uitf - Bangko Sentral ng Pilipinas

advertisement

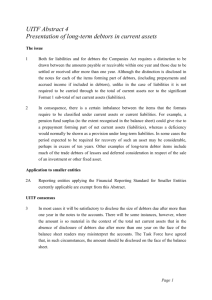

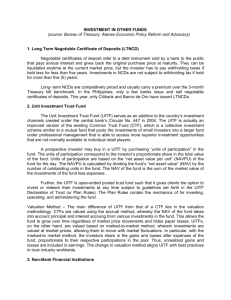

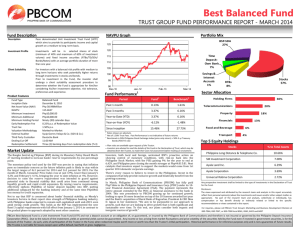

UNIT INVESTMENT TRUST FUND (UITF) Deputy Governor Nestor A. Espenilla, Jr. Bangko Sentral ng Pilipinas 1 Outline Legal Basis for Creation of UITF Definition Rationale for Shift to UITF Salient Features Investor Protection Measures May 2006 UITF Experience Further Enhancements 2 Legal Basis for the Creation of UITF Section 83.6 of the General Banking Law “A trust entity, in addition to the general powers incident to corporations, shall have the power to … Establish and manage common trust funds, subject to such rules and regulations as may be prescribed by the Monetary Board.” 3 Common Trust Fund Different Kinds of common trust funds: 4 – Common Trust Fund (“CTF”) – for phase out by 30 Sept. 2006 – UITF Rationale for Shift to UITF Align the operation of pooled funds under management by trust entities with international best practices Ensure differentiation from bank deposits and other direct liabilities of the financial institution 5 Rationale for Shift to UITF 6 Sound operations of pooled funds will enhance the credibility with retail investors and enable them to evolve as major institutional players that can support the deepening of domestic capital market. A client has free choice on what suits his financial objectives, particularly as to risks and returns and his perceived expertise of the fund manager. Governing Regulation Cir. No. 447 dated 03 September 2004 Regulations governing the creation, administration and investment/s of UITFs 7 UITF - Definition Open-ended pooled trust funds denominated in pesos or any acceptable currency, which are operated and administered by a trust entity and made available by participation Participation or redemption is allowed as often as stated in its plan rules Specie of common trust funds 8 UITF Documentation Plan Rules / Declaration of Trust - Written trust agreement - approved by the Board of Directors - submitted to the BSP for prior approval - approved copy of Plan available at the principal office of Trustee for inspection by any person having an interest in the fund or by his authorized representative. 9 UITF Documentation Minimum elements: 10 Title (product/brand name) Investment objectives and policies Investment powers of trustee Unitized NAVPU valuation methodology Terms and conditions governing the admission or redemption of units of participation UITF Documentation Minimum elements: External audit requirement Basis to terminate Plan Liability clause of trustee Fees/commission and other charges deductible from fund Other matters to define clearly the rights of participants 11 UITF Documentation 12 A copy of the plan rules shall be available at the principal office of the trustee during regular office hours for inspection by any person having an interest in the fund or his authorized representative. Upon request of the client, a copy of the plan rules shall be furnished to the interested person. Salient Features of UITFs I. Pooled UIT funds can only be invested in liquid investments and tradable financial instruments. 13 UITFs’ Allowable Investments 14 Bank deposits (for liquidity purposes) Financial instruments Government securities Tradable securities issued by the government of a foreign country, any political subdivision of a foreign country or any supranational entity Exchange-listed securities UITFs’ Allowable Investments Marketable instruments that are traded in an organized exchange Loans traded in an organized market Other tradable investment outlets/ categories as the BSP may allow 15 Subject to exposure limit to a single person/ entity (equivalent to 15% of market value of the UIT Fund) Tradable Financial Instrument Loans traded in an organized market Two-way prices are quoted readily and regularly available from an exchange, dealer, broker, industry group, pricing service or regulatory agency Prices represent actual and regularly occurring market transactions on an arm’s length basis. 16 Salient Features of UITFs II. UITFs may use financial derivatives to hedge market exposure. 17 Financial derivatives instruments Solely for the purpose of hedging risk exposures of the existing investments of the Fund 18 In accordance with existing BSP hedging guidelines, Trust Entity’s risk management and hedging policies Disclosed in the Plan and quarterly list of investment outlets Salient Features of UITFs III. Full transparency on the pricing of investments (valued at market daily) 19 Mark to Market (“MTM”) The market price determines the valuation of the securities underlying the UITF. Unlike the CTF, valuation is not on an accrual basis. If the investment deteriorates, the trustee shall provision to reflect fair value in accordance with generally accepted accounting principles (“GAAP”) or BSP regulations If security has no fair market value, then it shall be assumed to be of no value. 20 Salient Features of UITFs IV. Beneficial interest of each participation unit is determined under a unitized net asset value per unit (“NAVPU”). 21 NAVPU Total Net Assets divided by total outstanding units Total Net Assets : summation of the market value of each investment less fees, taxes, and other qualified expenses Made available to existing and prospective participants 22 NAVPU Daily computation of NAVPU Weekly publication Name of the UITF General classification (e.g., money market placement, bond, balanced, equity) UITF’s NAVPU Return on Investments of the UIT fund - Actual (not annualized) on a year-to-date (YTD) 23 - Actual year-on-year (YOY) Salient Features of UITFs V. Fees and expenses that may be charged from the UITF are clearly defined. 24 UITF Expenses Trust Fees - inclusive of the routine administrative expenses o o o o 25 Salaries and wages; office supplies Credit investigation/collateral appraisal BSP supervision fees/internal audit fees Security/messengerial/janitorial services UITF Expenses Special expenses Requirements o Preserve/enhance the value of Fund o Payable to third party o Covered by a separate contract o Disclosed to participants 26 Salient Features of UITFs VI. Trust entity’s staff charged with the marketing of the UITF shall be trained to properly market the instrument. 27 Marketing Personnel – 28 All personnel involved in the sale of UITFs shall undergo standardized training program for the purpose of developing/ improving their ability to Objectively make a judgment on client suitability Clearly explain to investors the inherent risks in investing in UITFs Marketing Personnel Conduct of training In accordance with TOAP minimum training program guidelines Undertaken by respective trust entities Training program regularly validated by TOAP 29 Salient Features of UITFs VII. Dealings with counterparties undertaken in a transparent manner. 30 Dealings with Counterparties Counterparties are qualified by the Trust Committee Counterparties are subject to appropriate limits in accordance with sound risk management principles. Trustee always transparent – 31 Maintains an audit trail for all transactions Salient Features of UITFs VIII. Dealings with related interest follow the principle of best execution. 32 Dealings with Related Interests Trustee observes principle of best execution - If purchase/sale of securities effected with related counterparties, trust entity shall consider at least two (2) competitive quotes from other sources. 33 Salient Features of UITFs VIII. An independent third party custodian accredited by BSP shall be appointed for UITF investments. 34 Custody of Securities BSP accredited third party custodian Take custody/safekeep investments in securities Perform independent marking-tomarket 35 Salient Features of UITFs IX. UITF may be denominated in any acceptable foreign currency and are not subject to the 30% FCDU liquidity cover 36 Salient Features of UITFs X. Exemptions from regulations on reserves, single borrower’s limit and DOSRI ceilings applicable to trust funds in general 37 Administration of UITF Trustee Exclusive management and control of each UITF under its administration Sole right at any time to sell, convert, reinvest, exchange, transfer or change or dispose of the assets comprising the fund 38 Administration of UITF Has no other relationship with such fund other than its capacity as trustee of the UITF Backroom operations with adequate system to support the daily marking-tomarket of UITF’s financial instruments 39 Investor Protection Features Minimum Disclosure Requirements Client Suitability Test 40 Minimum Disclosure Requirements Evidences of participation Participating Trust Agreement Confirmation of Participation o o o 41 NAVPU of fund on day of purchase; Number of units purchased/redeemed Absolute peso or foreign currency value Minimum Disclosure Requirements Documentations given to Client • Must contain a statement The contract is a trust agreement not a deposit account. Not insured by PDIC No Guaranteed Returns Losses or income are for the account of the trustor/investor. The Trustee is not liable for losses except upon gross negligence, fraud or bad faith. • 42 Such statements should be strategically placed near the space for the investor’s signature. Minimum Disclosure Requirements Printed marketing materials Name of fund Name of Trustee of UITF A trust product, not a “deposit account” No guaranteed rate of return No indicative rates of return Availability of Plan Rules Customer and Product Suitability Standards 43 Minimum Disclosure Requirements Printed marketing materials May present relevant historical performance purely for reference and with clear indication that past results do not guarantee similar future results 44 Minimum Disclosure Requirements Weekly Publication of the NAPVU Must contain: Name of the Fund General Classification Moving Return on UITF Investments on a year to date and year-on-year basis At least one newspaper of national circulation 45 Minimum Disclosure Requirements Quarterly Disclosure Statement Investment Objective Investment Policy Participations: Requirements and Restrictions List of prospective and outstanding investment outlets Admission and Redemption o Frequency, Date, Time and Other Requirements o Pricing/Currency o Fees/Other Terms Conditions 46 Client Suitability Investment Objective Risk Profiling (e.g risk appetite) Knowledge and Exposure to Financial Instruments Previous Investment Experience 47 Investment Options A CONSUMER has a basic right to choose where he can place his hard earned savings. 48 Banks need to compete for this business against other banks and non-bank financial institutions by offering deposit and non-deposit products that meet customer needs. Investment Options ? 49 UITF Growth (in Php billion) 324.3 Equity Funds Balanced Funds Bond Funds Money Market 2.8 350.0 0.5 261.6 300.0 Amounts (in Php Billions) 2.4 3.0 0.7 200.0 278.5 120.5 150.0 100.0 35.8 25.7 50.0 - 224.5 2.1 60.9 50 206.8 0.4 250.0 2.1 0.1 1.8 0.1 30.5 22.1 1.5 31 Mar 05 3.4 30 Jun 05 0.1 1.9 171.3 0.3 91.6 44.2 14.7 30 Sep 05 26.5 34.3 42.5 31 Dec 05 31 Mar 06 30-Apr-06 31.8 31-May-06 UITF Rapid Growth Reasons: UITFs answered the requirements of investors for high-yielding investment products that are readily available and convenient to buy. 51 Philippines interest rates for the past year were on a downtrend (until April 24, 2006). This positively affected the UITF NAVPUs, which increase when interest rates decrease. In addition to interest accruals on the investments, yields were improved with mark-to-market gains. Investors were happy about their returns. UITF Rapid Growth Reasons Trust Industry banded together on a UITF educational campaign, guided by BSP Circular 447. Individual trust institutions had their share in marketing the products through their branch network, advertisements, newspaper supplements and investor briefings. 52 Philippine interest rates Supreme Court decision, 3 November 2005, upholding RVAT Missed tax collection target Gov’t floats the idea of lifting RVAT on oil 53 Philippine Yield Curve As of 05 June As of 23 May As of 02 2May % 54 ! !""# * !""# *& !""# !% !""# # !""# $% $ () #$ !% ($ )* $ "" # $ &" #$ !# #$ #' )$ '% $ (% *+, !+, %+, '+, +, (+, *"+, !"+, #$ !% #$ '' ($ ** &$ ") ($ & #$' #$ (% ($ (! &$ #% &$ "" #$ #( #$ )# ($ &' &$ && &$ %" #$ () #$ &( )$ %' *"$( &$ (! #$ &* ($ *' )$ *"$ (& &$ ( ($ *) ($" &$ *& **$ !" &$ &' ($% ($ &% &$ '& **$ () *"$# )$ ) &$ %# *"$ &) *%$ "% *!$" What happened during the UITF May 2006 Experience? 55 The UITF experience also coincided at a time of growing risk aversion among global investors, which manifested in the fall of Asian currencies, the emerging markets, metal and the stock markets. As interest rates moved up, NAVPUs of the UITFs, particularly that of the Bond Funds, moved down as mark-to-market losses were reflected. While investors in these funds have experienced volatility in the past, the degree of volatility had been of smaller amounts and shorter duration (i.e. Hyatt 10, February 2006 Declaration of State of Emergency) Jittery investors withdrew from the UITFs and fund managers were forced to sell their bond assets to fund such withdrawals. It became a spiral: the more the investors withdrew, the more the fund managers sold the UITF assets, the more the interest rate increased, the more NAVPUs fell and this became a vicious cycle. Is there a future for the UITFs? UITFs are sound investment and present real value to investors in terms of returns and convenience. UITFs are meant to be held for long periods of time. They are a powerful way to mobilize funds for capital market development. They can be the answer to increasing the saving rate of the country. 56 Proposed Enhancements Ensure proper marketing of UITFs – – – Enhanced risk disclosure More effective client suitability testing More rigorous standards for training marketing personnel Promote better investor education through various programs Accelerate development of domestic capital market – – 57 Promote market depth and liquidity Encourage product diversification and new investment instruments Proposed Enhancements Adoption of Standards – – Global Investment Performance Obtain worldwide acceptance of standards for calculating and presenting fund performance Ensure accurate and consistent data Certification of UITF marketing personnel – 58 Course will include understanding of the underlying investments and workings of the financial market 59