Employee Future Benefits - CAUBO

advertisement

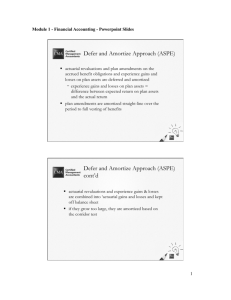

Canadian Association of University Business Officers Financial Reporting Information Note– Employee Future Benefits January 2012 Purpose Canadian colleges and universities hereinafter referred to as higher education institutions (“Institutions”) will be adopting a new basis of accounting for fiscal years beginning on or after January 1, 2012. Depending on their provincial jurisdiction and control structure, Institutions will be preparing their financial statements using (1) Part III of the CICA Handbook – Accounting Standards for Not for Profit Organizations, (2) Public Sector Accounting Standards with the Section 4200 series, or (3) Public Sector Accounting Standards without the Section 4200 series. Institutions who are government not-for-profit organizations (GNPO) will be reporting under the Public Sector Accounting standards either with or without the 4200 series. For these Institutions, the accounting and reporting of employee future benefits will be based upon sections PS3250 Retirement Benefits, and PS3255 Post- Employment Benefits and Termination Benefits. Part III of the CICA Handbook – Accounting Standards for Not for Profit Organizations does not include a section on employee future benefits specific to not for profits. Rather, Institutions who will be applying Part III of the Handbook as their basis of accounting are directed to follow CICA Handbook Section 3461 Employee Future Benefits which is found in Part II of the Handbook. This financial reporting information note assesses the impact of adoption of both PS 3250 and PS3255, and CICA Handbook section 3461 by Canadian Institutions. Employee Future Benefits CAUBO/ACPAU Page 1 of 21 January 2012 Key Topics This financial reporting information note will address the following key areas with respect to employee future benefits: Purpose ____________________________________________________________________________ 1 Key Topics __________________________________________________________________________ 2 Employee Future Benefits Offered By Canadian Institutions ___________________________________ 3 Current Accounting for Employee Future Benefits_________________________________________ 3 Analysis of Accounting Treatment under PSA and ASPE ______________________________________ 3 Pension Benefits ___________________________________________________________________ 3 Termination Benefits _______________________________________________________________ 8 Other Post Retirement Benefits _______________________________________________________ 8 Discount Rate ____________________________________________________________________ 10 Actuarial Gains and Losses __________________________________________________________ 10 Disclosure Requirements ___________________________________________________________ 11 Transitional Provisions _______________________________________________________________ 19 Closing Comments and On-Going Application _____________________________________________ 21 Employee Future Benefits CAUBO/ACPAU Page 2 of 21 January 2012 Employee Future Benefits Offered By Canadian Institutions For Canadian Institutions, employee future benefits typically represent pension benefits earned by employees, retirement and other future employee benefits (such as medical and dental care, life insurance commitments to eligible employees and retirees, long- and short-term disability payments and compensated absence such as sick leave), and termination benefits. Current Accounting for Employee Future Benefits Prior to the requirement for adoption of a new basis of accounting for all entities for fiscal years beginning on or after January 1, 2012, an Institution’s accounting for employee future benefits has been based upon the accounting standards issued by the Accounting Standards Board of the Canadian Institute of Chartered Accountants (hereinafter referred to as “commercial GAAP”) with respect to the recognition, measurement, and disclosure of the cost of employee future benefits, contained in Section 3461 Employee Future Benefits. In accordance with Section 3461 of commercial GAAP, an Institution presently accrues its obligations with respect to the defined benefit component of its pension plan and the related costs, net of plan assets. The costs and the obligations of the plans are actuarially determined using the projected benefit method prorated on services rendered and the Institution’s best estimate of a number of future conditions, including investment returns, compensation changes, withdrawals, mortality rates, and expected health care costs. The benefit plan expense for the year consists of the current service cost, the interest cost on the benefit obligation, the expected return on plan assets, and the amortization of actuarial losses (gains). For Institutions with defined contribution pension plans, their contributions to the plan would be expensed in the year to which the contributions relate. Analysis of Accounting Treatment under PSA and ASPE An Institution’s employee future benefits are broadly comprised of pension benefits and retirement and other future employee benefits, as well as severance benefits. Pension Benefits The pension plans offered by Canadian Institutions are typically defined contribution plans which include a defined benefit component to ensure a minimum level of pension benefits. In some jurisdictions, the Institution operates its own pension plan as administrator and sponsor. In other jurisdictions, Institutions participate with other employers in multi-employer plans such as the Public Service Pension Plan (PSPP), the Universities Academic Pension Plan (UAPP), or the Local Authorities Pension Plan (LAPP). Under both the PSA and the ASPE standards, an Institution must account for the defined contribution and defined benefit components of its pension plan separately, based upon their substance. The accounting for each of these components of a pension plan is generally similar under the PSA and the ASPE standards with a few differences in treatment as summarized below in the table. There are also some particular areas where significant GAAP differences exist between PSA and ASPE as it relates to pension plans – these are with respect to the recognition of actuarial gains and losses for defined benefit plans and the discount rate used in actuarial valuations. These significant GAAP differences are also summarized in the following table, and further explained in greater depth through this analysis section: Employee Future Benefits CAUBO/ACPAU Page 3 of 21 January 2012 Commercial GAAP Existing requirements Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Requirements Section 3461 Requirements Defined contribution plan An Institution recognizes a cost for a period comprising the current service cost for the period, the interest cost for the period, the amortization for the period of past service costs, and any reduction for the interest income for the period on any unallocated plan surplus. A liability is recorded by an Institution for retirement benefits it was required to contribute, but had not yet paid. A corresponding expense is recorded representing the amount of required contributions provided for employees' services rendered in the period, also plus any accrued interest. An Institution recognizes a cost for a period comprising the current service cost for the period, the interest cost for the period, the amortization for the period of past service costs, and any reduction for the interest income for the period on any unallocated plan surplus. Defined benefit plan Institutions recognize a liability and a cost for employee future benefits in the period in which employees render services in return for the benefits. Institutions recognize a liability and a cost for employee future benefits in the period in which employees render services in return for the benefits. Institutions either (1) recognize an accrued benefit obligation net of the fair value of any plan assets, adjusted for any valuation allowance, and the cost of the plan for the year as an expense (immediate recognition approach) or (2) a liability and a cost for employee future benefits in the period in which employees render services in return for the benefits (defer and amortize approach). The accrued benefit obligation is determined in reference to either the projected benefit method prorated on services, or the accumulated benefit method. Employee Future Benefits CAUBO/ACPAU The accrued benefit obligation is determined in reference to the projected benefit method prorated on services. Page 4 of 21 The accrued benefit obligation is determined in reference to the most recent actuarial valuation under the immediate recognition approach. Under the defer and amortize approach, the accrued January 2012 Commercial GAAP Existing requirements Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Requirements Section 3461 Requirements benefit obligation is determined in reference to either the projected benefit method prorated on services, or the accumulated benefit method. Multi-employer plan Accounting policy choice – an Institution shall accounting for its defined benefit plans using the deferral and amortization approach with the corridor method, or any other systematic method that recognizes gains and losses faster than the corridor method. Accounting policy choice - an Institution account for its defined benefit plans using the deferral and amortization approach in a systematic and rational manner. Corridor method is not available. Accounted for following the standards on defined contribution plans. If an Institution is the sponsor of a defined benefit multiemployer retirement plan, the Institution follows the standards for defined benefit plans in accounting for its obligation under the plan. Accounting policy choice - an Institution may account for its defined benefit plans using the immediate recognition approach; or the deferral and amortization approach with the corridor method or any other systematic method that recognizes gains and losses faster than the corridor method. Accounted for following the standards on defined contribution plans. If an Institution is a participating Institution in a defined benefit multiemployer retirement plan , the Institution follows the standards for defined contribution plans in Employee Future Benefits CAUBO/ACPAU Page 5 of 21 January 2012 Commercial GAAP Existing requirements Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Requirements Section 3461 Requirements accounting for the multiemployer plan. Institution Recognition of actuarial gains and losses – defined benefit plans An Institution uses a systematic method of recognizing actuarial gains and losses in income based upon the corridor method. An Institution must recognize actuarial gains and losses on a systematic basis over the remaining service life of the active employees. The corridor method of recognition is not permitted. An Institution may continue to use a systematic method of recognizing actuarial gains and losses in income based upon the corridor method, or may recognize actuarial gains and losses in income immediately in the year. Discount rate Determined as an interest rate in reference to the market interest rates at the measurement date on high-quality debt instruments, or as the interest rate inherent in the amount at which the accrued benefit obligation could be settled. Determined in reference to either the pension plan asset earnings (where relevant) or by reference to an Institution’s cost of borrowing Determined as an interest rate in reference to the market interest rates at the measurement date on high-quality debt instruments, or as the interest rate inherent in the amount at which the accrued benefit obligation could be settled. PSA Standards With respect to the accounting for the defined contribution portion of a pension plan, an Institution should record a liability for retirement benefits which represents the difference between the amount it was required to contribute, and the amount actually contributed during the fiscal year including accumulated interest on any outstanding amounts payable to the fund. The expense recorded by the Institution represents the amount of required contributions provided for employees' services rendered in the period, also plus any accrued interest. Where there is a past service plan amendment to a defined contribution plan, the cost of current and expected future years' contributions should be accounted for in the period of the plan amendment. Employee Future Benefits CAUBO/ACPAU Page 6 of 21 January 2012 With respect to the accounting for the defined benefit portion of a pension plan, the statement of financial position reports an Institution’s retirement benefit liability and the statement of operations reports the expenses for retirement benefits based on the value of the benefits attributed to employee service to the financial statement date. An Institution records a retirement benefit liability comprised of the accrued benefit obligation including the effects of plan amendments, settlements and curtailments, plan assets, if any, and unamortized actuarial gains and losses. Where an Institution has a multiemployer plan (defined by PS3255 to be a defined benefit plan to which two or more governments or government organizations contribute) the accounting for the plan is based on whether the Institution is the sponsor of the plan, or is a participant in the plan. If an Institution has sponsored a defined benefit multiemployer retirement plan, the PSA standards requires that it follow the standards for defined benefit plans in accounting for the obligation for the plan. For participating Institutions though, a multiemployer plan is accounted for by each participating Institution as a defined contribution plans because sufficient information is generally not available for it to be accounted for as a defined benefit plan. ASPE standards With respect to the accounting for the defined contribution component of a pension plan, an Institution recognizes a cost for a period comprising of the following: (a) the current service cost for the period (based on contributions required to be made in the current or future period based on services rendered by employees during the fiscal year); (b) the interest cost for the period on the estimated present value of any contributions required in future periods related to employee services rendered during the current period or prior periods; (c) the amortization for the period of past service costs; and (d) a reduction for the interest income for the period on any unallocated plan surplus. Past service costs arising from a plan initiation or amendment are to be amortized in a rational and systematic manner over the period during which an Institution expects to realize economic benefits from the plan initiation or amendment. The ASPE standards require an Institution to make an accounting policy selection with respect to defined benefit plans. An Institution may account for its defined benefit plans using the immediate recognition approach or the deferral and amortization approach. Immediate recognition approach - the accrued benefit obligation is determined based on an actuarial valuation report prepared for funding purposes or, when an appropriate valuation report is not available, using the same assumptions as are required under the deferral and amortization approach. The Institution recognizes the net amount of the accrued benefit obligation and the fair value of plan assets, if any, in the statement of financial position. Actuarial gains and losses and past service costs are included in the cost of the plan for the year. Deferral and amortization approach - the accrued benefit obligation is determined based on an actuarial valuation report prepared specifically for accounting purposes. The Institution recognizes on the statement of financial position, an accrued benefit liability or accrued benefit asset, which represents the sum of the current and prior years' benefit costs less the Institution's accumulated cash contributions to the plan. Past service costs are deferred and amortized over future periods. Actuarial gains and losses Employee Future Benefits CAUBO/ACPAU Page 7 of 21 January 2012 may also be deferred and amortized over future periods. The fair value of plan assets, if any, and the accrued benefit obligation are disclosed in the notes to the financial statements. Termination Benefits Employees of an Institution are typically entitled to termination benefits based upon their length of service, and dependent upon their reason for departure. The accounting for these benefits depends on whether the termination benefits are considered, in substance, to be retirement or post retirement benefits rather than termination benefits. The accounting for termination benefits is similar under the PSA and the ASPE standards. PSA Standards Where an Institution’s termination benefit is considered in substance to be a retirement or post retirement benefit (for example, benefits are payable regardless of the reason for an employee's departure), the resulting liability should be determined based upon a projected benefit method which considers such factors as the effect of future salary and wage changes to ensure consistency in determining the present value of the cost of the severance benefits earned to the financial statement date. Institutions recognize termination benefits as a liability and expense when they are committed to either terminating employment of an employee, or to providing termination benefits as a result of an offer to encourage voluntary termination. ASPE Standards Where an Institution’s termination benefit is considered in substance to be a retirement or post retirement benefit, it should be accounted for based upon the nature of the termination benefit, in a manner consistent with other post retirement benefits. Typically a liability would be accrued as employees render the service that gives rise to the benefits, in accordance with an actuarial methodology. Similar to the PSA standards, an Institution recognizes a liability for termination benefits when it is required by the existing terms of a benefit plan to provide termination benefits to employees, and it is probable that employees will be entitled to benefits and the amount can be reasonably estimated. Institutions also recognize a liability when employees accept a termination benefit offer and the amount of the special termination benefits can be reasonably estimated. Other Post Retirement Benefits Other types of future employee benefits for an Institution typically include medical and dental care plans, life insurance for eligible retirees and employees, short and long term disability, as well as sick leave benefits for employees that accumulate but do not vest. Based upon both PSA and ASPE standards, the accounting for other post retirement benefits is based upon whether the benefit plan is defined contribution or defined benefit in nature. The benefit plan must be accounted for in a manner consistent with pension benefits. The accounting for compensated absences that accumulate but do not vest is one significant GAAP difference between the ASPE and the PSA standards. Please refer to table below for an overview of the difference with further detailed discussion following. Employee Future Benefits CAUBO/ACPAU Page 8 of 21 January 2012 Existing requirements - commercial GAAP Compensated absences Not required to accrue a liability for compensated absences that accumulate but do not vest. Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Requirements Section 3461 Requirements Institutions must accrue for post-employment benefits and compensated absences that vest or accumulate in the period in which employees render services in return for the benefits Not required to accrue a liability for compensated absences that accumulate but do not vest. PSA Standards Based upon the PSA standards, PS3255 distinguishes between benefits which vest and accumulate. PS3255.12 notes that “A benefit vests if, after a specific or determinable date, the employees' right to receive the benefit is no longer conditional on the employees remaining in the service of the government.” PS3255.13 indicates that “A benefit accumulates if the employee rendering service earns the right to the benefit and, based on the length of service provided, the amount of the benefit increases. The benefit is earned but unused; the employee retains the right to use the benefit in future periods. This would be the case even if benefits increase only once as more years of service are rendered.” Examples of post-employment benefits and compensated absences are sick days that are paid out when the employee terminates, sick days which accumulate for use in future fiscal periods, or sabbaticals in which the leave is granted to provide unrestricted time off for past service. An Institution must recognize a liability and an expense for post-employment benefits and compensated absences that vest or accumulate in the period in which employees render services to the government in return for the benefits. The key here is that vesting and accumulation don’t have to occur for the liability to be accrued; as long as the benefits vest or accumulate, a liability must be accrued. In accordance with PS3255, the measurement of the obligation for benefits that accumulate but do not vest would consider the expectation of future utilization of the benefits. Typically, an actuarial valuation is undertaken to estimate the liability. Further, as noted in PS3255.21, for post-employment benefits or compensated absences that do not vest or accumulate, such as self-insured short-term and long-term disability benefits not related to service and self-insured workers' compensation benefits, a liability is recognized when an event that obligates the Institution occurs, such as an employee injury or illness which qualifies as a disability. It is important to note that prior to the transition to PSA, an Institution was not required to record an accrued benefit obligation related to sick leave benefits that did not vest. Employee Future Benefits CAUBO/ACPAU Page 9 of 21 January 2012 ASPE Standards Consistent with the PSA standards, the accounting for other post retirement benefits is based upon whether the benefit plan is defined contribution or defined benefit in nature. The benefit plan must be accounted for in a manner consistent with pension benefits. However, unlike the PSA standards, an Institution is not required to accrue a liability for compensated absences that accumulate but do not vest. Section 3461.044 specifically notes that, “…as a practical matter, an Institution is not required to accrue a liability for sick-pay benefits that accumulate but do not vest.” Discount Rate Institutions apply discount rates as one of the key actuarial assumptions to determine the costs and the obligations of their benefit plans using the projected benefit method. Guidance for determining an appropriate discount rate represents a key GAAP difference between the PSA and the ASPE standards as noted in the table above. PSA Standards PS 3255 requires the discount rate to be determined in reference to either the pension plan asset earnings (where relevant) or by reference to an Institution’s cost of borrowing. Note that as discussed in the Transitional Provisions section of this financial information note below, upon transition to the PSA standards Institutions have an option to delay the application of the change in the discount rate used until the sooner of the date of their next actuarial valuation or a date that is within three years of the transition date. ASPE Standards Section 3461 of the ASPE standards determines the discount rate in a consistent manner with an Institution’s present practice under commercial GAAP. Actuarial Gains and Losses Actuarial gains (losses) on an Institution’s accrued benefit obligation arise from differences between actual and expected experience and from changes in the actuarial assumptions used to determine the accrued benefit obligation. The recognition of actuarial gains and losses represents a key GAAP difference between the PSA and the ASPE standards as noted in the table above. PSA Standards PS3255 does not allow the application of the corridor method for the amortization of actuarial gains and losses. Consequently, upon the adoption of the PSA Standards, an Institution would need to revise its accounting policy to recognize actuarial gains and losses on a systematic basis over the remaining service life of the active employees. Upon transition to the PSA standards, an Institution may chose to apply certain of the exemptions provided under PS2125 First time Adoption of Public Sector Accounting by Government Organizations Employee Future Benefits CAUBO/ACPAU Page 10 of 21 January 2012 regarding retirement and post-employment benefits. These exemptions are discussed further in the Transitional Provisions section of this note. ASPE Standards Section 3461 of the ASPE standards provides an option to recognize actuarial gains and losses in a consistent manner with an Institution’s present practice. In other words, an Institution could continue to use a systematic method of recognizing actuarial gains and losses in income. An Institution would recognize the amortization of actuarial gains and losses in a period in which, as of the beginning of the period, the unamortized net actuarial gain or loss exceeds 10 percent (the “corridor”) of the greater of: (a) the accrued benefit obligation at the beginning of the year; and (b) the fair value, or market-related value, of plan assets at the beginning of the year. When amortization is required, the minimum amortization is the excess divided by the average remaining service period of active employees expected to receive benefits under the plan. This method of recognition is generally referred to as the “corridor method”. Under ASPE, Institutions are also given an accounting policy choice of recognizing actuarial gains and losses in income immediately. The method adopted must be applied consistently year over year and to both actuarial gains and losses. Disclosure Requirements Canadian Public Sector Accounting standards and the Accounting Standards for Private Enterprises both present a number of disclosure requirements that need to be addressed by Institutions. Many of these requirements are somewhat addressed with an Institution’s existing employee future benefits disclosure in their financial statements based upon commercial GAAP. The following table provides a detailed discussion and comparison between PSA and ASPE disclosure requirements: Employee Future Benefits CAUBO/ACPAU Page 11 of 21 January 2012 Existing disclosure requirements commercial GAAP General Institutions must provide the disclosures required for pension plans separately for plans that provide: (a) pension benefits; and (b) primarily other employee future benefits. Defined contribution plans For defined contribution plans, an Institution discloses: (a) the cost recognized for the period; and (b) a description of the nature and effect of each significant change during the period affecting the comparability of the costs for the current and prior periods, such as a change in the rate of employer contributions, a business combination or a divestiture. The Institution also discloses the total cash amount initially recognized in the period as paid or payable for that period for employee future benefits. This amount includes contributions to funded defined benefit plans and to defined contribution plans; payments directly to employees, their beneficiaries or estates; and payments to a third-party service provider on behalf of the employees. When the Institution discloses any component of the total cash amount Employee Future Benefits CAUBO/ACPAU Public Sector Accounting Standards PS 3250 and 3255 Disclosure Requirements Institutions are to provide the disclosures required for pension plans separately for plans that provide pension benefits and plans that provide retirement benefits other than pensions. For defined contribution plans, financial statements should disclose: Accounting Standards for Private Enterprises Section 3461 Disclosure Requirements Institutions must provide the disclosures required for pension plans separately for plans that provide: (a) pension benefits; and (b) primarily other employee future benefits. The ASPE standards do not specifically provide disclosure requirements for defined contribution plans. (a) a general description of benefit plans, contribution formulae and funding policy; (b) the expense recognized for the period; and (c) a description of significant changes to benefit plans during the period. Page 12 of 21 January 2012 Existing disclosure requirements commercial GAAP Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Disclosure Requirements Section 3461 Disclosure Requirements separately, it provides a reconciliation of this component to that total. Defined benefit plans An Institution discloses the following information about the effect of defined benefit plans on its financial statements for the period: (a) Description of the type(s) of plans; (b) Measurement date and dates of actuarial valuations; (c) Costs recognized (a breakdown of the total amount of benefit cost recognized for the period) (d) Assets and liabilities (e) Reconciliation of the accrued benefit obligation to the accrued benefit liability or accrued benefit asset (net of any valuation allowance) at the end of the period An Institution must also disclose the following information about defined benefit plans for which it is the sponsor: (a) Plan asset information, including : ii) the percentage of the fair value of total plan assets held at the measurement date represented by each major category of plan assets; and (iii) the amounts and types of Employee Future Benefits CAUBO/ACPAU Financial statements should disclose: (a) a general description of retirement benefit plans, benefit formulae and funding policy, including a description of significant changes to retirement benefit plans during the period; (b) the accrued benefit obligation at the end of the period, as determined by the actuarial valuation; (c) the market value of plan assets at the beginning and the end of the period and, if different, the market-related value of plan assets at the beginning and the end of the period; (d) the amount of retirement benefit liability or accrued benefit asset at the end of the period, indicating separately the amount of any valuation allowance. (e) unamortized actuarial gains and losses and the periods of amortization; (f) current period benefit cost; (g) cost of plan amendments incurred during the period; (h) net actuarial gains or losses recognized in the determination of the cost of plan amendments; (i) other gains and losses on accrued benefit obligations arising during the period; (j) other gains and losses on plan assets arising during the period; (k) gains and losses arising from plan Page 13 of 21 Institutions shall disclose the following information about defined benefit plans: (a) a general description of each type of plan, including whether the plan is a pension plan or a plan other than a pension plan such as a retiree health care plan; (b) the fair value of plan assets at the end of the year; (c) the accrued benefit obligation at the end of the year; (d) the plan surplus or deficit at the end of the year (the result of amount (b), if any, less amount (c)); (e) an explanation of any differences between the amount recognized in the statement of financial position and the plan surplus or deficit at the end of the year, including the amount of any valuation allowance; (f) the effective date of the most recent actuarial valuation for funding purposes; and (g) the nature and effect of significant changes in the contractual elements of the plans during the year. January 2012 Existing disclosure requirements commercial GAAP securities of the Institution and related parties included in plan assets, the approximate amount of future annual benefits covered by insurance contracts issued by the Institution or related parties, and transactions between the Institution and the plan during the period. (b) Non-routine events An Institution discloses the significant assumptions used in accounting for employee future benefits, including: (a) the weighted average of the amounts assumed in accounting for the plan for: (i) the discount rate at the end of the period used to determine the accrued benefit obligation; (ii) the discount rate at the preceding year end; (iii) the expected long-term rate of return on plan assets; and (iv) the rate of compensation increase (for pay-related plans); specifying, in a tabular form, the assumptions used to determine the accrued benefit obligation and the assumptions used to determine benefit cost; and (b) the assumed health care cost trend rate(s) for the next year used to measure the expected cost of benefits covered by the plan (gross eligible Employee Future Benefits CAUBO/ACPAU Public Sector Accounting Standards PS 3250 and 3255 Disclosure Requirements settlements and curtailments incurred during the period; (l) amortization of actuarial gains and losses reflected in the current year expense; (m) the amount recognized as a result of a temporary deviation from the plan; (n) the change in a valuation allowance; (o) the amount of contributions by employees during the period; (p) the components of the retirement benefits interest expense for the period; (q) the amount of contributions by the government during the period; (r) the amount of benefits paid during the period; (s) the expected return and actual return on plan assets during the period; (t) assumptions about long-term inflation rates, expected rate of return on plan assets, assumed health care cost trends, rate of compensation increase (for pay-related plans) and discount rate; and (u) the date of the most recent actuarial valuation performed for accounting purposes. Some of this disclosure information may be presented in reconciliations of the beginning and ending balances of the accrued benefit obligation and plan assets for the period, taking into account any unamortized actuarial gains or losses existing at the financial statement date. Page 14 of 21 January 2012 Accounting Standards for Private Enterprises Section 3461 Disclosure Requirements Existing disclosure requirements commercial GAAP Public Sector Accounting Standards Accounting Standards for Private Enterprises PS 3250 and 3255 Disclosure Requirements Section 3461 Disclosure Requirements charges), and a general description of the direction and pattern of change in the assumed trend rate(s) thereafter, together with the ultimate trend rate(s) and when each such rate is expected to be achieved. Termination benefits No specific disclosure requirements. No specific reference is provided in the PSA standards to disclosure requirements related to termination benefits. An Institution would follow the disclosure requirements outlined for post employment benefits. An Institution shall disclose the nature and effect of any termination benefits provided in the period. Disclosure of accounting policies An Institution discloses the significant accounting policies it has adopted in applying this Section, including where applicable: (a) whether future salary levels or cost escalation affect the amount of employee future benefits, and that therefore, the projected benefit method prorated on services has been used to determine the accrued benefit obligation, or whether future salary levels or cost escalation do not affect the amount of employee future benefits, and that therefore, the accumulated benefit method has been used to determine the accrued benefit obligation; (b) whether the expected return on plan assets is based on the fair value of plan assets or on a marketrelated value, and in the latter case, PS2100, Disclosure of Accounting Policies, requires that a clear and concise description of all significant accounting policies of an Institution be included as an integral part of its financial statements. No specific reference is made to other general disclosure requirements of accounting policies with respect to employee future benefits. Section 1505, Disclosure of Accounting Policies requires disclosure of significant accounting policies. For defined benefit plans, this requirement includes whether or not the accrued benefit obligation is measured using a funding valuation, and whether actuarial gains and losses and past service costs are included in the cost of the plan for the year as described in paragraph 3461.028 or are deferred and amortized to future periods as described in paragraphs. Employee Future Benefits CAUBO/ACPAU Page 15 of 21 January 2012 Existing disclosure requirements commercial GAAP Public Sector Accounting Standards PS 3250 and 3255 Disclosure Requirements the method used in calculating the market-related value for each class of asset; (c) the method used to amortize past service costs and the amortization period; (d) whether all actuarial gains and losses are amortized or only those in excess of 10 percent of the greater of the accrued benefit obligation and the fair value (or market-related value) of plan assets at the beginning of the year, the method used to amortize actuarial gains and losses, and the amortization period; (e) when the Institution applies this Section prospectively, the method used to amortize a transitional obligation or transitional asset and the amortization period; (f) the sequence in which a settlement and a curtailment are accounted for when a transaction or event gives rise to both; (g) the use of defined contribution plan accounting by an Institution that is part of a multiemployer plan for which the Institution has insufficient information to apply defined benefit plan accounting; and (h) the use of defined contribution plan accounting by an Institution that is part of a multiemployer plan of a related group of companies. Employee Future Benefits CAUBO/ACPAU Page 16 of 21 January 2012 Accounting Standards for Private Enterprises Section 3461 Disclosure Requirements Existing disclosure requirements commercial GAAP Post employment benefits and compensated absences There is no specific reference to disclosure requirements related to post employment benefits and compensated absences under commercial GAAP. An Institution would determine the required disclosure based on the nature of the benefit plan, and disclose information similar to the disclosures required for pension plans of a similar nature. Multiemployer plans For multiemployer plans, an Institution discloses: (a) the cost recognized for the period; and (b) a description of the nature and effect of each significant change during the period affecting comparability, such as a change in the rate of employer contributions, a business combination or a divestiture. Employee Future Benefits CAUBO/ACPAU Public Sector Accounting Standards PS 3250 and 3255 Disclosure Requirements For post-employment benefits and compensated absences, financial statements would disclose information similar to the disclosures required for pension plans. Professional judgment will be necessary to determine what disclosures will meet the requirements set out in PS 3250. For post-employment benefits and compensated absences, Institutions are encouraged to disclose a general description of the plans, information about key assumptions, a reconciliation of assets and accrued benefit obligations from the beginning of a fiscal period to the end of a fiscal period, and the expense for the period. The reconciliation of assets and accrued benefit obligations would specifically identify the effects of termination benefits. Similarly, the expense for the period would specifically identify the amount due to termination benefits. An Institution should disclose any available information about any surplus or deficit in a multiemployer plan, the basis used to determine the surplus or deficit and the implications, if any, for the Institution. Page 17 of 21 Accounting Standards for Private Enterprises Section 3461 Disclosure Requirements There is no specific reference to disclosure requirements related to post employment benefits and compensated absences under the ASPE standards. An Institution would determine the required disclosure based on the nature of the benefit plan, and disclose information similar to the disclosures required for pension plans of a similar nature. An Institution shall disclose the following information about multiemployer plans: (a) a general description of the plan, including whether the plan is a pension plan or a plan other than a pension plan such as a retiree health care plan, and whether the plan is a defined benefit plan or a defined contribution plan; and (b) when the plan is a multiemployer defined benefit plan but sufficient information January 2012 Existing disclosure requirements commercial GAAP In some circumstances, an Institution may be unable to obtain sufficient information about its multiemployer plans to disaggregate amounts it has contributed to provide pension benefits from amounts it has contributed primarily to provide other employee benefits. When such disaggregation is impracticable, an Institution discloses total contributions to multiemployer plans. Employee Future Benefits CAUBO/ACPAU Page 18 of 21 Public Sector Accounting Standards PS 3250 and 3255 Disclosure Requirements Accounting Standards for Private Enterprises Section 3461 Disclosure Requirements is not available to use defined benefit plan accounting, and defined contribution plan accounting is used: (i) the fact that the plan is a defined benefit plan; (ii) the reason why it is being accounted for as a defined contribution plan; (iii) any available information about the plan's surplus or deficit, and (iv) the nature and effect of significant changes in the contractual elements of the plan. January 2012 Transitional Provisions PSA Standards For Institutions adopting the Canadian Public Sector Accounting standards, Sections PS3250 and PS3255 would be applied to the opening statement of financial position for the first year presented in the financial statements for the year of adoption of those standards. The PSA standards provide certain elections which can be applied to minimize the difficulties of retroactive application of parts of these sections. Based upon PS3250 and PS3255, an Institution would determine its accrued benefit obligations, postemployment benefits and compensated absences by applying a discount rate with reference to its plan asset earnings or with reference to its cost of borrowing. Retroactive application of these sections would require an Institution to recalculate accrued benefit obligations, post-employment benefits and compensated absences at the time of transition to Public Sector Accounting Standards. Institutions adopting the Public Sector Accounting standards for the first time may apply an exemption available under PS2125, First Time Adoption by Government Organizations, to delay application of these sections relative to the discount rate used until the date of their next actuarial valuation or within three years of the transition date to Public Sector Accounting Standards, whichever is sooner. If a first-time adopter uses this election, it must be applied to all plans. PS3250 and PS3255 also require an Institution to amortize its actuarial gains and losses to the liability or asset, and the related expense in a systematic and rational manner over the expected average remaining service life of the related employee group. Retroactive application of this approach would require an Institution to split the cumulative actuarial gains and losses from the inception of the plan until the date of transition to Public Sector Accounting Standards into a recognized portion and an unrecognized portion. Institutions adopting the Public Sector Accounting standards for the first time may apply an exemption available under PS2125, First Time Adoption by Government Organizations to recognize all cumulative actuarial gains and losses as the date of transition to Public Sector Accounting Standards directly in accumulated surplus / deficit. Actuarial gains and losses after the date of transition to Public Sector Accounting Standards are to be accounted for in accordance with Sections PS 3250 and PS 3255. If a first-time adopter uses this election, it must be applied to all plans. ASPE Standards For Institutions adopting the Accounting Standards for Private Enterprises, and those reporting under Part III of the CICA Handbook – Accounting Standards for Not for Profit Organizations, CICA Handbook Section 3461 would be applied to the Institution’s opening statement of financial position for the first year presented in the financial statements for the year of adoption of those standards. The ASPE standards provide certain elections which can be applied to minimize the difficulties of retroactive application of parts of these sections. Under the deferral and amortization approach in Section 3461, an Institution may elect to use a "corridor" method for its defined benefit plans that leaves some actuarial gains and losses unrecognized. Retrospective application of this approach requires an Institution to split the accumulated actuarial gains and losses from the inception of the plan until the date of transition to the ASPE standards into a recognized portion and an unrecognized portion. Also, an Institution may not have recognized some past service costs at the date of transition to accounting standards for private enterprises. Institutions adopting Employee Future Benefits CAUBO/ACPAU Page 19 of 21 January 2012 the ASPE standards for the first time may apply an election available under section 1500, First Time Adoption to: (a) recognize all accumulated actuarial gains and losses and past service costs in opening retained earnings at the date of transition to accounting standards for private enterprises, even if it uses the corridor approach for later actuarial gains and losses; or (b) carry forward unrecognized actuarial gains and losses and past service costs that were determined previously in accordance with Section 3461, or an equivalent basis of accounting such as IAS 19 Employee Benefits in Part I of the Handbook. If a first-time adopter uses one of these elections, it must be applied it to all defined benefit plans. When an Institution makes the accounting policy choice at the date of transition to measure its benefit obligations using the funding valuation (when one is available) and to recognize all past service costs and actuarial gains and losses in the period they arise, it applies that accounting policy to all comparative years shown. Where a first-time adopter had an unamortized transitional asset or an unamortized transitional obligation in preparing financial statements using its previous accounting policies, any such transitional amount is recognized in opening retained earnings at the date of transition to accounting standards for private enterprises. Employee Future Benefits CAUBO/ACPAU Page 20 of 21 January 2012 Closing Comments and On-Going Application Going forward, Institutions reporting under the Canadian public sector accounting standards should assess, with the assistance of an actuary the liability and expense relating to sick leave credits which accumulate for employees as at the end of each fiscal year. Institutions should ensure that this assessment considers any revisions to the entitlement to sick leave based upon changes to the collective agreements. Institutions should ensure that the next actuarial valuation to measure their accrued benefit obligation for employee future benefits continues to apply a discount rate consistent with the requirements of their selected basis of accounting. Employee Future Benefits CAUBO/ACPAU Page 21 of 21 January 2012