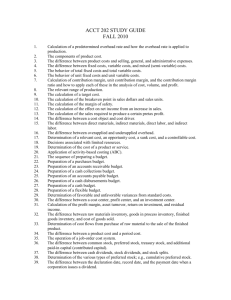

5. Profit-Oriented Bank Management Perspectives and Methods of

advertisement

Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5. Profit-Oriented Bank Management 5.1 Systems of Bank Calculation and Bank Management Perspectives and Methods of Bank Management Perspective Maximization of return Limitation of risk E(x) max! R<X Bank calculation - Interest margin calculation - Marktzinsmethode Documentation Planning - Cost accounting - Other risk measures Management of single transactions, portfolio management, incremental Value at Risk Management of single transactions, floor prices Internal transfer prices, budgeting or internal markets for company resources - Measures of downside risk, esp. Value at Risk Management Profit-oriented incentive systems Internal transfer price, limiting systems or internal equity markets Sanction in case of violation of limits Controlling division Controlling Risk management, Treasury Management of the entire bank with risk adjusted performance measures 140 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.2 Fundamentals of Bank Calculation Tasks of bank calculation (Pfingsten et al., p. 629): Documentation Preparing data for planning purpose Provision of crucial information Management of decision makers’ behavior Controlling of business processes “Wertbereich” versus “Betriebsbereich” in business and bank calculation 141 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management “Wertbereich” versus “Betriebsbereich” in the Contribution Margin Calculation Contribution margin calculation interest earnings - interest expense = customer interest contribution (“Konditionsbeitrag”) (section 5.3, 5.4) - risk costs (section 5.5.1) = contribution margin I (“Wertbereich”) + / - directly attributable commissions (section 5.5.2) = contribution margin II (“Wertbereich” and commission income) + / - attributable operating revenues and costs (section 5.5.2) = contribution margin III (market-related business performance) Calculation of single deals/transactions (section 5.6) aggregation (section 5.7) Management of the entire bank (section 5.8) 142 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.3 Traditional Methods to Calculate the Net Interest Income Interest Obligation Balance Vol. (mio.) 15 Ø interest 0% Revenues (mio.) Position 0 Unlimited maturity (real estate, buildings) Equity Debt with fixed interest period > 10 years Position Expenses (mio.) Ø interest Vol. (mio.) 0 0% 12 1.4 7.0% 20 15 8.5% 1.275 Loans with fixed interest period > 10 years 12 8.3% 0.996 9.5-10 years 9.5-10 years 0.408 6.8% 6 18 8.1% 1.458 9-9.5 years 0.536 6.7% 8 … … … … … … … … 30 6.1% 1.83 0.5- 1 year 0.5 - 1 year 2.2 4.0% 55 Sum of all Sum of all liabilities assets with with fixed fixed rate of rate of interinterest est 9.12 5.7% 160 Overdraft credits Short-term deposits 4.05 4.5% 90 Total assets Total liabilities 190 7.1% 13.49 60 10.5% 6.3 250 19.79 9-9.5 years 13.17 Objectives: - Calculation of the net interest income - Identification of the interest rate risk (risk of interest rate changes) 143 250 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Pooling Method versus “Schichtenbilanzmethode” Pooling method: The interest reference rate is the average interest rate of the other side of the balance sheet, respectively “Schichtenbilanzmethode”: The interest reference rate is the average interest rate of a (in terms of liquidity and profitability) comparable “Schicht” of the opposite side of the balance sheet Critical review of both methods: Objective inconsistency: Refinancing actually under different conditions Twofold attribution of the margin to lending and deposit business or random distribution Temporal inconsistency: The interest reference rate changes over time The Structure of the “Schichtenbilanz” and the pool change over time 144 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Example of Pooling Method and “Schichtenbilanzmethode” Loans with a fixed period of interest of 9.2 years: 7.9% For the interest obligation balance see slide 35 Pooling method: Interest reference rate as average interest rate of liabilities: (160/250)*5.7% + (90/250)*4.5% = 5.268% margin: 7.9% - 5.268% = 2.632% “Schichtenbilanzmethode”: Comparable “Schicht”, e.g. financial assets with comparable fixed interest rate, in this example 9 - 9.5 years: 6.7% margin: 7.9% - 6.7% = 1.2% Twofold attribution of the margin to lending and deposit business? Adjustment in the example: Pooling method: Average interest rate of assets (190/250)*7.1%+ (60/250)*10.5%=7.916% Gross interest spread of the whole balance sheet: 7.916%-5.268%=2.648% Margin of the loan: 2.632%-0.5*2.648=1.308% “Schichtenbilanzmethode”: Gross interest spread 9 – 9.5 years: 8.1% - 6.7%= 1.4% Margin of the loan: 1.2%- 0.5*1.4%= 0.5%. 145 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.4 Marktzinsmethode 5.4.1 Basic Idea Identification of sources of success in banking calculation Requirements: The bank has access to a perfect capital market (that is, complete and perfectly competitive) Completeness: Every new financial asset can be replicated with already existing financial assets Perfect competition: Banking transactions can be replicated frictionless on the capital market In the equilibrium of a perfect market: additivity property and absence of arbitrage and E.g.: Two-period loan t0 t1 t2 ? = b Replication with two zero-coupon bonds t1 t2 t1 t2 + a 146 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Interest Rate, Fixed Period of Interest and Success in Banking Key source of success in the banking business: interest income Yield curves as a function of fixed interest rates: 7,0% normal yield curve 6,0% inverse yield curve 5,0% flat yield curve 4,0% 3,0% 2,0% 1,0% 0,0% 1 year 2 years 3 years 4 years 5 years 6 years 7 years The sources of success for the interest rate business: - Customer interest contribution (“Konditionsbeitrag”): Difference to the interest reference rates with the same maturity - Mismatch contribution (“Strukturbeitrag”) (?): Difference between market interest rates with different maturity 147 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Customer Interest Contribution and Mismatch Contribution (In the Basic Concept of the Markzinsmethode I) Clients Clients Bank Lending business with clients Deposit business with clients Calculation of the customer interest contribution Hypothetical alternative investment on the capital market Calculation of the mismatch contribution Hypothetical alternative investment on the capital market Perfect capital market 148 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Numerical Example: Customer Interest Contribution and Mismatch Contribution Bank Balance Sheet [in mio.] customer debit market interest interest interest contr. rate assets liabilities market credit customer interest interest interest rate contr. 0.6% 4.1% 3.5% Acceptance credit (1 year) 100 Saving deposit (3 months) 140 3.2% 2.5% 0.7% 3.7% 8.9% 5.2% Consumer credit (3 years) 80 Savings bond (3 years) 90 5.2% 4.5% 0.7% 1.3% 7.5% 6.2% Mortgage loan (7 years) 140 Bond (5 years) 90 5.8% 6.1% -0.3% 1.68% 6.79% 5.11% 4.49% 4.08% average weighted interest rate interest reference rate for mismatch contribution 3.2% 1.91% mismatch mismatch contr. assets contr. liabilities mismatch contribution: 0.61% customer interest contribution: 2.1% 149 -1.29% 0.42% Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.4.2 Calculating a Single Deal Using Marktzinsmethode Replication of a Loan with Other Assets Loan: 2 years to maturity, 100 monetary units, 6%, retrospective interest payment and amortization, 50% amortization p.a., (no default risk) Other (default risk free) assets on the money and capital market: Coupon bond 1: 1 year, 3.5%, quoting at par Coupon bond 2: 2 years, 4.5%, quoting at par t0 t1 t2 -100 56 53 Coupon bond 2 (2 years, 4.5%) -53/1.045 = -50.72 50.72*4.5% = 2.28 53 Coupon bond 1 (1 year, 3.5%) -53.72/1.035 = -51.90 56-2,28 = 53.72 2.62 0 Credit: 6% Difference = Net present value 150 0 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Intertemporal Allocation of the Net Present Value (NPV) First step: Calculation of arbitrage-free discount factors using capital market prices (here: coupon bond 1 and 2) These discount factors can be interpreted as prices of normalized zero bonds (a normalized zero bond pays exactly 1 monetary unit at maturity). The price of a normalized zero bond in t0 is called ZB0,t, where t is the time to maturity. Coupon bond 1 is identical to a 1-year zero bond, thus: ZB 0,1 1 / 1.035 0.9662 . The arbitrage-free price of the 2-year zero bond results from replication: t0 t1 t2 Coupon bond 2 (2 years, 4.5%) -100 4.5 104.5 Zero bond (0,2) 104.5* ZB0,2 - -104.5 Zero bond (0,1) 4.5*ZB0,1 = 4.3478 -4.5 Difference = Net present value ! 0 0 100 104.5 ZB 0, 2 4.5 ZB 0,1 ZB 0, 2 0.9153 151 0 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management i) Effective Customer Interest Contribution Margin Calculation of the annuity pursuant base on the basis of the effective capital t0 Capital base Discount factor Present value of the capital base Annuity pursuant base t1 t2 100 50 0,9662 0.9153 0.9662*100 = 96.62 0.9153*50 = 45.77 142.39 Effective customer interest contribution margin = 2.62/142.39 = 1.84% Annuity pursuant of the customer interest contribution on the basis of the effective customer interest contribution margin t0 t1 t2 100 50 Annuity 1.84%*100 = 1.84 1.84%*50 = 0.92 Present value of the annuity 0.9662*1.84 = 1.78 0.9153*0.92 = 0.84 Capital base NPV 2.62 152 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management ii) Annuity Pursuant for Capital Congruent Refinancing For coupon bonds quoting at par: t0 t1 t2 -100 50 50 6 3 Loan: Capital (re)payment Interest payment Refinancing: coupon bond 1 (1 y., 3.5%): Capital (re)payment 50 -50 Interest payment -3.5%*50 = -1.75 Refinancing: coupon bond 2 (2 y., 4.5%): Capital (re)payment 50 Interest payment 0 -50 -4.5%*50 = -2.25 -4.5%*50 = -2.25 Capital difference 0 0 0 Interest difference 0 2 0.75 0.9662*2 = 1.93 0.9153*0.75 = 0.69 Present value of the interest surplus 2.62 Arbitrarily distribution of the NPV across the single periods? 153 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.4.3 Mismatch Contribution and Interest Rate Risk Concept of period transformation: Short-term financing (cheap) and long-term investment (expensive) Premise: Normal yield curve Is it possible to earn a profit doing period transformation solely? Idea: Replication of the basic business using short-term forward contracts No interest rate risk due to changing refinancing condition Credit: 6% t0 t1 t2 -100 56 53 53 1 i1, 2 -53 Refinancing in the second period (1 year, i1,2) Refinancing in the first period (1 year, 3.5%) Difference = NPV 56 53 1 i1, 2 53 56 1 i1, 2 1 i 0,1 56 53 1 i1, 2 1 i 0,1 100 Calculation of the forward rate i1,2? 154 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Absence of Arbitrage on the Capital Markets The forward rate is calculated so that the value of a multi-period investment equals the value of a repeated short-term (forward) investment (Otherwise a risk-free profit (arbitrage) is possible by taking a short position in the more valuable investment and a long position in the other one) Cash flow at time t 2-year investment with reinvestment of interest earnings Investment t0 -1 t1 -i0,2 Interest and amortization Revolving 1-year investment Investment Interest and amortization -1 i0,2 -(1 + i0,1) (1 + i0,2) + i0,2(1 + i1,2) t2 (1 + i0,1) (1 + i0,1)(1 + i1,2) 1 i i 1 i 1 i 1 i 0, 2 0, 2 1, 2 0 ,1 1, 2 1 i0, 2 1 i1, 2 1 i0,1 i0, 2 i1, 2 1 i0 , 2 1 i0,1 i0, 2 1 1 4.5% 1 5. 5 % 1 3.5% 4.5% (Notice to calculate with the correct interest rates esp. if coupon bonds do not quote at par!) Alternative and maybe easier way to calculate the forward rate: arbitrage strategy with zero bonds. 53 1 0.0 5 100 2.62 1 0.035 56 NPV of the whole transaction in the example above: NPV of the customer interest contribution: 2.62 Mismatch contribution: 0 An ex post positive mismatch contribution is the result of interest rate speculation! Consequences for banking policy? 155 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.5 Some More Components of the Contribution Margin Calculation 5.5.1 Costs of Risk Standard risk-costs versus real risk premium 2 1 E(x) Appointed repayment sum 1 Standard risk-costs of the portfolio, covered by (credit) terms Charged to the amount of the expected loss 2 Variation of the earnings, covered by equity Charged to the amount of the additional costs for the required economic or regulatory (equity) capital 156 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.5.2 Revenues and Costs of the Operating Sector Revenues: Provisions and charges Costs: Problem of attribution out of a technical perspective Problem of attribution out of an operational perspective Solution in banks: Activity based costing (process-oriented calculation of standard direct costs) 157 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Example: Standard Costs per Unit of a Small Loan (2-Years to Maturity) Personnel expenses Operation Preliminary talk Application handling Account opening “Schufa” information Loan folder creation Account analysis Data processing costs Operation Account opening/closing Account management Account closure Unit per loan 1 1 1 1 1 8 Minutes per unit 20 30 10 5 10 8 Costs per minute 3.25 1.90 1.90 1.90 1.90 2.10 Standard costs per unit 65 57 19 9.50 19 134.40 303.90 Unit per loan 2 24 2 Seconds per unit 0.3 0.3 0.5 Costs per second 2.50 2.50 2.50 Standard costs per unit 1.50 18 2.50 22 Units per loan 1 1 1 1 1 8 Costs per unit 0.40 0.20 0.20 1.45 0.15 1.00 Standard costs per unit 0.40 0.20 0.20 1.45 0.15 8 10.40 Other material expenses Material Application form Form on provision of collateral “Schufa” information Loan folder Loan confirmation form Postal charges Sum = Standard costs per unit of a small loan 336.30 (see Schierenbeck, p. 369) 158 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.6 Single Transaction Calculation as Contribution Margin Calculation Gross contribution margin (Actual contribution margin I) - Margin of standard risk costs = Net contribution margin - Standard operating expenses margin less provision margin = Total net contribution margin II (Actual contribution margin II) - Debit contribution margin for operating expenses and equity = Excess profit/deficit (Actual contribution margin III) (see Schierenbeck, p. 370) Each in percent of the present value of the particular cash flows relating to the present value of the average credit/investment volume 159 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.7 Aggregation of Results for Banking Management Ways of Aggregation Calculation of business transaction/ Account calculation Calculation of the clients consultant Product Client calculation calculation Product line Client group calculation Calculation of a profit center calculation Calculation of a branch from one district Aggregation to the performance of client business Profit center Product type calculation calculation Accounting and client calculation (see Schierenbeck, p. 399-403) 160 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Objectives of the Different Calculation for Controlling Profit center calculation: Product type calculation: Account and client calculation: 161 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 5.8 Global Bank Management Differentiated presentation of the bank’s performance: Market performance (client business) Customer interest contribution - standard costs of risk + commission earnings - standard operating expenses Risk performance (client business) Standard costs of risk - Actual costs of risk Operating performance (cost units) Standard operating expenses - Actual operating expenses Client business performance + Trading performance Treasury performance Contribution of trading income - direct costs of the trading section Contribution of treasury income - direct costs of treasury activities Investment performance Performance of investing central positions - direct costs respectively opportunity costs of central positions Central performance - Overheads = Operating income of the entire bank + Other and extraordinary earnings = Net earnings of the entire bank (see Schierenbeck, p. 407) 162 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management ROI Scheme Gross interest margin 1,7% Provision margin 0.9% Gross earnings margin 3.2% Return on equity after taxes Return on equity before taxes 10% 20% Gross profit margin Trading margin 1.3% 0.5% Net profit margin AOSE margin 1.0% 0.1% Risk margin Tax ratio Personnel expenses margin -0.3% 50% 1.2% Equity ratio Gross requirements margin 5.0% 1,0% Material costs margin 0.7% (see Schierenbeck, p. 421) 163 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Benchmark for Ratios 1. Transaction volume Compensated or uncompensated balance sheet? Average or reporting date balance sheet? Inclusion of off-balance positions? 2. Equity Balance sheet equity Liable equity 164 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Literature Burghof/Henke (2000): Kreditderivate und Bankenaufsicht – Entwicklungen und Perspektiven in Deutschland und international, in: Burghof et al. (Hrsg.): Kreditderivate. Hartmann-Wendels/Pfingsten/Weber (2000): Bankbetriebslehre, insbes. Kapitel H, I. Krümmel (1989): Unternehmenspolitische Vorgaben für die Risikosteuerung der Bank, in: Krümmel/Rudolph (Hrsg.):Finanzintermediation und Risikomanagement. Schierenbeck (2001): Ertragsorientiertes Bankmanagement. 165