new england market outlook 2014

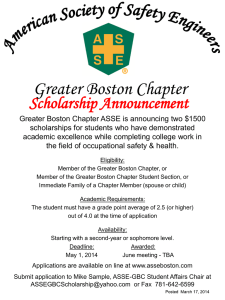

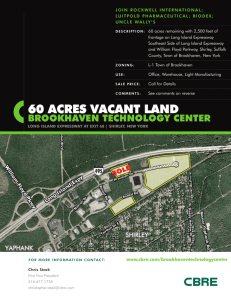

advertisement