Malaysia Customs Valuation Judgment: Nike Royalty Dispute

advertisement

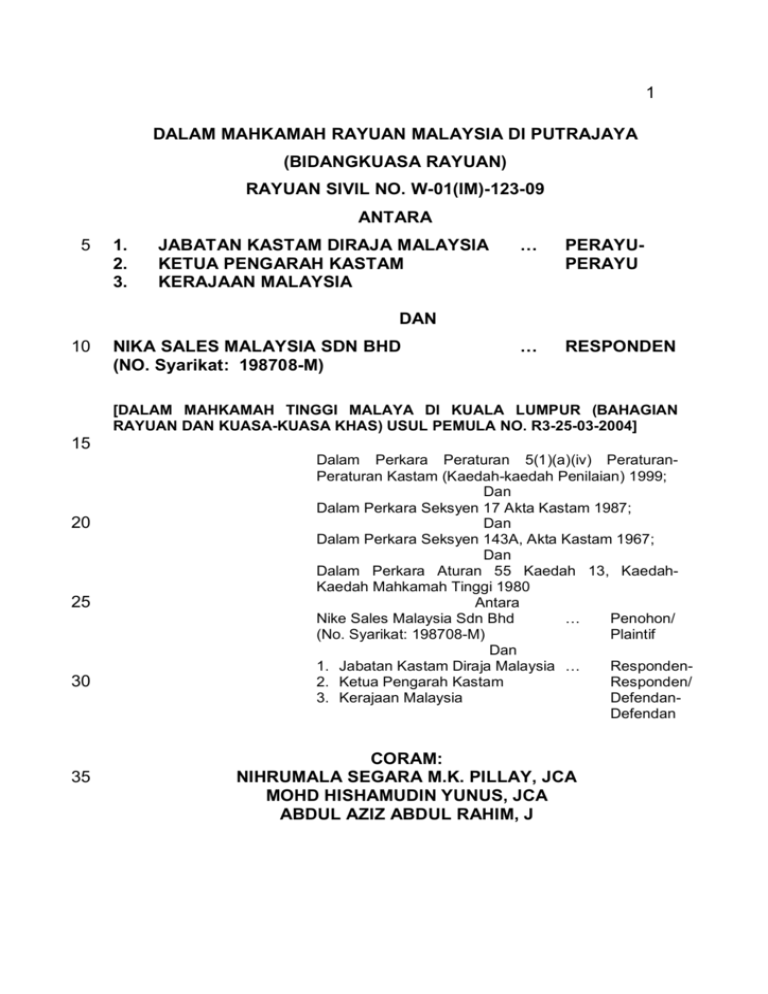

1 DALAM MAHKAMAH RAYUAN MALAYSIA DI PUTRAJAYA (BIDANGKUASA RAYUAN) RAYUAN SIVIL NO. W-01(IM)-123-09 ANTARA 5 1. 2. 3. JABATAN KASTAM DIRAJA MALAYSIA KETUA PENGARAH KASTAM KERAJAAN MALAYSIA … PERAYUPERAYU … RESPONDEN DAN 10 NIKA SALES MALAYSIA SDN BHD (NO. Syarikat: 198708-M) [DALAM MAHKAMAH TINGGI MALAYA DI KUALA LUMPUR (BAHAGIAN RAYUAN DAN KUASA-KUASA KHAS) USUL PEMULA NO. R3-25-03-2004] 15 20 25 30 35 Dalam Perkara Peraturan 5(1)(a)(iv) PeraturanPeraturan Kastam (Kaedah-kaedah Penilaian) 1999; Dan Dalam Perkara Seksyen 17 Akta Kastam 1987; Dan Dalam Perkara Seksyen 143A, Akta Kastam 1967; Dan Dalam Perkara Aturan 55 Kaedah 13, KaedahKaedah Mahkamah Tinggi 1980 Antara Nike Sales Malaysia Sdn Bhd … Penohon/ (No. Syarikat: 198708-M) Plaintif Dan 1. Jabatan Kastam Diraja Malaysia … Responden2. Ketua Pengarah Kastam Responden/ 3. Kerajaan Malaysia DefendanDefendan CORAM: NIHRUMALA SEGARA M.K. PILLAY, JCA MOHD HISHAMUDIN YUNUS, JCA ABDUL AZIZ ABDUL RAHIM, J 2 JUDGMENT OF THE COURT This is the Appellants’ appeal against the decision of the High Court which decided that the royalty paid by the respondent (Nike 5 Sales Malaysia Sdn Bhd) to Nike International (NIL) is not a condition of sale as provided under Regulation 5(1)(a)(iv) of the Customs (Rules of Valuation) Regulations 1999 and therefore should not be considered when determining the customs duties and sales tax. 10 The main issue in this appeal is whether the royalty cost should be included in calculating the customs value of the imported goods. 15 Under section 2 of the Customs Act 1967 “Value” in relation to imported goods means customs value as determined under s.142(35B)” Under s.142(35B) the Minister may make regulations to determine the customs value of imported goods. Accordingly, the Minister has made the Customs (Rules of Valuation) Regulations 1999 20 Regulation 4 of Customs (Rules of Valuation) Regulations 1999 states: “(1) The customs value of imported goods shall be their transaction value, that is, the price paid or payable for the goods when sold for 25 export to Malaysia, adjusted in accordance with Regulation 5” Regulation 5(1)(a)(iv) of the Customs (Rules of Valuation) Regulations 1999 clearly provides, inter alia, that royalties and licence fees that the 3 buyer must pay directly or indirectly, as a condition of the sale of goods for export to Malaysia, is part of the adjustment element that has to be taken into account in determining the transaction value (customs value) of imported goods under Regulation 4. For ease of 5 reference Regulation 5(1)(a)(iv) Customs (Rules of Valuation) Regulations 1999, reads: “5 (1) In determining the transaction value of imported goods under regulation 4, the price paid or payable for the goods shall be 10 adjusted (a) by adding thereto amounts, where such amount is not already included in the price paid or payable for the goods, determined on the basis of sufficient information, equal to: 15 (i) … (ii) … (iii) … (iv) royalties and licence fees, including payments for patents, trademarks and 20 copyrights in respect of the goods that the buyer must pay, directly or indirectly, as a condition of the sale of the goods for export to Malaysia, exclusive of charges for the rights to reproduce the 25 goods in Malaysia; (vi) … (emphasis in bold provided by us) 30 On the factual matrix of this case, we hold that the royalty, which was to be payable by the respondent after the goods were sold, is 4 to be regarded as an item to be included for adjustment of the price to be paid or payable. The contention of the respondent, that the royalty payable on the 5 goods at the point of import cannot be ascertained, because the amount of royalty can only be determined after the sale of the goods, is a non issue, and cannot exempt the respondent from not making a declaration in respect of the royalty at the time of import in the relevant custom forms, by an appropriate declaration to 10 meet the respondent’s situation. Non declaration gives the impression that payment of royalty does not arise at all for the imported goods by the buyer. The absence of any express provisions in the contractual documents and business transactions relating to the imported goods, that states the buyer must pay 15 royalties for the goods as a condition for the sale of the goods for export to Malaysia, does not take the adjustment for royalties for the imported goods paid after the goods are sold, out of the equation for the determination by the appellants the customs value (transaction value) under the Customs Rules of Valuation 20 1999. Nike Inc is the ultimate holding company of Nike International Ltd and Nike Sales Malaysia Sdn Bhd (Respondent). Nissho Iwai American Corporation (NIAC) is a wholly owned subsidiary of 25 Nissho Iwai Corporation (NISSHO). NISSHO is an independent, unrelated third-party that acts as a buying and trade finance agent. Manufacturers/Suppliers export the goods to the respondent, 5 through the intermediation of Nike Inc and NISSHO. The respondent is under an obligation to pay royalty, based on net invoiced sales to NIL. However, the price, paid or payable by the respondent to the manufacturers/suppliers for the goods exported 5 to the respondent, is invoiced without taking into consideration the obligatory royalty element payable to NIL by the respondent, pursuant to the Intellectual Property License and Exclusive Distribution Agreement between NIL, as Licensor and the Respondent, as Licensee. We are unanimous, that under such 10 circumstances, it would be a fallacy not to make an adjustment for the price paid or payable, merely because it was not expressed that the respondent must pay the said royalty as a condition of the sale of the goods for export to Malaysia. Such a proposition appears to be an ingenious attempt to evade the proper customs 15 duty on the imported goods by the respondent. In any event, we are in agreement with the decision of the New Zealand Court of Appeal in Chief Executive of New Zealand Customs Service v Nike New Zealand Ltd [2004] 1NLZR238 [hereinafter referred to 20 as the “Nike New Zealand case”] where the Court upheld the decision of the High Court of New Zealand, that royalties payable by Nike NZ to another subsidiary in the Nike group, NIL, were to be added to the price of the imported goods, in assessing the value of the goods for purpose of tariff (customs duty). The factual 25 matrix of the Nike New Zealand case is almost on all fours with the present appeal before us, a’fortori, the law under consideration in New Zealand and Malaysia, that is, clause 3(1)(a)(iv) of the 6 Second Schedule to the Customs and Excise Act 1996 of New Zealand and, Regulation 5(1)(a)(iv) Customs (Rules of Valuation) Regulations 1999 of Malaysia, are identical. 5 For the purposes of the present appeal, in order to better understand the position of the imported goods in the business transactions of the respondent, and the apparent similarity of facts with the Nike New Zealand case, three (3) pertinent documents need to be alluded to. They are: 1) Purchase Commission 10 Agreement; 2) Intellectual Property License and Exclusive Distribution Agreement; and 3) Amended and Restated Buying Agency and Logistics Services Agreement. 1) 15 The Purchase Commission Agreement (exhibit KA5 page 352-355 Jilid 4 Appeal Record) was an agreement made between the respondent [NIKE Sales (Malaysia) Sdn Bhd (Participating Company)], and NIKE Inc., USA (“NIKE”), the parent company in USA. 20 Under Recital A, the Participating Company is engaged in the business of marketing and selling NIKE brand products (“Products”) in Malaysia. Under clause 1, the Participating Company appoints NIKE 25 as its purchasing agent for such Products as Participating Company may from time to time request. 7 Under clause 2.1.1, NIKE shall receive purchase order from the Participating Company for Products and shall place such orders with its selected foreign manufacturers. NIKE shall order such Products at favourable prices in 5 accordance with the requirements of Participating Company with respect to type, quality, delivery datelines, financing and insurance. NIKE shall deliver such Products, or arrange for their delivery, to such ports as the parties may from time to time determine. NIKE shall 10 act in its own a name, for the account of Participating Company, but shall have authority to represent and bind Participating Company directly vis-à-vis foreign manufacturers. 15 Under clause 3, NIKE may engage the services of NISSHO IWAI American Corporation (“NIAC”), a whollyowned subsidiary of NISSHO IWAI Corporation, a Japanese trading company, to furnish NIKE import and export expertise and related services, including but not 20 limited to the handling of trade documentation, export financing and other technical assistance incidental to the international transport of Products ordered by Participating Company. NIKE may cause NIAC to invoice Participating Company directly for all products purchased 25 by or on behalf of Participating Company pursuant to this Agreement 8 2) Intellectual Property License and Exclusive Distribution Agreement (exhibit KA4 page 342-350 Jilid 4 Appeal Record). 5 This agreement was made between NIKE International Ltd (“LICENSOR”) and the respondent (“LICENSEE”). Under clause1.8, “Licensed Goods” means Footwear, Apparel, Accessories and Equipment which bear any of 10 the Trademarks or which incorporate any Other Propriety Rights. Under clause 1.9, “Licensed Goods Sold” means (i) Licensed Goods sold by LICENSEE to a third party that is 15 not an entity within the worldwide NIKE corporate structure and (ii) Licensed Goods sold by LICENSEE to a retail outlet owned by an entity within the worldwide NIKE corporate structure. 20 Under clause 1.10, “Licensed Territory” means Malaysia. Under clause 1.11, “Net Annual Sales Revenues” means the gross wholesale invoiced sales revenues from the sale of all Licensed Goods Sold during the relevant 25 Agreement Year, less deductions for trade or cash discounts, if any, and goods returned, if any, and excluding taxes. 9 Under clause 1.14, “Trademarks” means all of the trademarks owned by the LICENSOR in the Licensed Territory or licensed to the LICENSOR for use in the 5 Licensed Territory. Under clause 2.1, Subject to the conditions set forth in this Agreement, LICENSOR hereby grants to LICENSEE, for the term of this Agreement: 10 2.1.1, a non-transferable and non-exclusive license to manufacture or subcontract for the manufacture of Licensed Goods using the Trademarks and the Other Propriety Rights, provided that all such Licensed Goods are sold by LICENSEE in the 15 Licensed Territory in accordance with this Agreement; and 2.1.2, a non-transferable and exclusive license (i) to sell Licensed Goods in the Licensed Territory and (ii) to use the Trademarks and the Other Propriety 20 Rights in the Licensed Territory in connection with the advertising, marketing and sale of Licensed Goods. Under clause 2.2, the LICENSOR appoints LICENSEE as 25 its exclusive distributor of Licensed Goods in the Licensed Territory. 10 Under clause 4.1, the LICENSEE shall use its reasonable efforts to sell and promote the sale of Licensed Goods in the Licensed Territory. 5 Under clause 10.1, LICENSEE agrees to pay LICENSOR a royalty of six percent (6%) of the Net Invoiced Sales revenues of all Licensed Goods in the Licensed Territory. 10 Under clause 10.3, in addition to the royalties provided under Section 10.1 the parties agree that, in the event LICENSEE sells any Licensed Goods on account of which NIKE Inc., NIKE Europe B.V. or any related company must pay a royalty to a third party, LICENSEE 15 shall pay LICENSOR, or such other entity as may be designated by LICENSOR, the amount required to be paid to said third party. Such payments shall be separately invoiced and shall be made at the same time that LICENSEE makes its next royalty payment under 20 Section 10.1. Under clause 10.4, the royalties required under Section 10 shall be invoiced and paid in accordance with such schedules as are agreed to by the parties from time to 25 time, provided that all royalties for sales made during a particular Agreement Year shall be paid no later than one month after the end of such Agreement Year. 11 Under clause 13.1, the LICENSEE shall have the right to subcontract for the manufacture of Licensed Goods and shall be free to choose the suppliers with which it so 5 subcontracts. The parties agree that the Licensor shall impose no restrictions on Licensee’s choice of such suppliers. The parties further agree that in the event of non-payment of the royalty provided under Section 10, Licensor shall not prevent or impede such supplier from 10 selling to Licensee Licensed Goods manufactured pursuant to binding orders accepted by such supplier prior to such supplier’s receipt of notice of termination of this Agreement; provided, however, that this provision shall not restrict Licensor from asserting against Licensee 15 any claims that Licensor may have against Licensee under this Agreement or otherwise. 3) Amended and Restated Buying Agency and Logistics Services Agreement Nike Sales Malaysia Sdn Bhd 20 (exhibit KA-15 at page 442-453 Jilid 5 Appeal Record) was an agreement made between the respondent and Nissho Iwai American Corporation (“NIAC”). Under clause 1, in this agreement “Import Goods” shall 25 mean Goods which are sold by NIKE in Malaysia and that are manufactured or purchased outside of Malaysia and 12 “NIKE Order” shall have the meaning assigned thereto in Section 4.3 Clause 4 of this agreement provides the Ordering 5 Procedure. Where NIAC is to provide buying agency services and trade financing the ordering procedure with respect to Import Goods shall be as follows: 4.1 10 Initiation of Order. NIKE shall determine what Goods and quantities of Goods that it wishes to order. 4.2 Negotiation of the Terms. NIKE shall negotiate the Terms with the Supplier and obtain the Supplier’s indication that it shall accept an order for the supply 15 of Goods from NIAC on behalf of NIKE. Nike shall then provide an order confirmation to the Supplier outlining the Terms that have been negotiated. 4.3 Communication of NIKE Order to NIAC. On a monthly basis and as far in advance as reasonably 20 practical, NIKE shall transmit to NIAC the respective purchase orders, which shall include the name and address of the Supplier and the Terms which have been negotiated with the Supplier(“the NIKE Order). 4.4 25 Placement of NIAC Order. Relying on the NIKE Order, NIAC shall (i) forward to the Supplier the NIAC Order which will contain or refer to the same Terms as the correspondent NIKE Order (ii) forward 13 to NIKE the NIAC Order confirmation (iii) arrange the issuance of an L/C to the Supplier and send a copy to NIKE. NIAC will arrange for NIKE to have real time access via an electronic banking system of 5 the issuing bank to review all L/C issuances, amendments and presentments. 4.5 Arrangements for Production and Delivery of Goods. NIKE shall arrange that the Suppliers shall produce the Goods and shall be obligated to deliver 10 them as specified. Nike shall also arrange ocean/inland transportation, select the carriers and negotiate the freight rates and direct the carriers/forwarders to inform NIAC of expected shipments and to forward to NIAC appropriate 15 documentation as arranged. NIKE shall indemnify and hold NIAC harmless from any and all costs and/or liabilities arising from Supplier’s or carrier/s failure to deliver the Goods as specified, unless such failure results from NIAC’s non performance 20 hereunder. We repeat and, wish to emphasize, that the provisions of the New Zealand law, that is, Clause 3(1)(a)(iv) of the Second Schedule 25 Customs and Excise Act 1996, is identical to the provisions of our law under consideration in this appeal, that is, Regulation 5(1)(a)(iv) of the Customs (Rules of Valuation) Regulations 1999. 14 We reproduce below, relevant extracts from the judgment of the Court of Appeal in the Nike New Zealand case, which illustrates the similarity of the facts in our case, and highlights the 5 conclusions and observations of the Court, after considering the submissions and the authorities relied upon by counsel. We are in full agreement with the judgment, and the views expressed therein, for reaching the conclusion on the royalty issue before the New Zealand Court of Appeal. 10 “…….. [4] NIL, a subsidiary of Nike Inc, is the proprietor of the group’s intellectual property. During the period of the importations it had licensed Nike NZ to use in New Zealand and certain Pacific Islands its 15 trade marks, copyrights, designs and other intellectual property rights. Nike NZ agreed to use its reasonable efforts to sell and promote the licensed goods in the licensed territory: cl 4. The licence was granted expressly in relation to two activities. First, it was a non-exclusive licence to manufacture or “subcontract” (a term which, it is accepted, 20 should in New Zealand context be read as “contract”) for the manufacture of licensed goods provided that that were sold in the licensed territory in accordance with the agreement: cl 2.1. Secondly, it was an exclusive licence to sell the licensed goods in the licensed territory, in respect of which Nike NZ was appointed the exclusive 25 distributor of licensed goods: cl 2.2. [49] A royalty of 2.5 per cent of net annual sales revenues of sales in the licensed territory was required to be paid by Nike NZ to NIL; cl 10.4. 30 [50] The agreement required Nike NZ to obtain written approval from NIL of samples and specimens of the licensed goods: cl 7. But it was 15 free to choose its suppliers and there was express agreement that NIL should not impose restrictions on its choice and that, in the event of non-payment of royalty, NIL would not prevent or impede the supply to Nike NZ of goods manufactured pursuant binding orders accepted by 5 the supplier prior to the supplier’s receipt of notice of termination of the agreement; cl 13.1. NIL reserved the right to exercise other rights, such as termination, in that event. [51] The Customs Appeal Authority said that it was clear from the 10 documentation and “the true nature of the purchase transactions” that there was a strong link between the royalty payments and the sale of the goods for export to New Zealand. Through the various agreements Nike Inc or NIL could enforce all royalty obligations. It followed that it controlled the supply of goods for Nike NZ and that supply could be 15 terminated for non-payment of royalties, Payment of royalties was a condition of sale of the goods by way of export into New Zealand. It was commercial common sense that there would be no supply of Nike product to Nike NZ if royalties were not paid. 20 [52] In affirming the Authority’s decision, Williams J, after an extensive review of prior cases, said that when the agent employed to place Nike NZ’s orders was itself a branch of the company which, through another subsidiary, owned the intellectual property utilized in the goods’ manufacture for which the royalty was payable, it must be taken to be 25 the case that the agent would not have accepted and acted on the order without being assured that the royalty would be met by its principal, Nike NZ, when the goods were sold. Nike Inc plainly had the capacity to ensure “all” (that is, the Nike companies) acted so that its subsidiary met its royalty obligations. Although the evidence showed that Nike NZ 30 had been able to purchase stock even though, at times, its financial circumstances had meant it had been in arrears of royalty payments, Nike Inc’s ownership and ultimate control of Nike NZ and its directors meant that Nike NZ must comply with Nike Inc’s requirements if so directed. Nike Inc could not import the stock it later sold without 16 incurring a liability for royalty. The Judge preferred to view the word “condition” in the way described in the decisions of this Court in Adidas New Zealand Ltd v Collector of Customs (Northern Region) [1999] 1 NZLR 558 and Avon Cosmetics Ltd v Collector of Customs [1999] 5 NZAR 345, rather than viewing it in the way the Supreme Court of Canada had done in Deputy Minister of National Revenue v Mattel Canada Inc (2001) 199 DLR (4th) 598. The decision in Mattel might well be explicable, Williams J said, in terms of its particular contractual arrangements, but the case nonetheless merited the observation that 10 insistence on a contractual condition for royalties being included for the transaction to come under cl 3(1)(a)(iv) “simplifies avoidance”. Adidas and Avon remained the law binding on the High Court and the Judge saw nothing compelling arising out of the different approach in Mattel to endeavour to distinguish them. 15 [53] Mr Fardell, for Nike NZ, submitted…. [54] It was also submitted that, even if the Court preferred not to adopt the Canadian approach, a correct application of Adidas would have led 20 to a different result in this case. ……… [55] Mr Hancock supported the position taken by the Court in Adidas and Avon on the basis it best ensured the attainment of the object of the legislation. …. 25 [56] .... [57] ….. 30 [58] ….. [59] ….. [60] In Adidas the Court addressed three questions; 17 (a) Whether it could be said that royalties calculated by reference to the resales of product manufactured for adidas NZ and imported by it into this country, could be said to be payable “in respect of the 5 imported goods”; (b) Whether to fall within the subpara (iv) the royalty must be payable directly or indirectly to the seller; and (c) 10 Whether the royalty was payable “as a condition of the sale of the goods for export to New Zealand”. [61] The members of the Court were entirely of the one view concerning the first two questions. No challenge is made to their conclusions, with which we agree. In the leading judgment, delivered by 15 Henry J with Thomas J concurring, it was said that even if the payment was dependent upon distribution, it was unreal to suggest that the payment was not in respect of the product. It was the product which was impressed with the royalty obligation: p 564. Blanchard J said it was unrealistic to contend that royalties were not payable “in respect of the 20 imported goods” merely because they were fixed in relation to the price at which the importer sold them and because nothing was payable until and unless they were sold. In practice, royalty payments were almost invariably calculated on sales by the licensee. Clause 3(1)(a)(iv) must be directed to the ordinary run of royalty arrangements. 25 [62] On the second question, the Court said there was nothing in the clause requiring that the royalties must be payable to the party who sells the goods to the importer. 30 [63] Where Nike NZ says in the present case that the Court in Adidas erred was in relation to the third question, concerning which the members of the Court in Adidas did not speak with one voice. Henry J said that whether the royalty was payable as a condition of the sale for export seemed to be the critical question. As in the present case, the 18 contractual terms between the New Zealand company and the overseas manufacturer did not contain any provisions express or implied relating to royalty payments. Neither did that obligation appear to have featured in any formal way in the business dealings between adidas NZ and its 5 buying agent, adidas Asia-Pacific, which undertook the negotiations with the manufacturer. But that was not determinative. For the purposes of cl 3(1)(a)(iv) the sale must be the transaction or process under which the importer obtained the product. It was therefore the true nature of that transaction as evidenced by the relevant documentation which fell 10 for consideration. Under the licence agreement adidas NZ was granted the right to use the protected property (trade marks, patents, etc) for manufacture of goods outside New Zealand but only by manufacturers approved by adidas AG. Accordingly adidas NZ was contractually restricted in its ability to import manufactured product. The effect of the 15 licence provisions therefore was that adidas NZ could not through its approved manufacturers import product without incurring a liability to pay royalty on that product when it was sold. If adidas NZ could not import the product which it later sold without incurring the liability to pay royalty, then payment of the royalty was a condition of the sale to it of 20 the product: p 563. [64] The licence agreement obliging adidas NZ to pay royalty was closely related to the importation, that is, the sale for export. Adidas NZ’s right to contract with the manufacturer was governed by the 25 licence agreement. In Henry J’s view the obligation to pay royalty was undoubtedly closely related to the right of adidas NZ to contract with the Asian supplier, through another adidas related company, for the manufacture and its associated purchase or sale for export. 30 [65] Blanchard J placed emphasis not on the ability of the parent company to control the choice of manufacture but upon the particular buying practice adopted by adidas NZ. The New Zealand company had in practice left all the buying arrangements, including the placing of orders with the manufacturer/seller, in the hands of another member of 19 the adidas group. He said that it was inconceivable that if the New Zealand company had been under separate ownership and had placed its orders in this way, the agent would have undertaken such a function unless satisfied that royalty payments to its parent were being fulfilled 5 by the purchaser. He thought, therefore, that with this control voluntarily accepted by adidas NZ the situation could properly be seen as one involving as part of that purchasing arrangement an obligation on adidas NZ to pay the agreed royalties to the parent company. On that basis, of course, the present case is indistinguishable. 10 [66] In its judgment in the Mattel case , subsequently reversed by the Supreme Court, the Canadian Federal Court of Appeal was of the opinion that the payment of royalties was a condition of the sale of goods for export first if it appeared as such in the contract of sale 15 between the vendor and the importer and secondly, “if either the licensor because it owns or controls the vendor, or the vendor when it holds the trademarks or rights or copyrights, can prevent the importation of the goods by the purchaser or seriously compromise the ability of the purchaser to buy the goods for export in cases where he has failed to 20 pay the royalties”. The Court pointed out that the wording of subpara (iv) does not refer to a “condition for sale” and therefore, it was, in the opinion of the Federal Court, not a requirement that payment of royalties be expressly stipulated in the sale contract. The word “condition” was not considered to have been used in the Act as a term 25 of art carrying the meaning generally ascribed to it in the law of sales. Rather, the word was used in its ordinary and common sense way to mean that the payment of royalties had to be made as a perquisite or requirement for the export of the goods: para [26]. 30 [67] That view was not accepted by the Supreme Court, as we have seen, but, with respect, we find it convincing. It seems to us that for royalty to come within subpara (iv), there must be a combination of two features. First, the royalty must be payable to the manufacturer or to another person as a consequence of the export of the goods to 20 New Zealand, and, secondly, the party to whom the royalty is payable must have control of the situation going beyond the ordinary rights of a licensor of the intellectual property and giving it the ability to determine whether the export to New Zealand can 5 or cannot occur. An ordinary licensor, unrelated to the licensee, may be able to take steps to prevent future importations if royalties are not paid in respect of a particular importation of licensed product, but it has no control over an importation prior to any default. In contrast, where royalties are payable to a licensor which is member of the same 10 corporate group as the licensee – and where the buying is in practice conducted through another member of the corporate group – the situation is throughout under the parent company’s control exercisable on behalf of the licensor. 15 [68] In the present case the goods bearing the licensor’s trademarks and utilizing its other intellectual property were able to be exported to New Zealand only because of the existence of the licence agreement which required the payment of royalty. Although that agreement, like the one in Adidas, was not expressly related to the 20 export to New Zealand, it was stated to be for the events which preceded and followed that event, respectively the manufacture of the goods and their resale in the licensed territory by the Nike NZ. Importantly, there was an obligation on Nike NZ under the terms of the licence agreement to use reasonable efforts to sell the licensed goods. 25 But the manufacturing licence was conditional upon sales occurring only in the licensed territory. Implicitly, then, the agreement required the export the goods to New Zealand. If Nike NZ simply left the goods in the country of manufacture, it would not be making reasonable efforts to sell them in accordance with the agreement. Implicitly, the licence covers, 30 and royalties are payable for, the right to export the goods to New Zealand. The royalties may be calculated on sales in the licensed territory but they are payable, in part, for the right to bring the goods to New Zealand. Hence, they can be said to be payable as a condition of that act which is itself a step in fulfillment of an obligation to the licensor. 21 [69] Coupled with this was the overall control which Nike Inc was able to exercise. It was involved in the purchasing as the agent of Nike NZ and it had the ability to ensure royalty payments were made pursuant to 5 the licensing agreement with its subsidiary, NIL, through its control of the board of directors of Nike NZ. There was also a further measure of control in that NIAC did not take steps to arrange letters of credit on behalf of Nike NZ without first receiving a copy of an order placed by Nike Inc. The manufacture of the goods did not occur until a confirming 10 order was received from NIAC. [70] The factual situation in Mattel was quite different, There the royalty was payable as a consequence of the export of goods to Canada but the Licensor X had no ability to exercise control through 15 Mattel US, the exporter. All it could do if royalties were not paid was to invoke the provisions of the licensing agreement and seek to assert such rights as it has under the Canadian trade mark legislation in respect of future importations. 20 [71] We are therefore satisfied that the Customs Appeal Authority and the High Court were correct when they concluded that payment of royalty by Nike NZ to NIL was a condition of the sale of the goods for export to New Zealand in terms of cl 3(1)(a)(iv) of the Second Schedule.” 25 (emphasis in bold provided by us) We are unanimous that the High Court fell into a serious error in holding that royalty payable by Nike Malaysia to Nike International (NIL) cannot properly be taken as an adjustment item under 30 Regulation 5(1)(a)(iv) of the Customs (Rules of Valuation) Regulations 1999. We accordingly allow this appeal with costs and set aside the order of the High Court. 22 Appeal allowed. Costs fixed at RM20,000/- Deposit refunded to appellants. 5 NIHRUMALA SEGARA A/L M.K. PILLAY Judge Court of Appeal PUTRAJAYA 10 Reference: Chief Executive of New Zealand Customs Service v Nike New Zealand Ltd [2004] 1NLZR238 15 Peguam Perayu: 20 Dato’ Nik Suhaimi bin Nik Sulaiman Peguam Kanan Persekutuan Bahagian Perundangan Ibu Pejabat Kastam Diraja Malaysia Aras 8, Selatan Kompleks Kementerian Kewangan No. 3, Persiaran Perdana Presint 2, 62598 PUTRAJAYA 25 Peguam Responden: 30 35 En K. Maniam Tetuan Skrine Unit 50-8-1, 8th Floor Wisma UOA Damansara 50, Jalan Dungun Damansara Height 50490 KUALA LUMPUR 23 8 March 2011