ABC costing

advertisement

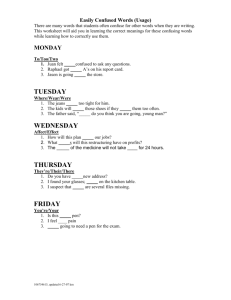

Activity Based Costing Notes to Chapter 7 Examples • • • • Split a restaurant bill Split profit in a partnership Allocate cost to products Cost of a degree program? – What is cost of an international student? – What is the cost of an auditing student? – What is the cost of a cand. merc. student? • Multi-product firms are found everywhere. 2 Indirect cost – Classic Pen • • Classic Pen was a low cost producer of pens. They had a profit margin of at least 20% of revenue Five years ago the firm started producing red pens • Last year purple was added • The controller of Classic Pen was disappointed by the result from last quarter • Same production technology • Could be sold at a premium price 3% higher than the two other types of pens – Profit margin 10% “higher” – The controller pondered if Classic Pen should continue to introduce new pens instead of focusing on the blue and black – The production manager pointed out the influence of the new types on the production 3 Indirect cost – Classic Pen • The costing system of Classic Pen was simple: – All indirect costs were aggregated at factory level and allocated to products based upon the direct labor cost – At this time the overhead rate was 300% of direct labor cost – Before new types of pens were introduced the overhead rate was only 200% of direct labor cost – Classical Pen uses only one cost center • This would not change even if several cost centers were introduced. The biases in the production costs would remain. 4 Indirect cost – Classic Pen Blue Black Red Purple Total Units 50.000 40.000 9.000 1.000 100.000 Price 4,50 4,50 4,65 4,95 Sales Materials Labor Overhead 225.00 75.000 30.000 90.000 180.000 60.000 24.000 72.000 41.850 14.040 5.400 16.200 4.950 1.650 600 1.800 451.800 150.690 60.000 180.000 Total man. cost. 195.000 156.000 35.640 4.050 390.690 Oper.inc 30.000 24.000 6.210 900 61.110 return. % 13,3% 13,3% 14,8% 18,2% 13,5% 5 Indirect cost – Classic Pen • Before: – Production primarily manual – Total indirect cost were less that the direct labor cost – Classic Pen’s two products were identical with respect to volume and batch size • Direct labor cost and indirect cost has decreased due to automation • As low volume products were introduced the result was increased demand for: – – – – Increased planning More setups of machines More quality control Computers to keep track of jobs and product specifications 6 Indirect cost – Classic Pen • Same physical output, same cost of material • The firm has approximately – Property taxes, security cost and heating cost which are unchanged – Much higher indirect and support costs due to the larger and more diversified product mix and more complex production • One unit of the high volume standard product (blue or black) uses approximately the same amount of direct labor as one unit of red or purple • The traditional costing system would fundamentally report identical costs for the standard and special products, independent of production volume The use of indirect and support activities by the special products are higher that the use by the standard products • 7 Indirect cost – Classic Pen ABC at Classic Pen - Analysis of the cost structure: • Indirect labor – 50% of the indirect labor costs are caused by what the controller called “handling of production batches” – 40% of the indirect labor cost were caused by th physical change from one color to another and were called setup costs – 10% of the time was used to an activity which the controller labeled support activities • Computer costs – 20% allocated to “support activities,” • This is an activity which is already found in the catalogue of activities as it was used to account for the 4 products – 80% of computer resources were used to produce batches and are closely related to handling of production batches 8 Indirect cost – Classic Pen Activity Cost Driver Blue Black Red Purple Total** 0,02 0,02 0,02 0,02 2.000 Mach. h/unit 0,1 0,1 0,1 0,1 10.000 Prod. series 70 65 50 15 200 4 2,4 5,6 5,6 -- 280 156 280 84 800 1 1 1 1 4 50.000 40.000 9.000 1.000 DL h/unit Setup time/batch Tot.setup.hours # products **Volume 9 Indirect cost – Classic Pen Indirect labor 50% 40% IT Maintenance Energy 10% 80% Handling Depreciation 20% Setup Support activities Operation 10 Indirect cost – Classic Pen • Three categories of indirect cost remained: – Machine depreciation – Machine maintenance – Energy for running the machines • These costs were incurred to maintain the production capacity for the production of pens. • The Controller calls the production activities “running the machines” 11 Indirect cost – Classic Pen • Identification of cost hierarchy • Four activities which explain the indirect cost at Classic Pen represents three levels in the cost hierarchy: Activity Cost hierarchy Running machines Unit level Handling of batches Batch level Setups of machines Batch level Product sustaining Product 12 Indirect cost – Classic Pen Cost-driver rates Aktivitycost Handling prod.batches 66.000 Setups of mach 33.600 Aktivitydriver #Batches Driver quantity 200 Rate 330 pr batch #Setup hours 800 42 pr setup hour Product sustain 14.400 # Products 4 3.600 pr product Running machines 42.000 # Machine hours 10.000 4,20 per machine ht 156.000 13 Indirect cost – Classic Pen Assigned IPO Blue Handling prod.batches Setups of machines Product sustain Running machines Total cost assigned Black Red Lilla Total** 23.100 21.450 16.500 4.950 66.000 11.760 6.552 11.760 3.528 33.600 3.600 3.600 3.600 3.600 14.400 21.000 16.800 3.780 420 42.000 59.460 48.402 35.640 12.498 156.000 14 Indirect cost – Classic Pen Profitability Blue Black Red Lilla Total** 225.000 180.000 41.850 4.950 451.800 75.000 30.000 12.000 59.460 60.000 24.000 9.600 48.402 14.040 5.400 2.160 35.640 1.650 600 240 12.498 150.690 60.000 24.000 156.000 176.460 142.002 57.240 14.988 390.690 Operating income 48.540 37.998 (15.390) (10.038) 61.110 B.M. % 21,6% 21,1% -36,8% -202,8% 13,5% Sales Materials Labor 40% Support Total prod.cost 15 Assigning service department costs to activities • Untraceable or common costs • Rough estimates of product cost – This is estimation by means of allocation • Cause and effect relationship • Link cost to activities – How are the activities using resources – What type of measures do we have – Fixed or variable costs 16 Ingredients • Aggregate cost pools • LLA’s • Allocation 17 Example 18 Impressionist 19 20 ABC Definitions 21 Indirect cost – Classic Pen Indirect labor 50% 40% IT Maintenance Energy 10% 80% Handling Depreciation 20% Setup Support activities Operation 22 Activity cost drivers • • • • Unit level activities Batch level activities Product sustaining activities Customer sustaining activities 23 Activity cost drivers • Transaction drivers • Duration drivers • Intensity drivers 24 Problem 7.15 Problem 7.15 OV1 = 750,000 + 0.4 DL OV2 = 200,000 + 0.2 DM + 1.5T OV3 = 750,000 OV4 = 1,500 S Problem 7.15 Problem 7.15 Problem 7.15 Problem 7.15 q UCI UCabc q UCI UCabc q UCI UCabc 2500 170 216 5000 141 171 2500 778 778 2500 630 631 500 558 562 0 0 0 2400 1392 1343 5200 1221 1192 0 0 0 30 Problem 7.15 The Firm’s Technology 32 The Firm’s Technology •Factor inputs •Production •Output z1,…z8 f,g,h q = (q1, …,qn) z5 z6 h z3 z7 f z4 z8 g q = (q1,…,qn) 33 Account structure 34 Marginal costs Impressionists estimation: 35 Marginal costs The Modernisms estimation: 36 Example 7.3 37 Example 7.3 38 Example 7.3 – Modern School 39 41 K ≤ 200 q12 q22 Solution : K = 200, L1 = = 50, L2 = = 200 200 200 Total cost = 100* 200 + 150*50 + 175* 200 MC1 = 150, MC2 = 350 Marginal costs • The marginal cost have a linear structure • The ABC cost results in marginal cost • The Impressionist School leads to different product cost 43 Problem 7.8 8. unit versus marginal cost Return to Example 7.3 and focus on the constant returns to scale case of α = β = .5. Determine total cost, marginal cost of each product, unit cost of each product under the impressionism school, and unit cost of each product under the modernism school for each of the following output pairs: q = [3, 8], q = [8, 3] and q = [10, 10]. Also determine the corresponding percentage estimation errors. 44 Example 7.3 45 Example 7.3 46 Example 7.3 – Modern School 47 Problem 7.8 Product one Example 7.3 q1 q2 TC MC UCt UCabc 7 9 632.33 47.60 54.99 47.60 3 8 408.70 47.60 58.39 47.60 8 3 480.50 47.60 50.58 47.60 10 10 808.37 47.60 53.89 47.60 48 Problem 7.8 Product two Example 7.3 q1 q2 TC MC UCt UCabc 7 9 632.33 33.24 27.49 33.24 3 8 408.70 33.24 29.19 33.24 8 3 480.50 33.24 25.29 33.24 10 10 808.37 33.24 26.95 33.24 49 Problem 7.9 9. unit versus marginal cost Repeat the above for the mixed case of α = .55 and β = .45. 50 Problem 7.9 Product one – non-linear Example 7.3 q1 q2 TC MC UCt UCabc 3 8 418.73 57.54 59.82 54.50 8 3 549.08 59.49 57.80 56.28 10 10 899.24 60.81 59.95 57.41 51 Ex 7.9 Product two – non-linear q1 q2 TC MC UCt UCabc 3 8 418.73 31.97 29.91 31.90 8 3 549.08 33.03 28.90 32.94 10 10 899.24 32.73 29.97 32.51 52 Decreasing Returns Marginal Cost for Product 1 Marginal cost for product 1: MC1 53 Decreasing Returns Marginal Cost for Product 2 Marginal cost product 2 54 Decreasing Returns Impressionism Error for First product 55 Decreasing Returns Impressionism Error for Second product 56 Decreasing Returns ABC Error for First Product 57 Decreasing Returns ABC Error for second Product 58 Increasing Returns Impressionisms Error for First Product 59 Increasing Returns Impressionisms error for second product 60 Increasing Returns ABC Error for First Product 61 Increasing Returns ABC Error for Second Product 62 Mixed Returns Impressionisms error for second product 63 Mixed Returns Impressionisms error for second product 64 Mixed Returns ABC Error for First Product 65 Mixed Returns ABC Error for Second Product 66 Errors • Error is the norm • Errors are functions of the accounting system • Different accounting systems produce different errors – Which department – Which product • Where to put errors • Where in the organization is precision important? • Portfolio of errors 68 Conclusion • ABC costing allows fine tuning of accounting system to technology • Is usable in a service organization • Requires more data collection • Assumes linearity in – Use of production factors – Cost functions • Allocation of errors • Theory of second best 69