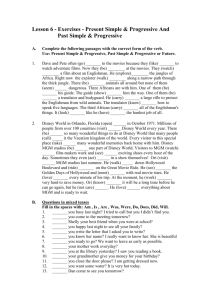

MGM Resorts International - Massachusetts Gaming Commission

advertisement