Earning Credit

advertisement

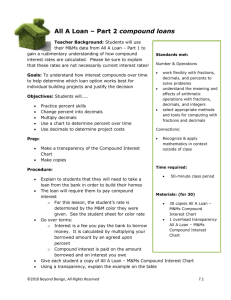

Earning Credit Compelling Question Have you ever borrowed money from someone and not repaid it? Or has anyone ever borrowed money from you and not repaid it? © Council for Economic Education 1 https://www.youtube.com/watch?v=nFY0HBkUm8o © Council for Economic Education 2 Credit - The opportunity to borrow money or to receive goods or services in return for a promise to pay later. Credit score – A single number assigned to a person used by lenders to predict the risk that borrowers will not repay. © Council for Economic Education 3 Your Credit Score Low 300 High 850 © Council for Economic Education 4 What makes up your credit score? • • • • • 35% Payment history 30% Managing your debt 15% Length of credit history 10% Diversity of accounts 10% Number of credit applications © Council for Economic Education 5 Interest rate - The price paid for using someone else’s money, expressed as a percentage of the amount borrowed Principal – An original amount of money invested or lent © Council for Economic Education 6 Price of car/Loan principal: $15,500 Interest rate: 0% Loan term: 5 years (60 months) What is the total cost of the car? What is your monthly payment? © Council for Economic Education 7 How to calculate simple interest Simple interest – Interest paid only on the principal of a loan Price of car/Loan principal: $15,500 Interest rate: 2% Loan term: 5 years (60 months) I (simple interest) = P (principal) x R (interest rate) x T (# of years) I = $15,500 x .02 x 5 I = $1550 © Council for Economic Education 8 Price of car/Loan principal: $15,500 Interest rate: 2.0% Loan term: 5 years (60 months) What is the total cost of the car? What is your monthly payment? © Council for Economic Education 9 How to calculate compound interest Compound interest – Interest paid on the principal of a loan and the interest owed Price of car/Loan principal: $15,500 Interest rate: 2% How much is owed at the end of 1 year? Principal ($15,500) + Interest (0.02 x $15,500) $15,500 + ($15,500 x 0.02) = $15,810 Another way to state this equation: $15,500 x (1 + 0.02) = $15,810 © Council for Economic Education 10 How to calculate compound interest Price of car/Loan principal: $15,500 Interest rate: 2% How much is owed at the end of 1 year? $15,500 x (1 + 0.02) = $15,810 How much is owed at the end of 2 years? $15,500 x (1 + 0.02) x (1 + 0.02) = How much is owed at the end of 3 years? $15,500 x (1 + 0.02) x (1 + 0.02) x (1 + 0.02) = What formula can you derive that will calculate the amount owed for a specific number of years? How can you state this as a ©general formula? Council for Economic Education 11 Price of car/Loan principal: $15,500 Compound Interest rate (annual): 2.0% Loan term: 5 years (60 months) What is the total cost of the car? What is your monthly payment? © Council for Economic Education 12 Car payment calculation A= Monthly payments i= monthly interest rate (annual interest rate/12) P= principal n= total number of payments © Council for Economic Education 13 © Council for Economic Education 14 Group Discussion Questions – – – – – – – – – What was your credit score? What was your interest rate? How are your interest rate differences related to your credit score differences? How did these differences impact the total cost of the car for individuals in your group? What behaviors caused some students to have lower credit scores? What behaviors caused some students to have higher credit scores? What could individuals with low simulated credit scores do to improve these credit scores? Now think about the categories used to calculate an actual credit score. What kinds of behaviors would result in a low score, representing a high risk? What kinds of things can each individual do in the future to ensure that your real credit score is high? © Council for Economic Education 15 The impact of compounding frequency on total interest paid © Council for Economic Education 16