GRAVIS HOSPITALITY LTD 2011-A.pmd

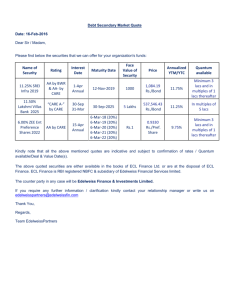

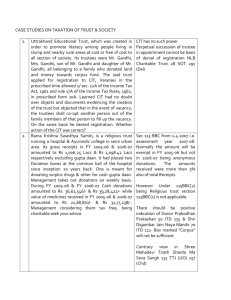

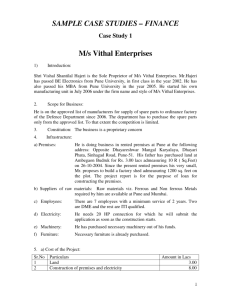

advertisement