Risk Measurement, Risk Management and Capital Adequacy in

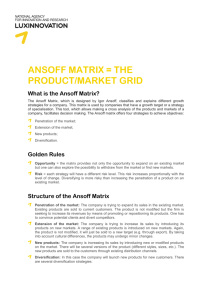

advertisement