Capital One Financial Corporation

advertisement

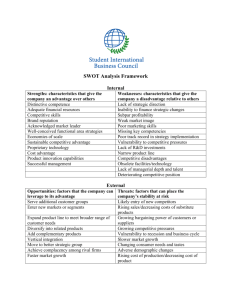

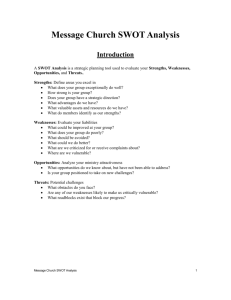

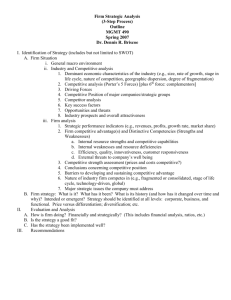

Capital One Financial Corporation “SWOT is an acronym for the internal Strengths and Weaknesses of a firm and the environmental Opportunities and Threats facing that firm. SWOT analysis is a widely used technique through which managers create a quick overview of a company’s strategic situation. The technique is based on the assumption that an effective strategy derives from a sound “fit” between a firm’s internal resources (strengths and weaknesses) and its external situation (opportunities and threats). A good fit maximizes a firm’s strengths and opportunities and minimizes its weaknesses and threats. Accurately applied, this simple assumption has powerful implications for the design of a successful strategy.” Capital One Financial Corporation Capital One Financial Corporation (Capital One or ‘the company’) is a diversified financial services provider in the US. Since its inception in the 1990s, Capital One has become one of the leading card issuers. The company has now shifted focus to diversifying from a monoline card issuer to full fledge financial services provider. Capital One primarily operates in the US, the UK and Canada. It is headquartered in McLean, Virginia and employs 23,700 people. Page 1 of 2 Capital One Financial Corporation Strengths, Weaknesses, Opportunities and Threats (SWOT) Location of Factor TYPE OF FACTOR Favorable Internal Strengths Weaknesses ¾ Strong market position ¾ Limited in credit card business international supporting revenue presence enlarging accretion business risk ¾ Innovative products ¾ Negative publicity and services in the UK market augmenting brand bringing brand strength value diminution ¾ Adequate liquidity External Unfavorable ¾ Increasing position lending provision for loan strength to balance losses impacting sheet profitability Opportunities ¾ Acquisition of Chevy Threats ¾ Identity thefts could Chase Bank likely to increase losses increase market share and affect the ¾ Participation in the US treasury department company’s margins ¾ Economic capital purchase slowdown in the US program (CPP) likely may affect to increase profitability shareholders returns ¾ Positive outlook of ¾ Volatility in financial markets likely to commercial banking in affect revenues and the US increase cost of capital Page 2 of 2