Annual Report 2013

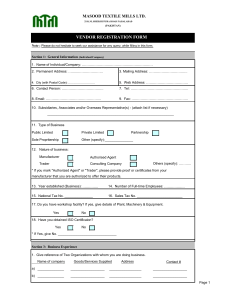

advertisement