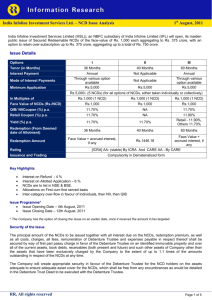

best... - Markets - IndiaInfoline

advertisement