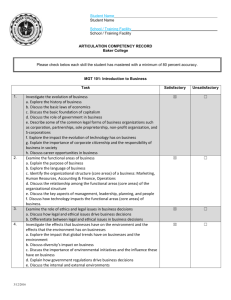

S-Corporation Requirements

advertisement

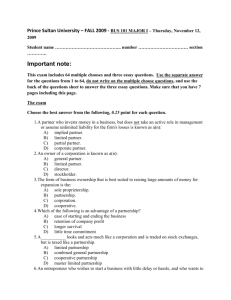

“To S, or Not to S: Subchapter S Corporations” Chris Ward Course: Acct 4611 Professor Hagan Ward 1 Table of Contents Title Page……………..……………………………………………………….……………………………1 Table of Contents..……………………………………………………………….……………………..2 Introduction………………………………………………………………………………..……………..3 Business Entity Options.....………………………………………….……………………..…….....3 Incorporations…...………………...….………………………………………………………………...4 C Corporations…………………………………………………………………………………..……….5 Limited Liability Company…………………………………………………………………………..5 S Corporations…………………...….……………………………………………….………………….6 S Corporation Requirements………………………………………………………………..………6 What is Reasonable Compensation?........................................................................8 Moving Forward………………………………………………………………….……………………..9 Conclusion…….………………………………………………………………….……...………………10 Bibliography…..……………………………………………………………...…………………………11 Ward 2 Introduction “A penny saved is a penny earned,” a wise man named Benjamin Franklin once stated. This is a maxim that is practiced by companies all over the world. Cutting expense costs, bargaining for a discount, and buying a product from a cheaper brand all have one valuable idea in common: Saving Money. There are various avenues that business owners follow in order to save money, and this paper will be focusing on one of them; Subchapter S Corporations. The Tax Code is not an exception when it comes to wanting the best bargain, and with the S-Election a business owner can do just that. In this paper, I will be discussing the beneficial aspects, as well as the negative side of electing to become a Subchapter S-Corporation. Business Entity Options So you have decided to open up your own business and are unsure where to even begin. Among the many pivotal decisions you will have to make, an important one will be to choose if you are going to embark as a Sole Proprietorship, or if you will incorporate your business. There are plenty of options to consider if you are incorporating your company, and each option has advantages as well as disadvantages. Many business owners are concerned with knowing which business entity is the best or most appropriate option. The answer to that question is similar to the answer to most other tax related questions… it depends!1 This paper will focus on one of the potential options, S-Corporations. I will be comparing and contrasting S-Corporations with other common business entity options, Sole Proprietorships, C-Corporations, and Limited Liability Companies. 1 Hagan, Joey. Tax Accounting Lecture. Spring 2013. Ward 3 There are many important considerations to take into account when making this decision. A few of the highlights are the Level of Liability Protection, Ease of Setup, and Tax Benefits. For starters, if you are opening a Sole Proprietorship a vital thing to remember is that there will not be very much protection regarding your personal assets in terms of liability. This means that if your company is sued and there are not enough funds in the company to pay it off, the prosecutor can come after your personal assets to recoup the funds. Ultimately, you could lose your personal home because of a work related incident. An advantage to being in a sole proprietorship is that it is very simple and easy to startup. All that’s required in a sole proprietorship is to sell goods or services and create revenue. The tax implications of a sole proprietorship are that you are taxed on an individual rate. There are not many tax benefits from being in a sole proprietorship, and it is also a risky path to take considering the lack of liability protection. For the risk-adverse person, it would be disheartening to know that at any given point a disgruntled customer could try and take your home away. Luckily, there are other options to consider. Incorporations One of the main reasons people incorporate is to have access to the liability protection on their personal assets. However, an equally common reason is to create a professional and public image for the company. An organization can sound more professional just by adding the word incorporated at the end of their name. For instance, a handyman working under a sole proprietorship with a business name of “Jerry’s Fix-It Company” gives off a small business vibe, and could turn away potential customers. However, if Jerry incorporated his company and became “Fix-It Incorporated” it immediately gives off a more professional sounding connotation. The customer will not know if it is one man performing small jobs, or if it is a large business Ward 4 with a big city headquarters. This can lead to a surge in his customer base just by creating a brand for himself. For reasons such as this, it is easy to see why a business would want to become incorporated. C-Corporations If your company has decided to go the incorporated route, you next have to choose between three various options. Your organization can become a C-Corporation, an SCorporation, or a Limited Liability Company. The default selection for a new incorporation is a C-Corporation. Some advantages to being a C-Corporation are that you may select your own fiscal year instead of following the calendar year, and there is the potential for tax savings by income splitting; a strategy to lower income revenue enough to get into a lesser tax bracket. The primary disadvantage to C-Corporations is that Dividends are subjected to double taxation, once at the corporate level and again at the personal level. Limited Liability Companies Another feasible business structure is to create a Limited Liability Company, also known as an LLC. They are referred to as disregarded entities, because an LLC with a single owner is taxed as a Sole Proprietorship, and an LLC with multiple owners is taxed as a Partnership. This is a major benefit, and it is easy to see why forming an LLC has become so common since its inception. However, there is less protection for personal liability in an LLC as opposed to incorporations. Another disadvantage to an LLC is that all income is subjected to selfemployment tax; which will lead to having larger overall taxes. Also, LLC’s can be subjected to extra state taxes since there isn’t a rule that states must tax LLC’s in the same manner as the federal government. Ward 5 S-Corporations This brings me to the main focus of this paper, S-Corporations. S-Corporations have been in existence for over 50 years, dating back to 19582. President Eisenhower deemed it necessary to create a type of corporation beneficial to the small business owners. Working alongside Senate Finance Chairman Harry Byrd, Eisenhower’s cabinet was able to create what is known today as the S-Corporation. For a general background of what an S-Corporation is, you can think of it as very similar to both an LLC and a C-Corporation, with a few key differences. A huge tax advantage for S-Corporations is that profits from an S-Corporation are not subjected to self-employment tax. This is extremely beneficial for small businesses where working capital is in high demand. A disadvantage for S-Corporations is that rules pertaining to retain your SElection are very strict and can be difficult to maintain. However, if the incorporation can retain their S-Election status, it can lead to some very beneficial tax savings. S-Corporation Requirements When electing to become an S-Corporation your company must meet a few specific regulations for tax purposes regarding shareholders. In order to qualify for the S-Election, your company must meet 4 specific standards3. The first is that every shareholder in your company must be a human being; another company cannot be a shareholder. The second rule is that the total number of shareholders cannot be greater than 100 separate individuals. Family members however, are treated as one combined individual. The third regulation is that every shareholder 2 3 Stancil, John. The CPA Journal. Has the S Corporation Outlived its Usefulness? Feb 2012. Pages (40-45) Stancil, John. The CPA Journal. Has the S Corporation Outlived its Usefulness? Feb 2012. Pages (40-45) Ward 6 must be a domestic resident of the United States. For tax purposes the shareholders must be citizens of the United States, so that the income may be taxed on a personal level. Finally, the last requirement is that there is only one class of stock. This ensures that all outstanding shares of stock are equal in value. As long as your company meets all of those requirements, you may elect to become an SCorporation. By filling out Form 2553 and submitting it to the Internal Revenue Service, a company announces it would like to become an S-Corporation. IRS Form 2553 must be filed with the Internal Revenue Service before the 16th day of the 3rd month of the tax year. All current shareholders must sign Form 2553 to ensure that this is the desired business structure of the company. Once a company has achieved S-Corporation status, it has to maintain its shareholder regulations in order to retain the title of being an S-Corporation. Now that your company has attained S-Corporation status, there are a few major tax benefits you will notice immediately. An S-Corporation is considered to be a “pass-through entity”, meaning that any income is passed on from a company directly to its shareholders. This leads to avoiding income taxes on a corporate level. Instead of the company paying the taxes on income, the shareholders pay for it on a personal level. Before dividends are distributed to each shareholder the corporation must pay the officers of the business a “reasonable compensation” for their efforts throughout the fiscal year. This is the only money that is subject to the Social Security and Medicare Taxes. Once a reasonable compensation has been paid to each officer, the corporation then funnels the remaining income to its shareholders. This is the major benefit of the S-Corporation as opposed to a C-Corporation, LLC, or a Sole Proprietorship. In each of those entities, all earnings are subjected to the Self-Employment taxes; however the shareholder’s piece of the S-Corporation income is not subjected to the Self-Employment taxes. Ward 7 With rising tax rates on self employment, S-Corporations have become even more popular as the tax benefits have skyrocketed. What is Reasonable Compensation? Because the salary to the officers is the only income that can be subjected to the SelfEmployment tax, it is common for shareholder-employees to lower their salaries in order to avoid the taxes to an even greater extent. However, if the salaries are not up to what is considered “reasonable compensation” the S-Corporation can be sought after through the law. So what exactly is reasonable compensation, and to what criteria must a corporation meet in order to avoid being penalized? A precedent setting moment was seen in the 2012 court case Watson v. Commissioner in the 8th Circuit. In the Watson v. Commissioner4 case, CPA David Watson paid himself what he considered a reasonable compensation of $24,000 over a two year span in the early 2000’s. During that same two year span, he collected over $375,000 in non-taxable distributions. The court disagreed with Watson claiming that a fair compensation would have been closer to $93,000 a year. This meant that Watson had to reclassify almost $70,000 per year of the nontaxable distributions, and instead categorize them as salary. In the end Watson’s corporation was responsible for over $23,000 in payroll taxes and interest, along with penalties. This court case was a bold statement towards others involved with an S-Corporation. After announcing the estimated reasonable compensation, the engineer that calculated the number went public with his formula5. By referencing MAP surveys that were conducted by the American Institute of CPA’s, he determined that a typical non-owner officer of a firm close in size of Watson’s could expect to 4 5 Watson v. Commissioner Court Case: 668 F.3d 1008 (8th Ct.) Watson v. Commissioner Court Case: 668 F.3d 1008 (8th Ct.) Ward 8 receive $70,000. Since Watson was also a stakeholder in the corporation, the engineer marked up the salary by 33% to achieve the $93,000 figure6. Because of this case, corporations now have a blueprint to quantify what exactly reasonable compensation is. Moving Forward It is uncertain what the future of S-Corporations will look like. With the creation of the Limited Liability Company, and a widening tax gap due to S Corporation owners not filing properly, there are a few very immediate threats to the demise of the S Corporation. It is estimated that there is a $22 Billion7 gap annually, between the amounts of tax revenues being paid and what should actually be collected. The factors attributing to this gap are incorrect reporting of items affecting net income and a staggering number of S Corporations that did not even file returns. Limited Liability Companies are ever growing in popularity and that fact poses the question are S Corporations still necessary? Small businesses would beg a resounding yes; as the S Corporation can lead to major tax benefits, but some tax experts would argue against it. John Stancil suggests otherwise stating8, “The current tax situation with regard to S Corporations cannot continue.” He later adds, “The LLC is a viable alternative to S Corporations and it is much simpler form of organization.” The one major tax benefit of S Corporations could also be threatened in the near future as well. Congress is now beginning the process of diminishing the Self-Employment exclusion that sets S Corporations apart from the rest of the pack. 6 Watson v. Commissioner Court Case: 668 F.3d 1008 (8th Ct.) Stancil, John. The CPA Journal. Has the S Corporation Outlived its Usefulness? Feb 2012. Pages (40-45) 8 Stancil, John. The CPA Journal. Has the S Corporation Outlived its Usefulness? Feb 2012. Pages (40-45) 7 Ward 9 Conclusion While it can become a very complicated form of business, the S-Corporation still has major upsides to the small business owner. By avoiding the Self-Employment tax on a majority of its company’s income, it is obvious to many why the S-Corporation is still a practical choice. If Congress decides to do away with this specific tax exemption, the practicality of running a Subchapter S-Corporation becomes nearly obsolete. In the mean time, all of the companies that wish to enjoy the benefits of an S-Corporation Election will continue to do so. As long as saving a penny is still earning a penny; S-Corporations will live on. Ward 10 Bibliography Hagan, Joseph. Tax Accounting Lecture. Spring 2013. Internal Revenue Code Title 26- Subtitle A- 1361. Subchapter S Nitti, Tony. Forbes Magazine, Top Ten Tax Cases of 2012, December 6, 2012. Peebles, Laura. Trust & Estates Newspaper- Donations of Subchapter S Stock – Jun 2012 Stancil, John. The CPA Journal – Has the S corporation Outlived its Usefulness? Feb 2012. Pages (40-45) TaxAlmanac.org – Treasury Regulations, Subchapter A, Sec. 1.1368-2 Watson v. Commissioner, Court Case: 668 F.3d1008 (8th Ct.) Ward 11