Commitment Form S - Catholic Tuition Support Organization Arizona

advertisement

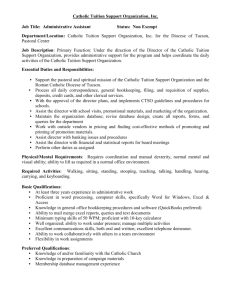

S-CORPORATION APPLICATION FOR PRE-APPROVAL FOR THE CORPORATE TAX CREDIT FOR CONTRIBUTIONS MADE THROUGH ARIZONA’S CATHOLIC TUITION SUPPORT ORGANIZATION (CTSO) Thank you for your interest in the Corporate Tax Credit. Arizona’s Catholic Tuition Support Organization will submit your request to contribute to CTSO. The Arizona Department of Revenue (ADOR) will qualify your contribution and will notify us within a twenty-day approval period. Time is of the essence because contributions are accepted on a first-come-firstserved basis. CTSO will be notified by the ADOR of the amount approved for your corporation. Mail or fax the completed form to: Arizona’s Catholic Tuition Support Organization Gracie Quiroz, Executive Director PO Box 31 Tucson, AZ 85702-0031 Fax: (520) 838-2578 If you have questions regarding completion of this form, please contact Gracie Quiroz at (520) 838-2571. This donation is for the Corporate Tuition Tax Credit (A.R.S.43-1183), from a corporation filing as an S-Corporation. This donation is for the Corporate Disabled/Displaced Student Tuition Tax Credit (A.R.S.431184), from a corporation filing as an S-Corporation. S-Corporation Name: Contact Name/Phone: S-Corporation’s Address: City: S-Corporation Employer Identification Number (EIN) State: Zip Code: Tax Year: Amount your S-Corporation is requesting to contribute: $ Arizona’s Catholic Tuition Support Organization will notify you of the amount qualified by the Arizona Department of Revenue. The amount approved will need to be mailed to CTSO within twenty days of notification. Again, thank you for your support.