishing between the actual scale-up and qualification runs required to demonstrate the capability of meeting specifications to regulatory agencies. The model proposed here considers both direct costs associated with a scale-up and the costs/capacity consumption induced by production trials. Generally, the structure of specialty chemicals production networks depends on value chain characteristics such as product stability, ratio of product value to weight/volume or the level of vertical integration. Figure 1 shows typical network designs to be found in industry. 3. Optimization-based Tactical Supply Network Planning in Specialty Chemicals 3.1 Major Elements of Tactical Supply Network Planning According to Shapiro (2001) the objective of a tactical supply network planning model is to determine an integrated supply, manufacturing, distribution and inventory plan that maximizes profits or minimizes costs with a typical time horizon of 12 months. The planning process is usually performed every month with the time interval being months for the first quarter and quarters for the remaining three quarters of the planning horizon (cf. Shapiro, 2001). 3.1.3 Product mix effects Product-plant allocation decisions in chemical industry are often associated with diseconomies of scope due to changeover processes. Whether these effects have to be modeled explicitly depends on the magnitude of the economies existent with the type of products considered. Since scope economies are especially hard to model, a separate class of optimization models solely dealing with plant loading decisions can be found. For example Mazzola and Schantz (1997) propose a non-linear mixed integer program that combines a fixed cost charge for each product-plant allocation, a fixed capacity consumption to reflect plant setup and a non-linear capacity-consumption function of the total product portfolio allocated to the plant. To develop the capacity consumption function the authors build product families with similar processing requirements and consider effects from intra- and inter-product family interactions. Based on a linear relaxation the authors explore both tabu-search heuristics and branch-and-bound algorithms to obtain solutions. In addition to the standard decisions such as product-plant-market allocations, which are at the interface between tactical and operational planning, a number of decisions affecting the entire planning horizon have to be made in tactical planning. Of these, capacity planning and product transfers are explicitly discussed below. 3.1.1 Capacity planning In tactical planning, changes to technical capacities are typically not possible due to the long lead times required to implement the corresponding investment projects. Nevertheless, depending on the operating mode of the different sites (e.g., five or seven day workweek, plant holidays) overtime capacity may be available at a subset of the plants. Additionally, inventory buildup can be used to deal with seasonal demand patterns. In tactical planning, the trade-off between the inventory carrying costs associated with stock buildup and the additional costs associated with overtime production has to be resolved. While the decision to use overtime production capacity can be made throughout the entire planning horizon, the extent to which tactical inventory buildup is to be used typically has to be determined at the beginning of each seasonal cycle. Also, some production network design models consider the problem. For example, Klincewicz and Luss (1987) include a fixed cost charge for every product allocated to a facility. Papageorgiou et al. (2001) explicitly model capacity requirements for changeover processes. They allocate products to individual production lines and implicitly assume that only one campaign is produced per product and time period. Cohen and Moon (1990) combine fixed cost effects with a variable unit cost function that contains both additional scale and scope effects to analyze their effects and the effects of varying transportation costs on production network design using a single-period, non-linear model. They find that economies of scale and scope can have considerable effects on optimal production network design. A feasible estimation approach can be developed analogous to the major/minor changeover concept Bi- 3.1.2 Product transfers In response to changes in comparative advantages between sites and available capacities, product transfers may be required to best satisfy demand. From a technical perspective, it is often possible to transfer products between production sites in specialty chemicals without having to invest into new equipments. However, even if the receiving plant has been running the equipment required to produce a certain product for a long period 45 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 cases exceeding 30%. The applicable tariff rate for importing a product depends not only on the product but also on the country of origin. Within free trade zones no duties have to be paid and for many trade relations preferential rates apply either due to bilateral trade agreements or because of exemptions to support less developed countries. Several options exist to reduce tariff costs. In some cases, duties can be avoided by choice of production locations. In other cases, refunds on duties paid (duty drawbacks) can be obtained. Figure 2 gives an overview of duty avoidance options and duty drawbacks. tran and Gilbert (1990) use to model sequence-dependent setup costs. Products are grouped into changeover families with changeovers within a family not significantly exceeding regular cleaning requirements between two batches of the same product. Assuming that comprehensive cleanings required independently of changeover family switches are already deducted from technical capacity, a lower bound on the number of comprehensive changeovers required can be calculated by subtracting from the number of changeover families allocated to a plant the number of production lines available. If this approach is chosen it is assumed that in each planning period the entire production volume of each changeover family is produced in one campaign. If this assumption is not adequate, additionally a maximum campaign size could be defined for each changeover family to account for the tradeoff between changeover costs and inventory carrying costs. Models from literature differ with respect to the extent to which they cover the complexity of tariff structures. Simplified modeling approaches only consider duties levied for supplying a certain market via imports or simply integrate tariffs into transportation costs (e.g., Kouvelis et al. 2004). For specialty chemicals, tariffs often constitute a higher share of total costs than transportation costs, making obvious the need to explicitly model tariff regimes. To model duty drawbacks, the lineage could theoretically be traced along multiple production levels based on the bill of materials. To reduce complexity in the case example only one level of intermediates is considered. 3.2 Additional Complexities in Global Supply Networks 3.2.1 Exchange rate fluctuations Exchange rate fluctuations affect companies in different ways. Generally, one distinguishes between three types of currency exposure. Translation or accounting exposure refers to the effects currency fluctuations can have on consolidated financial statements whereas transactional exposure refers to the effects on contractually defined cash flows and operational exposure on the way the viability and profitability of the business are affected. The effects of exchange rate fluctuations can be significant. For example, Mohamed (1999) shows based on a simple example that changes of the real exchange rate (change of nominal exchange rate adjusted for inflation levels in the countries involved) can lead to a decrease of profits of almost 50% if capacity constraints do not allow the company to re-allocate production volumes within the network. Consequently, it may be desirable to maintain excess capacity or utilize overtime capacity to shift production in reaction to exchange rate fluctuations (cf. Cohen and Huchzermeier 1999; Rosenfield 1996). While supply network robustness to currency fluctuations is primarily a strategic issue, significant exchange rate changes can also occur within relatively short time periods. For example, the Euro appreciated more than 20% against the US$ throughout 2002. 4. The tactical supply network planning model 4.1 Description of the Supply Network Considered The basic structure of the supply network to be considered is depicted in Figure 3. The production network comprises echelons producing intermediate products (which can be used internally and sold externally) and finished goods. Any intermediate facility can supply any finished goods facility with intermediate products. However, it is assumed that each facility receives each intermediate only from one source to ensure homogenous product quality. For all products inventory is assumed to be held only at the producing site (except for intermediate safety stocks to ensure uninterrupted production) to avoid transshipments between sites. Due to the fact that the tactical planning model covers only a single value chain, transportation costs were in the range of 3-4% for the products considered and safety stocks are in place, the structure of the distribution network within the different markets is not considered explicitly. Based on existing technical capacities, in the tactical planning phase decisions such as product-plant-market allocations, product transfers from one site to another site or the buildup of inventory to account for seasonality of demand have to be taken. These decisions are primarily influenced by factors such as expectations on demand and price developments or exchange rates. 3.2.2 Duties and duty drawbacks Duties are import taxes levied at the border for importing a product into the respective country. Duties are usually defined as a percentage of the value of imported goods including freight costs to border of destination country/trade area with product-specific rates commonly varying between 0 and 10% and in extreme 46 Asia Pacific Management Review (2007) 12(1), 43-51 Focus in tactical planning Duty avoidance via network design 1 Direct routing • Import of raw materials from China to Germany (tariff 4.5%) • Production and sale of finished product in Europe 2 Indirect routing • Import of raw materials from China to Switzerland (no tariff) • Transformation and export of finished product to European Union (no import duty charged due to Swiss origin) 1 2 Re-export in different condition • Intermediates imported from China to Germany (tariff 3%) • Finished product sold from Germany to Japan • Duty drawback in Germany due to re-export in different condition Re-export in identical condition • Import of finished product from China to Germany (tariff 6%) • Re-export of finished product from Germany to Switzerland (tariff Re-import in different condition • Intermediate transported to China for processing (tariff 0%) • Finished product exported from China to Germany (tariff 4%) • Duty drawback of 4% on value of intermediate contained in 3% due to Chinese origin) • Duty drawback in Germany due to re-export in identical condition finished product due to re-import in different condition Figure 2. Duty Avoidance and Duty Drawback Options Intermediate product sites dint pff 't trc ff 't Finished product sites Demand regions (countries) dem pct Demand Internal transport volume Transportation costs dext pfct Distribution volume trc fct Transport costs x pft y pft z ft Production volume Inventory at period end Use of overtime capacity pcap ft Production capacity pocap ft Overtime capacity icap ft Inventory capacity f ∈ FI f ∈ FF c ∈C Figure 3. Supply Network Structure 4.2 Model Formulation Products p ∈ Pg Products belonging to changeover family g k ∈ PF r∈R t ∈T Indices and index sets c ∈C c ∈ CNE f f ∈F f ∈ FF f ∈ FI f '∈ FNE f g ∈G i ∈ PI p∈P Demand regions (countries) No export country relative to facility f Production facilities (sites) Finished products Raw materials Time periods Parameters Finished products facilities Intermediate product facilities capreq p Capacity consumption factor of product p No export facility relative to facility f cfix ft Fixed costs of facility f in period t Changeover families contvol p Quantity of product p per full container load Intermediate products cv pft Variable costs of product p at facility f in period t 47 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 cvo ft Costs per unit of overtime capacity at facility f in period t dem pct Demand of product p in country c in period t duty pfc Import duty rate for product p originating from facility f into country c fx ct Exchange rate of country c in period t fx ft Exchange rate for facility f in period t fx rft Exchange rate for raw material r at facility f in period t h pft Holding costs for product p at facility f in period t icap ft Inventory capacity of facility f in period t ireqip Quantity of intermediate i required per unit of product p pcap ft Production capacity of facility f in period t plines f Production lines installed at facility f pocap ft Overtime capacity of facility f in period t price pct Sales price of product p in country c in period t rprrft Landed costs (excl. tariff) of raw material r at facility f in period t Quantity of raw material r required per unit of product p rreqrp trrf Import tariff rate for raw material r at facility f trif ' f Import tariff for intermediate i originating from facility f' to facility f Transport costs from facility f to facility f' in period t Transport cost from facility f to country c in period t trc ff' t trc fct trcost pt Transfer costs for product p in period t trpriceif' t Transfer price of intermediate i originating from facility f in period t xmin pf Minimum campaign size of product p at facility f xocap f Capacity consumption for major changeovers at facility f Costs for major changeovers at facility f in period t Large positive number xocost ft BigM dext pfct iduty if ' ft iduty ft rduty rt u pft viff ' w pft x pft xonum ft xofamallgft period t; 0 else Inventory of product p at facility f at end of period t z ft Use of overtime capacity at facility f in period t Objective function ⎡ ⎡ ⎡ price pct ⎤ ⎤⎤ ⎢ ⎢⎢ ⎥ ⋅ fxct ⎥ ⎥ ( ) − duty 1 ⎢ ⎥ ⎢⎢ ⎥⎥ pfc ⎦ dext pfct ⋅ ⎢ ⎣ ⎢ ⎥⎥ trc p P f F c C ∈ ∈ ∈ fct ⎢ ⎢⋅ ⎥⎥ ⎢ ⎢ contvol p ⎥⎥ ⎣ ⎦⎥ ⎢ ⎢ ⎥ ⎡ ⎤ ⋅ x cv ⎡ pft pft ⎤ ⎢ ⎥ ⎢ ⎢ ⎥ ⎥ ⎢ ⎥ ⎢ p∈P ⎢⎣+ y pft ⋅ h pft ⎥⎦ ⎥ ⎢ ⎥ ⎢ ⎥ ⎢ ⎥ ⎢+ z ft ⋅ cvo pft ⎥ ⎢− ⎥ ⎢+ xonum ⋅ xocost ⎥ ⋅ fx ft ft ft ⎢ f ∈F ⎢ ⎥ ⎥ ⎢ ⎥ ⎢+ rduty ft ⎥ ⎢ ⎥ ⎢ ⎥ ⎢ ⎥ ⎢+ cfix ft ⎥ ⎢ ⎥ ⎢+ iduty ⎥ ft ⎢ ⎥ ⎣ ⎦ ⎢ ⎥ w w trcost − − ⋅ pft −1 pt pft ⎢ ⎥ p∈P f ∈F ⎢ ⎥ ⎢ ⎥ trc ff 't dint pff 'st ⋅ ⎢− ⎥ contvol p ⎣⎢ p∈PI f ∈FI f '∈FF ⎦⎥ ∑∑∑ ∑ max ∑ ∑ t∈T ∑∑ [ (1) ] ∑∑ ∑ Subject to Capacity constraints ∑ ⎡ x pft ⋅ capreq p ⎤ ⎢ p∈P ⎥ ≤ pcap + z ft ft ⎢ ⎥ ⎢⎣+ xonum ft ⋅ xocap f ⎥⎦ z ft ≤ pocap ft ∀ f ,t (2) ∀ f ,t (3) ∀ f ,t (4) ⎡ p ∈ PF ,⎤ ∀⎢ ⎥ ⎣ f ,t ⎦ (5) ∀ p, f , t (6) ∀ p , c, t (7) ∀ i, f ', t (8) x pft ≤ w pft ⋅ BigM ∀ p, f , t (9) w pft ≥ wpft −1 ∀ p, f , t (10) ∑y pft ⋅ contvol p ≤ icap ft p∈P Flow constraints Decision variables dint pff' t y pft y pft = y pft −1 + x pft − ∑ dext pfct c∈C Quantity of intermediate i shipped from facility f to facility f' in period t Quantity of product p shipped from facility f to country c in period t Import duties paid for import of intermediate i from facility f' to facility f in period t Import duties paid for import of intermediate i to facility f in period t ⎡ ⎢ yift = yift −1 + xift − ⎢ ⎢+ ⎣ ∑ dext ∑ dint ∑ dext ∑ dint ifct c∈C iff 't f '∈FF ⎤ ⎥ ⎥ ⎥ ⎦ ≤ dem pct pfct f ∈FF Raw material duties paid at facility f in period t 1, if product p is produced at facility f in period t; 0 else 1, if intermediate i is supplied from facility f to facility f'; 0 else 1, if product p can be produced at facility f in period t; 0 else Quantity of product p produced at facility f in period t Minimum number of major changeovers required at facility f in period t iff 't ≥ f ∈FI ∑ x pf 't ⋅ ireqip p∈PF Product transfers Single sourcing of intermediates 1, if product family g is allocated to facility f in 48 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 ∑ dint ≤ v v ≤ ∑ dint ∑v ≤ 1 ∀ i, f , f ' (11) ∀ i, f , f ' (12) ∀ i, f ' (13) x pft ≤ u pft ⋅ BigM ∀ p, f , t (14) u pft ⋅ xmin pf ≤ x pft ∀ p, f , t (15) ∀ g, f ,t (16) ∀ f ,t (17) ⋅ BigM iff ' iff't port duties that might have to be paid and converted into the home currency of the company. Subtracted are the variable production costs, inventory holding costs, net import duties, overtime costs, fixed facility costs and transportation costs for both inter-site transports and transports to final markets. All transport costs are assumed to be denominated in the home currency of the company for simplification purposes. The constraints (2) to (4) limit the production to existing capacity and overcapacity and ensure inventory constraints being observed. The constraints (5) to (8) model the flow of goods between the stages in the supply chain. The first two link inventory levels to production and distribution quantities. The latter two ensure that distribution quantities do not exceed demand and that sufficient intermediate quantities are supplied to the consuming site. Again, it is assumed that all stocks are held at the producing site. The constraint (9) ensures that products are only produced at sites the product has already been transferred to and (10) ensures the continuity of these decisions, i.e., if a product has been transferred it can also be produced in later periods. t∈T iff ' iff't t∈T iff ' f ∈F Product-mix effects xofamall gft ⋅ BigM ≥ ∑u pft p∈Pg xonum ft ≥ ∑ xofamall gft − plines f g∈G Import duties for raw materials and intermediates ⎡ ⎡ v if ' ft ⋅ BigM − BigM ⎤ ⎤ ⎢⎢ ⎥⎥ dext pfct ⋅ ireq ip ⎥ ⎥ ⎢ ⎢+ iduty if'ft ≥ ⎢ ⎣⎢ p∈P c∈CNE f ⎦⎥ ⎥ ⎥ ⎢ fx f 't ⎥ ⎢ ⎥ ⎢⋅ trpriceif 't ⋅ trif ' f ⋅ fx ft ⎦ ⎣ ⎡i, f , ⎤ ∀⎢ ⎥ ⎣ f ',t⎦ (18) iduty ft = ∀ f ∈ FF , t (19) ∑∑ ∑∑ iduty if ' ft i∈PI f '∈FI ⎡ ⎡dext pfct ⋅ rreqrp ⎤ ⎢ ⎢ ⎥ fxrft ⎢ ⎢ ⎥ ⎢ p∈PF c∈CNE f ⎢⋅ rprrft fx ⋅ trrf ⎥ ft ⎦ ⎣ ⎢ ⎢ ⎡dint iff 't ⋅ rreqri ⎢ ⎢ fxrft ⎢+ ⎢ ⋅ trrf ⎢ i∈PI f '∈FNE f ⎢⋅ rprrft fx ft ⎢⎣ ⎣ ∑∑ rduty ft = ∑ r∈R ∑∑ ⎤ ⎥ ⎥ ⎥ ⎥ ⎤⎥ ⎥⎥ ⎥⎥ ⎥⎥ ⎦ ⎥⎦ ∀f , t The single sourcing constraints (11) to (13) serve two purposes. Firstly, supplying intermediates from only one source has the advantage of reducing the variability of material inputs. Secondly, the single-sourcing assumption is exploited in the duty drawback calculation for intermediates. It is assumed that single-sourcing decisions are taken for the entire planning horizon. (20) The constraints (14) to (17) capture the effect of product mix on capacity and production costs. As discussed above, products are grouped into changeover families. It is assumed that all products from a product family are produced within one campaign. The constraint (14) sets u to 1 for every product produced at a facility in a time period and (15) enforces minimum campaign sizes. The constraint (16) aggregates this to the level of changeover families. Finally, the constraint (17) determines the number of major changeovers as the difference between the number of product families allocated to a facility and the number of production lines available. If the assumption of producing the entire quantity allocated to a facility in one campaign is not realistic, a maximum campaign size could be included to further specify product mix effects. Variable domains dext pfct ≥ 0 ∀ p , f , c, t (21) dint pff't ≥ 0 ∀ p, f , t (22) iduty if ' ft ≥ 0 ∀i, f , f ' , t (23) iduty ft ≥ 0 ∀ f ,t (24) rduty ft ≥ 0 ∀ f ,t (25) ∀ p, f , t viff ' ∈ [0,1] (26) ∀ i, f , f ' wpft ∈ [0,1] (27) ∀ p, f , t (28) x pft ≥ 0 ∀ p, f , t xofamall gft ∈ [0,1] (29) ∀ g, f ,t (30) xonum ft ≥ 0 ∀ f ,t (31) y pft ≥ 0 ∀ p, f , t (32) z ft ≥ 0 ∀ f ,t (33) u pft ∈ [0,1] Finally, the constraints (18) to (20) determine the net duties that have to be paid for intermediates and raw materials. The constraint (18) uses the single-sourcing assumption and non-negativity constraint (23) to determine duties payable for each intermediate. The equation (19) determines the total import duties payable for intermediates at a facility. For simplification purposes duties are not calculated on products kept in in- The objective function (1) maximizes the pre-tax profit of the production network considered. Revenues realized in the different markets (it is assumed that no storage takes place at the market) are adjusted for im- 49 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 Application-oriented examples based on such an approach have been proposed by Eppen et al. (1989) for network design in automotive industry and Ahmed and Sahinidis (1998) for process planning in chemical industry. The network design model proposed by Hübner (2006), which was the basis for this tactical application, contains an illustrative example of employing the robust optimization framework to network design in specialty chemicals. ventory but only on those leaving the site in non-export sales. The equation (20) performs a similar calculation for raw materials. Again, supply from a single source throughout the planning horizon is assumed. 4.3 Model implementation The tactical planning model presented above is derived from the strategic production network design model developed by Hübner (2006). It was implemented using ILOG OPL Development Studio 4.2 and CLPEX 10.0 in conjunction with a visual user interface based on an MS Access database. In addition to supporting data entry and result evaluation via standardized reports the user interface also allows decision makers to manage and evaluate alternative planning scenarios. References Ahmed, S. and Sahinidis, N. V. (1998). Robust process planning under uncertainty. Industrial Engineering & Chemistry Research, 37, 1883-1892. Anthony, R. N. (1965). Planning and Control Systems: A Framework Problem instances of realistic size typically contain 10 to 15 major markets, up to several hundred product families/products and five to fifteen production facilities worldwide. While the nature of mixed-integer linear programming models causes calculation times to vary significantly for problem instances of identical size, the author's experience has been that solutions with a MIP-gap of 1% can typically be obtained in less than 5 minutes. Further details on implementation experiences and user interface can be found in Hübner (2006). for Analysis. Harvard University: Boston, MA. Bitran, G. R. and Gilbert, S. M. (1990). Sequencing production on parallel machines with two magnitudes of sequence-dependent setup cost. Journal of Manufacturing and Operations Management, 3, 24-52. Chopra, S. and Meindl, P. (2004). Supply Chain Management. 2nd edition. Prentice-Hall: Englewood Cliffs, NJ. Cohen, M. A. and Huchzermeier, A. (1999). Global supply chain management: a survey of research and applications. In: Tayur, S., Ganeshan, R. and Magazine, M. (Eds.), Quantitative models for 5. Conclusion and Directions for Future Research supply chain management,. 669-702, Kluwer Academic Publishers: Boston, MA. Major players in specialty chemicals industry operate global production networks with numerous sites located in different economic areas. If properly managed, these networks can by themselves be a source of competitive advantage, e.g., via exploitation of factor cost advantages or hedging against currency fluctuations. Tactical planning models such as the one presented above, while simplified with respect to some aspects, provide valuable insight into the solution space and allow planners to make more informed choices than traditional spreadsheet approaches. Especially, large numbers of scenarios can be evaluated and re-calculations based on more accurate data obtained throughout a (rolling) planning horizon become possible. Cohen, M. A. and Moon, S. (1990). Impact of production scale economies, manufacturing complexity, and transportation costs on supply chain facility networks. Journal of Manufacturing and Operations Management, 3, 269-292. Dornier, P. P., Ernst, R., Fender, M. and Kouvelis, P. (1998) Global Operations and Logistics. John Wiley & Sons: New York. Eppen, G. D., Martin, R. K. and Schrage, L. (1989). A scenario approach to capacity planning. Operations Research, 37, 517-527. Ferdows, K. (1997) Making the most of foreign factories. Harvard Business Review, 75, 73-88. Flaherty, T. M. (1986). Coordinating international manufacturing and technology. In: Porter, M. E. (Ed.) Competition in Global Industries. 83-109. Harvard Business School Press: Boston, MA. Fleischmann, B., Meyr, H., and Wagner, M. (2005) Advanced planning. In: Stadtler, H. and Kilger, C. (Eds.). Supply Chain Management and Advanced Planning. 3rd edition. 81-106. Springer: Despite the fact that parameters such as demands or exchange rates cannot be forecast exactly but are uncertain the proposed model is of deterministic nature and relies on scenario analyses to account for uncertainty. While stochastic optimization models are proposed in academia, they are typically not used in practice. The main reasons are that stochastic models remain difficult to solve and developing meaningful probability distributions and transition probabilities to link parameter realizations across time periods is extremely difficult. However, the scenario-based deterministic approach offers an opportunity for future research by extending the model into a robust optimization model. Berlin. Günther, H.-O. and Tempelmeier, H. (2005) Produktion und Logistik. 6th edition. Springer: Berlin. Hayes, R. H. and Wheelwright, S. C. (1984) Restoring Our Competitive edge: Competing through Manufacturing. John Wiley & Sons: New York. Hübner, R. (2006). Production network design in specialty chemicals. PhD dissertation. Technical University of Berlin, Berlin. Kallrath, J. (2002). Combined strategic and operational planning - an MILP success story in chemical industry. OR Spectrum, 24, 315-341. 50 Reinhard Hübner and Hans-Otto Günther/Asia Pacific Management Review (2007) 12(1), 43-51 Klincewicz, J. G. and Luss, H. (1987) A dual-based algorithm for Kouvelis, P., Rosenblatt, M. J. and Munson, C. L. (2004). A mathe- multiproduct: Uncapacitated facility location. Transportation matical programming model for global plant location problems: Science, 21, 198-206. Analysis and insights, IIE Transactions, 36, 127-144. Kulkarni, S. S., Magazine, M. J. and Raturi, A. S. (2004) Risk Sabri, E. H. and Beamon, B. M. (2000). A multi-objective approach pooling advantages of manufacturing network configuration. to simultaneous strategic and operational planning in supply Production and Operations Management, 13, 186-199. chain design. Omega, 28, 581-598. Lee, C. Y. (1991). An optimal algorithm for the multiproduct ca- Schmenner, R. W. (1982). Multiplant manufacturing strategies pacitated facility location problem with a choice of facility type. among the Fortune 500. Journal of Operations Management, 2, 77-86. Computers & Operations Research, 18, 167-182. Schmenner, R. W. (1979) Look beyond the obvious in plant location. Mazzola, J. B. and Schantz, R. H. (1997). Multiple-facility loading Harvard Business Review, 57, 126-132. under capacity-based economies of scope. Naval Research Shapiro, J. F. (2001). Modeling the Supply Chain. Duxbury: Pacific Logistics, 44, 229-256. Grove, CA. Miller, T. (2002) Hierarchical Operations and Supply Chain Plan- Simchi-Levi, D., Simchi-Levi, E. and Watson, M. (2003). Tactical ning. Springer: Berlin. Mohamed, Z. M. (1999) An integrated production-distribution planning for reinventing the supply chain. In: Harrison, T. P., model for a multi-national company operating under varying Lee, H. L. and Neale, J. J. (Eds.). The Practice of Supply Chain exchange rates. International Journal of Production Econom- Management: Where Theory and Application Converge. 13-30. Kluwer Academic Publishers: Boston, MA. ics, 58, 81-92. Vokurka, R. J. and Flores, B. E. (2002). Plant charter classifications N. N. (2004). Degussa to shift pharma production to China. and the operating homogeneity of US manufacturing plants. Chemical Market Reporter, 265, 6-27. Industrial Management + Data Systems, 102, 406-416. Papageorgiou, L. G., Rostein, G. E. and Shah, N. (2001). Strategic supply chain optimization for the pharmaceutical industries. Industrial Engineering & Chemistry Research, 40, 275-286. Rosenfield, D. B. (1996). Global and variable cost manufacturing systems. European Journal of Operational Research, 95, 325-343. 51