1031 Exchange Real Estate Handbook

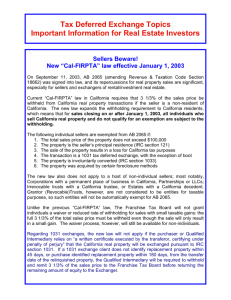

advertisement