Document

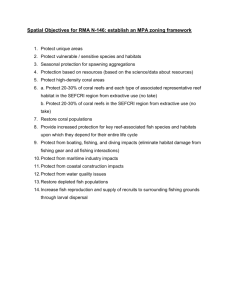

advertisement

Pua Kah Kin Samuel Disclaimer & Declaration The objective of the presentation is for educational purposes. The full content of the presentation is for illustration purposes only and should not be used as investment recommendations. AB Maximus and its presenters are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss. The company and presenters may have personal interest in the particular shares presented. Content Company Background Valuation Risks Conclusion Q&A Company Background Listed on 4 October 1996 in SGX Mainboard Global supplier of fish products One of the largest importers of frozen seafood in China Performs upstream industrial fishing via its strategic investment in SGX listed China Fishery Group Limited (58% owned) Shareholding Structure Obtained from PARD Investor Relations Business Segments Fishing Segment Fishery & Fish Supply Industrial-Scale Fishing Sourcing Onboard Processing of Ocean Fishes Frozen Fish Supply-Chain Management(SCM) Trading Sourcing & Import of Fishes Fishmeal Processing Logistical Support to Commercial Fishing Vessels Products Obtained from China Fishery Group Investor Relations Business Segments Sales (HK$ Mil) $4,369.00 $5,347.00 Fishing Supply Chain Management Obtained from PARD Annual Report Business Segments Operating Profit (HK$ Mil) $393.00 Fishing $1,427.00 Obtained from PARD Annual Report Supply Chain Management Business Segments – By Revenue (HK$ Mil) 6,000.00 5,000.00 4,000.00 Fishing 3,000.00 Supply Chain Management 2,000.00 1,000.00 0.00 2008 2009 2010 Obtained from PARD Annual Report 2011 Geographical Breakdown Sales (HK$ Mil) 1% 8% 1% 0% 7% China & Hong Kong Africa 18% Europe 65% East Asia North America Others South America Valuation DCF Valuation Free Cash Flow to Firm Estimate Revenue of Segments Apply Operating Margins Calculate Free Cash Flow to Firm Calculate Fair Price Peer Comparison P/E Comparison Trading Data Last Done 0.149 52wk Range: 0.14 - 0.28 Volume 1,598,000 Avg Volume (3 mnths) 1,829,800 Market Cap 475.91M Discounted FCFF HK$ Mil Book Value of Equity: Book Value of Debt: Annual Interest Payment: Tax Rate: 10362.298 10058.191 443 5% Risk Free Rate: Market Risk Premium: Beta: Beta Std Dev: 2.64% 10.60% 1.223 0.099 Equity Risk Premium: Long Term ERP Interest Rate: 12.38% 11.69% 4.40% WACC: 8.34% Discounted FCFF Asset Turnover Fishing 42% Frozen Fish Supply Chain Management 60% Overheads Ratio Effective Tax Rate WACC Long-Term Growth Rate 13.5% 5% 8.34% 2% Long-Term WACC 7.99% SGD/HKD 0.1606 Discounted FCFF HK$ Mil Y/E 28 Sep Revenue Fishing Frozen Fish Supply Chain Management Operating Margin Fishing Frozen Fish Supply Chain Management Operating Income (Segments) Fishing Frozen Fish Supply Chain Management Unallocated Costs/ Overheads EBIT Tax EBIT (1-T) Net Capital Expenditures Fishing Frozen Fish Supply Chain Management FCFF 2011 2012E 2013E 2014E 2015E $5,346.51 $6,148.49 $6,763.34 $7,439.67 $7,588.46 $4,369.43 $4,806.37 $5,287.01 $5,815.71 $5,932.03 26.69% 28% 28% 28% 28% 9.00% 9.50% 9.50% 9.50% 9.50% $1,426.79 $1,721.58 $1,893.73 $2,083.11 $2,124.77 $393.22 $456.61 $502.27 $552.49 $563.54 $265.74 $294.05 $323.46 $355.81 $362.92 $1,554.27 $1,884.13 $2,072.54 $2,279.79 $2,325.39 $30.50 $37.68 $41.45 $45.60 $465.08 $1,523.77 $1,846.44 $2,031.09 $2,234.20 $1,860.31 -688.57 $1,909.47 $1,463.93 $1,610.32 -$354.27 -418.5 -$728.24 -$801.06 -$881.17 -$193.86 $416.70 -$791.26 -$233.90 -$257.29 $1,312.18 Discounted FCFF Firm Value (HK$ Mil) Debt (HK$ Mil) Cash (HK$ Mil) Equity Value (HK$ Mil) Minority Interest (%) Minority Interest (HK$ Mil) Shareholder's Value (HK$ Mil) Total Number of Shares Fair Value (HK$) Fair Value (SGD $) $16,028.00 $10,058.19 $218.07 $6,187.88 30.00% $1,856.36 $4,331.51 3,193,994,892 $1.36 $0.218 Sensitive Analysis Sensitive Analysis 0.35 0.3 0.25 0.2 Fair Price 0.15 0.1 0.05 0 1 1.05 1.1 1.15 1.2 1.25 1.3 1.35 1.4 1.45 Peer Comparison – P/E Companies Chosen TSIT WING INTL KHONG GUAN FLOUR CONSCIENCE FOOD FOOD EMPIRE HLDG VIZ BRANZ LTD QAF LTD KENCANA AGRI CHINA MINZHONG DEL MONTE PAC LT PEOPLE'S FOOD MEWAH INTERNATIO PAC ANDES RESOUR SINARMAS LAND LT CHINA FISHERY GMG GLOBAL LTD YEO HIAP SENG SUPER GROUP LTD PETRA FOODS LTD INDOFOOD AGRI RE Peer Comparison – P/E Pac Andes EPS: Average P/E: Pac Andes Fair Price: 0.029005 14.42 SGD $0.418 Valuation Fair Price by Discounted FCF SGD $0.218 Fair Price by Peer Comparison SGD $0.418 Current Price SGD $0.149 Risks – Financial Risks Solvency Risk – Moderate Liquidity Risk – Moderate-High Interest Coverage: 3.1323 Current Ratio: 1.5932 D/A Ratio: 0.49255 Currency Fluctuation HK$ Peg with USD Large Minority Interest Minority interest of income amounts to 20%-35% Risk – Operational Risks Family Business Corporate Governance Fishing Segment Weather changes Over reliance of customer – One customer’s total revenue amounted to HK$ 1,511 Mil Over-fishing Supply-Chain Management Dependence on supplier Unsustainable Tax Rate