Snap-on Incorporated

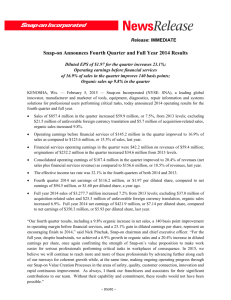

advertisement