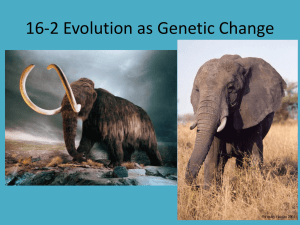

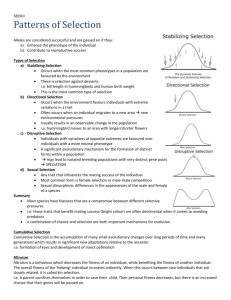

Directional, stabilizing and disruptive selection

advertisement