new england market outlook 2014

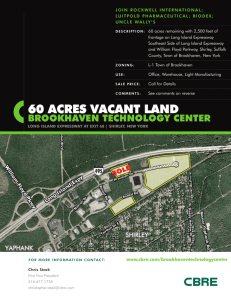

advertisement