allowance for loan and lease losses current issues and frequently

advertisement

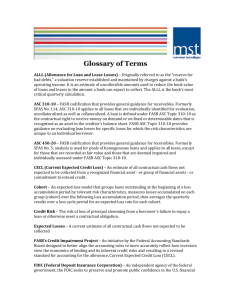

ALLOWANCE FOR LOAN AND LEASE LOSSES CURRENT ISSUES AND FREQUENTLY ASKED QUESTIONS Carol Gross Federal Reserve Bank of Kansas City Denver Branch Supervision and Risk Management Allowance for Loan and Lease Losses: Current Issues • • • • • • Allowance for Loan and Lease Losses (ALLL) releases Appropriate look-back period for calculating loss rates Qualitative factors The ALLL on junior lien portfolios Appropriate definition of impaired loans Purchased credit-impaired loans 3 Credit Quality • • • • Credit quality indicators improving Commercial real estate picking up in certain locales Past due and OREO levels generally decreasing Change in portfolio mix: ‒ C&I ‒ Oil and gas • Yield and earnings pressure to make up for bad years: ‒ Intense competition for limited loans • Upcoming home equity payment shock 4 Credit & Market Risk Examiner Focus • ALLL must be in accordance with supervisory guidance • Management’s reassessment of the ALLL methodology • Significant decreases or no increase in the allowance will be viewed with caution • Looking for solid improved trends • Accurate identification of impaired loans • Proper impairment measurement • Documentation and support: ‒ Are the qualitative adjustments sufficient? 5 Accounting Standards Codification (ASC) 450 Loss Histories • What is the appropriate time horizon for calculating historical loss rates? • There is no fixed period of time that banks should use to determine the historical loss experience 6 ASC 450 (Cont’d) Loss Histories (cont’d) • A bank’s supporting documentation should include an analysis of how the current conditions compare with those conditions during the period used in the historical loss rates for each group of loans assessed under ASC 450-20 7 ASC 450 (Cont’d) Loss Histories (cont’d) • A bank should review the range of historical losses over the period used, rather than relying solely on the average historical loss rate, and should identify the appropriate historical loss rate from within that range to use in estimating credit losses for the groups of loans 8 ASC 450 (Cont’d) Qualitative Factors • Require judgments • Are not strictly mathematical calculations • Reflect management’s estimate of the extent to which current losses on a pool of loans differ from historical loss experience 9 ASC 450 (Cont’d) Qualitative Factors (cont’d) • Document the qualitative factors considered and the conclusions reached. Support and documentation include: • • • • Description of each factor Management’s analysis of how each factor has changed over time Amount of adjustments to loss estimates for changes in conditions Which loan groups’ loss rates have been adjusted 10 ASC 450 (Cont’d) Qualitative Factors (cont’d) • Examiners will look for: • Documentation and its reasonableness • Whether management adequately identifies the qualitative factors that are determined to cause estimated losses to differ from historical loss experience • Directional consistency of adjustments with changes in the underlying factors 11 Other Current Issues: Junior Liens Junior Lien Guidance • SR Letter 12-3: Interagency Guidance on Allowance Estimation Practices for Junior Lien Loans and Lines of Credit • Intended to remind institutions of existing GAAP and regulatory guidance related to estimating the allowance for junior lien loans and HELOCs SR Letter 12-3: http://fedweb.frb.gov/fedweb/bsr/srltrs/sr1203.pdf 12 ASC 310 • Current U.S. GAAP: ‒ Incurred credit loss model ‒ Impairment of receivables shall be recognized when, based on all available information, it is probable that a loss has been incurred based on past events and conditions existing at the balance sheet date (ASC 310-10-35-4) ‒ A loan is impaired when, based on all current information and events, it is probable that a creditor will be unable to collect all amounts due according to the contractual terms of the loan agreement. All amounts due according to the contractual terms means that both the contractual interest payments and the contractual principal payments of a loan will be collected as scheduled in the loan agreement. (ASC 310-10-35-16) This does not consider possible or expected future trends that may lead to additional losses 13 Impairment Measurement ASC 310-10-35-20 through 32 – For impaired loans, which includes TDRs Option 1 • PV of expected future CFs discounted at the loan's effective interest rate Must consider defaults and prepayments Option 2 Option 3 • Loan's observable market price • FV of the collateral (less cost to sell) • Provided it is a collateral dependent loan Method not considered available because no market for impaired loans *Options 2 and 3 are used as practical expedients to Option 1, ASC 310-10-35-22 Judgment required in determining what is collateral dependent 14 Purchased Credit Impaired Loans Day 1 Day 2 • Purchased impaired loan is initially recorded at FV with no ALLL recorded at acquisition • Post acquisition, purchaser must regularly estimate CF expected to be collected to assess for impairment • Probable decrease in expected CF should be recognized as impairment through the ALLL 15 Loan Impairment Resources Evaluate for Impairment ASC 310-10-35-16 through 17 Measure Impairment ASC 310-10-35-20 through 32 Account for Impairment Record ALLL Call Report Instructions Glossary 16 Questions 17