report and financial statements

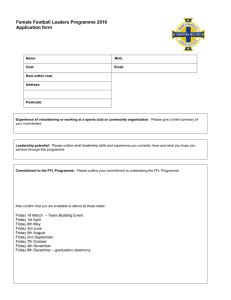

advertisement