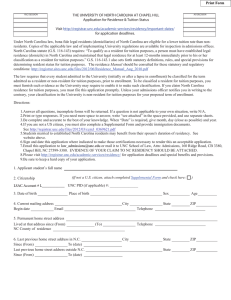

Application for Classification as a Legal Resident

advertisement

Application for Classification as a Legal Resident (Domiciliary) of North Carolina for Tuition Purposes State law allows bona fide North Carolina legal residents (domiciliaries) to be eligible for a lower tuition rate than non-residents. North Carolina law (G.S. 116-143.1) requires you to establish legal residence (domicile) in North Carolina and maintain it for at least 12 months immediately prior to the beginning of the term for which you seek classification as a resident for tuition purposes. The statute also contains definitions, rules and special provisions for determining residence for tuition purposes. Copies of the law and the local institution's policies may be obtained from each community college. If you are admitted to the college (or readmitted after a lapse in enrollment) the law requires the community college to classify you as a resident or non-resident for tuition purposes for your term of admission. To be classified a resident for tuition purposes, you must give the college the evidence it requires to enable it to make that classification. Directions 1. Please print (in black or blue ink) all responses. If the question is not applicable to your situation, write "NA". When "date" is requested, provide month, day, and year. 2. You will be asked to provide at least two appropriate documents to substantiate your claim. Examples of such documentation may include, but are not limited to, state or federal tax returns, a voter registration card, a birth certificate, a marriage license, utility bills, INS documents, current VISA, and/or a United States of America or North Carolina Government issued identification document(s). 3. Please answer all questions accurately and completely. You are encouraged to write on the back of the application or attach additional sheets if you need more space to provide a complete answer. You are also encouraged to provide detailed, supplemental information concerning your residency claim. By providing complete answers initially, you help eliminate processing delays that occur when we must get in touch with you to obtain additional information. 4. If you and/or your spouse are not U.S. citizens, you will be required to supply immigration information on a supplemental form by the community college. You will be expected to provide a current VISA. 5. All forms are available at the Registration and Records Office, or online at www.waketech.edu, and must be returned to the local community college where you are enrolled or intend to enroll for review. Remember: The application must be completed entirely in order for it to be reviewed. Thank you R E M O V E T H I S P A G E B E F O R E S U B M I T T I N G A P P L I C A T I O N North Carolina Residence and Tuition Status Application Application Information 1. Applicant Student’s Full Name: 2. Student ID or Social Security Number (voluntary): Citizenship: (If not a U.S. citizen, attach completed Supplemental Form)) If Supplemental Form attached, check here 3. Date of Birth: 4. Address while attending institution (current): 5. Permanent home address: Since: 6. Place of Birth: Telephone: Previous home address in N.C.: From: E-mail Address: To: Last previous home address outside N.C.: From: To: 7. Are you currently enrolled in this institution? Yes No Are you applying for admission? Circle earliest term and indicate year in which you want this decision to apply: Fall Semester Spring Semester Summer Semester st nd Fall 1 Mini-Semester st Spring 1 Mini-Semester st Summer 1 Mini-Semester Fall 2 Mini-Semester nd Spring 2 Mini-Semester nd Summer 2 Mini-Semester Important Notes: Apply for only one term per application. No change in residency status may be obtained for an academic term that has ended before a Residence and Tuition Status Application is submitted. 8. Why did you move your home to North Carolina? On what date did you move your home to North Carolina? 9. From what state or foreign country did you move you home and legal residence? 10. When do you claim your legal residence in N.C. began? 11. Has your residence status for tuition purposes been previously determined by the North Carolina public educational institution? Yes No If yes, (A) Name of institution: (B) Classification: Resident Non-resident (C) Last term and year you were so classified: 12. Secondary (high or preparatory) schools you attended in sequence: Name Address (place and state) a. From (date) To (date) b. 13. List all post-secondary schools (universities, colleges, junior colleges, community colleges, etc.) you have attended, in sequence (including this institution): Name Address (place and state) From (date) To (date) a. b. 14. Father living? (Yes or No) Permanent home address: Name Occupation: Since: 15. Mother living? (Yes or No) Permanent home address: Name Occupation: Since: Form 427 R-10 (10-27-08) LW Page 1 16. Parents separated or divorce? (Yes or No) 17. Legal guardian? (Yes or No) Permanent home address: Who has/had custody of you? Name Occupation: Since: Court appointed at (place): (on date) 18. Who (including yourself) last claimed you as an exemption on state and/or federal income tax returns, for what tax year, and in what state filed? a. On state return for tax year, filed in (state) on (date) Name: Relationship to you: b. On federal return for tax year, filed in (state) on (date) Name: Relationship to you: c. Does anyone intend to claim you as a dependent on state and/or federal income tax returns for the current tax year? Yes No 19. List in chronological order to date of this application all places you have spent at least 7 consecutive days during the past three years. Your response must include your current address, all other places lived, and vacations. Place (city and state) Occupation or Purpose From (date) To (date) a. b. c. 20. When and where (state or foreign country) did you do each of the following during the last 24 months? List each time you did each such act (If not done in the last 24 months, list where and when such acts were done the last time you did them; if never done at all, write “never”): Where Month/Day/Year a. b. c. d. e. f. g. h. i. j. Registered to vote Voted Called to serve on jury duty Acquired or renewed driver's license Acquired ownership of property for use as your principal dwelling Inclusive dates of such property ownership Filed state intangibles tax return Listed personal property for taxation in the county where you live Filed state income tax return Did you file as a resident or nonresident? Had state income tax withheld during the current tax year? Beginning (Month/Day/Year) During the previous year? k. from: to: Yes Where Month/Day/Year from: to: No from: to: State(s) Yes No State(s) Beginning (Month/Day/Year) Was all of the amount withheld refunded to you? Yes No Registered/licensed a motor vehicle (car, truck, or other requiring license) Type of vehicle (list all) Where registered/ licensed Form 427 R-10 (10-27-08) LW Where Month/Day/Year Page 2 (Month/Day/Year) 21. The car(s) or other motor vehicles which you maintain and operate in N.C. are owned by: Name: Address: Registered/licensed in (state or foreign country): Insured in the name of: Address: 22. List the addresses at which you own and maintain personal property (clothing, furniture, cars, boats, checking or savings accounts, stocks, bonds, pets, jewelry, appliances, etc.) and give percentage of value (of total personal property) maintained at each address: Address % at this address a. b. 23. List your employment for wages in the last 24 months? Job Title Employer Address (place and state) Dates (from) (to) Hours per week a b. c. 24. Of the total money required to meet your expenses, what percentage came from each of the following sources and what was it used for? Source Your earnings Your savings Parent(s) or Guardian Name Other (specify) Total 25. a. b. Preceding Calendar Year (Jan-Dec % of Total Used For 100% ) Current Calendar Year (Jan-Dec ) % of Total Used For 100% Have you or either of your parents been in active military service within the past two years? (Yes of No) If so, for each such person, attach copies of the "Leave and Earnings Statements" for the most recent pay period and for the pay period 12 months ago. If you or either of your parents have been in active military service or other federal government employment within the past two years, answer the following for each such person: Name(s): Relationship to you: Home address upon entry: Official “home or record”: Official home address now: Date this home address was declared: Home address upon discharge: Date of discharge: Legal residence most recently claimed on DD Form 2058 (State of Legal Residence Certificate): Date that DD Form 2058 was completed: Place to which mileage was paid upon discharge: State for which income tax withheld: From what date? 26. Answer the questions below for each of the following individuals: Your parents (or legal guardian) if you now live with them or have lived with them in the past 24 months or if they have claimed you as a dependent for tax purposes in the past 24 months. Answer this question for your father unless you parents are separated or divorced. If your parents are separated or divorced, answer this question for both parents. Any other person who has claimed you as a dependent for tax purposes within the past 24 months. a. Names(s): Relationship to you: Permanent home address: Lived at this address since (date): Last previous home address: From (date): To (date): Form 427 R-10 (10-27-08) LW Page 3 b. Where (state or foreign country) and when did this person do each of the following during the last 24 months? List each time he or she did each such act. (If not done in the last 24 months, where and when did he or she do these acts last? If never done at all, write "never"): Where Month/Day/Year 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 27. Registered to vote Voted Called to serve on jury duty Acquired or renewed driver's license Acquired ownership of property for use as your principal dwelling Inclusive dates of such property from: ownership to: Filed state intangibles tax return Listed personal property for taxation in the county where you live Filed state income tax return Did you file as a resident or nonresident? Registered/licensed a motor vehicle (car, truck, or other requiring license) Claimed you as an exemption on state income tax return for on (date) ; federal income tax return for Where Month/Day/Year from: to: Where Month/Day/Year from: to: Tax year, file in (state) tax year, filed in (state) If there are additional circumstances, events, or acts that you feel support your claim to North Carolina legal residence (domicile) for tuition purposes, attach a description of each, specifying the place and date of its occurrence. Applicant’s Acknowledgement and Certification I hereby acknowledge that completion of Item 2 (Social Security Number) is voluntary, is requested by the institution solely for administrative convenience and record-keeping accuracy, and is requested only to provide a personal identifier for the internal records of this institution. I hereby certify that all information I have set forth herein is true to the best of my knowledge, pursuant to my reasonable inquiry where needed. I hereby acknowledge that the institution may verify the information set forth herein from sources accessible under law to the institution but that the institution may divulge the contents of this application only as permitted under the Family Educational Rights and Privacy Act of 1974 if I am, or have been, in attendance at this institution. Applicant’s Signature Date Signature of parent or guardian (if applicant is under 18 years of age) Date For Office Use Only Approved Date: Form 427 R-10 (10-27-08) LW Disapproved Initials: Date: Updated Initials: Page 4 Date: Initials: