Toy and Game Stores

Industry Overview

The toy store industry, like many other retail industries

in the U.S., has changed radically since the 1970s.

Before then, most toy stores were independent, momn-pop shops or small chains. The advent of Toys “R”

Us, the first toy “superstore discounter,” and its imitators changed the landscape of the business. Customers

flocked to these stores because they offered the most

complete selection of toys at the lowest prices.

In the 1990s, toy superstores began to lose market

share to mass merchandisers like Wal-Mart and Target. Superstore chains like Lionel Kiddie City and Child

World went bankrupt. The industry has been in a perpetual state of consolidation and acquisition for a decade,

as more toy stores close and fewer major players are

left in the field.

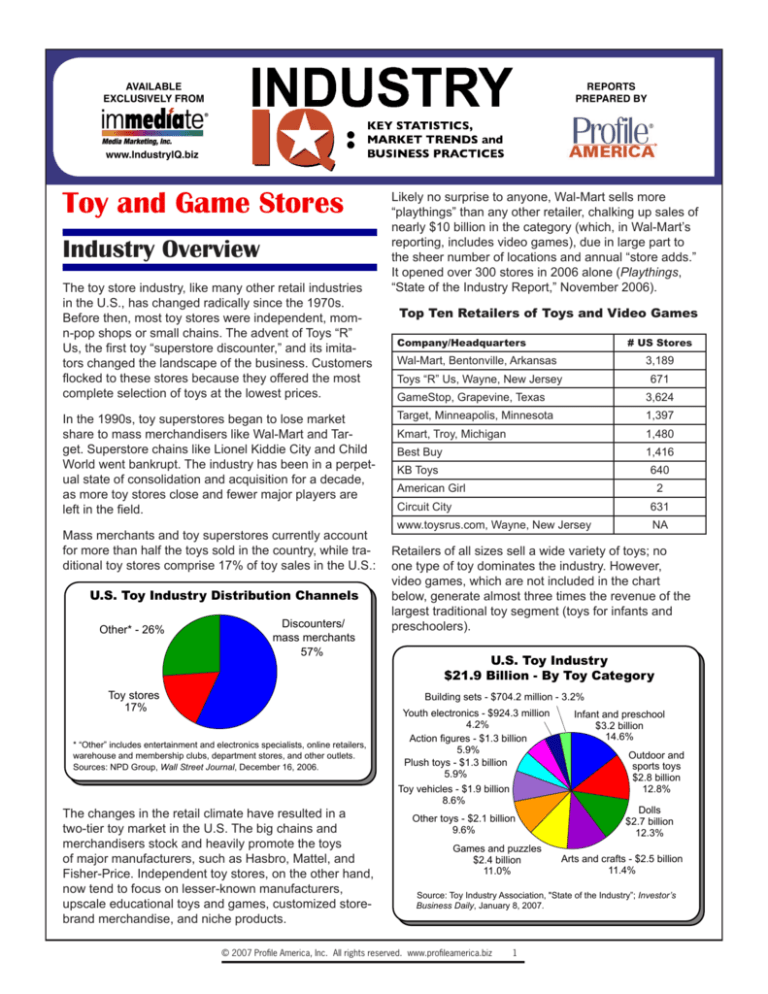

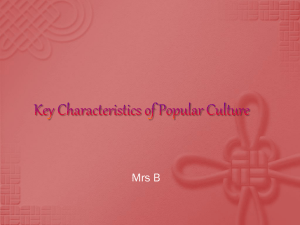

Mass merchants and toy superstores currently account

for more than half the toys sold in the country, while traditional toy stores comprise 17% of toy sales in the U.S.:

U.S. Toy Industry Distribution Channels

Other* - 26%

Discounters/

mass merchants

57%

Toy stores

17%

Likely no surprise to anyone, Wal-Mart sells more

“playthings” than any other retailer, chalking up sales of

nearly $10 billion in the category (which, in Wal-Mart’s

reporting, includes video games), due in large part to

the sheer number of locations and annual “store adds.”

It opened over 300 stores in 2006 alone (Playthings,

“State of the Industry Report,” November 2006).

Top Ten Retailers of Toys and Video Games

Company/Headquarters

# US Stores

Wal-Mart, Bentonville, Arkansas

3,189

Toys “R” Us, Wayne, New Jersey

671

GameStop, Grapevine, Texas

3,624

Target, Minneapolis, Minnesota

1,397

Kmart, Troy, Michigan

1,480

Best Buy

1,416

KB Toys

640

American Girl

2

Circuit City

631

www.toysrus.com, Wayne, New Jersey

NA

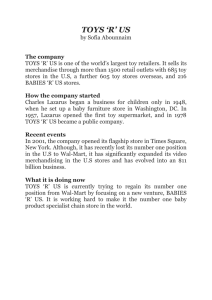

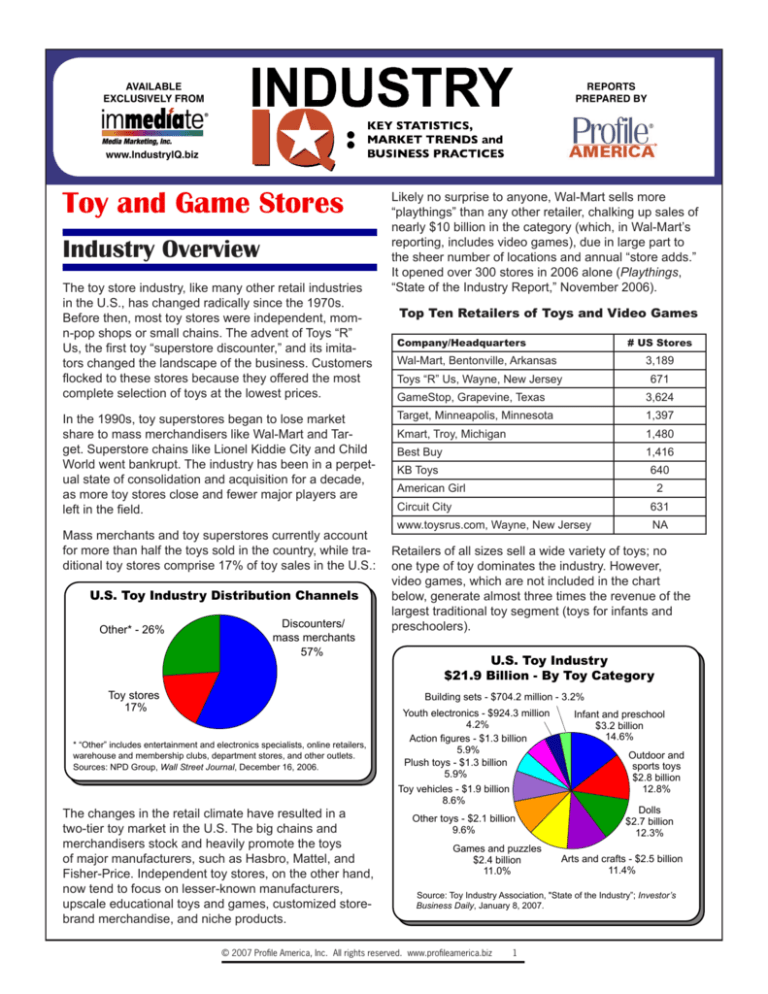

Retailers of all sizes sell a wide variety of toys; no

one type of toy dominates the industry. However,

video games, which are not included in the chart

below, generate almost three times the revenue of the

largest traditional toy segment (toys for infants and

preschoolers).

U.S. Toy Industry

$21.9 Billion - By Toy Category

Building sets - $704.2 million - 3.2%

* “Other” includes entertainment and electronics specialists, online retailers,

warehouse and membership clubs, department stores, and other outlets.

Sources: NPD Group, Wall Street Journal, December 16, 2006.

The changes in the retail climate have resulted in a

two-tier toy market in the U.S. The big chains and

merchandisers stock and heavily promote the toys

of major manufacturers, such as Hasbro, Mattel, and

Fisher-Price. Independent toy stores, on the other hand,

now tend to focus on lesser-known manufacturers,

upscale educational toys and games, customized storebrand merchandise, and niche products.

Youth electronics - $924.3 million

4.2%

Action figures - $1.3 billion

5.9%

Plush toys - $1.3 billion

5.9%

Toy vehicles - $1.9 billion

8.6%

Other toys - $2.1 billion

9.6%

Games and puzzles

$2.4 billion

11.0%

Infant and preschool

$3.2 billion

14.6%

Outdoor and

sports toys

$2.8 billion

12.8%

Dolls

$2.7 billion

12.3%

Arts and crafts - $2.5 billion

11.4%

Source: Toy Industry Association, "State of the Industry”; Investor’s

Business Daily, January 8, 2007.

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

Issues and Trends

The rising popularity of home video games has

had an undeniable impact on the toy store industry.

Many traditional toy stores were initially reluctant to

stock video game hardware, as the profit margin is

considerably lower than for traditional toys. But the

enormous demand for these products inspired toy

stores, particularly the larger stores, to reluctantly

embrace them. An estimated $10 billion is spent by

U.S. households on video games, and the category is

growing by around 6% annually, according to the Toy

Industry Association.

As recently as the early 2000s, many toy stores began

stocking fewer traditional toys and more video games,

to satisfy the nearly half of U.S. children who start on

video games at 4 to 5 years of age (Time magazine,

December 2004). But while the video game category

continues to generate a lot of attention and revenue,

traditional toys are poised to make a comeback, after

dropping by around 3% in 2005 and 2006.

With the growing number of children in the preschool

age group, and with many parents looking for more

“balance in the toybox,” traditional toys that encourage

creativity are rebounding (Investor’s Business Daily,

January 8, 2007). That trend will benefit high-end

specialty retailers (like F.A.O. Schwarz), which typically

emphasize unique, ornate, handcrafted, and exclusive

toys (Wall Street Journal, December 16, 2006).

The biggest category winners of late have been youth

electronics, which refers not to video games but instead

to educational DVDs for preschoolers -- like Baby

Einstein and its new rival Little Steps -- as well as Digital

Song and Story Player from Fisher-Price, VCamNow

(a video recorder), and the Kid-Tough Digital Camera.

Suffering the biggest losses have been action figures

and accessories, as well as stuffed animals (“plush”):

Toy Supercategories: Winners and Losers

Youth electronics

Vehicles

Building sets

Arts and crafts

-3%

-3%

-3%

-5%

- 9%

-13%

-15%

-15

4%

2%

0

1

2

3

4

5

6

10

15

20

25

Toy Industry Trends and Forecasts

•

Despite all the hype generated by video games,

traditional toys still occupy more of kids’ playtime.

A study conducted by NPD Group in the Fall of

2006 reported that children spend about 9% of their

free time playing with traditional toys, compared to

6% with video games and other electronic items.

Traditional toys also typically enjoy higher profit

margins than video games.

•

The trend toward “more active parenting” will help

drive sales of traditional toys. As parents look for

more ways to engage with their children and spend

quality time together, they’ll turn to construction

blocks, art materials and crafts. These toys are

also desirable because they are simple to use:

parents open a box and are able to immediately

sit on the floor with their children and play -- with

no need to read operating instructions or technical

specifications, or assemble sophisticated products.

•

Another reason parents are returning to traditional

toys is to encourage social interaction. Unlike

digital technology, which promotes a solitary

pattern of play, traditional toys also encourage kids

to develop math skills and creativity.

6%

Source: U. S. Cenusu Bureau

5

According to a review of several articles about the toy

industry, there may just be reason to celebrate in 2007.

Target Market Population Growth Projections

9 to 12

0

U.S. toy producers and retailers have struggled for years

with price competition, kids’ changing toy preferences,

and escalating operating costs (driven by high energy

costs, increasing interest rates, and the growing costs

of marketing and advertising). Industry participants of all

stripes are ready for a few good years.

Stability, if not growth, should return to the industry if

for no other reason than the population of children is

expected to grow. Consider the chart that follows, which

indicates that the preschool set (age five and younger)

is expected to increase by 6% between 2005 and 2010,

outpacing growth of other age groups.

6 to 8

-5

Source: Playthings, “State of the Industry,” November 2006.

Around 62% of industry revenue is generated by toys

for the 7-and-under set, with the 18-and-older segment

(primarily “gamers”) generating 19%. The remaining two

segments (the 8-to-12 age group and teenagers aged

13 to 17) generate 16% and 3%, respectively, of industry

revenue (Playthings, November 2006).

5 and under

-10

+23%

+8

+3%

0%

Total toy industry

Games and puzzles

Outdoor and sports toys

All other toys

Dolls

Plush

Action figures and accessories

Sources: Investor’s Business Daily, January 8, 2007; New York Times, February 11, 2006; Playthings, January 2007.

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

Differentiation strategies used by many independent

retailers help set them apart from their big-box

competitors. They not only stock unique, hand-crafted

items and educational toys, they also use a variety of

other strategies, including the following:

Independents’ Differentiation Strategies

•

•

•

•

Hosting birthday parties in the store, for a fee

(ranging from an ice-cream treats party for $25

per child, to an all-out all-nighter for thousands).

Creating giant displays of unusual items, especially those that provide some interactivity to more

fully “engage” children (which gives their parents

time to browse through the store).

Offering frequent-buyer loyalty programs to

reward customers, which encourages them to

return (giving a gift or a half-off coupon when

they reach a certain level of spending within a

designated period of time).

Assembling (for a price) toys that consumers

may have purchased at big-box retailers (and

encouraging parents to browse while assembly is

taking place).

While it’s parents who actually pay for toys, the real

decisions about what toys to buy are made by kids.

Producers and retailers alike are in a competitive

contest to win the hearts and minds of youngsters,

so most advertising is geared toward children. And

since online sales of toys are increasing by around

35% annually (Forrester Research, “The 2006

State of Retailing Online”), many retailers are taking

their messages to the Internet, in addition to using

traditional offline advertising vehicles like television

and radio (used largely by national chains), as well as

newspapers, local magazines, Yellow Pages, and direct

mail (used routinely by independents).

Value of Products and

Services in the Industry

Toy costs run the gamut from a $1 bag of marbles to

a $15,000 miniature Mercedes-Benz that travels up

to 15 miles an hour. Average per-visit spending on

toys also varies dramatically, depending on the outlet

where they’re purchased; Wal-Mart or Target items

cost considerably less, on average, than toys at FAO

Schwarz or at specialty toy stores.

Determining average household spending on toys

can help a specialty retailer determine market size

and market share. The industry’s $21.9 billion in retail

revenue translates to average annual household

spending of $195. In an area of 30,000 households, it is

fair to assume that $5.8 million is spent on toys.

If a specialty toy retailer generates revenue of $1 million

annually, his or her market share would be 17%, a

baseline for comparison against future performance.

Typical prices for a variety of popular toys follows:

Brand Name / Type of Toy

Average Price

Atari Flashback

$69.95

Emerson Radio, Spongebob DVD-CD Player

$35.24

Oregon Scientific Smart Globe

$99.99

Playskool Weebles Castle

$39.95

Dora’s Talking Dollhouse

$49.99

Spider-Man, Itsy Bitsy Spider-Man

$24.99

Chatnow Communications 2-Pack

$74.99

Xbox 360 Console

$299.99

Kid-Tough Camera

$65.99

TMX Elmo

$44.99

Critical Success Factors

CSFs For Toy Retailers

•

Hire enthusiastic employees who are customerservice “ambassadors,” and train them to be

knowledgeable enough to help educate parents and

patient enough to guide children in the selection of

age- and personality-appropriate items.

•

Stock a vast array of toys: trendy toys, classic toys,

toys that appeal to every age group, active indoor

toys, and toys that shoppers can feel good about

giving their children and grandchildren.

•

Know the demographics of the area in which the

store is located, and target advertising messages

and promotions accordingly. To neighborhoods

populated primarily by older people, convey “gifts for

grandchildren” messages. In an area populated by

young couples with preschoolers, describe the many

offerings of stimulating educational products.

•

Monitor the competition and stock what they do not,

and become friendly with the service desk folks and

toy department employees at the “big boxes.” Ask

them to refer customers to the store for items they

do not carry. Most will be happy to do so, rather than

sending them to their mass merchant competitors.

•

Rearrange the store and change window displays

frequently, to create awareness of the breadth and

depth of the store’s merchandise.

Sources: Playthings, January 2007; Investor’s Business Daily, January 8,

2007; Wall Street Journal, December 16, 2006; Playthings, November 2005.

Industry Resources

Playthings magazine, www.playthings.com

Toy Industry Association, www.toy-tia.org

The Toy Book, www.toybook.com

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz

Background

Values and Benefits

Media Marketing, Inc., creators of imMEDIAte®

software, has been in the forefront of sales

presentation systems since 1987. The imMEDIAte suite, a state-of-the-art consultative

system, is used by hundreds of media reps every day to create compelling presentations

and expert media proposals. Built on Microsoft

Office® technology, the imMEDIAte system

provides a complete solution to your media

sales needs.

Media Marketing is an authorized distributor

of Profile America’s IndustryIQ reports. Sales

and marketing teams embrace these industryknowledge reports because of their concise,

easy-to-read style and rich store of information.

Regular use of IndustryIQ reports creates a

relationship-building, consultative environment. Since 1986, Profile America has provided

profiles of industries, markets and trends to

business-to-business marketers, facilitating

an understanding of the industries into which

they sell their products and services.

Program Objectives

IndustryIQ reports are used by managers

as sales training, planning and business

development tools. Sales reps use IndustryIQ

reports to prepare for sales calls and as a

valuable leave-behind.

Armed with independent, third-party

assessment of industry dynamics, media reps

can “walk the walk and talk the talk” of their

advertisers’ industries, allowing reps to better

assist advertisers in creating compelling,

effective messages for their target audiences.

Sales reps want to be smart about advertisers’

industries, but face the realities of limited time

and resources. They need to track dozens of

different industries, and value these concise,

easy-to-use sales tools that they can leave

behind with their advertisers.

Likewise, managers want reps to be confident,

professional and informed. They want their

reps viewed as partners, not vendors -- and

they appreciate the IndustryIQ method

of collecting, analyzing and presenting

information.

Independent, third-party IndustryIQ reports

leave marketing and sales professionals

free to practice their core competencies:

developing successful advertising strategies

for their clients.

Delivery

IndustryIQ reports incorporate a customer-

guided approach to gathering information

and creating industry-knowledge products.

We value your content recommendations as

we strive to create the most useful, fact-filled

industry reports available.

IndustryIQ reports are available in PDF

format from Media Marketing’s web site,

www.industryIQ.biz.

IndustryIQ is distributed by Media Marketing, Inc., in association with Profile America, Inc., for use by advertising sales representatives.

Although the information in this report has been obtained from sources that Profile America, Inc. believes to be reliable,

no guarantees are made as to the accuracy of the information presented, and any information presented may be incomplete or condensed.

© 2007 Profile America, Inc. All rights reserved. www.profileamerica.biz