2.3 Sources of monopoly power 2.4 Government policy

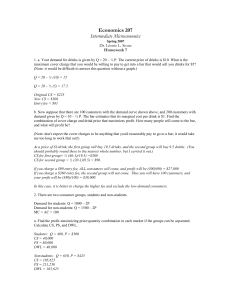

advertisement

2.3 Sources of monopoly power • Basic question: What are the factors that lead to the number of firms in market to be small (or one)? • Reason 1: Economies of scale in production – For reasons shown in Part VII, number of firms in long-run equilibrium will be approximately given by size market/e f f icient production scale where the level of efficient scale is given by the min of the ATC curve. – As illustrated in Fig. 6, some industries have a small optimal-scale-ofproducion, others have a very large one – Think. Can you relate this to the size of the FCs relative to other costs? – Think. Can you use this example to make sense of the changes taking place on the bookstore market? – An extreme case of this, illustrated in Fig. 7, are increasing returns to scale (often called a natural monopoly). – Examples of natural monopolies include most utilities. • Reason 2: Network economies – Cases in which value of using a product increases with number of otehrs suing it – Ex: Facebook, HBO, software • Reason 3: Ownership of essential/critical resources – Ex: Suez Canal – Ex: Unique deposits to a critical mineral required for computing • Reason 4: Government allocation of monopoly rights – Often given for patronage purposes – But also frequently given to give incentives for private sector to carry out expensive investments (e.g., infrastructure) • Reason 5: Patents and copy-rights – Innovators dilemma: > many technologies and goods very expensive to produce but can be copied at close to zero MC > Ex: Star Wars, software > Without copy-right protection no incentive to innovate – If we have time, will discuss patents in more detail at end of this Part of the course. 2.4 Government policy • In order to address the problems associated with the monopolist DWL and distributional issues, the government has three main policy tools at its disposal: 1) Promote competition 2) Regulation 3) Tax policy • Let’s look at each of them 6 2.4.1 Promote competition • The easiest solution is to introduce competition in the market, which removes the source of the inefficiency in the first place • Problem: Some of the reasons for the existence of market concentration, such as increasing returns to scale and network economies, are not easily eliminated • So this policy tool is of limited value • Exception: – Some public investments public investments in R&D can help by promoting the development of new technologies that open markets to competition – Ex: Cost-efficient small reactors would eliminate the natural monopoly structure of power utilities 2.4.2 Regulation • The basic idea of regulation is to get the monopolist to behave as a perfectly competitive firm • To analyze the effect of this policy, assume that the government has full information about the market’s aggregate demand (after all, it can collect it using the same market research methods used by the monopolist) • There are two cases two consider: 1) full information about the firm’s cost, and 2) imperfect information • Case I: Full information – In this case the government has full knowledge of the firm’s cost function – Then the solution is trivial: > Compute qoptimal and the associated price poptimal (= MSBopt = MSC opt ) > Allow the firm to either seel as much as it wants up to qoptimal (quantityregulation) or whatever it wants but at the price poptimal (price-regulation) – In this idealized case the policy restores first-best • Case II: Imperfect information IMPORTANT: > This case is meant to ’challenge’ your understanding. > You will not be asked to solve this problem in PSs or Exams. – The basic idea is that the government needs to choose either policy but it has uncertainty about the firm’s true cost function – A full treatment of this case is beyond the scope of the course, but an example will provide insight into the about the economics of the problem, and on the difficulty of identifying optimal government policies in this setting. – Suppose, as before, that quadratic costs (so that c(q) = Aq2 ) and linear demand (P(q) = 300 q). – Problem: The government does not know if Ahigh = 1 or Alow =0.5 (and it attributes an equal 50% likelihood to both events). 7 – Look at price regulation, so that a policy is a price preg at which the monopolist can sell as much as it wants. – Intuition for the problem: > The government cannot optimize the policy to the cost-parameters because it does not know them. > Instead, the best it can do is to pick a single policy preg , that minimizes the expected value (or averge). – The monopolist reacts to the policy by setting preg = MC so for the parameters of the problem it sets q= if its costs are high and preg 2 q = preg if its costs are low. – In contrast, the efficient level of produciton is given by solution to P(q) = MC which equals 300 = 100 2Ahigh + 1 if the costs are high and 300 = 150 +1 2Alow if the costs are low. > For use in the calculations below, let MSBopt ( A) denote the level of the MSB at the optimum as a function of the cost parameter A, which is given by 200 when costs are high and 150 when costs are low. (Think. How do you know this?) > The next step is to compute the DWL generated by everyp possible combination of the policy and realization of the firm’s costs. > This requiring looking at several cases > Look first at the case in which costs are high (with Ahigh = 1). > As illustrated in Fig. 8, there are several possibilities to consider. > Sub-case 1: preg > 200. – In this case, the quantity traded is given by D ( preg ) = 300 preg , and by assumption is less than the optimal amount of 100. – The DWL in this case is given by the triangle in Fig. 8 (top), which has an area given by 0.5 ⇤ ( preg 2(300 preg )) ⇤ (100 (300 preg )) = 1.5( preg )2 600preg + 60, 000 – Note/intution-check: 1) The DWL is zero when preg = 200 (as it should be, since that prices 8 induces optimal production) 2) The DWL increases with the square of deviations from the optimum. 3) DWL only deined for preg 300, since demand is zero beyond that range. > Sub-case 2: preg = 200 – This case is depicted in Fig. 8 (middle). – The DWL is zero in this case since the policy induced optimal production by the monopolist (for the case of high-costs) > Sub-case 3: preg < 200. – This case is depicted in Fig. 8 (bottom). – In this case the quantity traded is determined by the MC curve (i.e, there is excess demand), and by the arguments above it is given by preg /2. – Assuming that the limited supply is obtained by the individuals with the higher MB for it, the DWL is given by the area of the triangle depicted in the figure, and is equal to 0.5 ⇤ ((300 p reg ) 2 preg 1 ) = (3( preg )2 2 8 preg ) ⇤ (100 1200preg + 120, 000). > Now look at the case where costs are low (with Alow = 0.5). > A similar series of arguments (not described in detail here) allow us to establish that the DWL is as given in the following three sub-cases): – subcase 1: preg > 150. Here the DWL is given by 0.5 ⇤ ( preg (300 preg )) ⇤ (150 (300 preg )) = 1 ⇤ (2( preg )2 2 600preg + 45, 000 – subcase 2: preg = 150. Here the DWL is zero. – subcase 3: preg < 150. 0.5 ⇤ ((300 preg ) preg ) ⇤ (150 preg ) = 1 ⇤ (2( preg )2 2 600preg + 45, 000. • Fig. 9 (top and middle) provides a plot of how the DWL changes with preg in both cases • Given the government’s uncertainty about the firm’s costs, the best it can do is to maximize the expected DWL, which is given by 1 1 DW L( Ahigh ) + DW L( Alow ). 2 2 • The government’s problem can then be written as max preg 0 EDW L( preg ) • Fig 9 (bottom) describes the shape of the optimal DWL, as well as the solution. • The following two properties of the solution are generic and intuitive. 9 • Property 1: optimal solution is to set the preg between the optimal MSB of the of the two cost-cases (i.e., preg is between 150 and 200). • Property 2: it is optimal to always have a positive DWL ex-post in orde to minimize DWL on average. • Why/intuition? – As shown in Fig. 9, the slope of the DWL is approximately zero at the opimum of each case. – Thus, it makes sense to introduce a little bit of DWL in both cases, as opposed to only distort the market ex-post in one of the cases. 2.4.3 Tax policy • Another possibility is to give a subsidy to the monopolist in order to restore its incentives • Fig. 10 shows that, under full information, the optimal subsidy is given by t = P(qopt ) MR(qopt ). • Under these subsidy the FOCs of the monopolist become (at interior solution) MC = MR + t = P(qopt ) = MSBopt which are sufficient to restore optimality • If the subsidy is financed with lump-sum taxes (that do not introduce inefficiencies of their own) the policy restores efficiency • In the case of uncertainty the analysis is similar to the one of regulation and leads to similar conclusions: Can’t fully restore efficiency for every state of the world, only minimize DWL on average. 10