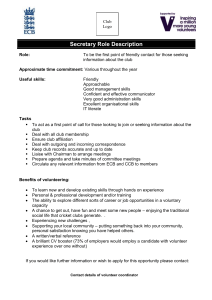

Service Guide

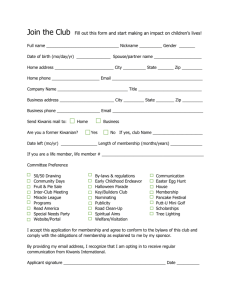

advertisement