Determinants of Store-level Price Elasticity

advertisement

Determinants of Store-Level Price Elasticity

Author(s): Stephen J. Hoch, Byung-Do Kim, Alan L. Montgomery, Peter E. Rossi

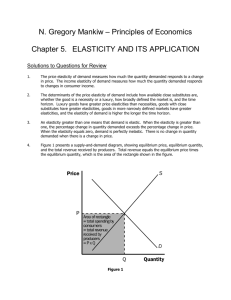

Source: Journal of Marketing Research, Vol. 32, No. 1, (Feb., 1995), pp. 17-29

Published by: American Marketing Association

Stable URL: http://www.jstor.org/stable/3152107

Accessed: 15/07/2008 17:56

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=ama.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit organization founded in 1995 to build trusted digital archives for scholarship. We work with the

scholarly community to preserve their work and the materials they rely upon, and to build a common research platform that

promotes the discovery and use of these resources. For more information about JSTOR, please contact support@jstor.org.

http://www.jstor.org

STEPHENJ. HOCH,BYUNG-DO

KIM,

and PETERE. ROSSI*

ALANL.MONTGOMERY,

Using weekly scanner data representing 18 product categories, the

authors estimated store-specific price elasticities for a chain of 83

supermarkets.They related these price sensitivities to a comprehensive

set of demographicand competitorvariables that described the trading

areas of each of the stores. Despite the inabilityof previous research to

find much of a relationshipbetween consumer characteristicsand price

sensitivity,11 demographicand competitivevariablesexplainon average

67% of the variationin price response. Moreover,the authorsfound that

the consumer demographic variables are much more influentialthan

competitivevariables.Theirfindingsopen the possibilityfor more effective

everyday and promotional pricing strategies that exploit store-level

differences in price sensitivity.

Determinantsof

Store-Level

Price

Elasticity

design of promotions, choice of regular shelf prices, and

pricing of privatelabel brands.

Using store-level scanner data from Dominick's Finer

Foods (DFF), a major chain in the Chicago metropolitan

area,we develop price elasticity measuresfor each store.We

obtain store-level price elasticity estimates in each of 18

productcategories.These elasticities exhibit a great deal of

variation across the diverse set of DFF store locations,

demonstratingthat individual stores have distinct price response profiles. These distinct store price profiles for each

store provide the necessary condition for successful

micromarketing.

To provide insight into the determinantsof price sensitivity and for predictivepurposes,we then relateour price elasticity estimates to consumerdemographiccharacteristicsas

well as to measuresof the natureand extent of local market

area competition.Our findings can be used to predict price

sensitivityon the basis of readilyavailabledemographicand

competitiveinformationfor undevelopedstore locations, or

to help retailers who are unwilling or unable to conduct

time- and computer-intensiveeconometricanalyses of store

scanner data. A small set of demographicand competitive

environmentalvariablesexplains two thirdsof the variation

in the price elasticities across stores. For the most part,there

areconsistentpatternsin the sign and size of the relationship

between the explanatoryvariablesand the price elasticities

across the 18 categories. We use pooling methods to summarize the informationfrom individual category analyses

and provide furtherevidence on the commonality between

categories.

The approachof the paper is as follows. First, we develop a conceptual frameworkthat guides the selection of demographic and competitive variables and review work on

the correlatesof price sensitivity that uses either household

Micromarketingseeks to customize retailing policies to

exploit differences across stores in consumercharacteristics

and the competitive environment. This store-level customization presupposes the existence of significant and

identifiable differences in consumer response to retailing

policies across stores. To implementa micromarketingstrategy, the retailermust develop quantitativemeasuresof relevant aspects of consumer response to differentmerchandising policies and then adopt a method for computing these

measureson a store-by-storebasis. The retailercan then implement customized pricing on the store level. In addition,

retailersand manufacturerscan work togetherand lever existing promotional expendituresthrough more precise micromarkettargetingof stores. The premise is simple: Spend

disproportionatelymore in stores that are most sensitive to

changes in promotionand price.

We focus on consumerresponse to price changes, as capturedby price elasticity measures.Price sensitivityis fundamental to many importantaspects of retail policy, including

*Stephen J. Hoch is Robert P. Gwinn Professor of Marketingand BehavioralScience at the Universityof Chicago GraduateSchool of Business.

Byung-Do Kim is Assistant Professor of Marketing at Carnegie-Mellon

University GraduateSchool of IndustrialAdministration.Alan L. Montgomery is Assistant Professorof Marketingat the Universityof Pennsylvania WhartonSchool of Business. Peter E. Rossi is Professorof Marketing

and Statistics at the University of Chicago GraduateSchool of Business.

The authors thank Dominick's Finer Foods, InformationResources Inc.,

and MarketingMetrics for their assistance and the provision of data, and

Xavier Dreze and Mary Purkfor their indispensablehelp throughout They

acknowledge useful comments from Greg Allenby, Bob Blattberg, Ed

George, Rob McCulloch, and Carol Simon. Fundingfor this work was provided by the Micro-MarketingProjectat the GraduateSchool of Business,

Universityof Chicago.

17

Journal of MarketingResearch

Vol. XOXII(February 1995), 17-29

18

JOURNALOF MARKETING

RESEARCH,FEBRUARY1995

or store-level data. Sources of data are then discussed. Second, we presentthe item-level sales responsemodels used to

estimate store price elasticities, which are related to variables thatmeasurethe store areademographicand competitive environment. The results of the individual category

analyses are provided, followed by material on pooling

acrosscategories.Finally,we presentthe implicationsof our

findings for everyday and promotionalpricing policies.

OF

CONSUMERAND COMPEIl lVE CORRELATES

PRICESENSITIVITY

Household-LevelResearch

We view shopping activity as a part of an overall household productionprocess (Becker 1965). Returns to household shopping,which allow the consumerto take advantage

of price reductions, are balanced against various costs, including inventory, transportation,opportunity (time), and

searchcosts. This viewpoint provides some discipline in selecting and constructing variables from the rather large

menu of availabledemographicdata.

Inventoryor storage costs influence price sensitivity by

affecting a household's ability to take advantageof deals.

Households with largerstorage facilities have the ability to

buy larger quantities.Transportationcosts also may influence price sensitivity; vehicle ownership increases one's

ability to take advantageof deal prices and to stockpile.

Sensitivity to price requiresan awarenessof the distribution of prices, which requiresconsiderabletime and psychological effort. Therefore,factors that influence the opportunity cost of time should in turndrive price sensitivity.From

an economic perspective, consumers will make trade-offs

between expendingtime on shoppingversus otheractivities,

dependingon the returnsfrom each activity.

The prediction is that consumers with high opportunity

costs (in particular,wealthy consumerswith a high marginal

value of time) will be less price sensitive. This implies a

negative relationshipbetween price sensitivity and level of

education, though some have argued that education might

contemporaneouslyreduce the psychological costs of price

comparisons. It also implies that all else being equal, we

would expect elderly consumersto be more price sensitive,

because of greaterleisure time. Moreover,we expect large

households to be more price sensitive; because of the large

amountof disposableincome spent on groceries,the greater

the potentialreturns(savings) from shopping.

Standard economic demand theory suggests that the

household allocates disposable income over various expenditure categories, taking into account the relative price indices of each category. Measuredhousehold income, however, may play only a small role in determiningthis price response, because the observedprice response of a household

to changes in the price of items in any productcategory depends on many factors.

Blattbergand colleagues (1978) adoptedBecker's (1965)

point of view in their study of diary data. Using data from

the Chicago TribunePanel for five productcategories collected over the years between 1958 and 1966, they discovered threedemographiccharacteristicsthatwere mildly predictive of deal proneness:car ownership,home ownership,

andhouseholdswith unemployedwives. However,theirdata

were collected more than 30 years ago, and the radical

changes in the work force and in family structurethat have

occurredsince then may have alteredthe empiricalregularities. Many women work because they have to (e.g., single

motherfamilies) and thereforethey may be more price sensitive. Income had no effect on deal proneness when controlling for other relevantfactors, despite theory suggesting

a negativerelationship.

Most otherattemptsto identify demographiccorrelatesof

price sensitivity and deal proneness using household panel

dataconclude thatthereis a weak to nonexistentrelationship

(Frank,Massy, andWind 1972; Montgomery1971; Webster

1965). In theirevaluationof differentaggregationapproaches to developing marketsegments, Elrod and Winer (1982)

relatedobserveddifferencesin price sensitivityto socioeconomic and demographic characteristics and found only

weak associations. Price response increasedwith age, educationallevel, and householdsheadedby females. Rossi and

Allenby (1993) found little relation between household

characteristicsand household-level estimates of logit price

coefficients. Narasimhan (1984) found relationships between coupon usage and household demographiccharacteristics. Under a price discriminationtheory of couponing,

this would suggest indirectlythat there is a relationshipbetween price sensitivity and the demographicvariablesconsidered by Narasimhan.In related work, Bawa and Shoemaker(1987, 1989) found thatpropensityto use an off-price

coupon increased with education, income (weakly), and

household size.

Thereis also substantialliteraturethatinvestigatesthe determinantsof price search behavior (e.g., number of store

visits and prices paid). The theory is well developed, but

there is a paucity of supportingempirical findings. Carlson

and Gieseke (1983) found that price search behavior increased with age and was single-peakedwith respect to income. Marvel (1976) and Maurizi and Kelley (1978) found

an inverse relation between income and search. Goldman

and Johansson (1978) related a combination of attitudinal

and economic variables to self-reported search behavior.

Marmorstein,Grewal, and Fishe (1992) found that the subjective value of price comparisonshopping time decreases

with wage rates and increases with enjoyment of the shopping process. In all cases, the percentage of variance explained was small (< 15%).

To summarize,previous research at the household level

has not been able to explain a very large fractionof variation

in price sensitivity on the basis of observed consumercharacteristics.There are severalpossible reasons for lack of explanatorypower.First,most of the researchhas utilized consumerpanel data;such dataoften containsmanyhouseholds

with very short or sparse purchase histories. Second, the

purchasehistories usually involve only one or two product

categories and do not capturebehavior across the multiple

categoriesthat make up consumers'weekly marketbaskets.

Third, in-store and competitive promotionalactivities may

overwhelmany demographic-basedconsumerprice proclivities that might exist, that is, short-termenvironmentalfactors swamp individualdifferences, much as has been found

in the field of personality psychology (Mischel 1984). Finally, the variation in demographicattributesis often less

Store-LevelPrice Elasticity

among scannerpanel membersthan in the store populations

found in a majormetropolitanarea.1

Store-LevelResearch

We expect observedprice sensitivityto be relatednot only

to consumercharacteristicsbut also to the competitiveenvironment. Price sensitivity can be reflected in switching

among brandsof the same productcategory,between product categories in the same store, and across differentstores.

As the number of alternativeretail outlets increases, the

household is given more substitution possibilities and

should be more price sensitive unless the prices are perfectly correlatedacross stores.

The competitive environmentis determinednot only by

the numberof shopping alternativesor substitutionpossibilities but also by the cost of searchand the formatof the competition.The costs of searchshould increaseas a functionof

the physical distance and driving time between stores. The

greaterthe dispersion of prices in the market,the higher is

the expected savings from search.Therefore,we would expect tradingareas with greaterretail density (more different

outlets in a given area) to display greaterprice dispersion,

which in turn drives greaterprice sensitivity on the part of

the consumer.

Most consumers shop at a numberof stores, both within

and across weeks. Depending on whethera shoppingtrip is

primary(buying groceries to last 1 to 2 weeks or more) or

secondary (filling a immediate need resulting from an outof-stock condition at home), consumers may place more or

less emphasis on convenience versus price. Larger stores

will tend to attractmore primaryshoppers(because of wider

assortments),whereas smaller stores will attractmore secondaryshopperswho are interestedin convenience.

We might expect that, relative to the competition, larger

volume stores would be more price sensitive than smaller

stores. To stay in business, larger stores have to draw from

largertradingareas;consumersmust be willing to drive farther. Consumers who frequent smaller, more proximate

stores may self-select on the basis of location and the ability to get in and out of the store quickly ratherthan on selection/assortmentor price.

Store-level scannerdata has been used to study this competition between stores. In general, the research suggests

that within-store price effects are much greater than those

observed between stores. Kumarand Leone (1988) studied

the disposable diaper category and found that though there

is significant promotion-inducedstore substitutionbetween

proximatestores, within-storesubstitutionrates were two to

three times greater.Walters (1991) examined both withinstore and between-store substitutionand complementarity.

Store substitutionrates were very low compared to brand

switching within a store.

Bolton (1989) used store-levelscannerdatato relateprice

elasticities to a varietyof variablesthatcharacterizethe promotion and performanceof each brand.She consideredthe

IFor example, the standarddeviation of our ETHNIC variable across

stores is .34, whereas the median standarddeviation among the census

tracts that make up each store is .10. Similarly, the standarddeviation of

HOUSE_VALacross stores is .33, with a median of .26 within store market areas.

19

extent of couponing, market share, price activity, and display/feature activity and found that these were correlated

with price elasticities. All the variables considered by

Bolton arejointly determinedby the marketingstrategyand

not fundamentallyexplanatoryin nature.The characteristics

of consumersand the competitiveenvironmentstudiedhere

are better seen as the primitives that determine price

sensitivity.

To summarize,the store-levelresearchhas focused on the

patternsof substitutionbetween and across stores. In the

empiricalwork discussed subsequently,we examine the relationshipbetween store price elasticity and detaileddataon

the competitiveenvironmentsurroundingeach store.

SOURCESOF DATA

There were three main sources of data:Dominick's Finer

Foods (DFF); InformationResources, Inc. (IRI); and Marketing Metrics.Dominick's has approximately90 stores and

a marketshare of approximately20%.

Store-LevelSales Data

Dominick's provided the University of Chicago with

weekly store-level scanner data by UPC, including unit

sales, retail price, profit margin,and a deal code indicating

shelf-tag price reductions(bonus buys) or in-store coupons.

The categories are displayed in Table 1. There is an average

of 270 UPCs in a productcategory,from a low of 57 in bath

tissue to a high of 637 in cookies. The time span for DFF

scannerdata is 160 weeks, the first 80 of which are used for

elasticity estimationand the next 80 are reservedfor model

validation.Because some of the stores had limited historical

data, we limited our attentionto a sample of 83 stores.

Chain and Market-LevelPromotionalActivity

InformationResources, Inc. provided us with InfoScan

data for the Chicago market that was broken out for Dominick's and the remainingcompetitorsas an aggregate;for

our purposes,we focus only on Dominick's promotionalactivity. The IRI data is based on a representativesample of

approximately60 stores drawn from the population of all

major Chicago-areachains and independents.We utilized

this data to obtain informationon promotionalactivity. By

week we had available the percentage of All Commodity

Volume(ACV) of a particularUPC that(1) receivedin-store

display along with a price reduction,(2) was featureadvertised along with a price reduction,or (3) was both displayed

and featureadvertised.

Because feature advertisingis a chainwide corporateactivity, an individualUPC will either be featuredor not featuredin all stores duringa particularweek. Display activity

is more discretionary,and except for largerpromotionsthe

decision is left up to the store managers.Except for the extremecases where no stores or all stores display an item, we

do not know which stores actually displayed the item. The

percent ACV data from IRI provide probabilisticinformation about the likelihood that an item has received display

support. Given the measurementerror that is likely to be

presentin any display variable,we used only informationon

chainwide featureactivity in the demandmodel.

20

JOURNALOF MARKETING

RESEARCH,FEBRUARY1995

Table 1

ESTIMATES

ANDELASTICITY

CATEGORY

AGGREGATES

Basis of Aggregation

Average

Category

Elasticity

Standard

Deviation

Average

Own

Elasticity

10

12

18

13

10

15

12

12

17

14

21

21

4 manufacturersand 2 size aggregates

4 brandsby water/oil,4 price tier aggregates

13 Campbell'sflavor/size aggregates,5 misc. aggregates

8 brands(all sizes), 5 manufactureraggregates

5 brands(all flavors) by 2 types

11 brands(all flavors, sizes), 4 manufactureraggregates

11 brands(all flavors), 1 miscellaneous aggregate

5 orangejuice brandsby 1-2 sizes, 4 flavor aggregates

5 brandsby 2-5 types, 1 miscellaneous aggregate

9 orangejuice brands,5 flavor aggregates

19 brands(all sizes), 5 type aggregates

I10brandsby 1-4 sizes, 1 miscellaneous aggregate

-3.18

-1.79

-1.62

-1.60

-1.01

-.86

-.77

-.74

-.72

-.55

-.20

-.09

.39

.47

.22

.25

.57

.36

.46

.51

.35

.32

.22

.26

-2.59

-.96

-1.66

-.90

-1.46

-.79

-1.65

-2.24

-1.44

-1.95

-1.14

-1.49

9

10

8

13

11

12

8 brands,1 aggregate

4 brands(all sizes) by 2 forms, 2 form aggregates

3 brands(all sizes) by 2 forms, 2 form aggregates

6 brandsby sizes, 2 size aggregates

4 brands(all flavors) by 2 sizes, 2 size aggregates,kids

7 brandsby 2 sizes, 2 size aggregates

-2.42

-1.58

-.79

-.74

-.45

.05

.19

.21

.06

.29

.37

.52

-2.28

-1.99

-1.77

-1.64

-2.00

-1.21

Number

of UPCs

Number

of Items

Food Items

Soft Drinks

CannedSeafood

CannedSoup

Cookies

Grahams/Saltines

Snack Crackers

Frozen Entrees

RefrigeratedJuice

Dairy Cheese

Frozen Juice

Cereal

Bottled Juice

619

180

89

637

230

197

500

108

367

105

298

242

Nonfood Items

Bath Tissue

LaundryDetergent

FabricSoftener

Liquid Dish Detergent

Toothpaste

PaperTowels

57

303

140

178

296

90

Category

StoreTradingAreaData

Metricsprovidedus withtradingareadatafor

Marketing

each of the 83 stores.Theydeterminetradingareasfor all

stores with yearly sales volume greaterthan $2 million,

modelsthattakeinto accountpopulation

using proprietary

density (e.g., urbanversus suburban),competition,road

conditions,and various regional differences.Marketing

Metricsdefines a tradingarea by expandinga polygon

aroundeach storelocationto enclosean arealargeenough

to supporttheACVof the store.

functionsbasedon the Bureauof

Householdexpenditure

LaborStatisticsConsumerExpenditure

SurveyandMediamarkResearchInstitute's1990Doublebasesurveyarecombinedwithcensusblockdatato estimatethesize of thepopulationneededto supporttheACV.Thesetradingareasalso

who areshartakeintoaccountthe presenceof competitors

totalfor a givenareaas well as

ing the groceryexpenditure

geographicalbarrierssuch as expresswaysand riversand

times.

differencesin estimatedtransportation

EventhoughDFFoperatesin a generallyhighlycompetthereis stilla greatdealof variationin the

itiveenvironment,

natureand extent of competition.In some locations,the

DFF andcompetingstoresare locatedside by side andin

otherlocationsthe DFF storeis not nearany majorcompetitor.Tomeasuretheextentandnatureof thecompetition,

aboutthetoptencompetiwe reliedon detailedinformation

tors in the tradingarea,includingdistancefrom the Dominick'sstore (in miles and estimateddrivingtime minandwarehouse

superstore

utes),retailformat(supermarket,

outlets,andfood/drugcombos),andestimatedweeklysales

volume.Thislevel of detailon thecompetitiveenvironment

is uniquein studiesof competitivebehavior.

Censusblockdatafrom1990provideveryextensivedeon householdsize andcomposition,

mographicinformation

income, housing, educationalattainment,ethnicity,and

manyothervariables.The marketareadefinitionsareused

to formweightedaveragesof theblockdatawithinthetrading area.The weightsdecayat differentratesfor everydirectionfromthe storelocation.

DATAANDAGGREGATION

ISSUES

STORE-LEVEL

Becauseourempiricalworkis basedon store-leveldata,

it is importantto recognizethe advantagesand disadvanover

On the positiveside,aggregation

tagesof aggregation.

individualconsumersto the storelevelmaytendto average

householdout individualstochasticbehavior.Temporary

factors(e.g.,existinginventorylevelsafspecificsituational

fectingresponseto a deal)will tendto be equalizedacross

consumers,leadingto a reductionin systemwidenoise.Alternatively,store-levelanalysiswouldseem to be counterproductiveon the independentvariableside, becausethe

couldwashout interestingdifferhighlevel of aggregation

encesbetweenindividualconsumers.

In our analysisof storemarketareas,we mustrely on

thedistribution

of keyexsummarystatisticsto characterize

in

area.

market

over

the

consumers

the

variables

planatory

As in manymajormetropolitan

areas,Chicagohas always

been a city of manydistinctand homogenousneighborto the suburbshas inhoods;in recentyears,out-migration

creasedthe patternof residentialseparationby wealthand

the variationin consumercharacethnicity.Consequently,

teristicsacrossdifferentstoremarketareasis substantially

withineachmargreaterthanthevariationin characteristics

ket area.This,coupledwiththe averagingoutof individual

stochasticbehavior,mayaffordus witha betteropportunity

betweenpricesensitivityandmarket

to detectrelationships

areacharacteristics.

A simpleexamplewill help clarifythesepointsfurther.

betweenpricesensitivityandconConsidertherelationship

sumerwealth.Withconsumerpaneldata,we couldattempt

to measurepricesensitivityforeachconsumerandthenperforma cross-sectionalregressionof price sensitivityon a

Store-LevelPriceElasticity

wealthmeasurefor each household.Givenpreviousfindin thisconings, we wouldexpecta veryweakrelationship

sumer-level data.To reducemeasurement

noise, we might

averagepricesensitivityoverconsumersof exactlythesame

wealthlevel andregresstheseaverageson ourwealthmeasure.This amountsto averagingthe regressionerrorterms

verticallyat eachof somegroupof wealthpoints.

Ourstore-leveldatadividestheconsumerpopulationinto

groupsby marketarea.Wecomputetheaveragepricesensitivityfor each marketareaandregressthis on the average

wealthfor eachmarketareagroup.Thisis analogousto averagingthe regressionerrorsboth vertically(acrossconsumersof the same wealthlevel) and horizontally(across

consumersof differentwealth levels in the same market

area).Thus,the successof ourempiricalanalysishingeson

the trade-offbetweenreducingnoise in the dependentvariableandthe loss of informationthroughaggregationof the

variablesto marketareas.

independent

Inthenextthreesectionswe will describeourmethodand

results.We adopta two-stepprocedure.First,we estimate

store-specificprice elasticitiesfor each of the 18 product

categories.2Second,we relatethese store/product

category

andcompetitivevariables.

elasticitiesto demographic

OBTAINING

PRICEELASTICITY

ESTIMATES

Obtainingpriceelasticityestimatesfor an entirecategory

is a complicatedtask involvinga numberof decisionson

bothaggregationandmodelspecification.In a typicalgrocery category,supermarkets

carryupwardsof 250 UPCs.

Ourapproachis to builda detaileddemandmodelat a low

level of aggregationto avoidthe extremeassumptionsand

possibleaggregationbias thatwouldaffecta highlyaggregatedanalysis.This detaileddemandmodelcan be usedto

measurethe sales responseto changesin the priceof individualitemsandsubaggregates

or to predicttheresponseof

the whole categoryto a uniformprice changeacrossall

itemsin the category.

We concentrateon measurementof the category-level

pricesensitivity,whichis at thecoreof theretailer'scategomostretailershavefairlyunirypricingproblem.Currently,

formpricingpolicies(e.g., theyfollowor leadthe competition), whichare not customizedto store-specificclientele.

Exploringsystematicpatternsof pricesensitivityon thecategorylevel canopenthepossibilityof improvingprofitabilpricing.Reity by store-specificeverydayandpromotional

tailersalso may be interestedin individualitem or brand

elasticities,whichcan be used to predictpatternsof differentialpromotional

response.

DemandModelSpecification

Our aggregationscheme startswith the total of 4636

UPCs thatmakeup the 18 categories.Even with our 160

weeksof data,it wouldbe difficultto preciselymeasure83

x 4636 store-UPCelasticitycombinations.Furthermore,

2An alternativeapproachwould a one-step procedurein which the elasticity coefficients in the demandmodel in (1) are made functions of the demographicvariables.To implement a one-step strategy,we would need to

make specific distributionalassumptionsregardingthe store elasticity random component or asymptotic argumentswhich requirea large numberof

categories. Our approachis a nonparametricfixed effects one, which estimates a store elasticity component in the first step.

21

the pricesof manyUPCsareperfectlycorrelated,because

theyarepricedandpromotedtogether(e.g.,differentflavors

or formsof the samebrand).Therefore,we formedaggregatesin eachcategory,consistingof top-sellingbrandsand

aggregatesof otherUPCson thebasisof size, form,flavor,

andtype.As shownin Table1, we formed265 itemswithan

averageof 15 aggregatesper category(columnlabeled

"Number

of Items")fromthe4636 UPCs.

Theaggregation

schemevaried,dependingon thelevelof

andconcentiation

differentiation

in thecategory.Forexamin

the

ple,

refrigerated

juice category,the top ten selling

UPCsaccountfor morethan53%of dollarsales volume,

whereasin ready-to-eat

breakfast

cerealsthetoptenaccount

forless than17%of sales.Incategorieswithdispersedsales,

we aggregated

acrosseithersizesand/orflavors/forms

to get

to a pointwherethetop 10 to 20 itemswouldaccountforat

least50%of sales.

Thechoiceof modelspecificationalsorequiresa number

of tradeoffs in orderto maketheproblemtractablefroman

Forexample,we mighthavestarteconometricperspective.

ed with a flexiblefunctionalformfor the utilityfunction

overall brandsin eachof our 18 categories.Wethencould

derivea hugedemandsystemthatwouldfeaturehundreds

of

of thousands

of parameters.

Instead,our

pricesandhundreds

approachis to specifya simplelog-lineardemandmodelin

whichthelog of unitsalesfor eachitemis regressedon the

log of priceof thatitemandotheritemsin the samecategory. In addition,we includepromotionalvariablesand a

laggedsales volumetermin each item equation.Thus,we

specifym log-lineardemandequationsfor each of the m

itemsin a category.The parameters

fromthis demandsystemarethenusedto definea categorypriceelasticity,as describedsubsequently.

Thebasicdemandsystemstartswiththevectorof log unit

sales(standardized

by size) in storej duringweekt, qjtand

thevectorof log pricesof eachof them itemsin eachcategory, Pjt (throughout,we denote the logs of variables in

lowercase).Eachelementof thevector,qjt,is denotedqijt,i

= 1,...,I, whereI is thetotalnumberof itemsin the category; in the equations,i will alwaysdenotethe index of an

item.Thepriceof eachof the itemsin eachcategoryis defined as the geometricshareaverageor the Divisiaprice

indexof all of UPCsthatmakeupthatitem.Forexample,in

therefrigerated

juicecategory,thereare12itemsthatareaggregatesof the 108UPCs.Foreachweekandstore,we computethe share-weighted

averageof the log priceof eachof

the UPCsin eachitemto formthe Pjtvector,whichis a 12

X 1 vector.

For each category,we define a standardlog-lineardemandsystem:

(1) q

=

oa + Tj + (N + Aj)pj + (qj,-I + A Dealjt+ B Fjt+

e

Lis a m X 1 vectorof ones,Aj= kjI, = 4<I,A = diag(8),B

= diag(O).The a vectorallowsfor item-specificintercepts,

andthe rTj

is a store-specificintercept.Dealjtis a

parameter

vectorof dummyvariablesthatindicatewhetherthereis a

temporary

pricereductionoranin-storecoupon.Fjtis a vector of featureindicatorvariablesobtainedfromIRI'sInfoScansampleof DFFstoresin the Chicagoarea.Themodel

JOURNAL

OF MARKETING

FEBRUARY

1995

RESEARCH,

22

in (1) is estimatedon thefirst80 weeksof ourstoredata,reservingtheremaining80 weeksfor modelvalidation.

The demandsystemin (1) allows for a full patternof

crosselasticities,as capturedby the elementsof the N matrix, N = [ir'], along with a lagged value of the dependent

serialcorrelation

to accommodate

variablethatis introduced

behavior.The

introduced

by forwardbuyingor inventorying

on

the ownelaseffect

a

allows

for

matrix

store-specific

Aj

ticities.The modelin (1) makesthreebasicsets of restrictionson thecategorydemandmodel.Weallowonlytheown

(ri' + kj) to varyacrossstores,while

elasticityparameters

we restrictthecross-elasticity

(N) so theyarethe

parameters

sameacrossstores.

Featureanddeal effectsare allowedto be item-specific

but not store-specific.The lagged sale effect is the same

acrossitemsin the samecategory.Thepriceelasticitymodels fit the dataverywell, with R2rangingfrom.76 to .93.

Largefeatureeffects are observedin most categories.To

extenvalidatethis modelingapproach,we experimented

formulations

thatare,to varyingdesivelywithalternative

grees,less restrictivethanthe modelin (1). Ourmodelperformswell relativeto theseless restrictivemodels,as measuredby both in-sampleand out-of-sampleyardsticksof

performance.3

Category-LevelPrice Elasticities

in (1) canbe usedto preThe priceresponseparameters

dictresponseto a widevarietyof pricechangeson boththe

item andcategorylevel. Sinceourfocusis on the retailer's

categorypricingproblem,we derivea categoryelasticity

measureby computingthe categoryvolumeresponseto a

changein all pricesin the category,holding

proportionate

the promotional

policy variablesconstant.For a particular

store,the demandsystem(1) canbe writtenas

qj= a + Fjpj

The intercepta includesthe feature,deal, andlaggedq

variables,whicharenot changedin the priceresponsepartial derivative,andrj = N + Aj, whichis the store-specific

pricecoefficientmatrix.Becausethedemandsystemis written in logs, ourcategoryelasticitymeasurecanbe computed by addinga constantto the vectorof log prices,p + hi,

andobservingits effecton log volumein thecategory.

3Withoutrestrictions on the variation in cross-elasticity patterns, we

would be faced with the problem of estimating m2 X J price parameters

(where J is the total numberof stores) versus the m2 + J parametersemployed in (1). To assess the validity of these restrictions,we also estimated

a completely unrestrictedmodel that allows the cross-elasticities to vary

across stores. We use out-of-samplepredictivevalidationand the Schwarz

(1978) model selection criterionto comparethe restrictedand unrestricted

models. The unrestrictedmodels have between 30 and 60 times the number

of parametersas the restrictedmodel in (1) and, as might be expected, they

show a somewhatsmallerin-sampleMSE. The lower in-sampleMSE is almost entirelyattributableto a fuller set of brand-storeintercepts;freeing the

restrictionson the cross-priceelasticity terms results in little improvement

in fit. However,the out-of-samplepredictiveperformanceof the unrestricted model is much inferior to the restrictedmodel. The restrictedmodel

shows an average 55% reductionin out-of-sampleMSE, with a minimum

of 14% and a maximumof 97%. This suggests that there is a greatdeal of

sampling variabilityin the parameterestimates in the unrestrictedmodel.

The Schwarz (1978) model selection criterion also favors the restricted

model.

Totalcategoryunitvolumeis writtenas V(p) = Zexp(qi)

= Zexp{ai+ Yij'P},where-Yij

is the ith rowof Fj.The categoryelasticityforstorej is definedas thepercentagechange

in the categoryvolumeproducedby a uniform1%increase

in the prices of all items in the category.In differential

of lnVwithrespect

terms,we musttakethepartialderivative

to h, whereh is the constantof proportionality;

we increase

p to p' = p + hL.We areconsideringthe local or derivative

as h -> 0.

measure,so we musttakethelimitof thisderivative

(2)

Icj=

lnV(p +h)lh=o=

y'j = w'j

wj is the vectorof volumeshares,w. = Qij/V,whereQ. is

theunitvolumeforitemi in storej. Thecategorypriceelasticity measurein (2) providesan estimateof the expected

changein categoryunitvolumefora 1%uniform

percentage

increasein the pricesof all the itemsin the category.For

each category (c = 1, ..., C) and each store (j = 1, ..., J), we

use (2) to computea categoryelasticity,lcj.Weshouldnote

thatthese are short-runelasticities;the long-runelasticity

wouldbe scaledup by the factor1/(1-4).

on the level and

Table1 presentsdescriptiveinformation

dispersionof the categoryelasticityestimates.The categoriesaresortedfirstintofoodandnonfooditemsandthen

rankedon the basis of the size of elasticities.The average

deviacategoryelasticityis -1.06, andthe averagestandard

tionacrossstoresin thesamecategoryis .33, indicatingthat

thereis a greatdeal of variationacrossstoreswithinthe

samecategory.

Table1 presentsthe averageownpriceelasticityin additionto the categoryelasticity,whichis drivenby the degree

of substitutability

amongcategoriesin the same storeand

betweencompetingstores. Substitutionor switchingbetweenbrandsin the samecategoryhas a smalleffecton the

categoryelasticity(it canhavesomeeffectif the volumeof

purchaseschange).Thissuggeststhatthecategoryelasticity

shouldbe smallerthantheitemorbrandelasticity,as shown

in Table1, whichis the case in 13 out of the 18 categories.

for thosecategoriesin whichthereis intense

Furthermore,

storecompetitionand widerretaildistribution(e.g., drug,

conveniencestores,anddiscountstores),we shouldexpect

highercategoryelasticitiesdrivenby substitutionacross

stores.This is the case in the soft drinkand bath tissue

categories.

Figure1 is a mapof the Chicagoareawith each of the

DFF storelocationsmarkedwith a dot.Aroundeach store

to thesize of

locationis a circlewhoseradiusis proportional

the price elasticityestimatesfor the soft drinkcategory.

variationin the size of elasticities,clustering

Considerable

of similarsize elasticities,andsmoothtransitionfromone

geographicareato the next areapparentin the figure.The

challengenowis to relatethisvariationin elasticitiesto market areacharacteristics.

RESULTSFOR INDIVIDUALCATEGORIES

Giventhe categoryelasticityestimates,we examinethe

betweentheseestimatesandmeasuresof conrelationship

A regressionrelasumerand competitivecharacteristics.

tionshipbetweenthe elasticityestimate,nj, andthe independentvariablesis postulated.

(3)

ncj = xj'Pc + eCj

ej

- iid

N(0,c)

c = 1, 2,... 18

Store-LevelPrice Elasticity

There are 18 category-level regressions each with 83 store

observations on consumer and competitive characteristics

(these are in the vector xj). Because the ncjare based on regression coefficient estimates (see (2)), they could be heteroskedasticover stores in the same category. This regression equation assumes that the estimates are homoskedastic

within a category and heteroskedasticacross categories. To

check this assumption,we computed the standarderrorsof

the n,c using standardregression theory and (2). We found

very little variationin these standarderrorsacross stores for

each of the 18 categories,justifying our errorspecification

in (3). We now turn to the constructionand selection of independentvariables.

23

Figure 1

BY DFF LOCATION

SOFT DRINKPRICEELASTICITIES

0

0

?

Selection of IndependentVariables

Because of the comprehensiveamountof backgroundinformationavailable for each tradingarea, we spent considerable effort identifying a parsimoniousmodel of price sensitivity that containedboth consumer and competitivecharacteristics. Our intent was not so much to find the one true

model but to identify factors consistent with the household

productionand economics of informationapproaches.Relating specific demographicvariablesto economic concepts

is difficult. For example, a numberof demographicvariables

could be relatedto wealth or to the opportunitycost of time.

We use multiple variables as proxies for key concepts and

anticipatethat some collinearity will exist between the demographic variables. The final model that we report here

contained 11 predictorvariables.

Consumer characteristics: Seven of the predictor variables were consumer characteristics.The percentageof the

populationover 60 years of age (ELDERLY),the percentage

of the populationwith a college education(EDUC), and the

percentage of households with five or more members

(FAM_SIZE)relate to opportunitycosts. Elderlypeople and

largerhouseholds were expected to be more price sensitive,

leading to negative relationships with price elasticity. The

log of median income (INCOME)and the percentageof the

homes with a value greaterthan $150,000 (HOUSE_VAL)

are related to income constraints on purchasingbehavior.

We also included the percentage of women who work

(WORK_WOM).If this variable representsthe higher opportunitycosts of working women, then we would expect it

to be positively relatedto price elasticity. If, however,many

workingwomen face budgetconstraints,then the sign might

reverse.We tried to isolate demographicsthat might capture

differentiallevels of storageand transportationcosts, but we

could find no systematic relationshipsto price sensitivity.

In addition, we included the percentage of consumers

who were black and Hispanic (ETHNIC)as an independent

variable. This variable is best regardedas an intermediate

construct that captures underlying characteristicssuch as

certainpatternsof income, household composition, and personal wealth for which economic theory makes price response predictions.

We experimentedwith model specifications in which the

ETHNIC variable was replaced by associated measures

(e.g., percentagebelow the povertyline, unemploymentlevels, telephone ownership, percentage of singles); however,

ETHNIC capturedsomething additional,so we retainedthe

?

0

variable. In addition, the ETHNIC variable has obvious

value as a predictorin the event that this analysis was used

to forecastprice sensitivity at locations for which we do not

have detailed scannerdata.

Competitivecharacteristics: Four of the predictor variables were competitivecharacteristics.We divided the competition into two sources: traditional supermarkets and

warehouse or superstoreoperations.Distance in miles and

drivingtime were closely related.We calculatedthe average

distancein miles to the nearestfive supermarketcompetitors

(SUPER_DIS) and the distanceto the nearestwarehouseoperation(WARE_DIS).Distance in urbanareaswas scaled by

a factor of two to reflect greatercongestion and density.We

also calculated the sales volume (a proxy for store size) of

each store relative to both the supermarket(SUPER_VOL)

and warehouse(WARE_VOL)competitors.

Examinationof the distributionof the independentvariables across each of the 83 stores shows that there is considerablevariationin both the demographicand competitive

characteristics.For example, there are DFF stores in market

areas in which less than 5% of the adult populationis college-educated,whereasother locations have more than 50%

of college-educated consumers. Figure 2 shows the difference in the EDUC variable on the map of DFF locations.

Some DFF stores are located right next to both supermarket

and warehousecompetition,and others are located as far as

JOURNALOF MARKETING

RESEARCH,FEBRUARY1995

24

Figure 2

BY DFFLOCATION

COLLEGEEDUCATED

PERCENTAGE

We now turnto an analysis of the directionof the effects

of each independentvariable. In inteipreting these coefficients, it is importantto rememberthat the dependentvariable is a negative number.A positive coefficient indicates

that as the associated independent variable increases, the

price elasticity moves closer to zero. These coefficient distributionscan be summarizedas follows:

variablesreducepricesensitivi*TheEDUCandHOUSE_VAL

ty, as evidencedby the overwhelmingmajorityof positive

coefficients.

variablesin*TheETHNIC,FAM.SIZE,and WORK_WOM

creasepricesensitivityforthemostpart

variablesarea mixedbag,with

*TheINCOMEandELDERLY

almostequalnumbersof positiveandnegativecoefficients.

increasesprice sensitivity as expected, and

*WARE_VOL

reducespricesensitivity.

WARE_DIS

variableshaveweakand

*TheSUPER_DISandSUPER_VOL

mixedeffects.

18 miles from warehouse competition and 4 miles from

majorsupermarketcompetition.In addition,most of the intercorrelationbetween the 11 independentvariablesis below

.5 in absolute value, with the exception of a .89 correlation

between HOUSE_VALand EDUC.

Results of CategoryRegressions

The 18 category regressions of elasticities on this set of

independentvariables are listed in Table 2. The categories

are listed in alphabeticorderacross the columns of the table.

Below each coefficient is the standarderror,and the bottom

two rows give the adjustedR2 and standarderrorof the regression.The last column displays the varianceinflationfactors (VIF) for each independentvariable(see Weisberg1985

for a definition of the VIF).

Note that the VIF depends only on the independentvariables, which are the same in each of the 18 regressions.The

regressions have an average adjusted R2 of .67 (median,

.78), rangingfrom a low of .34 for toothpasteto a high of .86

for frozen entrees.The regressionsshow a remarkablygood

fit, especially in light of previous attemptsto explain variations in price response. In addition, our success in explaining variationsin price elasticity measures suggests that the

measurementerrorin these elasticities is low relativeto their

store-to-storevariation.

To assess the potential problems associated with

collinearity,we computedvarianceinflation factorsfor each

of the independentvariables.The only large VIFs were associated with the EDUC and HOUSE_VAL variables, reflecting their high degree of intercorrelation.Even these

VIFs were around7.0, which shows that there is still considerableindependentvariationin these variables.All other

VIFs are 4 or below, with most below 3. Thus, the diversity

in the DFF marketarea allows us to isolate effects that are

difficult to find in the relativelyhomogenous cities in which

scanner panel data is usually collected (e.g., Sioux Falls,

SD, and Springfield,MO, for ERIM data and Marion, IN,

and Rome, GA, for the IRI academic data sets).

Although Table 2 provides informationabout the direction of the effects and the statisticalstrengthof the evidence,

it does not directly address the substantiveimpact of the

variables.To better gauge the relative importanceof demographic versus competition variables, Table 3 presents the

results of a series of four sets of regression equations. It

startsin column 2 with the root mean squarederror(RMSE)

for the base model, which is a simple category-levelmean.

The rest of the columns presentthe ratio of RMSE from regressions with differentsets of independentvariablesto this

base model. The addition of the demographicvariables to

the base model results in a large decrease in RMSE (the column marked DemographicVariables).On the other hand,

the competitionvariablesadd little eitherincrementallyover

the demographic variables (Demographic 1Competition

Variables)or comparedto the base model alone (Competition Variables).This is an interestingresult, given retailers'

typical focus on their competition.

Despite the large qualitative differences between the

product categories, the regression coefficients consistently

cluster aroundpositive or negative values for many of the

independentvariables.However,there are a few exceptions;

for example, althoughmost of the coefficients for the EDUC

variable are positive and most of the coefficients for the

ETHNIC variablesare negative, there are a few significant

coefficients of the opposite sign.

For other independentvariables, such as the ELDERLY

variable,there are a numberof significantpositive and negative coefficients. The elderly may display a preferencefor

Table 2

INDIVIDUAL

CATEGORY

REGRESSIONRESULTS

Independent

Variables

ELDERLY

Bath

Tissue

Bottled

Juice

Grahams/

Saltines

Canned

Seafood

Canned

Soup

1.119

(.463)

2.136

(.833)

1.830

(.617)

-.942

(.399)

.051

(.296)

-.70

(.436)

-1.660

(.824)

.635

(.586)

.347

(.236)

1.398 -1.405

(.777)

(.671)

.819

(.323)

1.646

(.434)

-.754

(.112)

.074

(.099)

-.152

(.123)

-.233

(.108)

.558

(.610)

-.566

(.232)

.817

(.205)

-.081

(.165)

-.170

(.146)

-.206

(.174)

.325

(.066)

.624

(.497)

.133

(.189)

.227

(.167)

.884 -1.764

(.780)

(.715)

-1.882

(1.476)

-.126

(1.049)

Cereal

Cookies

Dairy

Cheese

.341

(.539)

.365

(.399)

1.978

(.452)

.630

(.343)

-.121

(.152)

-.257

(.134)

.424

(.130)

-.600

(.115)

.860

(.334)

-.074

(.127)

-.453

(.113)

FAMILY.SIZE -.745 -1.658

(.964)

(.829)

-.023

(.809)

-.498

(.235)

-.303

(.208)

1.285

(1.492)

WORK-WOM -1.475

(.625)

.464

(.524)

.100

(.967)

-.556

(.463)

-.697

(.505)

-.609

(.956)

.371

(.680)

1.172

(.265)

-.000

(.008)

.273

(.127)

.605

(.139)

.001

(.004)

.727

(.262)

EDUC

ETHNIC

INCOME

-.339

(.537)

.394

(.147)

Fabric

Softener

Frozen

Entree

Frozen

Juice

.433

(.576)

Laundry

Detergent

-2.158

(.557)

Liquid Dish

Detergent

Paper

Towels

-.645

(1.007)

.190

(.849

.289

(.628

-.631

(.383)

-.487

(.239

.022

(.161)

.702

(.339)

.176

(.211

-2.439

(1.52

-.386

(.985

1.34

(.270

-.606

(.648)

.466

(.480)

-.759

(.183)

-1.271

(1.360)

.015

(.219)

-.148

(.194)

-.535

(.412)

-.241

(.157)

-.063

(.139)

.597 -1.906 -2.877

(.422) (1.201) (1.392)

-2.056

(.997)

-.703

(1.161)

-2.587

(2.435)

-.340

(.646)

.539

(.177)

.299

(.752)

-1.118

(1.578)

.233

.796

(.206)

(.433)

.006

(.007)

.007

(.014)

-.087

(.051)

-.184

(.107)

.056

(.059)

.605

(.186)

-.255

(.273)

.079

(.075)

.849 -1.365

(.902)

(.778)

1.300

(.214)

.819

(.248)

.009

(.006)

-.100

(.046)

-.004

(.002)

.010

(.019)

-.006

(.007)

.028

(.053)

.019

(.008)

.030

(.061)

.004

(.006)

-.021

(.044)

Refrigera

Juice

WARE_VOL

-.022

(.042)

-.049

(.036)

.628

(.144)

-.010

(.005)

.010

(.036)

SUPERJDIS

-.042

(.026)

-.003

(.022)

-.003

(.021)

.041

(.040)

.001

(.019)

.019

(.021)

-.014

(.039)

-.007

(.028)

-.004

(.011)

.054

(.032)

-.008

(.037)

.042

(.026)

-.043

(.031)

.003

(.065)

.010

(.009

-.081

(.067

-.038

(.040

SUPER_VOL

.063

(.114)

.017

(.098)

-.193

(.096)

-.229

(.177)

-.045

(.085)

-.055

(.093)

-.072

(.175)

.043

(.124)

.034

(.050)

-.263

(.142)

-.293

(.165)

.031

(.118)

-.325

(.289)

-.151

(.180

5.990

.765

(1.307) (1.124)

2.576

(1.096)

.195

(2.022)

-592

(.969)

1.120

(1.057)

-9.043

(2.000)

.363 -1.449 -4.110

(1.421)

(.572) (1.628)

1.692

(1.886)

-.305

(1.351)

-.057

(.138)

-.768

(1.573)

-6.180

(3.301)

-2.481

(2.060

HOUSE.VAL

WARE_DIS

Intercept

.136

(.171)

.013

(.005)

-.003

(.005)

-.031

(.066)

.008

(.004)

-.114

(.031)

-.045

(.034)

-.004

(.008)

-.093

(.065)

RMSE

.142

.122

.119

.220

.105

.115

.217

.155

.062

.177

.205

.147

.171

.359

.224

AdjR2

.417

.782

.698

.782

.771

.782

.852

.804

.450

.854

.595

.492

.646

.524

.810

JOURNALOF MARKETING

RESEARCH,FEBRUARY1995

26

Table3

RMSEBY MODELSPECIFICATION

RELATIVE

Demographic

BaseRMSE

Constant

BathTissue

BottledJuice

CannedSeafood

CannedSoup

Cereals

Cookies

Grahams/Saltines

DairyCheese

FabricSoftener

FrozenEntrees

FrozenJuice

LaundryDetergent

LiquidDish Detergent

PaperTowels

RefrigeratedJuice

Soft Drinks

SnackCrackers

Toothpaste

.187

.263

.474

.218

.221

.247

.569

.351

.084

.466

.324

.207

.289

.523

.517

.391

.367

.374

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

1.0

Average

.338

1.0

Category

some product categories, such as condensed soup, which

may counterbalanceother factors that would lead to greater

price sensitivity.

It is unreasonableto expect all categories to display the

same patternof coefficients. There is tremendousvariation

in the size, level of aggregation,type of product,inventory

patterns,and degree of complementarityor substitutability

with other products across the 18 categories. Furthermore,

we have estimated216 regressioncoefficients in the category regressions and it is possible to obtain a numberof significantcoefficients of the opposite sign from the population

value, even when testing at the 5% level.

Therefore,we conductedan exploratoryprincipalcomponent analysis to assess commonalityacross categoriesin the

elasticity estimates.The first principalcomponentof the 18

X 18 correlationof the categoryelasticities across the stores

explains some 54% of the total variation.Any one of the

other factors explains little of the total variation.The first

eigenvectorweights every categoryexcept one with positive

weights, suggesting that there is a strong common component that might be interpretedas an overall store elasticity.

The common patterns in regression coefficients across

categories naturallyleads to considerationof methods for

pooling the information across categories, both to obtain

more precise estimates of the common patternand to better

summarizethe centraltendencies in the data.

In the next section, we explore pooling methodsfor combining informationacross categories.

POOLEDANALYSIS

All pooling strategiesrely on a set of assumptionsthattie

together each of the individual category regressions. We

startby introducingnotation and errorassumptionsfor the

system of category regressions that form a multivariateregression system.

Variables

.78

Competition

Variables

Demographic/Competition

Variables

.46

.47

.56

.55

.47

.38

.45

.74

.39

.67

.71

.60

.71

.44

.63

.48

.89

.87

.87

.94

.93

.83

.90

.84

.86

.94

.93

.91

.92

.86

.91

.89

.85

.83

.92

.76

.46

.46

.55

.48

.46

.38

.44

.74

.38

.63

.71

.59

.69

.43

.61

.47

.81

.58

.89

.56

(4)

Yl = al + Xpi + e1

' = (e', .....e ) - MVN(O,A In)

2

2

A = diag(a

1cr, ... a c)

Yc =Ta

+ X3c + EC

The specification in (4) allows for category-specific intercepts. Ycis a N (numberof stores) X 1 vector of elasticities

for the cth category expressed in terms of deviations from

the mean category elasticity. X is the N X k matrix of values of the k independentvariables, ,Pc is the cth category

slope coefficient vector, and cc is the N X 1 vector of error

terms for the cth category.In our case, there are C = 18 categories, k = 11 independentvariables, and N = 83 stores.

Note that our regression specification has a separateintercept for each category;this is true even for the randomcoefficient approachdiscussed subsequently.

This means that we seek only to explain the variationin

elasticities across stores. We do not attemptto identify factors thatcould explain differencesin mean elasticities across

categories. Admittedly, understanding differences in the

level of elasticities across categories is an interestingtopic,

though it is not our focus here.

We make two key assumptions about the correlation

structureof the errorterms.First, we assume that errorsare

independentacross stores within a given category, that is,

that e, -~ MVN(0, or In). This is reasonablebecause of our

careful selection of relevantindependentvariables.Second,

we assume that errorsacross categories for the same store

are independent.Our analysis of the correlationmatrix of

category-level regression residuals justifies this second

assumption.

One standardapproachto pooling informationacross categories would be to restrictsome or all of the regressioncoefficients so they were the same across each of the C cate-

Store-LevelPriceElasticity

goryregressionsin (4). The evidencereportedin section6

suggeststhatsuch severepoolingrestrictionsare not warranted.Wemightexpectthatthe coefficientswoulddisplay

consistentpatternsin sign,butwe see no a prioritheoretical

reasonswhy the coefficientsshouldhavethe samemagnitudeacrosscategories.To formallytest the poolingrestriction,Ho:P1i= ... = Pc, we computedlikelihoodratiotestsof

this restrictionin the system(4). The restrictionis rejected

at the .001 level.

thepooledresultsin theconIt is alsopossibleto interpret

textof a randomcoefficientmodel,in whicheachof thecategorycoefficientvectorsis viewedas a drawfroma superthatis, ic are distributediid with

populationdistribution;

= Vp.Tocharacterize

meanE[13c]= 1 andvariance,Var(13c)

the centraltendencyor commonalityamongthe categories,

we wouldlike to makean inferenceaboutthe meanof this

randomcoefficient distribution.The pooled regression

stacksup the C regressionsin (4) into one largeregression

systemwithcommonslopecoefficients.y = Xp3+ u, where

y is a CN X 1 vectorof elasticities,X is a CN X (C + k) matrixof independent

variables,P is the vectorof categoryink

commonslope coefficients.The least

and

is

the

tercepts,

of

the

commoncoefficientvectorin the

estimates

squares

pooled regressionapproachis a consistentestimateof 13.

However,if one subscribesto the randomcoefficientview,

thenthe errortermsin the pooledregressionwill displaya

In the standardrandom

specialformof heteroskedasticity.

reviewin

coefficientliterature

(see discussionandliterature

Judgeet al. 1985,Chapter13), variousmethodsof estimatarecoming the variancecomponentsin the errorstructure

binedwith a feasibleGLSapproachto produceasymptoticallyefficientestimatesof 13.

Ourapproachis to avoidspecificassumptionsregarding

the formof the heteroskedasticity

inducedby the random

and use insteadthe generalhetcoefficientinterpretation

eroskedasticestimatorof the variancecovariancematrixof

theleastsquaresestimatorproposedby White(1980).Thus,

we use ordinaryleast squaresand computeadjustedstandarderrorsthatareasymptotically

justified.

It is importantto note thatthe asymptoticarguments

requiredfor use of our adjustedstandarderrorsnecessitate

that the numberof observationsin the pooled regression

randomco(CN= 83 X 18 = 1494)to be large.Thestandard

efficientapproachespursuedin the econometricsliterature

areasymptoticin the numberof categories.A moreformal

of any

analysisthatdoes not requireasymptoticarguments

sort can be obtainedby the use of Bayesianhierarchical

andRossi(1993)conducta hierarchimodels.Montgomery

cal analysisusing Gibbssampling,whichprovidesresults

verysimilarto thosepresentedhere.

Table4 presentsthepooledestimatesof 1 alongwiththe

standarderrorsand 90% confiheteroskedastic-consistent

denceintervals.The pooledanalysisreinforcesthe conclusions from individualcategoryregressions.On average

across categories, the ETHNIC, FAM_SIZ, and

variableshavenegativecoefficients,leadingto

WARE_VOL

high price sensitivityfor highervaluesof these variables.

TheEDUC,HOUSE_VAL,

andWARE_DIS

variableshave

positivecoefficients.

27

Table4

RESULTSPOOLEDACROSSCATEGORIES

(3

Variable

(StandardError)

ELDERLY

EDUC

ETHNIC

-.082

(.25)

.76

(.17)

-.27

90% Confidence

Interval

(-.50, .33)

(.48, 1.0)

(-.43,-.11)

(.10)

INCOME

-.071

(.076)

FAMILY_SIZE

-.84

(-.20, .054)

(-1.7,-.0018)

(.50)

WORK.WOM

HOUSE_VAL

WARE_DIS

WARE_VOL

SUPER_DIS

SUPER_VOL

-.29

(.28)

.54

(.071)

-.00042

(.00024)

-.065

(.017)

.012

(.012)

-.056

(.048)

(-.75, .17)

(.42, .66)

(-.00083,.00003)

(-.093,-.037)

(-.0077, .032)

(-.13, .023)

FOR RETAILPRICING

IMPLICATIONS

In thissection,we exploretherelevanceof ourresultsfor

boththeeverydayandpromotional

pricingpoliciesof theretailer.Dominick'scurrenteverydaypricingpolicyallowsfor

somecustomization

to the storelevel, with the assignment

of storesto one of threepricezones.Thepricezonesessentiallydictatethe everydaypricingof all itemsin the store,

withthepromotional

in a uniformmanner

pricesdetermined

acrossthe chain.Ourresultssuggestthatboth theirprice

zonesandthe relianceon uniformpromotional

policiescan

be improved.

ThethreeDFFpricezonesaredefinedalmostentirelyby

theextentof nearbycompetition.

Thelowestpricezoneis a

zone,whichis aimedat achievingcloser

warehouse-fighter

paritywith largeEDLPwarehouseoperations.Consumer

characteristics

demographic

figureonlyminimallyin thedeof the pricezones.To explorethe potentialfor

termination

improvementin the existingeverydaypricingpolicy, we

constructa table showingthe relationshipbetweenstore

in eachof thethreepricezonesandthelevelof

membership

pricesensitivity.We computea share-weighted

averageof

eachof thecategoryelasticitiesforeachstoreanddividethe

storesinto the top quartileof pricesensitivity,the middle

50%,andthebottomquartile(high,medium,andlow in the

tablebelow).

Table5 shows no relationshipbetweenprice zone and

testfor independence

hasp =

pricesensitivity(chi-squared

.28 and Spearmanrankcorrelation= .20). This opens the

possibilityforanimprovedpricingpolicyin whichthemore

price-sensitivestores have lower everydayprices. Hoch,

in

Dr6ze,andPurk(1993)discusstheresultsof experiments

28

JOURNALOF MARKETING

RESEARCH,FEBRUARY1995

sureswill forceretailersandmanufacturers

to adopta more

database-driven

approachto pricing.

Table5

DFF PRICEZONESENSITIVITY

Zone I

Low Price

High Price

Sensitivity

Medium

Low

Total

2

6

1

9

3

Zone2 Zone

MediumPrice

High Price

14

25

10

49

4

11

10

25

Total

20

42

21

83

the DFF chain that confirmthe short-runprofitabilityof

sucha strategy.

Perhapsthe mostimmediatebenefitthatourresultsprovide the retaileris a methodto moreeffectivelyuse a proDFFconductsa chainwidepromotionalbudget.Currently,

motionalstrategyin whichpricesareloweredby a uniform

percentageacrossall storesin the chain.The purposeof

thesetemporary

pricecuts is to stimulatesalesof the item.

DFFon the

to reimburse

It is commonforthe manufacturer

basisof increasedsalesof an item.

If we viewthenarrowobjectiveof a pricepromotionas to

achievinga given percentageincreasein sales, then it is

clear that our price sensitivityestimatescan be used to

achievea givenpromotionallift at a lowertotalcost. This

for store-level

nonuniform

policyexploitsthe opportunities

BecauseDFF gets more bang for a

price discrimination.

storesthanin the

givenpricereductionin theprice-sensitive

stores,a simplestrategyfor rerelativelyprice-insensitive

ducingpromotioncostswouldbe to havesmallerpricecuts

in the highlysensitivestorescoupledwithlargecutsin the

insensitivestores.The benefitsof utilizinga customized

strategywill dependprimarilyon the variation

promotional

of the item

in storepriceelasticitiesas well the magnitudes

priceelasticity.

Toillustratehowlargethesebenefitsmightbe, let us first

consideran item in the refrigerated

juice categorythathas

devibothhighvariationin storepriceelasticities(standard

ationof .51)combinedwitha highlevelof elasticity(-2.24).

We selecttheTropicana64-ounceorangejuice item,which

in this

hasoneof thehighestmarketsharesof ouraggregates

category.To achievean expectedincreaseof 50%in unit

sales over the whole chain, DFF's uniformpromotional

strategywouldrequirea 10.84%pricecutata costmeasured

by reducedprofitsof $570 perweek.On the otherhand,a

customizedpromotional

strategythatadjuststhe amountof

the pricereductionfor each store,dependingon the price

elasticity,wouldhavea cost savingsof 15%.Cost savings

fromcustomizedpromotionalstrategieswouldbe minimal

in othercategoriesthatshowlow variationin pricesensitivity acrossstores.Forexample,in thefabricsoftenercategory, a customizedstrategyfor the promotionof the Downy

sheetsitemwouldresultin a cost savingsof onlyabout1%.

We do not meanto suggestthatthe currentpoliciesof

The optimalityof current

or suboptimal.

DFFareirrational

to the informationprorelative

be

should

judged

policies

cessing and analyticalconstraintsunderwhichDFF operates.Eventhoughthe scannerdatausedin this analysisis

availableto mostmajorgroceryretailers,theanalyticaltools

andsoftwareandhardware

technologyarenotreadilyavailWe expectthatcompetitivepresable or well appreciated.

CONCLUSIONS

As the consumerpackagedgoods industrygrows more

are investing

competitive,bothretailersandmanufacturers

stratesubstantialresourcesin developingmicromarketing

gies in an effortto capturenew economicrentsfromcustomizedpolicies. These efforts are predicatedon the assumptionthatthereare systematicand identifiabledifferencesin consumerbehavioracrossstorelocations.

Ouranalysisprovidessupportfor this view by demonrestratingthatpricesensitivitymeasuresaresystematically

of the consumersin the marketarea

latedto characteristics

andthe competitiveenvironment.

Typically,morethantwo

variationin elasticitiescanbe exthirdsof thestore-to-store

andcompetitivevariables.The

plainedby 11 demographic

and

directionof the relationshipbetween characteristics

price sensitivityfollows those predictedby a simpleecoas follows:

nomicframework.

Theresultsaresummarized

costs,so

(1) Moreeducatedconsumershavehigheropportunity

theydevoteless attentionto shoppingandthereforeareless

pricesensitive.

(2) Largefamiliesspendmoreof theirdisposableincomeon

groceryproducts,andthereforetheyspendmoretimeshoppingto gamertheirincreasedreturnsto search;theyarealso

morepricesensitive.

(3) Householdswith larger,moreexpensivehomeshavefewer

so theyareless pricesensitive.

incomeconstraints,

(4) Blackandhispanicconsumersaremorepricesensitive.

(5) Storevolumerelativeto the competitionis important,

suggestingthatconsumersself-selectfor locationandconvenienceor priceandassortment.

(6) Distancefromthe competitionalso matters.Isolatedstores

displayless pricesensitivitythanstoreslocatedcloseto their

costs.

increases

Distance

shopping

competitors.

of thecompetOurresultssuggestthatthecharacteristics

arenot all thatimportantas determinants

itiveenvironment

of storepricesensitivity(see Table3). It is reasonableto ask

measuresof

whythisis so. Wecouldbe utilizinginadequate

fornumerous

with

we

However, experimented

competition.

mulationsof competitionwithno success.Moreover,to our

knowledge,our competitivedata is more comprehensive

thananythingthathasbeenusedpreviously.

It is also possiblethaterrorin the competitivevariables

inducesbias andreducestheirpredictivepower.No doubt

thereis errorin ourmeasuresof competition,butprobably

no greaterthanthe errorfoundin the consumervariables

basedon censusdata.It may also be thatthe marketis alandas a resultthereareno returns

readyin priceequilibrium

for the consumerto searchfor, becauseretailers have alreadyadjustedtheirpricesto theirconsumersandthe competition.We find no evidenceto supportthis contention.

Acrosscategories,the averagecorrelationbetweenweekly

pricesattheskulevelis only .32.Althoughthere

competitor

is pricematchingin termsof everydayprices,promotional

pricingis not coordinated.Therefore,sizable gains from

consumerpricesearcharepossible.

Anotherexplanationfor the failureof competitivevariandReiss

ablesmaybe inferredfromtheworkof Bresnahan

(1991),who findthatonce a marketis servedby morethan

Store-LevelPrice Elasticity

three firms, the monopoly rents have virtually disappeared.

Thus, althoughit may seem that there is a good deal of difference in the competitionvariables,it may be that all DFF

locations face an extUemelycompetitive environment.

Although a metropolitanarea like Chicago has few geographically isolated stores (as are found in a rural area),

there are some DFF locations on the south side of the city

with very little competition.These stores are in economically disadvantagedurbanareas,in which few retailersare willing to locate. However, despite little competition, these

stores are among the most price sensitive in the chain.

Our results cast some doubt on the optimalityof the current pricing policies of grocery retailers.All the major retailers in Chicago divide their stores into a small set (typically less than five) of price zones. These pricing practices

are driven almost exclusively by local competition. On an

everyday basis, shelf prices will be at most a few pennies

differentthan the local competition.Although it does make

sense to charge different prices at different locations, depending on the extent of competition,our analysis suggests

that consumer characteristicsas well as the extent of competition are important and should inform the pricing

decision.

REFERENCES

Bawa,KapilandRobertShoemaker(1987), "TheCoupon-Prone

Consumer:

SomeFindingsBasedon PurchaseBehaviorAcross

ProductClasses,"Journalof Marketing,

51 (October),99-110.

and

(1989), "AnalyzingIncrementalSales

Froma DirectMailCouponPromotion,"

Journalof Marketing,

53 (July),66-78.

Becker,Gary(1965),"ATheoryof theAllocationof Time"EconomicJournal,75, 493-517.

Blattblig,Robert,TomBuesing,PeterPeacock,andSubrataSen

the DealProneSegment,"

Journalof Mar(1978),"Identifying

ketingResearch,15 (August),369-77.

BetweenMarketCharacBolton,Ruth(1989),"TheRelationship

teristicsandPromotional

PriceElasticities,"

Science,

Marketing

8, 153-69.

Bresnahan,

TimothyandPeterReiss(1991),"EntryandCoinpetition in Concentrated

Markets,"

Journalof PoliticalEconomy,

99,977-1009.

Carlson,JohnandRobertGieseke(1983),"PriceSearchin a ProductMarket,"

Journalof Consumer

Research,9 (March),357-65.

Elrod,TerryandRussellWiner(1982),"AnEmpiricalEvaluation

of Aggregation

for DevelopingMarketSegments,"

Approaches

Journalof Marketing,

46 (Fall),65-74.

29

Frank, Robert, William Massy, and YoramWind (1972), Market

SegmentationtEnglewood Cliffs, NJ: Prentice-Hall.

Goldman, Arieh and J. K. Johansson (1978), "Determinantsof

Search for Lower Prices: An EmpiricalAssessment of the Economics of InformationTheory,"Journal of ConsumerResearch,

5 (December), 176-86.

Hoch, Steve, Xavier Drtze, and Mary Purk (1993), "Data Driven

Micro-Marketing:An Analysis of EDLP and Hi-Lo Pricing

Strategies,"micromarketingresearch project, GraduateSchool

of Business, Universityof Chicago.

Judge, George et al (1985), The Theoryand Practice of Econometrics. New York:John Wiley and Sons, Inc.

Kumar,V. and RobertLeone (1988), "Measuringthe Effect of Retail Store Promotionson Brandand Store Substitution,"Journal

of MarketingResearch, 25 (May), 178-85.