MGM Resorts International (MGM) - Henry B. Tippie College of

advertisement

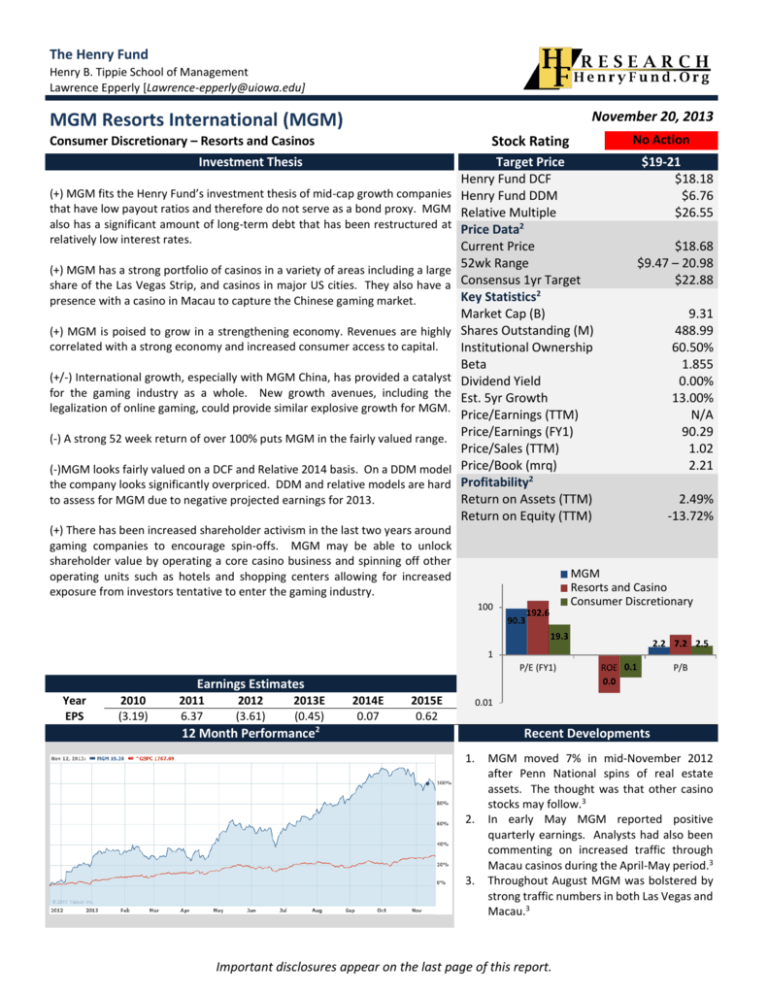

The Henry Fund Henry B. Tippie School of Management Lawrence Epperly [Lawrence-epperly@uiowa.edu] November 20, 2013 MGM Resorts International (MGM) No Action Stock Rating Consumer Discretionary – Resorts and Casinos Investment Thesis (+) MGM fits the Henry Fund’s investment thesis of mid-cap growth companies that have low payout ratios and therefore do not serve as a bond proxy. MGM also has a significant amount of long-term debt that has been restructured at relatively low interest rates. (+) MGM has a strong portfolio of casinos in a variety of areas including a large share of the Las Vegas Strip, and casinos in major US cities. They also have a presence with a casino in Macau to capture the Chinese gaming market. (+) MGM is poised to grow in a strengthening economy. Revenues are highly correlated with a strong economy and increased consumer access to capital. (+/-) International growth, especially with MGM China, has provided a catalyst for the gaming industry as a whole. New growth avenues, including the legalization of online gaming, could provide similar explosive growth for MGM. (-) A strong 52 week return of over 100% puts MGM in the fairly valued range. (-)MGM looks fairly valued on a DCF and Relative 2014 basis. On a DDM model the company looks significantly overpriced. DDM and relative models are hard to assess for MGM due to negative projected earnings for 2013. Target Price Henry Fund DCF Henry Fund DDM Relative Multiple Price Data2 Current Price 52wk Range Consensus 1yr Target Key Statistics2 Market Cap (B) Shares Outstanding (M) Institutional Ownership Beta Dividend Yield Est. 5yr Growth Price/Earnings (TTM) Price/Earnings (FY1) Price/Sales (TTM) Price/Book (mrq) Profitability2 Return on Assets (TTM) Return on Equity (TTM) (+) There has been increased shareholder activism in the last two years around gaming companies to encourage spin-offs. MGM may be able to unlock shareholder value by operating a core casino business and spinning off other operating units such as hotels and shopping centers allowing for increased exposure from investors tentative to enter the gaming industry. 100 90.3 $19-21 $18.18 $6.76 $26.55 $18.68 $9.47 – 20.98 $22.88 9.31 488.99 60.50% 1.855 0.00% 13.00% N/A 90.29 1.02 2.21 2.49% -13.72% MGM Resorts and Casino Consumer Discretionary 192.6 19.3 2.2 7.2 2.5 1 P/E (FY1) Earnings Estimates Year EPS 2010 (3.19) 2011 6.37 2012 (3.61) 2013E (0.45) 2014E 0.07 2015E 0.62 ROE 0.1 0.0 P/B 0.01 12 Month Performance2 Recent Developments 1. 2. 3. MGM moved 7% in mid-November 2012 after Penn National spins of real estate assets. The thought was that other casino stocks may follow.3 In early May MGM reported positive quarterly earnings. Analysts had also been commenting on increased traffic through Macau casinos during the April-May period.3 Throughout August MGM was bolstered by strong traffic numbers in both Las Vegas and Macau.3 Important disclosures appear on the last page of this report. EXECUTIVE SUMMARY MGM Resorts International (MGM) is one of the world’s leading global hospitality companies, operating a worldrenowned portfolio of destination resort brands. MGM has transformed itself from the brink of bankruptcy in the heart of the financial crisis to a diversified casino conglomerate with resorts in the United States and Macau. Since the lows of 2009 the stock has more than quadrupled and is up over 100% in the last year. MGM is a mid-cap company with a low payout ratio, two things we have targeted for the Henry Fund portfolio moving forward. However, the company is currently fairly valued and we are recommending No Action at this time. From a valuation perspective we see slight upside with our DCF model and a relative valuation. The significant downside on our Dividend Discount model, does not concern us due to difficult current forecasting for the growth company. Combining these three and weighting them at 75% DCF, 5% DDM, and 20% relative we come out with a target range of $19-21, just shy of our investment objectives. COMPANY DESCRIPTION MGM operates in a variety of segments and geographic regions. The most prominent of these geographic regions are the United States and Macau. Business segments revenues includes that from the casino, rooms, food and beverage, entertainment, retail, and others. The following graph shows the revenue breakdown for MGM by geographic segment. MGM has been looking to broaden this geographic reach but currently operates in a limited space. Since the IPO of MGM China in 2011, China has already captured 31% of the total revenue for MGM. We expect continued increase in this proportion moving forward as the Chinese gaming market is much more growth oriented than in the United States. 2012 Geographic Revenue Breakdown 31% 4% 65% Wholly owned domestic resorts Corporate and other MGM China Source: 10-K1 Next, you can see the revenue breakdown for each business segment for MGM. Going forward we have projected a modest growth rate for casino and a slow but steady growth rate for food and beverage and entertainment segments. We think the majority of growth will come from room revenue. With a strengthening economy MGM should be able to increase occupancy, REVPAR (revenue per available room), and ADR (average daily rate). Segments Casino Rooms Food and beverage Entertainment, Retail & Other Reimbursed costs Less: Promotional allowances Total 2008 2976 1907 1582 1372 47 -675 7208.77 2009 2618 1370 1362 1194 99 -666 5978.59 2010 2479.70 1370.05 1339.17 1104.36 359.47 -633.53 6019.23 2011 4002.985 1547.765 1425.428 1205.35 351.207 -683.423 7849.31 2012 5319.489 1588.77 1472.382 1163.431 357.597 -740.825 9160.84 Source: 10-K1 The following graph from the annual report shows the properties that MGM wholly or partially owns. It does not include projects that are currently in development. For our projections we have used the current 48,311 rooms. We do expect this number to grow as the company takes on projects in Dubai, Abu Dhabi, and other areas of the United States. We think that this portfolio is strong and provides marquee destinations with resorts like CityCenter and the Bellagio while also having the ability to cater to the middle market with properties like MGM Grand, Mandalay Bay, and the Mirage. It also caters to the lower end travelers with properties like the Circus Circus and the Excalibur which serve a younger, more value oriented crowd. This ability of MGM to compete in all three of these market segments gives them a competitive advantage over other resorts that operate in a specialized segment like Wynn or Las Vegas Sands. Page 2 resorts find easily accessible gaming, lodging, dining, shopping, and entertainment at a variety of price points in order to serve the targeted market for each particular resort. Shareholder Returns MGM has not paid a dividend for over a decade. They have also not engaged a large repurchase program over that period. Share count has gone up over 60% since 2003. We are not concerned about this lack of shareholder return because of the fact that MGM was on the brink of bankruptcy in 2009. Since that time the company has been a growth play and these lack of shareholder returns are common in growth companies. The stock price has followed going from under $5 per share to over $20. We do not see a change coming in this payout policy anytime in the next 5 years as the company is has a large amount of debt to pay down. RECENT DEVELOPMENTS MGM has experienced a lot of recent developments. These include changes in the resort portfolio, management changes, and of course, earnings announcements. When looking into the future the biggest catalyst for change may be online gambling. New Projects and M&A Treasure Island Source: 10-K1 Company Strategy MGM’s strategy is focused on creating great destination resorts around the globe for travelers. We see the company slowing the expansion of their brand in order to pay down debt. Currently, 60% of MGM is financed through debt with 40% equity. We think MGM will take the next couple years attempting to pay down some of this debt in order to refinance at still favorable rates in a year or two. Most of their debt does not mature for at least 2 years. MGM has also been creating value by adding top of the line entertainment, dining, retail at their resorts. By doing this they are able to control and attract consumers in all aspects of the vacation spend. Travelers visiting their The sale of Treasure Island (TI) is an example of the dire straits that MGM was in during the heart of the financial crisis. On March 19th, 2009 MGM sold TI to Phil Ruffin for $775 million. MGM offered a $20 million discount to Ruffin if he paid in cash. They did this because the company was in need of cash to meet obligations.5 While the sale of TI may have caused MGM to lose one of their quality properties, the sale allowed the company to survive and continue meeting obligations on the rest of their extensive properties. We think that this was a good decision because the TI offered enough cash to meet these demands without losing a top of the line property. MGM China In 2011 MGM acquired an additional 1% of the overall capital stock in MGM China.1 MGM currently owns 51% of MGM China. Macau earns roughly six times more Page 3 gambling revenue than Las Vegas.6 There have only been six players in the area as government licenses are tightly controlled. Earlier this year MGM won approval for a second casino in the area. This was a huge approval for the organization as they should be able to capture a larger share of the total Macau gaming revenue. We believe that MGM China will be a catalyst for the company in the future and the company’s stock will move significantly more on news coming out of Macau than it will with events domestically. Construction is expected to take at least three years and still needs government approval.6 CityCenter CityCenter accounts for close to 4% of overall revenues for MGM. This is a unconsolidated affiliate and therefore reports into the corporate and other business segment. CityCenter is a development in Las Vegas between the Bellagio and the Monte Carlo that is owned 50% by MGM and 50% by Infinity World Development Group (Dubai World). CityCenter is home to the Aria casino and hotel, the Mandarin Oriental non-gaming hotel boutique, a retail and entertainment district called Crystals, and Vdara luxury condominiums. While CityCenter was expensive and has experienced multiple writedowns on MGM’s balance sheet in the last couple of years, we believe that this can be a growth driver going forward. The timing of CityCenter almost sent MGM into bankruptcy. The project was announced just before the recession hit. The recession caused a lot of capital to dry up in Las Vegas and slowed the growth. WE think that as the economy continues to recover, CityCenter could be a positive benefit to MGM instead of the liability it has been for the last three years. Earnings IN Q3 MGM missed earnings. Consensus estimates were that MGM would report -0.03 and the number came in at -0.07 with revenue at 2.46B beating the consensus estimates of 2.41B. This was not a surprise for us as we think MGM is still a year away from starting to earn positive earnings per share.3 In Q2 MGM missed estimates of 0.01 and reported -0.19. After accounting for one time charges the company actually beat by three cents per share. Revenue of 2.48B beat the 2.47B estimate. Revenue numbers on both the strip and in Macau caused the stock in increase 6% on the announcement.3 In Q1 MGM earned 0.01 matching estimates and beat by 0.06B on revenue. Revenue numbers from both China and Macau came in strong. The stock moved up 5% on the announcement.3 Online Gambling In October 2011, MGM announced a strategic partnership with bwin.party digital entertainment plc, the world’s largest publicly traded online poker operator with operations under the “PartyPoker” brand.1 We believe this was a crucial agreement as online gambling may be the revenue driver of the future. It is our belief that bwin.party was not the top player in town but that the partnership was crucial because having a platform for online gaming will be crucial. We also believe that online poker will be legalized before the rest of online gaming and therefore Pokerstars will have a dominant market share with the rest of the websites coming in well behind. Pokerstars in privately owned and has had strategic partnerships with Wynn Resorts and Resorts Caino. Management In December 2008 James Murren took over as Chairman and CEO. We believe that Mr. Murren is a definite asset with a long history in the gaming industry and a background in investment community. Murren was managing director and director of equity research at Deutsche Bank. He worked on Wall Street for 14 years before starting at MGM as CFO in 1998.7 We think that this experience on the investment side coupled with the result over the last 5 years that Murren is a true strength for the organization and adds significant value to the company. INDUSTRY TRENDS The casino and resort industry is being shaped by economic and political factors. The biggest political factors are garnering licenses from governments. This is true with both online gambling as well as international and domestic expansion. There is also a significant dependce on a strong macroeconomy in order to make people comfortable enough to travel, gamble, and spend money. Page 4 Online Gambling As discussed earlier MGM has a strategic partnership with bwin.party. We think that within the next five years online gambling will be legalized, with full online gambling following. Full online legalization may take 10-15 years. We expect this legalization to increase MGM’s revenue 50100% over the course of the first 3 years of legalization. This has not been factored into our model since predicting government legislation is risky and difficult. If such a bill were to pass we would recommend a BUY on MGM. Rate (ADR) was $129 and Revenue Per Available Room (REVPAR) was $117. We have held occupancy steady at 91% but think it could rise to as much as 95% if the economy grows faster than expected. We have calculated the ADR to be $140 in 2013 rising to $180 by 2017. This is well below industry predictions of 193 by 2015 but we think that the economy will grow very slowly and that this will cause that number to grow slowly as well. Similarly we have REVPAR growing to $140 by 2017 while industry average has it at $162 by 2015. The slow growth here is for the same reasons listed for the slow growth in ADR International and Domestic Expansion Expansion is key to MGM being able to broaden its revenue base over the next few years. Currently MGM is trying to secure licenses to operate in both New York and Japan.3 Gaining licenses in different political environments is challenging and understanding each areas norms, cultures, and practices is crucial to success. The approval of MGM’s 2nd license in Macau is encouraging and we believe they are a top contender for licenses in Japan where they are competing with the likes of Wynn Resorts and Las Vegas Sands. The rise in local casinos is another problem for MGM. Many states have started looking to get in the gaming business and have awarded local gaming licenses. This makes it less likely for people to travel to destination resorts to fulfill their gaming desires and puts pressure on destination resorts to offer significantly enhanced experiences. Macroeconomic Dependence The casino and resort industry is highly dependent on a strong macroeconomic environment. As we saw in the Great Recession, a weak economy could cripple MGM Resorts and many other casinos. All aspects of the casino and resort industry (gaming, dining, entertainment, retail, and hotel) are dependent on consumers having disposable income. If people find they have less disposable income the traffic that comes through travel destinations like Las Vegas or Macau could be dramatically slowed. We are particularly concerned about a slowdown in China due to the fact that the economy has been growing so fast for so long and gaming revenues are larger in Macau than in Vegas. MARKETS AND COMPETITION In order to analyze the markets and competition we will do a Porter’s 5 Forces analysis and a competitive outlook with other major players in the casino and resorts industry. Bargaining Power of Suppliers (Varies) The bargaining power of suppliers shifts depending on which business segment you are analyzing. Suppliers in the gaming and dining segments are typically either commoditized or stable and predictable. However, when looking at expansion opportunities the contractors to build facilities and retailers to put in the shopping centers may be able to leverage some sort of bargaining power. Bargaining Power of Consumers (High) The bargaining power of consumers is high. Resorts operated by MGM tend to be in destination locations where there are multiple competitors that guests can choose from. MGM’s ability to continue providing exceptional customer service to all levels of clients will be critical for them to keep consumers frequenting their resorts. Threat of New Entrants (Low) The threat of new entrants is relatively low. The difficulty and highly political process of obtaining licenses is not easy and most of the big players are already established in the market. Most new entrants are entering in smaller markets and will struggle to reach the size and reach of MGM. Industry Statistics We expect industry statistics to continue to grow. In 2012 MGM posted an occupancy rate of 91%. The Average Daily Page 5 Threat of Substitute Products (High) ECONOMIC OUTLOOK Consumers have a variety of substitute products they can choose from. In Vegas alone there are dozens of casinos. Walking down the Vegas Strip, consumers could visit more than 5 different casino operators properties in a couple of hours. Competitive Rivalry (High) The competitive rivalry is high. When competing for new licenses and customers there is a great deal of promotion and money spent. Loyalty programs offer rewards and billions are given out each year in Vegas and Macau to try and lure gamblers to different properties. The following are a few graphs detailing metrics of different major casino and resort companies. This details where MGM is strong relative to peers and where they need to look to improve. Company Las Vegas Sands Wynn Resorts Boyd Gaming Penn National Melco Crown Average MGM Market Cap (B) Revenue (B) P/E (ttm) P/E (FY1) 57.41 13.19 26.56 19.28 16.27 5.39 26.16 22.3 1.08 2.84 N/A 47.9 1.15 3.02 13.23 27.11 18.88 4.79 36.3 21.64 18.96 5.85 25.56 27.65 9.21 9.23 N/A 85.31 Company Operating Margin Profit Margin ROA Las Vegas Sands 24.65% 16.40% 8.91% Wynn Resorts 22.55% 11.62% 10.98% Boyd Gaming 9.42% -32.82% 2.75% Penn National 13.95% 3.80% 5.08% Melco Crown 15.21% 10.89% 5.93% Average 17.16% 1.98% 6.73% MGM 11.53% -14.55% 2.49% ROE Div. Yield 27.91% 2% 303.49% 2.40% -92.66% N/A 4.99% N/A 11.62% N/A 51.07% 2.20% -13.72% N/A Source: Yahoo! Finance2 For our comparisons here we used all data from Yahoo! Finance. As you can see MGM is second in revenue to LVS meaning they generate a large amount of money flowing through the organization. They are also the most expensive on a forward P/E ratio. On a size basis they compete with the larger companies like Las Vegas Sands but when it comes to efficiencies and margins they seem to compete more with the smaller players like Penn National. As MGM continues to improve its balance sheet we expect margins and returns to look more like the bigger players than the smaller players. We also do not expect them to start paying a dividend in the foreseeable future due to the amount of debt that the company is going to have to pay down. Given the current environment of muted economic growth due to the recent government shutdown, potential for ongoing fiscal issues, as well as continued tapering, we do not anticipate any substantial changes in the current economic outlook. We expect Real GDP growth will pull back slightly due to fiscal turmoil to a level closer to 2% versus the 2nd Quarter 2.5%. Due to a lack of strong economic growth and little movement in energy prices, both CPI and employment growth will remain subdued at an estimated CPI of 1.5% with unemployment slightly higher at 7.3%. Interest rates may back up from the current unsustainable rates of 0.11% for the 1 year T Bill and the 2.53% for the 10 year T-Bond, but we don’t expect them to rise above 0.2% and 3% respectively. With limited economic growth and an increase in supplies, we estimate oil prices to remain in the $95-105 range for the near future. With current market levels at all-time highs, a pullback of 5% from current levels is certainly not out of the question. Despite our lackluster outlook, our concerns for portfolio construction are related to longer term macro issues, most notably the upcoming Federal Reserve tapering process. We are not in a position to predict a starting point in time, but are confident that it will occur during the holding period of any new selections for the portfolio. Given our concerns regarding market impact from the changes in economic policy from the Fed, we believe that underweighting holdings that would be most severely impacted by tapering is a priority. Portfolio holdings that would be underperformers would likely include higher yielding stocks and/or sectors, as well as companies with higher financing needs. These will be areas for potential future disinvestment. When it comes to a macroeconomic view, a few factors play into the casino and resort industry. The industry is highly reliant on strong macroeconomic and consumer data. Consumer factors like consumer confidence, consumer sentiment, and unemployment rates greatly affect the industry. We believe that both unemployment and consumer confidence will slowly improve in both the United States and China which should allow people to spend freely on leisure in the future. Page 6 confidence should prove very beneficial for MGM Resorts International. INVESTMENT POSITIVES Source: www.tradingeconomics.com8 Long-term restructured debt at low rates should allow for a continued improvement in the financial statements MGM is a mid-cap growth stock which should be less affected by rising interest rates since they have not been serving as a bond proxy MGM has a strong portfolio of resorts with locations in the United States and Macau and expansion opportunities in both of those locations as well as Japan and the Middle East MGM could unlock shareholder value if it follows PENN and spins off the hotel and shopping center business segments INVESTMENT NEGATIVES Source: www.tradingeconomics.com8 CATALYSTS FOR GROWTH MGM has many catalysts for growth coming in the future. As noted earlier expansion into new territories is a huge catalyst for a gaming company. MGM has projects in the works and hopes to build new resorts in Macau, Japan, and New York. The biggest catalyst to the industry is the legalization of online gambling. We at the Henry Fund predict that this will first take the form of legalizing online poker and then full gaming to follow. The lack of a dividend skews our DDM model to reflect a significant downside High reliance on consumer confidence could be problematic in the current uncertain economic and political environment MGM looks fairly valued when looking at a DCF or relative multiple valuation A 52 week return of over 100% may cause investors to take gains and not continue to put money into the stock on a momentum buy VALUATION For the purposes of valuation we have conducted a discounted cash flow model, a dividend discount model, and relative P/E and relative PEG valuations. We acknowledge that all of these have advantages and disadvantages so we have weighted them in the following order: The last major catalyst is a strong world economy. If the economy continues to improve we project that MGM will thrive as people have more disposable income. A continued decrease in the unemployment rate coupled with increasing consumer sentiment and consumer Page 7 DCF – 70% - This provides us with what we think is the best account of the three and reflects what we believe are both sustainable and realistic future projections DDM – 5% - This give us a lower valuation metric. This will be an unreliable metric as it is hard to forecast this since MGM has never paid a dividend and does not have a set payout policy yet 2014 Relative Weighted Average – 25% - We conducted our relative valuations as a weighted average of the 2014 P/E and 2014 PEG. Considering the low earnings and high growth potential the PE comes out artificially low and the PEG comes out around the current stock price. We chose to weight the PEG at 80% and the P/E multiple at 20% In addition we have used the following assumptions for our model: Tax Rate – 30% Risk-free rate – 2.8% Market Risk Premium – 5.60% Beta – 1.855 WACC – 7.8% CV growth of NOPLAT – 2% CV growth of EPS – 2% Cost of Equity – 13.19% CV ROIC – 10.96% This report was created by a student enrolled in the Applied Securities Management (Henry Fund) program at the University of Iowa’s Tippie School of Management. The intent of these reports is to provide potential employers and other interested parties an example of the analytical skills, investment knowledge, and communication abilities of Henry Fund students. Henry Fund analysts are not registered investment advisors, brokers or officially licensed financial professionals. The investment opinion contained in this report does not represent an offer or solicitation to buy or sell any of the aforementioned securities. Unless otherwise noted, facts and figures included in this report are from publicly available sources. This report is not a complete compilation of data, and its accuracy is not guaranteed. From time to time, the University of Iowa, its faculty, staff, students, or the Henry Fund may hold a financial interest in the companies mentioned in this report. REFERENCES 1 Using these assumptions our model returns us values as follows: IMPORTANT DISCLAIMER MGM Resorts www.sec.gov 2 International regulatory filings. Yahoo! Finance 3 www.seekingalpha.com DCF - $18.18 DDM- $6.76 Relative Average: $26.55 4 mgmresorts.com 5 This created a weighted average target range of $19-$21. Our estimates are generally in line with estimates. We do project a slightly higher tax rate at 30% since MGM generally does pay close to the effective rate. We are also using a relatively low CV value of 2%. This may increase with the GDP rate if the economy picks up In the future. http://www.lasvegassun.com/news/2009/mar/19/mgmruffin-treasure-island-changes-hands-friday/ 6 http://online.wsj.com/news/articles/SB10001424127887 323482504578230702968530038 7 http://www.masslive.com/news/index.ssf/2013/04/ceo_ james_murren_turned_around.html 8 www.tradingeconomics.com Page 8 MGM Resorts International Key Assumptions of Valuation Model Ticker Symbol Current Share Price Fiscal Year End MGM 18.68 Dec. 31 Hard Code Actual 30.00% 6.00% 18.00% 2.80% 5.60% 1.855 7.80% 7.80% 2% 2% 10.96% 10.96% 13.19% 13.19% Tax Rate Pre tax Cost of Debt Normal Cash as percentage of sales Risk Free rate Risk Premium Beta WACC CV growth of NOPLAT CV growth of EPS CV ROIC Cost of Equity DCF/EP Value DDM Value 80% 2014 PEG 20% 2014 PE DCF @ 70%/DDM @ 5%/relative 2014 @ 25% USD $ 18.18 $ 6.76 $ 26.55 $ 19.70 $ Page 9 19.21 $ 20.19 MGM Resorts International Weighted Average Cost of Capital (WACC) Estimation risk free rate Risk Premium (Spread) Beta Cost of Equity (CAPM) 2.80% 5.60% 1.855 13.19% Pre-tax Cost of Debt Tax Rate Cost of Debt 6.00% 30.00% 4.20% Market Cap Book Value of Debt Capitalized Operating Leases Enterprise Value 9,134 13,590 57 22,781 % of debt % equity 59.90% 40.10% WACC 7.80% Page 10 MGM Resorts International Revenue Decomposition Fiscal Years Ending Dec. 31 2008 2009 2010 2011 5634.35 5892.9 5932.79 6526.069 7178.6759 7896.5435 8686.1978 9554.8176 0.00 4.59% 1534.96 384.88 421.45 0.68% 2807.68 82.92% 420.37 10% 10% 10% 10% 10% 3088.448 3397.2928 3737.0221 4110.7243 4521.7967 10% 10% 10% 10% 10% 462.407 508.6477 559.51247 615.46372 677.01009 6019.23 9.50% 7849.31 -0.26% 9160.84 2012 5 year CAGR 2013E 2014E 2015E 2016E 2017E Geographic Revenue Wholly owned domestic resorts Domestic Resort Growth Rate MGM China MGM China Growth Rate Corporate and other Corporate and Other Growth Rate Total Segments 2008 Casino 2976 Casino Growth Rate Rooms 1907 Rooms Growth Rate Food and beverage 1582 Food and Beverage Growth Rate Entertainment, Retail & Other 1372 Entertainment, Retail & Other Growth Rate Reimbursed costs 47 Reimbursed costs as a % of SG&A 3.34% Less: Promotional allowances -675 Promotion Allowance as a % of revenues 9.37% Total 7208.77 Revenue Growth Rate 2009 2618 -12.02% 1370 -28.16% 1362 -13.91% 1194 -12.92% 99 7.57% -666 11.13% 5978.59 -17.07% 2010 2479.70 -5.29% 1370.05 -0.01% 1339.17 -1.70% 1104.36 -7.54% 359.47 28.59% -633.53 10.53% 6019.23 0.68% 2011 4002.985 61.43% 1547.765 12.97% 1425.428 6.44% 1205.35 9.14% 351.207 25.87% -683.423 8.71% 7849.31 30.40% RevPar (Revenue Per Available Room) 137 ADR (Average Daily Rate) 148 Occupancy 92% EPS Rooms 100 111 91% 102 115 89% 115 127 90% 10% 10% 10% 10% 10% 2012 5319.489 12.32% 5691.8532 32.89% 7% 1588.77 -3.59% 1795.3101 2.65% 13% 1472.382 -1.43% 1501.8296 3.29% 2% 1163.431 -3.24% 1198.3339 -3.48% 3% 357.597 49.80% 361.17297 24.21% growth rate 1% -740.825 1.87% -748.23325 8.09% growth rate 1% 9160.84 4.91% 9800.27 16.71% 6033.3644 6% 2028.7004 13% 1531.8662 2% 1234.2839 3% 364.7847 1% -755.71558 1% 10437.28 6335.0326 5% 2251.8575 11% 1562.5036 2% 1258.9696 2% 368.43255 1% -763.27274 1% 11013.52 6588.434 4% 2409.4875 7% 1593.7536 2% 1284.149 2% 372.11687 1% -770.90547 1% 11477.04 6786.087 3% 2481.7721 3% 1625.6287 2% 1309.832 2% 375.83804 1% -778.61452 1% 11800.54 125 150 91% 130 160 91% 135 170 91% 140 180 91% 117 129 91% Page 11 120 140 91% MGM Resorts International Income Statement Fiscal Years Ending Dec. 31 2008 2009 2010 2011 2012 Sales/Revenue 7,208.77 5,978.59 6,019.23 7,849.31 9,160.84 COGS excluding D&A 4,034.37 3,539.31 3,757.54 5,026.36 5,921.28 Depreciation & Amortization Expense 2013E 9,800.27 6,272.17 887.17 2014E 10,437.28 6,575.49 862.90 2015E 11,013.52 6,828.38 844.82 2016E 11,477.04 7,000.99 831.46 2017E 11,800.54 7,080.33 820.91 778.24 689.27 633.42 817.15 927.70 Gross Income 2,396.16 1,750.01 1,628.27 2,005.81 2,311.87 2,640.93 2,998.90 3,340.32 3,644.58 3,899.31 SG&A Expense 1,419.99 1,312.09 1,257.29 1,357.48 1,476.91 9.16 0.00 0.00 0.00 0.00 1,568.04 - 1,643.87 - 1,707.10 - 1,750.25 - 1,770.08 - 967.01 437.93 370.98 648.33 834.96 1,072.89 1,355.03 1,633.22 1,894.33 2,129.23 (697.76) (88.20) 882.02 196.01 (93.94) 730.61 208.75 (99.12) 550.68 220.27 (103.29) 573.85 229.54 (106.20) 590.03 236.01 321.74 763.15 987.65 1,196.98 359.10 Other Operating Expense EBIT (Operating Income) Nonoperating Income (Expense) - Net 186.90 (175.51) 144.05 Interest Expense 609.29 775.43 1113.58 1086.83 (41.27) 1116.36 Unusual Expense (Income) - Net 1213.62 1499.57 1617.47 (3311.41) 755.05 Pretax Income (668.99) (2012.59) (2216.03) 2831.63 (1734.21) (93.34) Income Taxes Consolidated Net Income M inority Interest Expense Net Income Basic Shares Outstanding EPS (basic) 186.30 (720.91) (778.63) (403.31) (117.30) (28.00) 96.52 228.95 296.29 (855.29) (1291.68) (1437.40) 3234.94 (1616.91) (65.34) 225.21 534.21 691.35 837.89 120.31 150.78 161.70 172.22 181.72 189.37 194.71 3114.64 (1767.69) (227.05) 53.00 352.48 501.98 643.18 502.09 508.64 515.19 521.74 0.00 0.00 0.00 (855.29) (1291.68) (1437.40) 279.82 378.51 450.45 488.65 488.99 495.54 (3.06) (3.41) (3.19) 6.37 (3.61) (0.46) Page 12 0.11 0.69 0.97 1.23 MGM Resorts International Balance Sheet Fiscal Years Ending Dec. 31 2008 2009 2010 2011 2012 292.33 2013E 1,435.49 490.01 122.50 294.01 2014E 1,472.35 521.86 130.47 313.12 2507.09 2,342.01 2,437.80 1,794.17 1,944.49 2,162.16 20203.74 19907.90 5337.10 5713.25 14554.35 14866.64 14194.65 2521.89 2142.19 1444.55 430.61 429.16 7944.73 7640.68 0.00 0.00 0.00 0.00 497.77 20,406.76 6,600.42 13,806.35 1,470.04 7,350.20 539.01 20,980.45 7,463.31 13,517.14 1,356.85 7,306.10 521.86 21,611.51 8,308.13 13,303.38 1,211.49 7,158.79 495.61 22,274.12 9,139.59 13,134.53 1,032.93 6,886.22 459.08 22,969.86 9,960.50 13,009.36 826.04 6,490.30 472.02 23274.72 22518.21 18961.05 27766.28 26284.74 25,507.61 25,139.75 23,963.43 23,457.25 22,959.88 1049.30 1081.52 1.50 1.47 0.28 187.80 173.72 167.08 170.99 199.62 227.53 1.35 1,878.71 2,107.59 2.55 240.09 1.35 1,927.37 2,171.36 2.65 250.20 1.35 1,951.10 2,205.30 2.73 257.25 1.35 1,947.09 2,208.42 12,584.03 11,054.58 10,069.38 8,977.38 Cash & Cash Equivalents 295.64 2056.21 648.96 2015.91 1663.51 Short-Term Receivables 368.10 753.03 497.88 491.73 443.68 Inventories 111.51 101.81 96.39 112.74 107.58 Other Current Assets 757.78 142.46 212.41 192.34 Total Current Assets 1533.03 3053.50 1455.65 2812.72 20098.72 19431.27 19385.78 3809.56 4361.32 4831.43 Net Property, Plant & Equipment 16289.15 15069.95 Total Investments and Advances 5018.97 3964.15 433.56 Other Assets Total Assets Property, Plant & Equipment - Gross Accumulated Depreciation Intangible Assets & Goodwill 2015E 775.42 550.68 137.67 330.41 2016E 882.86 573.85 143.46 344.31 2017E 1,070.61 590.03 147.51 354.02 7.61 1.35 Other Current Liabilities 1765.48 1128.36 1077.63 1564.69 1724.42 Total Current Liabilities 3002.58 2383.60 1246.22 1744.76 1925.67 213.65 1.35 1,813.05 2,028.05 12421.31 12978.75 12048.93 13470.79 13589.63 13,013.63 3441.20 3031.30 2469.33 2502.10 2473.89 2473.89 2473.89 2473.89 2473.89 Other Liabilities 435.27 254.13 198.01 166.40 179.53 196.01 208.75 220.27 229.54 236.01 Total Liabilities 19300.36 18647.78 15962.50 17884.05 18168.72 17,711.57 17,374.26 15,920.10 14,978.11 13,895.70 Common Stock and Additional Paid-In Capital 4022.10 3501.84 4065.71 4099.21 4137.55 Retained Earnings 3365.12 370.53 (1066.87) 1981.39 213.70 4,232.15 (13.35) 28.73 4,326.74 39.65 28.73 4,421.34 392.14 28.73 4,515.94 894.12 28.73 4,610.54 1,537.30 28.73 ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Long-Term Debt Deferred Tax Liabilities 0.00 Cumulative Translation Adjustment/Unrealized For. Exch. (2.63) Gain Other Appropriated Reserves Treasury Stock Total Shareholders' Equity Accumulated M inority Interest Total Equity Liabilities & Shareholders' Equity 2473.89 (2.10) (0.40) 6.23 28.73 (54.27) 0.17 0.10 (0.25) (14.42) (14.42) (14.42) (14.42) (14.42) (3355.96) 0.00 0.00 0.00 0.00 - - - - 3870.43 2998.55 6086.58 4365.55 4,233.11 4,380.70 4,827.79 5,424.37 6,162.15 3974.36 (14.42) - 0.00 0.00 0.00 3795.64 3750.47 3,562.94 3,384.80 3,215.56 3,054.78 2,902.04 3974.36 3870.43 2998.55 9882.22 8116.02 7,796.05 7,765.50 8,043.34 8,479.15 9,064.19 23274.72 22518.21 18961.05 27766.28 26284.74 25,507.62 25,139.76 23,963.44 23,457.25 22,959.89 Page 13 MGM Resorts International Cash Flow Statement Fiscal Years Ending Dec. 31 Net Income 2013E 2014E 2015E 2016E 2017E (227.05) 53.00 352.48 501.98 643.18 Depreciation Expense 887.17 862.90 844.82 831.46 820.91 Short Term Receivables (46.34) (31.85) (28.81) (23.18) (16.18) Inventories (14.93) (7.96) (7.20) (5.79) (4.04) Other Current Assets (1.68) (19.11) (17.29) (13.91) (9.71) (41.25) 17.15 26.26 36.53 (12.94) Accounts Payable 14.03 13.89 12.56 10.10 7.05 Other Current Liabilities 88.63 65.66 48.66 23.73 (4.01) Other Assets Other Liabilities 16.47 12.74 11.52 9.27 6.47 675.06 966.41 1,243.00 1,370.20 1,430.74 (498.86) (25.49) (573.69) 113.19 (631.06) 145.36 (662.61) 178.55 (695.74) 206.90 290.48 44.10 147.31 272.57 395.92 Accumulated M inority Interest (187.52) (178.15) (169.24) (160.78) (152.74) Net Cash from (used in) Investing Activities (421.40) (594.54) (507.63) (372.27) (245.66) Net Cash from (used in) Operating Activities Capital Expenditures Total Investments and Advances Intangible Assets & Goodwill ST Debt (0.28) LT Debt (576.00) Common Stock for ESOP Net Cash from (used in) Financing Activities Net increase (decrease) in cash & cash equivalents Cash & cash equivalents, beginning balance Cash & cash equivalents, ending balance 94.60 - 2.55 (429.60) (1,529.45) 94.60 94.60 0.11 0.07 (985.20) (1,092.00) 94.60 94.60 (890.49) (997.33) (228.02) 36.87 (696.93) 107.44 1663.509 1435.487391 1472.3549 775.4214 1,435.49 1,472.35 775.42 882.86 187.75 882.8619 1,070.61 (481.68) Page 14 (335.00) (1,432.30) MGM Resorts International Common Size Income Statement Fiscal Years Ending Dec. 31 Sales/Revenue COGS excluding D&A Depreciation & Amortization Expense Gross Income SG&A Expense Other Operating Expense EBIT (Operating Income) Nonoperating Income (Expense) - Net Interest Expense Unusual Expense (Income) - Net Pretax Income Income Taxes Consolidated Net Income M inority Interest Expense Net Income 2008 100.00% 55.96% 10.80% 33.24% 2009 100.00% 59.20% 11.53% 29.27% 2010 100.00% 62.43% 10.52% 27.05% 2011 100.00% 64.04% 10.41% 25.55% 19.70% 0.13% 13.41% 21.95% 0.00% 7.32% 20.89% 0.00% 6.16% 17.29% 0.00% 8.26% 16.12% 0.00% 9.11% 2.59% 8.45% 16.84% -9.28% -2.94% 12.97% 25.08% -33.66% 2.39% 18.50% 26.87% -36.82% -0.53% 13.85% -42.19% 36.07% 2.58% -11.86% 0.00% -11.86% -12.06% -21.61% 0.00% -21.61% -12.94% -23.88% 0.00% -23.88% 2012 5 year average 100.00% 100.00% 64.64% 61.25% 10.13% 10.68% 25.24% 28.07% 2013E 100.00% 64.00% 9.05% 26.95% 2014E 100.00% 63.00% 8.27% 28.73% 2015E 100.00% 62.00% 7.67% 30.33% 2016E 100.00% 61.00% 7.24% 31.76% 2017E 100.00% 60.00% 6.96% 33.04% 19.19% 0.03% 8.86% 16.00% 15.75% 15.50% 15.25% 15.00% 0.00% 10.95% 0.00% 12.98% 0.00% 14.83% 0.00% 16.51% 0.00% 18.04% -7.62% 12.19% 8.24% -18.93% -1.22% 13.19% 6.97% -12.52% -0.90% 9.00% 2.00% -0.90% 7.00% 2.00% -0.90% 5.00% 2.00% -0.90% 5.00% 2.00% -0.90% 5.00% 2.00% -5.14% 41.21% 1.53% 39.68% -1.28% -17.65% 1.65% -19.30% -5.77% -6.76% 0.64% -7.39% -0.29% -0.67% 1.65% -2.32% 0.92% 2.16% 1.65% 0.51% 2.08% 4.85% 1.65% 3.20% 2.58% 6.02% 1.65% 4.37% 3.04% 7.10% 1.65% 5.45% MGM Resorts International Common Size Balance Sheet Fiscal Years Ending Dec. 31 2008 4.10% 5.11% 1.55% 10.51% 21.27% 2009 34.39% 12.60% 1.70% 2.38% 51.07% 2010 10.78% 8.27% 1.60% 3.53% 24.18% 2011 25.68% 6.26% 1.44% 2.45% 35.83% 278.81% 52.85% 225.96% 69.62% 6.01% 0.00% 322.87% 325.01% 72.95% 252.07% 66.31% 7.20% 0.00% 376.65% 322.06% 80.27% 241.80% 41.90% 7.13% 0.00% 315.01% 257.40% 67.99% 189.40% 27.29% 101.22% 0.00% 353.74% 217.32% 62.37% 154.95% 15.77% 83.41% 5.43% 286.92% 14.56% 2.61% 0.00% 24.49% 41.65% 18.09% 2.91% 0.00% 18.87% 39.87% 0.02% 2.78% 0.00% 17.90% 20.70% 0.02% 2.18% 0.10% 19.93% 22.23% 172.31% 47.74% 6.04% 267.73% 217.09% 50.70% 4.25% 311.91% 200.17% 41.02% 3.29% 265.19% Total Equity 55.79% 46.68% -0.04% -0.75% -46.55% 55.13% 0.00% 55.13% 58.57% 6.20% -0.04% 0.00% 0.00% 64.74% 0.00% 64.74% Liabilities & Shareholders' Equity 322.87% 376.65% Cash & Cash Equivalents Short-Term Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment Total Investments and Advances Intangible Assets & Goodwill Other Assets Total Assets ST Debt & Curr. Portion LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Deferred Tax Liabilities Other Liabilities Total Liabilities Common Stock and Additional Paid-In Capital Retained Earnings Cumulative Translation Adjustment/Unrealized For. Exch. Gain Other Appropriated Reserves Treasury Stock Total Shareholders' Equity Accumulated M inority Interest 2013E 2014E 2015E 2016E 2017E 5.00% 1.25% 3.00% 5.00% 1.25% 3.00% 5.00% 1.25% 3.00% 5.00% 1.25% 3.00% 5.00% 1.25% 3.00% 280.12% 67.28% 212.84% 44.18% 40.99% 1.09% 331.04% 208.23% 67.35% 140.88% 15.00% 75.00% 5.50% 201.01% 71.51% 129.51% 13.00% 70.00% 5.00% 196.23% 75.44% 120.79% 11.00% 65.00% 4.50% 194.08% 79.63% 114.44% 9.00% 60.00% 4.00% 194.65% 84.41% 110.24% 7.00% 55.00% 4.00% 0.00% 2.18% 0.01% 18.82% 21.02% 6.54% 2.53% 0.02% 20.01% 29.09% 0.00% 2.18% 0.01% 18.50% 20.69% 0.00% 2.18% 0.01% 18.00% 20.19% 0.02% 2.18% 0.01% 17.50% 19.72% 0.02% 2.18% 0.01% 17.00% 19.21% 0.02% 2.18% 0.01% 16.50% 18.71% 171.62% 31.88% 2.12% 227.84% 148.34% 27.01% 1.96% 198.33% 181.91% 39.67% 3.53% 254.20% 132.79% 25.24% 2.00% 180.73% 120.57% 23.70% 2.00% 166.46% 100.37% 22.46% 2.00% 144.55% 87.74% 21.56% 2.00% 130.51% 76.08% 20.96% 2.00% 117.75% 67.55% -17.72% -0.01% 0.00% 0.00% 49.82% 0.00% 49.82% 52.22% 25.24% 0.08% 0.00% 0.00% 77.54% 48.36% 125.90% 45.17% 2.33% 0.31% -0.16% 0.00% 47.65% 40.94% 88.59% 55.86% 12.55% 0.06% -0.18% -9.31% 58.98% 17.86% 76.84% 43.18% -0.14% 0.29% -0.15% 0.00% 43.19% 36.36% 79.55% 41.45% 0.38% 0.28% -0.14% 0.00% 41.97% 32.43% 74.40% 40.14% 3.56% 0.26% -0.13% 0.00% 43.84% 29.20% 73.03% 39.35% 7.79% 0.25% -0.13% 0.00% 47.26% 26.62% 73.88% 39.07% 13.03% 0.24% -0.12% 0.00% 52.22% 24.59% 76.81% 315.01% 353.74% 286.92% 331.04% 260.27% 240.86% 217.58% 204.38% 194.57% Page 15 2012 5 year average 18.16% 18.62% 4.84% 7.42% 1.17% 1.49% 3.19% 4.41% 27.37% 31.94% MGM Resorts International Value Driver Estimation Fiscal Years Ending Dec. 31 NOPLAT EBITA: Total Revenues -Cost of Products Sold -Depreciation Expense -Selling, General, and Administrative Expenses -Other (Income)/expense +Implied Interest on Operating Leases (Cost of Debt * PV lease(t-1) EBITA 2008 2009 2010 2011 2012 2013E 2014E 2015E 2016E 2017E 7208.77 4034.37 778.24 1419.99 9.16 967.01 5978.59 3539.31 689.27 1312.09 0.00 4.00 441.92 6019.23 3757.54 633.42 1257.29 0.00 4.37 375.35 7849.31 5026.36 817.15 1357.48 0.00 3.63 651.96 9160.84 5921.28 927.70 1476.91 0.00 3.74 838.70 9800.27 6272.17 887.17 1568.04 0.00 3.41 1076.30 10437.28 6575.49 862.90 1643.87 0.00 3.50 1358.53 11013.52 6828.38 844.82 1707.10 0.00 3.60 1636.82 11477.04 7000.99 831.46 1750.25 0.00 3.71 1898.04 11800.54 7080.33 820.91 1770.08 0.00 3.82 2133.05 186.30 182.79 56.07 364.08 0.00 789.24 -720.91 232.63 -52.65 449.87 1.20 -89.87 -778.63 334.07 43.22 485.24 1.31 85.21 -403.31 326.05 -12.38 -993.42 1.09 -1081.98 -117.30 334.91 -209.33 226.51 1.12 235.92 -28.00 264.61 -26.46 58.80 1.02 269.97 96.52 219.18 -28.18 62.62 1.05 351.20 228.95 165.20 -29.74 66.08 1.08 431.57 296.29 172.16 -30.99 68.86 1.11 507.44 359.10 177.01 -31.86 70.80 1.15 576.19 3441.20 3031.30 -409.90 2469.33 -561.97 2502.10 32.76 2473.89 -28.21 2473.89 0.00 2473.89 0.00 2473.89 0.00 2473.89 0.00 2473.89 0.00 177.77 121.89 -271.84 1766.70 574.58 806.33 1007.33 1205.25 1390.60 1556.86 295.644 1076.146 648.964 1412.8762 1648.9519 368.101 753.029 497.876 491.73 443.677 111.505 101.809 96.392 112.735 107.577 758 142 212 192 292 $ 1,533.03 $ 2,073.44 $ 1,455.65 $ 2,209.68 $ 2,492.53 1435.49 490.01 122.50 294.01 2342.01 1472.35 521.86 130.47 313.12 2437.80 775.42 550.68 137.67 330.41 1794.17 882.86 573.85 143.46 344.31 1944.49 1070.61 590.03 147.51 354.02 2162.16 Operating Current Liabilities 187.796 173.719 167.084 170.994 199.62 0 0 0 7.611 1.35 $1,765.48 $1,128.36 $1,077.63 $1,564.69 $1,724.42 $1,953.28 $1,302.08 $1,244.72 $1,743.29 $1,925.39 213.65 1.35 1813.05 2028.05 227.53 1.35 1878.71 2107.59 240.09 1.35 1927.37 2168.81 250.20 1.35 1951.10 2202.65 257.25 1.35 1947.09 2205.69 Net Operating Working Capital + Net PP&E + PV of Operating Leases + Total Investments and Advances + Other Operating Assets - Other Long-Term Liabilities $ (420.25) $ 771.36 $ 210.93 $ 466.39 $ 567.14 16289.154 15069.952 14554.35 14866.644 14194.652 66.60 73 60 62 57 5018.97 3964.151 2521.893 2142.186 1444.547 0 0 0 0 497.767 435.269 254.126 198.012 166.403 179.534 313.97 13806.35 58.32 1470.04 539.01 196.01 330.21 13517.14 59.96 1356.85 521.86 208.75 -374.64 13303.38 61.76 1211.49 495.61 220.27 -258.16 13134.53 63.65 1032.93 459.08 229.54 -43.53 13009.36 65.64 826.04 472.02 236.01 20,519.21 15991.68 15577.27 14477.32 14202.50 14093.52 806.33 16581.47 4.86% 1007.33 15991.68 6.30% 1205.25 15577.27 7.74% 1390.60 14477.32 9.61% 1556.86 14202.50 10.96% 574.58 (789.77) 1,364.35 806.33 -589.79 1396.12 1007.33 -414.41 1421.74 1205.25 -1099.95 2305.19 1390.60 -274.83 1665.43 1556.86 -108.97 1665.83 20,519.21 19,624.14 17,149.60 17,371.23 0.59% -1.39% 10.30% 3.31% 7.80% 7.80% 7.80% 7.80% -1478.61 -1802.52 429.03 -780.38 16581.47 0.05 0.08 -487.02 15991.68 0.06 0.08 -240.02 15577.27 0.08 0.08 -9.78 14477.32 0.10 0.08 261.37 14202.50 0.11 0.08 449.06 Less Adjusted Taxes: Tax Provision + Tax shield on Interest Expense + Tax Shield on nonoperating expense + Tax shield on unusual expense + Tax shield on implied lease interest - Total Adjusted Taxes +Change in Deferred Tax Liabilities: Deferred Tax Liabilities +Net Change in Deferred Tax Liabilities (t,t-1) NOPLAT (EBITA - Adjusted Taxes + Change in Deferred Tax Liabilities) Invested Capital (IC) Operating Current Assets: Normal Cash Short term receivables Inventories, net Other current Assets Operating Current Assets Operating Current Liabilities: Accounts payable Income taxes payable Other Current Liabilities Invested Capital NOPLAT (EBITA-Adjusted Taxes+Change in Deferrred Tax Liabilities) 177.77 Beginning Invested Capital Return on Invested Capital (ROIC) (NOPLATt/Begin ICt) NOPLAT Change in Invested Capital Free Cash Flow (FCF) (NOPLATt - Change in ICt,t-1) Beginning Invested Capital ROIC WACC Economic Profit (EP) (Begin IC * (ROICt - WACC)) 177.77 19,624.14 17,149.60 17,371.23 16,581.47 121.89 -271.84 1766.70 574.58 20,519.21 19,624.14 17,149.60 17,371.23 0.59% -1.39% 10.30% 3.31% 121.89 -271.84 (895.07) (2,474.54) 1,016.96 2,202.70 Page 16 1766.70 221.63 1,545.06 MGM Resorts International Discounted Cash Flow (DCF) and Economic Profit (EP) Valuation Models Key Inputs: CV Growth CV ROIC WACC Cost of Equity 2% 10.96% 7.80% 13.19% Fiscal Years Ending Dec. 31 2013E 2014E 2015E 2016E 2017E DCF Model Free Cash Flow PV of Free Cash Flow 1,396 1,295 1,422 1,223 2,305 1,840 1,665 1,233 21,944 16,250 (240) (207) (10) (8) 261 194 7,742 5,733 Present Value of Operating Assets (-) Book Value of Debt (-) PV of Operating Leases (-) PV of ESOP Intrinsic Value 21,842 13,590 57 237 7,958 DCF Share Value 12/31/12 DCF Share Value Today 16.27 18.18 EP Model Economic Profit PV of Economic Profit (487) (452) Present Value of Operating Assets (-) Book Value of Debt (-) PV of Operating Leases (-) PV of ESOP Intrinsic Value EP Share Value 12/31/12 EP Share Value Today 21,842 13,590 57 237 7,958 16.27 18.18 Page 17 MGM Resorts International Dividend Discount Model (DDM) or Fundamental P/E Valuation Model Fiscal Years Ending Dec. 31 2013E Key Assumptions CV growth of EPS CV ROE Cost of Equity 2015E 2016E 0.11 0.69 0.97 2017E 2.00% 7.59% 13.19% Earnings Per Share P/E Multiple Future Stock Price (0.46) Dividends Per Share Discounted Periods Discounted Cash Flows Fundamental P/E 9/30/12 Fundamental P/E today 2014E 0.00 1 $ $ 0.00 2 - 0.00 3 - 1.23 6.58 8.111892 0.00 4 - 4 6.05 6.05 6.76 MGM Resorts International Relative Valuation Models WYNN BYD PENN ISLE MPEL Company Las Vegas Sands Wynn Casinos Boyd Gaming Penn National Gaming Isle of Capri Melco Crown Price $ 69.52 $ 159.08 $ 14.69 $ 7.36 $ 33.63 $ 18.68 EPS 2013E $3.00 $6.94 ($0.24) $1.35 $0.27 $1.22 MGM MGM Resorts International $ 18.68 ($0.46) Ticker Penn National Implied Value: Relative P/E (EPS13) Relative P/E (EPS14) PEG Ratio (EPS13) PEG Ratio (EPS14) EPS 2014E $3.61 $7.25 $0.21 $0.55 $0.37 $1.58 Average P/E 13 23.2 22.9 (61.2) 5.5 124.6 15.3 21.7 P/E 14 19.3 21.9 70.0 13.4 90.9 11.8 37.9 $0.11 (40.8) 177.0 $ (9.94) $ 4.00 $ (223.30) $ 32.19 Page 18 Est. 5yr Gr. 15.53 11.33 57.7 -24.33 4 28.6 55.40 PEG 13 1.49 2.02 (1.06) (0.22) 31.14 0.53 8.8 (0.7) PEG 14 1.24 1.94 1.21 (0.55) 22.72 0.41 5.5 3.2 MGM Resorts International Key Management Ratios Fiscal Years Ending Dec. 31 2010 2011 2012 2013E 2014E 2015E 2016E Liquidity Ratios Current Ratio Cash Ratio Quick Ratio 1.17 0.52 1.09 1.61 1.16 1.55 1.30 0.86 1.25 1.15 0.71 1.09 1.16 0.70 1.09 0.83 0.36 0.76 0.88 0.40 0.82 3.15 37.92 9.62 3.54 48.07 15.86 2.87 53.75 19.59 2.60 54.52 20.99 2.41 51.99 20.63 2.18 50.93 20.54 2.04 49.81 20.41 Activity or Asset-Management Ratios Assets to Sales Inventory Turnover Ratio Accounts Receivable Ratio Financial Leverage Ratios Debt to Equity Ratio Debt Ratio Debt to Non-Cash Assets 4.02 0.84 0.87 Profitability Ratios Operating Margin Net Profit Margin Free Cash Margin Return on Assets Return on Equity 1.36 0.64 0.69 1.67 0.69 0.74 1.67 0.69 0.74 1.62 0.69 0.73 1.37 0.66 0.69 1.19 0.64 0.66 6.16% 8.26% -23.88% 39.68% 36.59% 19.68% -6.38% 16.43% -37.14% 103.87% 9.11% -19.30% 14.89% -6.37% -17.89% 10.95% -2.32% 14.25% -0.86% -2.80% 12.98% 0.51% 13.62% 0.21% 0.68% 14.83% 3.20% 20.93% 1.40% 4.54% 16.51% 4.37% 14.51% 2.09% 6.24% Present Value of Operating Lease Obligations 2012 Capitalization of Operating Leases Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment Year 1 2 3 4 5 6 & beyond PV of Minimum Payments Lease Commitment 16.211 10.114 7.711 5.295 2.96 2.96 0.98 Current Assets/Current Liabilities 0.48 (Cash + Equivalents)/Current Liabilities 0.91 (Current Assets-Inventory)/Current Liabilities 1.95 Total Assets/Sales 48.67 COGS/Average Inventory 20.28 Net Sales/Average Receivables 0.99 Book Value of Debt/Book Value of Equity 0.61 Total Liabilities/Total Assets 0.63 Total Liabilities/(Total Assets-(Cash+Equivalents)) 18.04% 5.45% 14.12% 2.74% 7.59% Operating Profit/Sales Net Income/Sales Free Cash Flow/Sales Net Income/Beginning Assets Net Income/Beginning Book Value of Equity Present Value of Operating Lease Obligations 2011 Operating Leases 16.211 10.114 7.711 5.295 2.96 38.879 81.17 24 57 Fiscal Years Ending Dec. 31 2013 2014 2015 2016 2017 Thereafter Total Minimum Payments Less: Interest PV of Minimum Payments 2017E Operating Leases 17.92 12.992 6.972 4.977 3.772 39.181 85.814 23 62 Fiscal Years Ending 2012 2013 2014 2015 2016 Thereafter Total Minimum Payments Less: Interest PV of Minimum Payments Capitalization of Operating Leases 6.00% 13.1 PV Lease Payment 15.3 9.0 6.5 4.2 2.2 19.7 56.9 Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment Year 1 2 3 4 5 6 & beyond PV of Minimum Payments Page 19 Lease Commitment 17.92 12.992 6.972 4.977 3.772 3.772 Present Value of Operating Lease Obligations 2010 Operating Fiscal Years Ending Leases 2011 13.917 2012 11.868 2013 8.308 2014 5.644 2015 4.908 Thereafter 36.799 Total Minimum Payments 81.444 Less: Interest 21 PV of Minimum Payments 60 Capitalization of Operating Leases 6.00% 10.4 Pre-Tax Cost of Debt 6.00% Number Years Implied by Year 6 Payment 7.5 PV Lease Payment 16.9 11.6 5.9 3.9 2.8 21.3 62.4 Lease PV Lease Year Commitment Payment 1 13.917 13.1 2 11.868 10.6 3 8.308 7.0 4 5.644 4.5 5 4.908 3.7 6 & beyond 4.908 21.6 PV of Minimum Payments 60.4 Effects of ESOP Exercise and Share Repurchases on Common Stock Balance Sheet Account and Number of Shares Outstanding Number of Options Outstanding (shares): Average Time to Maturity (years): Expected Annual Number of Options Exercised: Current Average Strike Price: Cost of Equity: Current Stock Price: $ $ Increase in Shares Outstanding: Average Strike Price: Increase in Common Stock Account: $ Change in Treasury Stock Expected Price of Repurchased Shares: Number of Shares Repurchased: $ Shares Outstanding (beginning of the year) Plus: Shares Issued Through ESOP Less: Shares Repurchased in Treasury Shares Outstanding (end of the year) 23 3.50 7 14.44 13.19% 18.68 2013E 7 14.44 $ 95 2014E 7 14.44 $ 95 2015E 7 14.44 $ 95 2016E 7 14.44 $ 95 2017E 7 14.44 $ 95 2018E 7 14.44 $ 95 2019E 7 14.44 95 0 18.68 $ - 0 21.14 $ - 0 23.93 $ - 0 27.09 $ - 0 30.66 $ - 0 34.71 $ - 0 39.28 - 489 7 496 496 7 502 502 7 509 509 7 515 515 7 522 522 7 528 VALUATION OF OPTIONS GRANTED IN ESOP Average Average B-S Value Range of Number Exercise Remaining Option of Options Outstanding Options of Shares Price Life (yrs) Price Granted Range 1 22.929 14.44 3.50 $ 10.32 $ 237 Total 23 $ 14.44 3.50 $ 10.32 $ 237 Page 20 528 7 535