Financial Accounting

advertisement

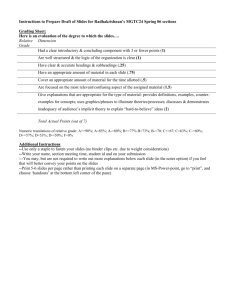

Supplemental Instruction Handouts Financial Accounting Chapter 5: Accounting for Merchandising Activities Activities: Perpetual Journal Entries Required: Prepare general journal entries to record the following perpetual merchandising transactions of Carmen’s Antique Shop. Use a separate account for each receivable and payable. June 1st purchased merchandise from Dave’s Wholesalers for $2,500 under credit terms of 2/10, n/30, and FOB shipping point. Date June 1 General Journal Account Titles and Explanations Inventory Accounts Payable – Dave’s Wholesalers PR Debit 2,500 Page ____ Credit 2,500 June 2nd received the merchandise and a bill for shipping of $150 from Ron’s Shipping Company. The bill was paid when received. Date June 2 General Journal Account Titles and Explanations Inventory Cash PR Debit 150 Page ____ Credit 150 June 3rd sold $500 worth of antiques for cash. The cost of the antiques was $300. Date June 3 June 3 General Journal Account Titles and Explanations Cash Sales Cost of Goods Sold Inventory PR Debit 500 Page ____ Credit 500 300 Academic Success Centre www.rrc.mb.ca/asc This answer key was created by Michael Reimer for the Academic Success Centre. For more questions or links to the Wise Guys videos check out blogs.rrc.ca/michael 300 June 5th sold $750 worth of antiques on credit to Mrs. Burns with credit terms of 3/10, n/30 FOB destination. The antiques cost $400. Date June 5 June 5 General Journal Account Titles and Explanations Accounts Receivable – Mrs. Burns Sales PR Debit 750 Page ____ Credit 750 Cost of Goods Sold Inventory 400 400 June 6th paid $100 for the delivery of antiques to Mrs. Burns. Date June 6 General Journal Account Titles and Explanations Delivery Expense Cash PR Debit 100 Page ____ Credit 100 June 6th received a $500 credit memo from Dave’s Wholesalers for a return of unsatisfactory antiques. Date June 6 General Journal Account Titles and Explanations Accounts Payable – Dave’s Wholesalers Inventory PR Debit 500 Page ____ Credit 500 June 10th purchased merchandise from Angie’s Antique Dealers for $1,750 with credit terms of 1/10, n/20, and FOB destination. Date June 10 General Journal Account Titles and Explanations Inventory Accounts Payable – Angie’s Antique Dealers PR Debit 1,750 Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This answer key was created by Michael Reimer for the Academic Success Centre. For more questions or links to the Wise Guys videos check out blogs.rrc.ca/michael 1,750 June 11th made a payment to Dave Wholesalers less the return and applicable discount. Date June 11 General Journal Account Titles and Explanations Accounts Payable – Dave’s Wholesalers (2,500 – 500) Inventory (2,000 x 0.02) Cash (2,000 – 40) PR Debit 2,000 Page ____ Credit 40 1,960 June 12th made a sale to Mr. Ireland for $600 with credit terms of 3/10, n/30 FOB shipping point. The antiques cost $350. Date June 12 June 12 General Journal Account Titles and Explanations Accounts Receivable – Mr. Ireland Sales PR Debit 600 Page ____ Credit 600 Cost of Goods Sold Inventory 350 350 June 15th received payment from Mrs. Burns regarding the June 5th sale. Date June 15 General Journal Account Titles and Explanations Cash (750 – 22.50) Sales Discount (750 x 0.03) Accounts Receivable – Mrs. Burns PR Debit 727.50 22.50 Page ____ Credit 750 June 16th after negotiations with Angie’s Antique Dealers we received an allowance of $450 for merchandise that had some problems with it upon arrival to our store. Date June 16 General Journal Account Titles and Explanations Accounts Payable – Angie’s Antique Dealers Inventory PR Debit 450 Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This answer key was created by Michael Reimer for the Academic Success Centre. For more questions or links to the Wise Guys videos check out blogs.rrc.ca/michael 450 June 18th issued a credit memo for $200 to Mr. Ireland for return of unsatisfactory antiques. The antiques were destroyed beyond repair and were thrown out. Date June 18 General Journal Account Titles and Explanations Sales Returns and Allowances Accounts Receivable – Mr. Ireland PR Debit 200 Page ____ Credit 200 June 22nd received payment from Mr. Ireland regarding the June 12th sale. Date June 22 General Journal Account Titles and Explanations Cash (400 – 12) Sales Discounts (400 x 0.03) Accounts Receivable – Mr. Ireland (600 – 200) PR Debit 388 12 Page ____ Credit 400 June 30th made a payment to Angie’s Antique Dealers less the allowance. Date June 30 General Journal Account Titles and Explanations Accounts Payable – Angie’s Antique Dealers Cash (1750 – 450) PR Debit 1,300 Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This answer key was created by Michael Reimer for the Academic Success Centre. For more questions or links to the Wise Guys videos check out blogs.rrc.ca/michael 1,300