Dynamics for Today's Market

advertisement

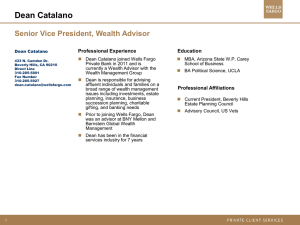

TWM MD 6.22.10 Dynamics for Today’s Market The TWM Approach to Tactical Allocation new parameters “The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” - William Arthur Ward (1921-1994) World financial markets have transformed greatly and society is now more complex, but people and money are still the same: People still worry and make many financial decisions based on emotion. Extra care is demanded in today’s market climate, which requires a more active approach than conventional buy and hold strategies. The key is being able to recognize impending trends as early as possible: you must be able to observe change is coming, and prepare for its arrival. Many investors simply invest through predetermined allocation programs, hoping the market will conform to their goals, thus surrendering control to the market. At TWM we take a dynamic approach to investing in an effort to profit regardless of what direction markets are going. We believe you should adjust to changing market conditions, instead of just trusting your future to set allocations. Meeting the challenge by setting the standard for investment management. Our focus is three-fold: strategy variation, prudent risk management, and adaptive neural network technology. A true tactical approach requires the ability to effectively and successfully take advantage of short term weakness in a longer term trend. TWM investment programs provide a wide variety of investment solutions to suit various portfolios and strategies - each is designed to stand alone, or be used as a building block in a complete investment portfolio. We can also combine our programs with those offered by leading external money managers. Our propriety system technology adjusts dynamically to the markets, with portfolio model parameters adapting to ever changing market conditions. TWM MD 12.10 Today brings a new paradigm for investing. 1 In today’s turbulent economy, it’s important to analyze information, understand human tendencies, and know how to protect the wealth you’ve accumulated. A New Paradigm Meets the New Standard üExtreme Variation üPrudent Risk Management ü Adaptive Neural Network Technology Successful investing is more complicated than ever before, and action in one area can impact other areas. Small stocks are often highly correlated with large and mid cap stocks, and in today’s global markets, what happens with the stocks and bonds of one country is often highly correlated with what is happening in another country. TWM models and strategies, and our approach to risk management successfully factor in these concerns, as we customize your portfolio to fit your needs and goals. Tactical Management Models The key to our investment philosophy is strategy variation. To many, diversification means investing in or trading various non-correlated markets. We don’t use this type of shotgun approach. The problem: even assets defined as diverse can all move down at the same time. Instead, we build a well planned portfolio of markets, and our programs trade multiple strategies based on different underlying premises. Each model is built from a variety of ETFs, index funds, and other mutual funds. Client portfolios are then designed by combining the models, based on the needs of the individual client. new standards The best opportunity for maximum returns with minimum risk. 2 solid approach “True diversification is being invested in different markets and applying different methodologies to invest in each of those markets.” - Matthew Tuttle Tuttle Wealth Management provides three levels of tactical investing, each backed by proprietary dynamically adaptive technology: ● Foundational, actively managed tactical portfolio models ranging from moderate volatility and risk to high risk - high reward opportunity. ● Specialized strategy models for customizing individual client portfolios based on segregated time horizons. ● Counter-trend strategy models seek to buy into weakness and sell into strength. MODERATE AGGRESSIVE SPECULATIVE Regardless of your lifestyle needs or where you are on the retirement timeline, there is generally a place for having a portion of your assets seeking greater growth through properly managed risk. It’s reassuring to know the managers watching your money not only know the markets, they know what drives the markets. 3 Risk Management Our approach is to trade a basket of systems and markets; our risk management algorithm matrix holds everything together. Every effort is made to minimize risk throughout each type of economic environment. The models may go through significant periods holding a large percentage in cash. Each model seeks to provide above average returns with greatly reduced risk. Because different strategies perform differently at different times, our approach can strive to produce superior results consistently. We believe that an investment strategy can only be successful in the long term when following disciplined defined strategies in both bull and bear market conditions. Mechanical methods should be folIowed 100% except when illiquid or extreme events occur; it is important to retain the flexibility to override the systems. These overrides may either positively or negatively affect returns. Our program is not static and will be changed over time. In addition many of our systems are self-adaptive in nature and will automatically adjust to market conditions. In the event of lengthy declines, our risk management philosophy strives to keep these models out of the market entirely, Research Our research will be conducted and approved by our Investment Policy Committee which consists of Matthew Tuttle and outside systems consultants. These may include the dynamic elements of our trading program. Research might also include markets which did not exist when the program was started or markets that were not liquid enough to trade or had a history sufficient to meet our analysis requirements. risk averse 4 twm management Matthew Tuttle is a Certified Financial Planner™ professional and president of Tuttle Wealth Management. The Stamford, CT based company was founded on the philosophy of designing innovative absolute return investment strategies and comprehensive wealth management, for helping clients create a business plan for life. Matthew is a familiar face among the financial media. In addition to speaking at accounting and trade association meetings across the country, he is a frequent guest on Fox Business News, BusinessWeek TV and Channel 12 News, and has been interviewed on both CNBC and Fox News. Matthew has appeared numerous times on CNNfn, notably on the Your Money Show and Dolans Unscripted with Ken and Daria Dolan. He is the author of How Harvard & Yale Beat the Market and Financial Secrets of my Wealthy Grandparents. In addition to his books, Matthew has contributed timely articles to a variety of financial publications, including the CPA Journal, Pennsylvania CPA Journal, TAXPRO Journal, Accounting Crossing, the Fairfield County Business Journal, the Stamford Senior Flyer, and over 25 other publications nationwide. He also is a frequent contributor to Forbes.com, the Wall Street Journal, CNBC.com, SmartMoney, and Dow Jones Newswires. He has been quoted in Kiplinger’s Personal Finance, Money Magazine, USA Today, the Star Ledger, Bankrate.com, the Christian Science Monitor, and the Journal of Financial Planning. In addition, Matthew has been profiled in the New York Times, Stamford Advocate and Greenwich Time. An experienced educator, Matthew teaches personal finance to consumers as an adjunct professor at Norwalk Community Technical College. He instructs through the Continuing Education centers of the Westport, Stamford, Darien, Greenwich, and Katonah districts, and the 92nd Street YMCA. He has also provided continuing education instruction to CPAs at Baruch College, the CPA / LAW Forum and through the CPA Report. He has received the Fairfield County “40 Under 40 Award,” given annually to 40 executives who demonstrate extraordinary leadership qualities plus a strong ongoing commitment to professional development, and have made outstanding accomplishments in their fields. In addition to his books, Matthew has written two chapters for the Life Insurance Answer Book, the desk reference guide for life insurance agents. He has also contributed to the Wealth Management Manual. Confirming his expertise, he is a sought after expert witness in court cases dealing with financial planning matters. Matthew has an MBA in finance from Boston University. TWM MD 12.10 5 Murray A. Ruggiero, Jr. is a systems developer for Tuttle Wealth Management, LLC. He is one of the world’s foremost experts on the use of inter-market and trend analysis in locating and confirming developing price moves in the markets. Murray has been called the Einstein of Wall Street by those who know the value of his amazing work. Both his personal and work history reflect his attention to mathematics. After earning his college degree in astrophysics, Murray began working on neural net and artificial intelligence (A.I.) systems for applications in the investment arena. He was subsequently awarded a patent for the process of embedding a neural network into a spreadsheet. Murray’s reputation as a system developer expanded quickly; it wasn’t long before some of the most powerful names in the investment world began coming to him for help. John L. Murphy, known as the Father of Intermarket Analysis noticed Murray’s work during the early stages, and on several occasions invited the young analyst to appear on his CNBC television show. Murphy has remained one of Murray’s staunchest supporters, openly applauding the practical applications of his work. Business Week magazine featured Murray as one of the nation’s leading experts on applying neural networks to finance and investing. Dozens of high profile traders and professional money managers seem to agree, as they consult Murray on a regular basis in the areas of analysis and systems development. He has been a contributing editor of Futures magazine since 1994. Murray has written over 150 articles, and has been featured on the cover of Omega magazine and other prestigious periodicals. Murray’s first book Cybernetic Trading revealed details of his market analysis and systems testing to a degree seldom seen in the investment world. Reviewers were universal in their praise of the book, and it became a best seller among systems traders, analysts and money managers. He has also co-written the book Traders Secrets, interviewing relatively unknown but successful traders and analyzing their trading methodologies. Dean Kasparian is a market analyst and consultant for Tuttle Wealth Management, LLC. A veteran of the investment industry, Dean has devoted over 20 years to the science and study of quantitative market analysis, using a proprietary system and approach to market strategies and tactical asset allocation. He has acquired and honed a unique blend of skills; not only does he have proven software development expertise, his experience with both trading and investing has given him a deep understanding of the financial marketplace. Dean is the founder and CEO of Sierra Analytics, and Vice President of Online Advisors. In 2005, Dean was recruited to PerTrac Financial Solutions (formerly Strategic Financial Solutions) as Chief Operating Officer. PerTrac is the world’s leading asset allocation and investment analysis software for money managers, hedge funds, or family trusts. In 1988 Dean became Director of Development for AIQ Systems, helping to create and establish the industry standard for Artificial Intelligence screening technology. Track Data Corporation of New York purchased of AIQ Systems in 1994, and Dean was appointed Division President. The company won multiple awards for financial software during his tenure, including Best Trading System. Other areas of specialization included general market timing, trading system development tools, and group / sector analysis techniques. He has provided market analysis for a number of companies, and has appeared as a regular on The Advisors television show and the Wizard of Wall Street radio program. Dean has also appeared frequently as a guest on many local and national financial television and radio programs, and is a featured presenter on the national lecture circuit, speaking on technical analysis, market timing, and designing and testing trading systems, 6 Tuttle Wealth Management, LLC 1 Stamford Plaza 263 Tresser Boulevard 9th Floor Stamford, CT 06901 Phone: 1-800-462-1655 Email: mtuttle@tuttlewealth.com www.tuttlewealth.com contact Tuttle Wealth Management, LLC is an investment advisor registered with the U.S. Securities and Exchange Commission. You should not assume that any discussion or information contained in this brochure serves as the receipt of, or as a substitute for, personalized investment advice from Tuttle Wealth Management, LLC. It is published solely for informational purposes and is not to be construed as a solicitation nor does it constitute advice, investment or otherwise. To the extent that a reader has questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. A copy of our written disclosure statement regarding our advisory services and fees is available upon request. Our comments are an expression of opinion. While we believe our statements to be true, they always depend on the reliability of our own credible sources. Past performance is no guarantee of future returns. TWM MD 12.10