Winery Inventory Worksheet WINERY XYZ SCHEDULE III WINE

advertisement

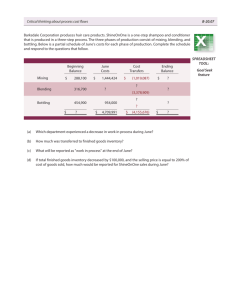

Winery Inventory Worksheet WINERY XYZ SCHEDULE III WINE INVENTORY – NET REALIZABLE VALUE As of December 31, 2011 Inventory Gallons Bottles BOTTLED - FINISHED GOODS 2008 Vintage 2009 Vintage 2010 Vintage Total Bottled 3,630 79,179 5,184 87,993 Inventory Cases Gallons 354 147 16,593 6,910 20,723 8,630 BULK No Vintage 2010 Vintage 2011 Vintage Total Bulk Average Revenue per Bottle Estimated Value 138.46 75.28 54.00 $ Average Revenue per Case Estimated Value 66,150 3,546,000 4,770,000 8,382,150 $ 450.00 513.00 553.00 Total Wine Inventory 502,623 5,960,953 279,936 6,743,512 $ 15,125,662 ADDITIONAL COSTS required for normal sale Bulk - Shrinkage Bulk - Cooperage/Aging Cost Bulk - Bottling Selling General Administration Total Wine Inventory less costs Profit and Risk Adjustment (to be est. by appraiser) Net Realizable Value (rounded) © 2012 Business Valuation Resources, LLC % or Per Case (654,000) (1,612,000) (623,000) (1,513,000) (1,513,000) (5,915,000) Sch X Sch X Sch X 10% 10% $ 9,210,662 (3,025,000) $ 6,186,000 20% Winery Inventory Worksheet Notes to Schedule III – Wine Inventory – Net Realizable Value Schedule III represents the fair market value of the wine inventory that is ready for sale and waiting to be bottled utilizing the net realizable value method. We have used estimates that we believe are reasonable based on the Company’s historical performance and knowledge of the industry in general. 1. Finished Goods Cases: The number of cases of finished wine inventory is from the internal inventory prepared by the Company as of December 31, 2011. This internally prepared inventory is used as a basis for insuring the inventory and is detailed in quantity and price per bottle to the varietal and year, size of bottle, and expected sales channel. We have reduced the finished goods inventory for inventory that is not planned to be sold, i.e. inventory that will be used in marketing, research, and charitable donations. 2. Bulk Inventory: The amount (in gallons) of bulk wines came from the internal inventory prepared by the Company as of December 31, 2011. This internally prepared inventory is used as a basis for insuring the inventory and is detailed in quantity and case equivalent price to the varietal and year. Bulk wine was converted from gallons to equivalent cases at the ratio of 2.4 gallons per equivalent case. The value of the equivalent cases was estimated by using the average price per case in the internally prepared inventory. 3. Cost to Finish Bulk Wine: We have estimated the cost to finish the bulk wine by evaluating the costs to age and bottle the wine. We have also allowed for shrinkage due to evaporation and spillage. Below, we show the schedule of costs to finish the bulk wine. Cost to Finish Bulk Wine Vintage None 2010 2011 Cases Average Shrinkage Total Case Adjusted Aging Total Aging Factor Shrinkage Shrinkage Cases Factor Costs Sales Retail Value 147 6,910 8,630 $ 450.00 $ 66,150 513.00 3,546,000 553.00 4,770,000 15,687 $ 8,382,150 0% 5% 10% $ 177,000 477,000 346 864 147 $ $ 6,564 80.00 525,000 7,766 140.00 1,087,000 14,477 $ 654,000 Adjusted cases Bottling Cost Per Case $ 1,612,000 14,477 $ 43.00 Total Bottling Costs $ 623,000 For the 2010 and 2011 vintages, aging the wine in barrels was estimated at $80 per case equivalent per year, based on 2011 cellaring costs of approximately $1,179,000 allocated to bulk wine inventory and 14,477 case equivalents inventory. We assumed 75 percent of the 2011 vintage would be cellared for an additional year as 25 percent of the 2011 bulk © 2012 Business Valuation Resources, LLC Winery Inventory Worksheet inventory is sauvignon blancs and pinot noirs which are likely bottled in 2012. Shrinkage was estimated at 5 percent for the 2010 vintage and 10 percent for the 2011 vintage based on our industry experience. We have estimated bottling costs at $43 per case, based on management’s estimate of bottling costs and the 2011 bottling expense. 4. Selling Costs: The selling and administrative costs (SG&A) are the estimated costs to sell, deliver and account for case sales. These costs include the direct and indirect costs of the sales representatives, administrative employees, and tasting room operations. In 2011, marketing and selling costs were 9 percent of revenue. We have rounded up to 10 percent of revenue, in part to reflect the new emphasis on wine club sales. 5. General and Administrative Costs: Like selling costs, we have estimated general and administrative costs at 10 percent based on 2011 general and administrative costs at 12 percent of revenue. We expect that as the price per bottle increases, and revenues increase, that there will be efficiencies in administrative costs. 6. Profit and Risk Adjustment: The adjustment accounts for the profit or return that a buyer would require in return for purchasing the inventory. There is inherent risk in wine-making and the industry pricing trends in general. The sales value of the wine inventory is approximately three times the 2011 annual sales of the Company, so it will take time to liquidate the inventory. The return reflects the time value of money as there is a three or more year time horizon for liquidating the inventory in the marketplace. To test the reasonableness of our profit and risk adjustment, we consider the return a hypothetical investor would get from buying the wine inventory at December 31, 2011 for the net realizable value of $6,186,000. We can estimate the investor’s expected return. The total investment that the hypothetical buyer would make in the inventory and return on that investment would be as follows: Inventory - Net Realizable Value Aging Bottling Selling General and Administrative $ 6,186,000 1,612,000 623,000 1,513,000 1,513,000 Investment in Inventory $11,447,000 Profit and Risk Adjustment Profit and Risk Adjustment and % of Investment in Inventory $ 3,025,000 26% The return on investment would equate to approximately 26 percent, which seems reasonable given the risks and the potential time it could take to convert the finished goods to revenue at the expected prices. © 2012 Business Valuation Resources, LLC