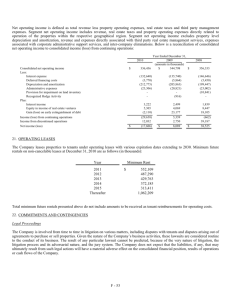

Long-term Assets, Long-term Debt, and Leases Assigned Exercises

advertisement