Consumption Responses to In-Kind Transfers

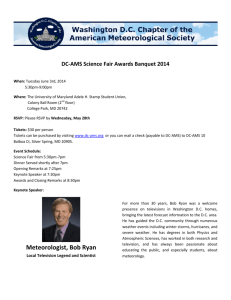

advertisement