Here

advertisement

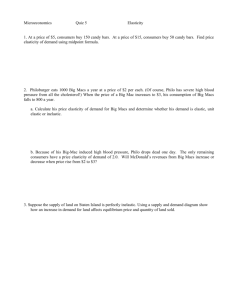

Some Homework Problems: Chapter 5

#5. Part of the approach required here is to hold “other things constant,” as appropriate.

If you are considering the response of quantity demanded to changes in income, hold price

fixed; obviously, you cannot hold quantity demanded fixed since its change is the focus of

the problem.

a) Maria spends 1/3 of her income on clothing; i.e., PxQ = (1/3) Y [let Y denote money

income]. If we are going to hold P constant why not pick as convenient a price as possible,

namely P = 1, [if you are squeamish over this, all we are doing is measuring the quantity of

clothing, Q, in different units: if Q had been measure in suits and price was $109, now we

are measuring clothing in units of 1/109 suits, each with a price of $1; a bit odd maybe, but

no harm is done, and it does make the computation of elasticity easier.]

So, Q = (1/3) Y. This is easy: if Y doubles, Q doubles; if Y decreases 20 %, Q decreases 20

%. Income elasticity is 1.00. Plug in some (arbitrary) numbers if you insist: let Y change

from 18 to 24, Q changes from 6 to 8.

ε = {+2 / (6+8)} / {+6 / (18+24)} = {2/14} / {6/42} = {1/7} / {1/7} = 1.00

b) What is Maria’s price elasticity of demand? Here we hold Y constant. Then,

PxQ = constant. This is the same as part 2 of question 7 in this chapter of the text.

If expenditure is unchanged as P and Q change, the price elasticity is 1.00. Again, if you

are not convinced, convince yourself with some numerical examples.

#6. a) ε = ( – 0.043) / ( +0.25/ [1.25 + 1.50]) note: 4.3 % is expressed as a decimal.

= ( – 0.043) / ( +0.0909) = 0.47 [in absolute value]

b) the estimated elasticity is less than 1.00, inelastic, hence, a price increase raises revenue.

c) [REAL WORLD ISSUES] The comparison is December versus December, which

controls for “seasonal” factors, such as weather, Christmas – New Year’s tourism, and other

similar effects that vary over the year. However, this may limit the applicability of the

measure to other months if those who ride in December are either more or less especially

dependent on public transportation. Perhaps, tourists ride the subway as part of their New

York experience and have especially inelastic demand; if so, the responsiveness to the price

increase may be greater in other months. Weather issues also may make ridership less price

elastic in the winter than in the summer or fall. Finally, over the one year interval,

December to December, other things may not have remained constant. In particular,

population may have risen—this would lead to the measured elasticity being too low (with

constant population, measured riders would have fallen more than “nearly four million”).

Further, per capita income may have risen—this would mean that the measured elasticity

understates the response to the price change if subway rides are non-inferior and overstates

the response if subway rides are inferior. Clear?

16 Feb. 08