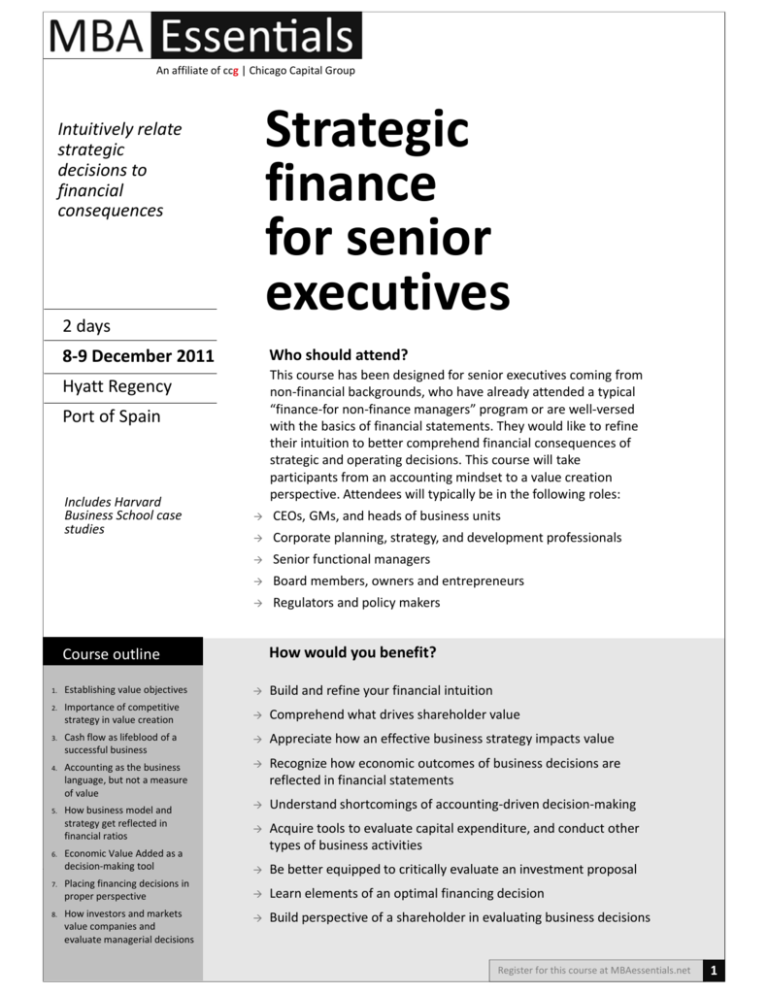

Strategic Strategic finance for senior for senior executives

advertisement

An affiliate of ccg | Chicago Capital Group Strategic finance for senior for senior executives IIntuitively relate t iti l l t strategic decisions to financial consequences 2 days Who should attend? 8‐9 December 2011 This course has been designed for senior executives coming from Thi h b d i df i ti i f non‐financial backgrounds, who have already attended a typical “finance‐for non‐finance managers” program or are well‐versed with the basics of financial statements. They would like to refine their intuition to better comprehend financial consequences of strategic and operating decisions. This course will take participants from an accounting mindset to a value creation perspective Attendees will typically be in the following roles: perspective. Attendees will typically be in the following roles: Hyatt Regency Port of Spain Includes Harvard Business School case studies CEOs, GMs, and heads of business units Corporate planning, strategy, and development professionals Senior functional managers Board members, owners and entrepreneurs Regulators and policy makers How would you benefit? Course outline 1. Establishing value objectives Build and refine your financial intuition 2. Importance of competitive strategy in value creation Comprehend what drives shareholder value 3. Cash flow as lifeblood of a successful business Appreciate how an effective business strategy impacts value pp gy p 4. Accounting as the business language, but not a measure of value Recognize how economic outcomes of business decisions are reflected in financial statements 5. How business model and strategy get reflected in financial ratios Understand shortcomings of accounting‐driven decision‐making Acquire tools to evaluate capital expenditure, and conduct other types of business activities 6. Economic Value Added as a decision‐making decision making tool tool Be better equipped to critically evaluate an investment proposal Be better equipped to critically evaluate an investment proposal 7. Placing financing decisions in proper perspective Learn elements of an optimal financing decision 8. How investors and markets value companies and evaluate managerial decisions Build perspective of a shareholder in evaluating business decisions Register for this course at MBAessentials.net 1 Strategic finance for senior executives Course introduction Course introduction Transition from an accounting mindset to i d learn shareholders’ language What others are saying ‘Provides insight beyond numbers.’ —Galfar Engg & Construction, Oman ‘An excellent training program.’ —Oman Oil Marketing Co ‘Great course.’ —Grupo Entero, Guatemala ‘Excellent course! Waseem really masters the subject and provides practical business applications!’ —MABE, Mexico ‘Enlightening course with applied course with applied cases.’ —Salam International, Qatar In today’s competitive environment, every business executive and owner must possess a fundamental knowledge of how financial resources are accumulated, utilized and monitored to create shareholder value. Knowledge of accounting, without an appreciation of financial value creation, is not sufficient. Companies that leave these critical issues to the exclusive domain of financial executives stand to be at a clear competitive disadvantage disadvantage. Designed as an intermediate‐level course for senior executives coming from non‐financial backgrounds, the course will focus on economic and strategic consequences of business decisions, and will discuss how business strategies must be formulated in the context of financial economics. We will look at a broader picture and learn the integral role of corporate finance in all facets of corporate management. We will explore and tie together issues such as performance We will explore and tie together issues such as performance measurement, strategy formulation, valuation and capital budgeting, risk and return relationship, financing choices as well as internal governance. We will also discuss the criteria that investors employ to evaluate a company and determine its value. The program will equip the participants with a collection of simple tools and insights to enable them to build and refine their financial intuition. Harvard Business School case studies Chemalite, Inc An engineer who has set up a company to who has set up a company to manufacture and market one of his inventions is trying to prepare his state of the corporation report. This case introduces participants to accounting, and contrast it with the objective of value with the objective of value creation. Drivers of industry financial structure This case contains common‐size balance sheets and financial ratios for 10 companies, each representative of a different industry. Participants are asked to identify industries from the structure of financial statements. Investment Analysis and Lockheed Tri Star Lockheed Tri Star Participants calculate and compare various decision criteria (including IRR and NPV) for capital investment projects. Focus is on the decision to invest. The final "exercise" is a three page "exercise" is a three page mini‐case analyzing Lockheed's decision to invest in the TriStar L‐1011 Airbus project. This drives home the importance of discounting and NPV, and shows the adverse effect of a negative NPV project on shareholder value. Register for this course at MBAessentials.net 2 Strategic finance for senior executives A Agenda d 8:30 AM — 3:00 PM Two 15‐minute snack breaks No lunch break Includes Harvard Business School case studies What others are saying ‘[His] way of delivering the course was excellent.’ —Kinan Intl., Saudi Arabia ‘Concise Concise, interactive interactive and clearly presented.’ 1 4 Finance versus accounting Strategy in the context of finance Establishing shareholders’ objective Drivers of value versus accounting profitability Assessing costs and benefits with net present value How competitive strategy drives value Hallmarks of an effective strategy 2 How companies and projects are valued Comprehension and analysis of financial information Understanding impact of managerial decisions and business activities on accounting statements Value creation in the context of accounting information Using ratios to assess profitability, liquidity, leverage and risk and risk Limits of financial ratio usage in managerial decision‐making 5 Approaches to analyzing investments Prioritizing investment projects How financial markets value How financial markets value companies 6 Selected strategic transactions Mergers and acquisitions Mergers and acquisitions Initial public offerings —Dubai Islamic Bank, UAE ‘Very good course overall.’ —Monsanto, Mexico ‘Excellent course and very good course leader.’ —Grupo Mundial, Panama ‘Excellent course.’ —GRUMA, Mexico ‘Very good.’ — Regency Energy Partners, Texas, USA 3 From accounting to value creation Inadequacies of accounting information Tradeoffs between operating and asset efficiencies Integrating opportunity cost of capital in performance measurement Measuring Economic Value Added and utilizing it as a decision‐making tool Understanding and fixing managerial misalignment Register for this course at MBAessentials.net 3 Strategic finance for senior executives Course leader Certificate for CPE credits Upon completion of this course you will earn 14 continuing professional education (CPE) credits. Prerequisite to attend Course level Instructional method Advanced preparation Waseem Anwer, a finance and management professional d t f i l trained at the University of Chicago and experienced in diverse emerging markets, has taught programs in finance, banking, and management to senior executives, board members and family‐business owners in the UAE, Saudi Arabia, Kuwait, Jordan, Qatar, Turkey, Malaysia Mexico Central Malaysia, Mexico, Central America, and the U.S. He has been a guest speaker at several universities and conferences, and is an adjunct faculty member at the City University of New York. He specializes in issues in finance, strategy, and governance. In addition to leading MBA Essentials, Waseem is the Managing Director of Chicago g g g Capital Group, an advisory and business development firm. He is also a board member at Capitas Group International, an Islamic Development Bank joint venture set up to launch a mortgage finance company in Saudi Arabia and incubate other initiatives in OIC countries. In addition to teaching, Waseem advises corporate clients on business development and strategic initiatives, investment transactions, restructurings, financial policy, real estate investments, risk management, and executive compensation. He has worked with family‐owned and public companies in both developed and emerging economies in North and South i i N th d S th America, and in the Middle East. Previously, Waseem was a Vice President with Stern Stewart & Co, a global advisory firm specializing in corporate finance advisory, shareholder value management and corporate governance issues. He was also with Hewlett‐Packard Company in the United States for five years in the United States for five years. Waseem holds an MBA from the University of Chicago. In addition, he earned an MS in computer engineering from Syracuse University and holds a bachelor’s degree in electrical engineering. He lives in New York City. Basics of accounting Intermediate Live group session None required MBA Essentials is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors State boards of accountancy have final authority on the Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org. About MBA Essentials MBA Essentials is an executive training firm that offers public and incompany programs. What distinguishes us is our focus. We specialize in fi finance and db business i management, with i h a particular i l iinterest iin emerging economies. We help management professionals unlock value in their businesses with grounded decision-making. Our focus, applied knowledge, and deep experience ensure your success in navigating today’s volatile markets. Learn more about us at MBAessentials.net Course registration 8‐9 December 2011 8:30 AM to 3:00 PM Registration at 8:15 AM on 1st day Venue Hyatt Regency 1 Wrightson Road Port of Spain, Trinidad Hotel telephone 868 623 2222 Registration fee USD 1,650 per delegate. F i Fee is net of any bank charges and t f b k h d withholdings, and includes cost of attendance, course materials, and refreshments. Register for the course at MBAessentials.net Direct any inquiries to Laura Molina Telephone +1 212 545 0228 LM@MBAessentials.net SPECIAL OFFERS Early registration bonus. Register and pay by 28 October 2011 and receive 5% off! Third for free. Register two delegates and the third delegate is on us! Cancellations. You may cancel and get a ll l d refund, minus a USD 250 administrative fee, provided the cancellation request is received by email at least 21 days prior to the course start date. We’ll refund 50% of the fee if you write to us to cancel 20 to 14 days before the course start date. Cancelations within 13 days of the course start date are non‐ refundable. MBA Essentials reserves the right to cancel the course or change the venue. You should, therefore, maintain flexibility in your air travel and hotel bookings to allow for any changes. In case of a cancellation, registration fees will be refunded in full within 15 days. We will not be responsible for any other expense that you might have incurred. Register for this course at MBAessentials.net 4