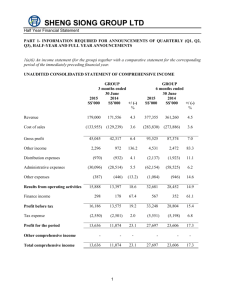

FY 2013 Annual Report

advertisement