W1S1 - The Accounting Equation Worksheet Q

advertisement

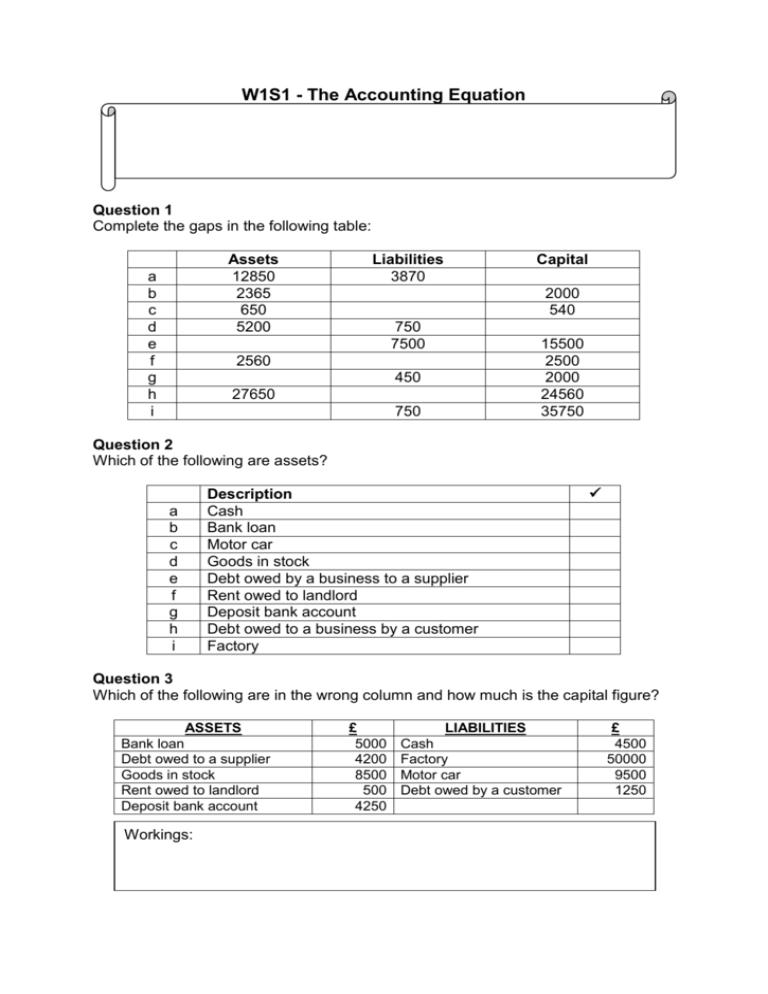

W1S1 - The Accounting Equation Question 1 Complete the gaps in the following table: Assets 12850 2365 650 5200 a b c d e f g h i Liabilities 3870 Capital 2000 540 750 7500 2560 450 27650 750 15500 2500 2000 24560 35750 Question 2 Which of the following are assets? a b c d e f g h i Description Cash Bank loan Motor car Goods in stock Debt owed by a business to a supplier Rent owed to landlord Deposit bank account Debt owed to a business by a customer Factory Question 3 Which of the following are in the wrong column and how much is the capital figure? ASSETS Bank loan Debt owed to a supplier Goods in stock Rent owed to landlord Deposit bank account Workings: £ 5000 4200 8500 500 4250 LIABILITIES Cash Factory Motor car Debt owed by a customer £ 4500 50000 9500 1250 Question 4 State the ‘accounting equation’ and explain the meaning of each of the terms used in the equation. Question 5 Write out the accounting equations for each of the following:Fred invests £100,000 into his business by putting it into a bank account He spends £50,000 on premises and £15,000 on equipment paying by cheque He buys a £10,000 van on credit Question 6 Write out the accounting equations for each of the following:Anita invests £5,000 of her own money. She also obtains a loan of £5,000 from the bank. She puts it all into an account. She spends £2,000 on a van and £6,000 on equipment She obtains £3,000 worth of stock on credit.